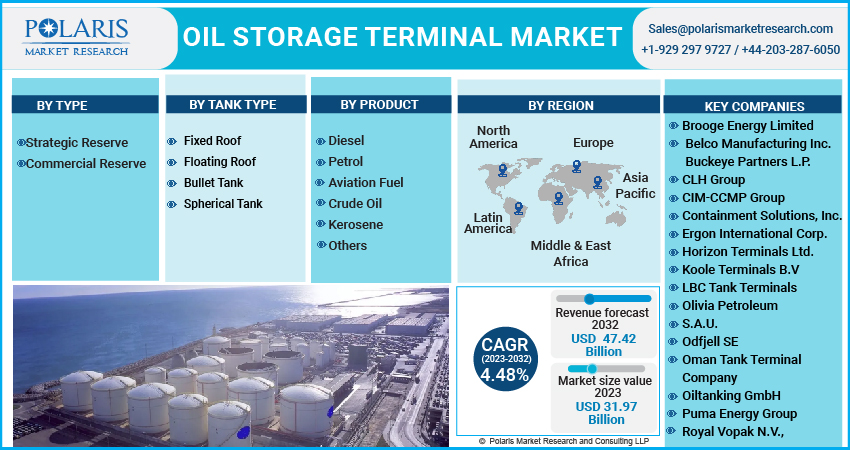

Oil Storage Terminal Market Share, Size, Trends, Industry Analysis Report

By Type (Strategic Reserve, and Commercial Reserve); By Tank Type; By Product; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 115

- Format: PDF

- Report ID: PM3161

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

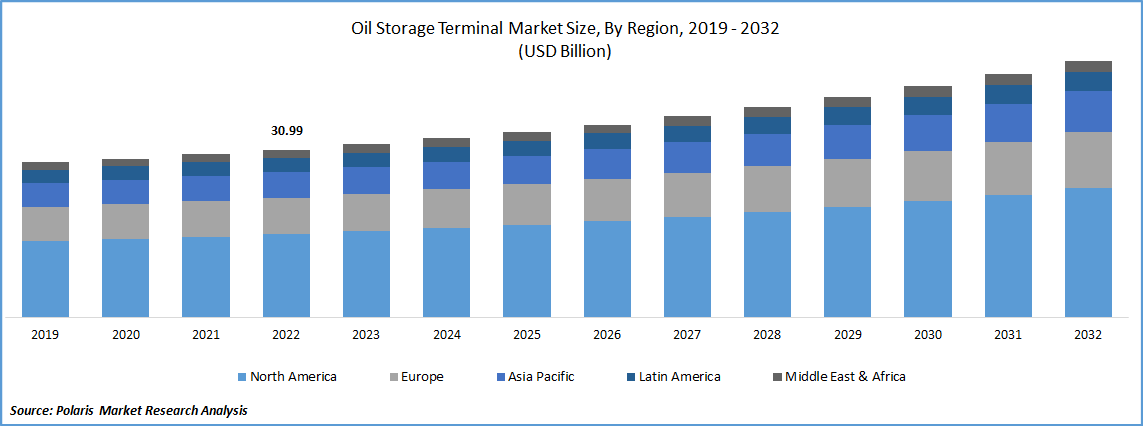

The global oil storage terminal market was valued at USD 30.99 billion in 2022 and is expected to grow at a CAGR of 4.48% during the forecast period. The most essential parts of the global network for the production of oil and gas are oil storage terminals. The center of international trade in oil and gas is these terminals. The countries heavily depended on their oil imports, and all of the countries supplying excess oil have these terminals. For commercial and strategic reserves purposes, raw petroleum and its products are stored. Several different types of storage tanks are used to keep raw petroleum. The types that are most commonly used are rooftop storage tanks that drift and those that are permanent.

Know more about this report: Request for sample pages

The creation of new terminals has been impacted by the increasing demand for energy brought on by the growing population and rapid urbanization, which is a key factor. According to the United Nations (UN) Department of Economic and Social Affairs, the population is projected to be approximately 9.8 billion people by 2050 and 11.2 billion people by 2100. Undoubtedly, this growth factor will influence the establishment of these terminals by industrialized countries to meet domestic oil demand and generate cash through commercial use of the equivalent.

The outputs of a petroleum refinery include diesel, petroleum, lubricants, & other petroleum products that are made from crude oil. The two refined products that are used most frequently as a source for the ethylene cracking and mixed into LPG for use as fuel are propane and butane. Industrial plants, as well as commercial and domestic heating, use industrial gas as a fuel for furnace burning. Similar to how it is used in huge ocean-going ships and power plants, leftover oil is used as bunker fuel. These growth-related variables have increased demand for products like diesel, gasoline, and other oils, which logically increases the need for crude oil and, consequently, the construction of these terminals.

The global oil and gas business has been severely impacted by the COVID-19 epidemic, which has led to an absence of storage restrictions. The embargo of the oil and gas inventory network has a particularly negative effect on the major exporters and oil-producing nations. Numerous oil and gas companies have been forced to alter their consumption for the upcoming year due to the current situation. Projected speculations have decreased, and as a result, the expansion of the storage terminal industry is expected to slow down over the next few years. The production operations in offshore and onshore locations have come to a stop due to the decline in demand for oil and oil-related goods. Therefore, the slowdown in the global oil & gas business is a further motivator for the development and upgrade of projects for oil storage tank terminals. For a defined period, this variable will surely impact the yearly interests in market development.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The oil storage terminal market is likely to be driven by falling crude oil prices because, as oil prices fall, more people are expected to store more of it when prices are low, increasing the demand for oil storage. As per the U.S. Energy Information Administration, globally, the average annual price of Brent Crude oil increased to USD 70.68 per barrel in 2021, surpassing the average annual price in 2020, when an oil emergency was caused by the COVID pandemic's crippled demand. The price of crude oil is the one commodity that is most closely watched since it affects costs across the whole production cycle and affects consumer pricing as well.

Additionally, it is anticipated that the oil trade between countries would increase in the speculative time frame, which will lead to increased government investment in storage facilities. In November 2022, the largest crude consumer in the world, China, is anticipated to increase its daily crude imports to 10.47 MM barrels from 8.9 MM barrels in October, the lowest level since September 2018.

Also, in July 2019, Long-term contracts supporting the growth of Enterprise's Sea Port Oil Terminal in Gulf of Mexico have been signed by Enterprise Products Partners & Chevron USA. The SPOT project consists of onshore and offshore facilities, along with a stationary platform situated in 115 feet of water 30 nautical miles off the coast of Brazoria County, Texas. Approximately 85,000 barrels/hour, or 2 Mn gallons/day, are the maximum speeds at which SPOT can load VLCCs. In addition, unlike other proposed offshore terminals and current offshore terminals, the SPOT design complies with or surpasses federal criteria and has a vapor monitoring system to reduce emissions. Therefore, the falling crude oil process as well as the oil trade agreement among the public and private players are driving the market growth over the forecast period.

Report Segmentation

The market is primarily segmented based on type, tank type, product, and region.

|

By Type |

By Tank Type |

By Product |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Floating Roof segment is expected to witness the fastest growth during projected timeframe

Crude oil evaporation losses are reduced due to the no-gap distance between the floating rooftop deck and the oil level. In filling stations & terminals stabilized at the vapor pressures under 11.1 psi, floating roof tanks are frequently employed. The cylindrical tank with the floating roof is suspended above the surface.

On the liquid's surface, the roof is dangling. The liquid level determines how high or low the roof goes. The deck and other components make up the floating roof. The tank has fittings that are used for strategic reasons. Both fixed and floating roofs are used in interior floating roof tanks. Vertical columns inside the tank maintain the fixed roof tank. In the tank, there have been floating roofs that float and move up and down with the level of the liquid inside. Additionally helping to maintain the high quality of the liquids being held is the floating rooftop.

The Commercial Reserve segment industry accounted for the highest market share in 2021

Since a significant portion of the built terminals is designed for the commercial use of crude oil, commercial reserves have dominated the market in recent years. If a crisis or disappointing imports should arise, the strategic reserves are held to meet the country's energy needs. In this way, the capacity of these terminals is constrained, but with fluctuating energy demand and imports, commercial storage extensions are common.

The Crude Oil segment industry accounted for the largest market share in 2021

Many products like diesel, gasoline, aviation fuel, kerosene, and others are created from crude oil and utilized all over the world. In recent years, the vehicle industry has grown rapidly, and new products like liquefied natural gas have applications in this sector. The demand for storage terminals has increased as LPG has become more widely used in developing nations. To meet the oil demand in the event of an import failure or catastrophe, countries have been forced to prioritize expanding their storage capacity due to national policies of industrialized and emerging countries regarding strategic petroleum reserves. Due to the ever-increasing air traffic, the development of aviation-related transportation infrastructure has increased the demand for aviation fuel, which has a favorable effect on crude oil demand. With more people driving cars powered by petroleum and more people flying, the price of petroleum and aviation fuel will rise steadily.

The demand in Asia-Pacific is expected to witness significant growth during forecast period

The Asia-Pacific region is dominating the market and is expected to grow with the fastest CAGR over the forecast period. The divestiture efforts of a few regional organizations will surely inspire fresh extension strategies and improve the business angle. For instance, in December 2020, Bright Oil Petroleum transferred the Zhoushan oil storage and terminal offices as well as approximately 90% of the offers in its Hong Kong-based business to Yantian Group.

A healthy growth in oil storage terminals is anticipated in Europe due to rising production capacity from numerous important businesses. As businesses try to better position themselves for the future and increase returns, the need for oil storage has been rising, generating interest in the region and escalating competition. Additionally, it is anticipated that the territorial landscape will be supported by the central players' expanding efforts to find natural and inorganic extensions.

The market for oil storage terminals in Europe is anticipated to grow strongly as a result of several major players' increased production capacities. Oil storage has become more and more necessary as businesses aim to better position themselves for the future and maximize revenues, sparking interest and escalating rivalry. Owing to expanded production capacity from a few important companies, the market for European oil storage terminals is anticipated to expand at a healthy rate.

Many nations in the area rely on imported oil to meet their energy needs. In addition, it is anticipated that the expansion of the storage limit will be finished due to the rise in energy demand. Additionally, it is anticipated that the territorial landscape would be maintained due to the main actors' increasing efforts to stop organic and inorganic expansions.

Competitive Insight

Some of the major players operating in the global market include Brooge Energy, Belco Manufacturing, Buckeye Partners, CLH Group, CIM-CCMP Group, Containment Solutions, , Ergon International, Horizon Terminals, Koole Terminals, LBC Tank Terminals, Olivia Petroleum, S.A.U., Odfjell SE, Oman Tank Terminal, Oiltanking, Puma Energy Group, Royal Vopak, Shell Oil Company, & Vitol Group.

Recent Developments

- In November 2022, the government intends to construct a floating LNG storage capacity at all of its main ports. The project, with a projected price tag of Rs 20,000 crore, will be completed by March 2023 and be available for private-sector involvement. Liquefied petroleum gas (LPG) terminals located on Indian soil currently provide service to 12 of the country's largest ports.

- In December 2021, NOLA Oil Terminal has started the construction of the phase 1 of the oil & refined fuels terminal project in Louisiana. The United States invested $300 in purchasing the 158 acres. The project's include 2 deep-water ports & 1 barge dock. When both ports are completely operating, they can moor 170.000 tank ships.

Oil Storage Terminal Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 31.97 billion |

|

Revenue forecast in 2032 |

USD 47.42 billion |

|

CAGR |

4.48% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Tank Type, By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Brooge Energy Limited, Belco Manufacturing Inc., Buckeye Partners L.P., CLH Group, CIM-CCMP Group, Containment Solutions, Inc., Ergon International Corp., Horizon Terminals Ltd., Koole Terminals B.V., LBC Tank Terminals, Olivia Petroleum, S.A.U., Odfjell SE, Oman Tank Terminal Company, Oiltanking GmbH, Puma Energy Group, Royal Vopak N.V., Shell Oil Company, and Vitol Group. |

FAQ's

The oil storage terminal market report covering key segments are type, tank type, product, and region.

Oil Storage Terminal Market Size Worth $47.42 Billion By 2032.

The global oil storage terminal market expected to grow at a CAGR of 4.48% during the forecast period.

Asia-Pacific region is leading the global market.

Key driving factors in oil storage terminal market increased government investment in storage facilities.