Oil and Gas Corrosion Protection Market Size, Share, Trends, Industry Analysis Report: By Type, Location, Sector (Upstream, Midstream, and Downstream), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5312

- Base Year: 2024

- Historical Data: 2020-2023

Oil and Gas Corrosion Protection Market Overview

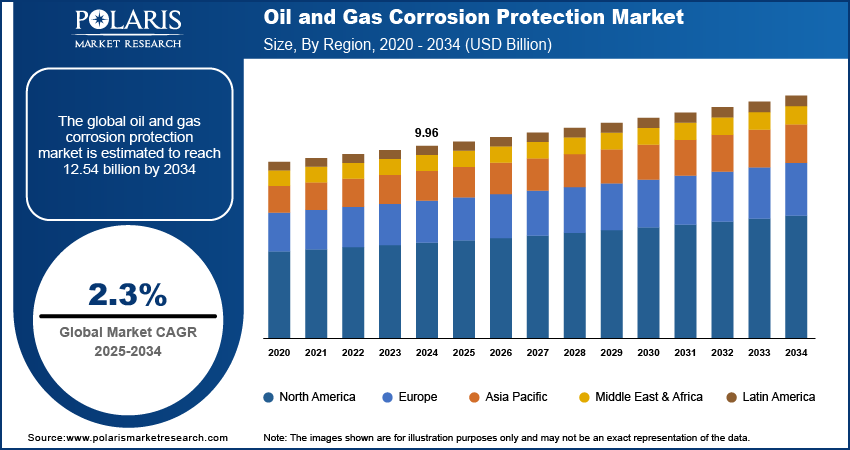

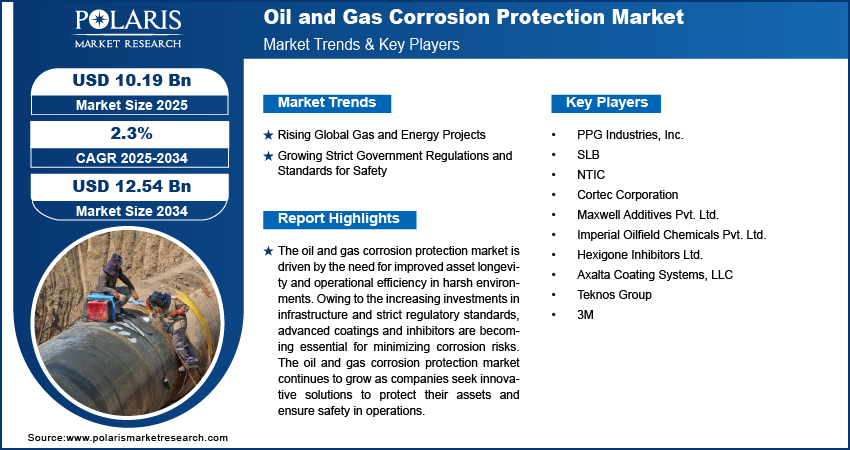

The oil and gas corrosion protection market size was valued at USD 9.96 billion in 2024. The market is projected to grow from USD 10.19 billion in 2025 to USD 12.54 billion by 2034, exhibiting a CAGR of 2.3% during 2025–2034.

The market focuses on the methods and materials used to prevent and minimize corrosion of infrastructure and equipment in the oil & gas industry. This includes protective coatings, corrosion inhibitors, and maintenance practices designed to extend the lifespan and maintain the integrity of pipelines, storage tanks, and offshore platforms. Effective corrosion protection is essential for assuring operational efficiency, safety, and environmental compliance.

The oil and gas corrosion protection market is crucial for safeguarding infrastructure and equipment against the harmful effects of corrosion. Increasing exploration and production activities, along with the need for strict safety and environmental regulations, boost the market growth. Moreover, aging infrastructure and the need for maintenance in existing facilities further drives the market expansion. Orbital O2 tidal energy turbine, equipped with two 1 MW turbines, harnesses strong tidal currents to generate 2 MW of clean energy, enough to power about 2,000 homes. In April 2021, Hempel supplied high-performance anti-corrosion coatings and biofouling-resistant solutions to O2 for the project.

The oil and gas corrosion protection market is witnessing significant investments from major players aiming to innovate and expand their product portfolios, ensuring long-term sustainability and operational efficiency in the oil & gas industry.

To Understand More About this Research: Request a Free Sample Report

Oil and Gas Corrosion Protection Market Drivers

Rising Global Gas and Energy Projects

The increasing number of gas and energy projects is driving the need for oil and gas corrosion protection, stemming from the crucial requirement for robust infrastructure capable of withstanding harsh operational conditions. According to the International Trade Administration, in 2021, Qatar Energy's North Field Expansion Project aimed to boost Qatar's LNG storage tank production. The project focused on building new offshore platforms, pipelines, and processing facilities in a highly corrosive marine environment. These harsh conditions require advanced corrosion protection, such as specialized coatings and linings, to ensure infrastructure durability and reduce maintenance costs. Moreover, the expansion of offshore and deep-water exploration boosts the necessity for refined protective coatings, which is further contributing to the market size expansion. Consequently, strategic investments in advanced corrosion mitigation solutions are essential to improve asset longevity and ensure operational safety throughout the industry.

Growing Strict Government Regulations and Standards for Safety

Government regulations and safety standards are driving changes in the oil & gas industry. These regulations set detailed measures to mitigate risks associated with leaks, spills, and structural failures, such as those summarized in the US Pipeline and Hazardous Materials Safety Administration (PHMSA) regulations or the EU's Offshore Safety Directive.

Regular inspections and maintenance are crucial to maintaining asset integrity, leading to increased application of high-performance protective coatings and advanced anti-corrosion technologies. For instance, British Petroleum adjusted its maintenance protocols for North Sea oil platforms in 2022, increasing inspection frequency and applying advanced coatings to address corrosion challenges in offshore environments. Non-compliance with safety regulations results in significant fines or operational shutdowns, further incentivizing investment in corrosion protection measures. Hence, regulatory requirements and safety priorities are driving demand for innovative materials and technologies to enhance corrosion resistance and ensure compliance, which propels the oil and gas corrosion protection market expansion.

Oil and Gas Corrosion Protection Market Segment Insights

Oil and Gas Corrosion Protection Market Assessment by Type Outlook

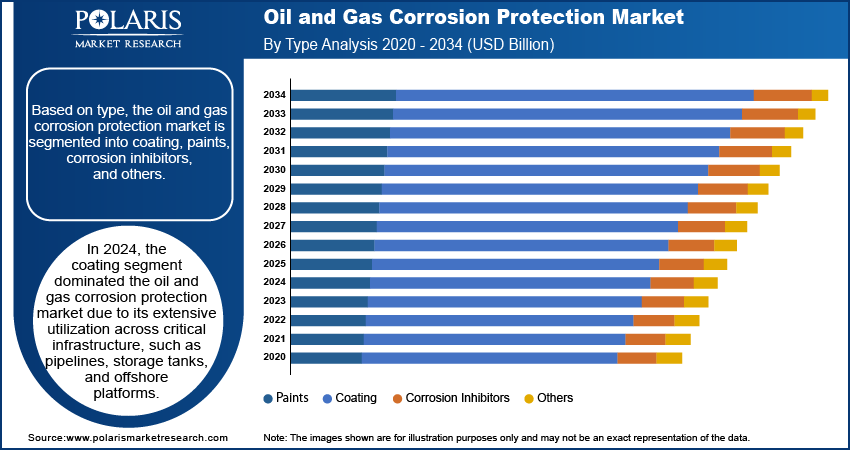

The global oil and gas corrosion protection market segmentation, based on type, is segmented into coating, paints, corrosion inhibitors, and others. In 2024, the coating segment dominated the market due to its extensive utilization across critical infrastructure, such as pipelines, storage tanks, and offshore platforms. The coatings have a robust protective barrier that effectively minimizes corrosion, even under harsh environmental conditions. Additionally, recent advancements in coating technologies, such as high-performance epoxy and polyurethane formulations, have significantly improved durability against extreme temperatures and chemical exposure. These technologies offer better cost efficiency and easier application, making them a preferred choice for corrosion prevention in the oil and gas sector.

Oil and Gas Corrosion Protection Market Evaluation by Sector Outlook

The global oil and gas corrosion protection market segmentation, based on sector, is segmented into upstream, midstream, and downstream. The downstream segment is expected to register the highest CAGR in the market during the forecast period due to the increased focus on refining and petrochemical operations. Moreover, downstream operations are highly exposed to corrosion from exposure to chemicals, high temperatures, and pressure; hence, the need for oil and gas corrosion protection is projected to increase over the period. Also, aging infrastructure in refineries and strict safety regulations and standards in the downstream sector drive demand for advanced corrosion protection solutions to prevent costly shutdowns and ensure operational efficiency. Thus, all these factors contribute to the accelerated growth of the downstream segment.

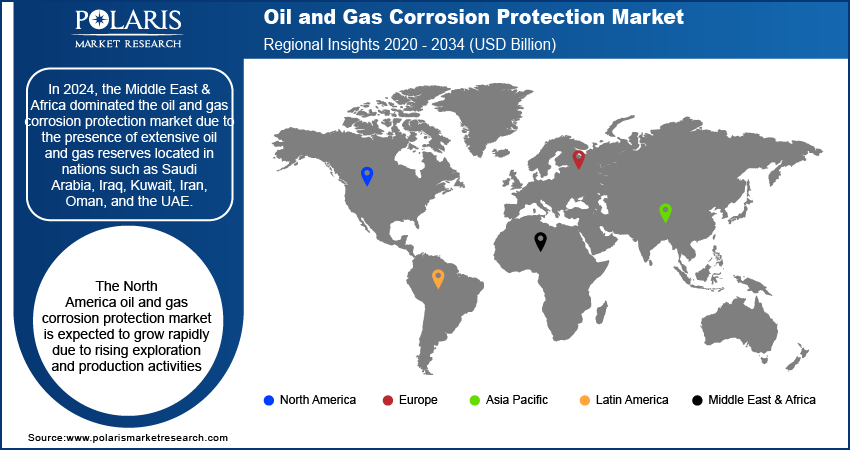

Oil and Gas Corrosion Protection Market Share, by Region

By region, the study provides oil and gas corrosion protection market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Middle East & Africa dominated the market due to the region's extensive oil and gas reserves located in nations such as Saudi Arabia, Iraq, Kuwait, Iran, Oman, and the UAE. As per the current estimates from the Organization of the Petroleum Exporting Countries (OPEC), in 2023, the OPEC member countries hold 79.1% of the world's proven crude oil reserves, totaling 1,241.33 billion barrels. Notably, as a substantial portion of these reserves, ∼67.3%, is concentrated in the Middle East, the necessity for vast infrastructural developments, such as pipelines, refineries, and offshore platforms, drives the demand for robust corrosion protection. These assets require regular maintenance and upgrades to withstand the harsh operating environments. Additionally, ensuring the longevity and operational efficiency of these critical infrastructures is essential, as any corrosion-related failures lead to costly downtime and environmental hazards. Thus, the focus on advanced corrosion protection solutions is essential for sustaining the region's oil & gas industry.

The North America oil and gas corrosion protection market is expected to grow rapidly during the forecast period due to rising exploration and production activities. According to the US Energy Information Administration, in 2024, oil production in the US, including condensate, reached an average of 12.9 million barrels per day, surpassing the previous record of 12.3 million b/d set in 2019. In December 2023, average crude oil production in the country reached a record high of over 13.3 million barrels per day for the month. In 2024, the US continued to lead this market as energy demands increased, driving investments in corrosion protection solutions. Furthermore, strict safety and environmental regulations are prompting companies to prioritize corrosion management, ensuring the stability of critical infrastructure amid rising energy needs.

Oil and Gas Corrosion Protection Market – Key Players and Competitive Insights

The competitive landscape of the oil and gas corrosion protection market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic collaborations, and geographical expansion. Major companies in the sector such as 3M, Cortec Corporation, and others utilize their robust R&D capabilities and extensive distribution networks to provide advanced corrosion protection solutions tailored to applications in upstream, midstream, and downstream operations. These leading companies prioritize product innovation, improving the durability and effectiveness of coatings and inhibitors to meet the strict requirements of the oil & gas industry. At the same time, smaller regional companies are emerging with specialized corrosion protection products designed for specific local needs, offering unique solutions and customized applications. Competitive strategies in this market encompass mergers and acquisitions, partnerships with technology providers, and the diversification of product portfolios to strengthen market presence in key geographic areas. Overall, the focus on technological advancements and tailored solutions is driving growth and fostering competition within the oil and gas corrosion protection market. A few key major market players are SLB; NTIC; Cortec Corporation; Maxwell Additives Pvt. Ltd.; Imperial Oilfield Chemicals Pvt. Ltd; Hexigone Inhibitors Ltd.; Axalta Coating Systems, LLC; Teknos Group; 3M; and PPG.

PPG is a manufacturer and supplier of paints, coatings, optical products, and specialty materials, catering to various sectors, including industrial, transportation, consumer products, and construction. Their extensive product range serves numerous industries, such as food & beverage, cosmetics, civil infrastructure, petrochemical, and marine. In August 2024, PPG launched the PPG PITT-THERM 909 spray-on insulation (SOI) coating. This advanced silicone-based formulation is engineered for high-thermal environments commonly located in the oil & gas, chemical, and petrochemical sectors, as well as other critical infrastructure applications. The company claims that PITT-THERM 909 offers improved safety, superior asset protection, and improved operational efficiency relative to conventional thermal insulation materials, making it a robust solution for demanding industrial settings.

Cortec Corporation, based in Minnesota, US, specializes in advanced corrosion management solutions tailored for diverse industries worldwide. The company offers innovative, environmentally sustainable VpCI and MCI corrosion control technologies. Cortec provides comprehensive approaches to tackle corrosion challenges across sectors such as oil and gas, packaging, construction, metalworking, and electronics. In February 2023, Cortec launched an upgraded version of its proprietary VpCI-126 film technology. The VpCI-126 PCR corrosion-inhibiting film contains a significant proportion of post-consumer recycled content, facilitating efficient resource recovery, recycling, and reuse, thereby reducing the ecological footprint associated with industrial processes. The company states that the film leverages cutting-edge polymer technology and delivers robust corrosion protection for all metal substrates.

Key Companies in Oil and Gas Corrosion Protection Market Outlook

- PPG Industries, Inc.

- SLB

- NTIC

- Cortec Corporation

- Maxwell Additives Pvt. Ltd.

- Imperial Oilfield Chemicals Pvt. Ltd.

- Hexigone Inhibitors Ltd.

- Axalta Coating Systems, LLC

- Teknos Group

- 3M

Oil and Gas Corrosion Protection Market Developments

In June 2023, CORROSION and Bluestream introduced the ICCP-SAM, a solution for the sustainable protection of XX(X)L monopile foundations against corrosion on a global scale. This system is engineered for the remote installation of ICCP anodes, capable of being deployed on monopile foundations of various sizes. Its design ensures effective operation in the most challenging marine environments, making it a versatile option for corrosion management in offshore structures.

In June 2022, Hempel launched Hempaprime CUI 275, a fast-drying coating engineered to mitigate corrosion under insulation (CUI). This new formulation features exceptionally short overcoating windows and demonstrates a broad temperature resistance. It is specifically designed to improve operational efficiency and maintain corrosion protection in critical sectors such as energy generation and oil & gas.

In May 2022, Armach Robotics, a subsidiary of Greensea Systems Inc., introduced its first Hull Service Robot (HSR) following extensive development. Designed for corrosion prevention and maintenance on offshore structures and vessels, the robot weighs less than 66 pounds and measures ∼34 inches in length. Its compact design aims to lower deployment costs and improve ease of use. The HSR underwent initial in-water trials in Plymouth, Massachusetts, as part of efforts to enhance underwater cleaning, fuel efficiency, and vessel performance.

Oil and Gas Corrosion Protection Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Coating

- Paints

- Corrosion Inhibitors

- Others

By Location Outlook (Revenue, USD Billion, 2020–2034)

- Offshore

- Onshore

By Sector Outlook (Revenue, USD Billion, 2020–2034)

- Upstream

- Midstream

- Downstream

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oil and Gas Corrosion Protection Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.96 billion |

|

Market Size Value in 2025 |

USD 10.19 billion |

|

Revenue Forecast by 2034 |

USD 12.54 billion |

|

CAGR |

2.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global oil and gas corrosion protection market size was valued at USD 9.96 billion in 2024 and is projected to grow to USD 12.54 billion by 2034.

The global market is projected to register a CAGR of 2.3% during the forecast period.

In 2024, the Middle East & Africa dominated the oil and gas corrosion protection market share.

A few key players in the market are SLB, NTIC, Cortec Corporation, Maxwell Additives Pvt. Ltd., Imperial Oilfield Chemicals Pvt. Ltd, and Hexigone Inhibitors Ltd.

In 2024, the coating segment dominated the market.

The downstream segment is expected to grow fastest in the market during the forecast period.