Offsite Data Center Power Infrastructure Market Size, Share, Trends, Industry Analysis Report: By Offering (Solution and Software), Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5264

- Base Year: 2024

- Historical Data: 2020-2023

Offsite Data Center Power Infrastructure Market Overview

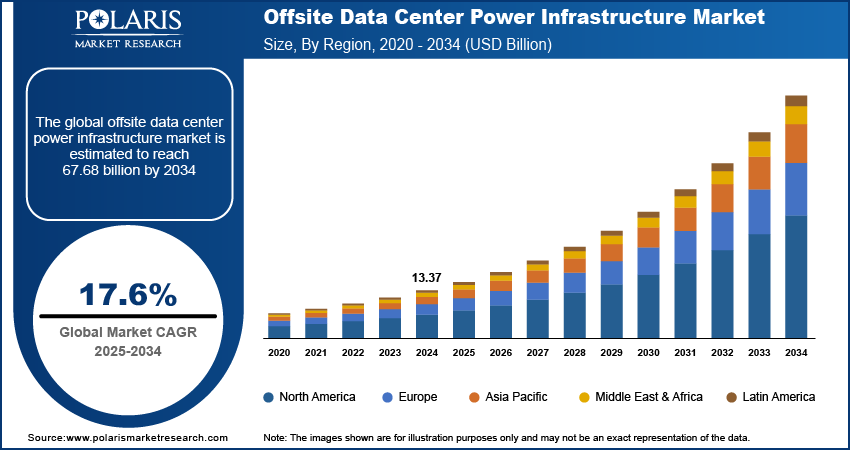

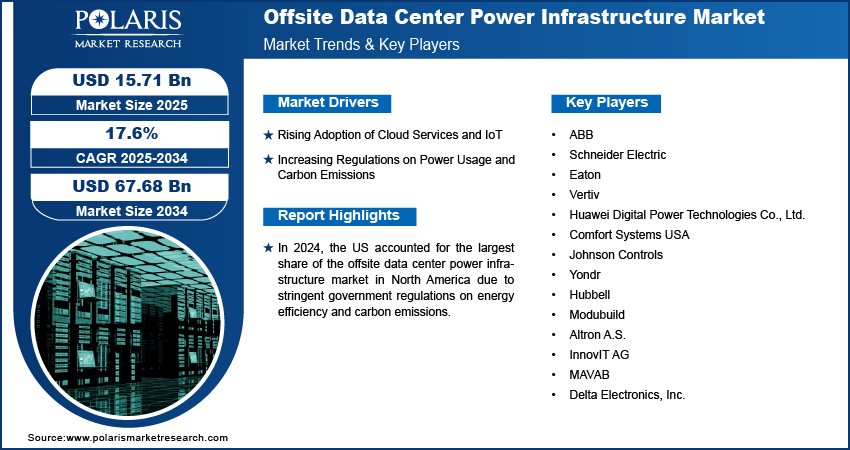

The offsite data center power infrastructure market size was valued at USD 13.37 billion in 2024. The market is projected to grow from USD 15.71 billion in 2025 to USD 67.68 billion by 2034, exhibiting a CAGR of 17.6% during 2025–2034.

Offsite data center power infrastructure refers to the power systems and equipment that supply, manage, and maintain continuous and reliable electricity for colocation or edge data centers located away from a company’s premises. Offsite data centers are typically managed by third-party providers and house critical IT infrastructure for multiple clients.

Enterprises are outsourcing IT infrastructure to colocation facilities to reduce costs and improve scalability. Similarly, edge data centers are growing to support latency-sensitive applications, necessitating distributed power solutions and reliable backup infrastructure, which is further fueling the offsite data center power infrastructure market growth. Furthermore, data center operators are focusing on energy efficiency to reduce operational costs and meet sustainability goals. This trend is expected to drive the adoption of advanced uninterruptible power supply (UPS) systems, battery energy storage, and DC power distribution solutions, which would improve power utilization efficiency (PUE), thereby fueling the offsite data center power infrastructure market expansion.

Hyperscale operators such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are expanding globally, requiring large-scale, highly efficient power systems. The need for high-performance generators, transformers, and modular power systems is surging with hyperscale deployments. Moreover, new technologies such as solid-state transformers, lithium-ion batteries, and fuel cells are gaining momentum, providing better power management and storage solutions. These innovations enhance the performance and reliability of offsite data center power infrastructure, which is further contributing to the offsite data center power infrastructure market development.

To Understand More About this Research: Request a Free Sample Report

Offsite Data Center Power Infrastructure Market Driver Analysis

Rising Adoption of Cloud Services and IoT

Cloud-based platforms and IoT ecosystems continue expanding, generating, transmitting, and processing enormous volumes of data. Cloud services enable businesses to scale operations efficiently, while IoT networks produce continuous streams of real-time data from interconnected devices, including sensors, wearables, and industrial equipment. Managing the growing data load requires advanced offsite data centers offering reliable storage, computing, and processing capabilities. Therefore, the rising adoption of cloud services and Internet of Things (IoT) technologies is significantly driving the offsite data center power infrastructure market demand.

Increasing Regulations on Power Usage and Carbon Emissions

Governments are implementing stringent policies to reduce energy consumption and lower carbon footprints, prompting organizations to reevaluate their energy strategies. For instance, the US Department of Energy (DOE) is expecting and planning to fulfill rising electricity demand highlighted by the nationwide goal to reach net-zero emissions economy-wide by 2050. Data centers are transitioning to renewable energy sources such as solar and wind power. This shift helps comply with environmental standards and enhances their sustainability profile, appealing to stakeholders. Additionally, data centers are adopting smart power monitoring systems that provide real-time insights into energy consumption, enabling operators to optimize usage and implement demand-response strategies. Thus, the increasing imposition of regulations on power usage and carbon emissions is reshaping the operational landscape for data centers worldwide, which can positively influence the offsite data center power infrastructure market growth.

Offsite Data Center Power Infrastructure Market Segment Analysis

Offsite Data Center Power Infrastructure Market Assessment by Offering Insights

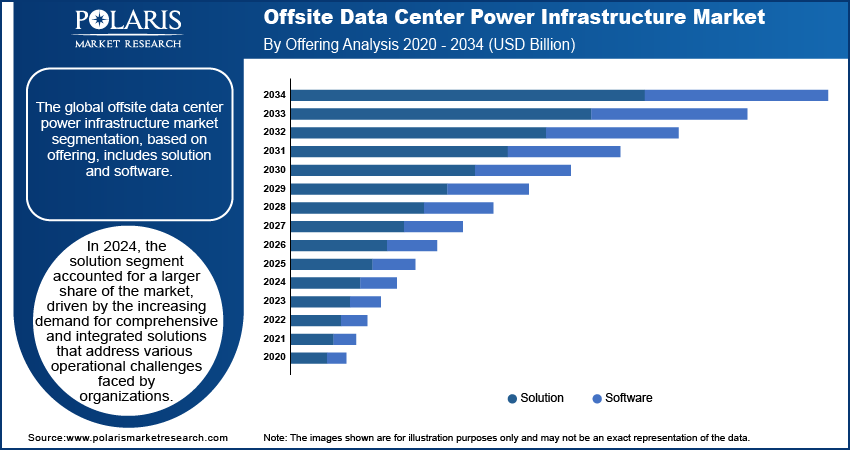

The global offsite data center power infrastructure segmentation, based on offering, includes solution and software. In 2024, the solution segment accounted for a larger share of the market, driven by the increasing demand for comprehensive and integrated solutions that address various operational challenges faced by organizations. As businesses seek to enhance efficiency, reduce costs, and improve overall performance, the need for robust solutions encompassing software, hardware, and services has surged. This segment includes advanced technologies such as cloud computing, data management tools, and cybersecurity solutions, which are critical for ensuring data security, optimizing resource utilization, and facilitating seamless operations. Furthermore, the rapid digital transformation across industries has led to a heightened emphasis on solutions that offer scalability and flexibility, enabling organizations to adapt to changing market conditions swiftly.

Offsite Data Center Power Infrastructure Market Evaluation by Vertical Insights

The global offsite data center power infrastructure market, based on vertical, is segmented into BFSI, government and defense, IT and telecom, manufacturing, media and entertainment, retail, and others. The IT and telecom segment is expected to record the highest CAGR during the forecast period due to the rapid expansion of digital technologies and increasing reliance on cloud-based services. According to the United Nations, digital technologies have advanced rapidly, reaching nearly 50% of the developing world’s population. Businesses across various sectors continue to undergo digital transformation, driving demand for advanced telecommunications infrastructure and IT solutions. The IT and telecom segment experiences significant growth from the proliferation of 5G networks, which enhance connectivity and enable new applications such as IoT and smart city initiatives. Additionally, growing needs for data security and compliance in the IT and telecom sector prompt organizations to invest in innovative solutions.

Offsite Data Center Power Infrastructure Market Regional Outlook

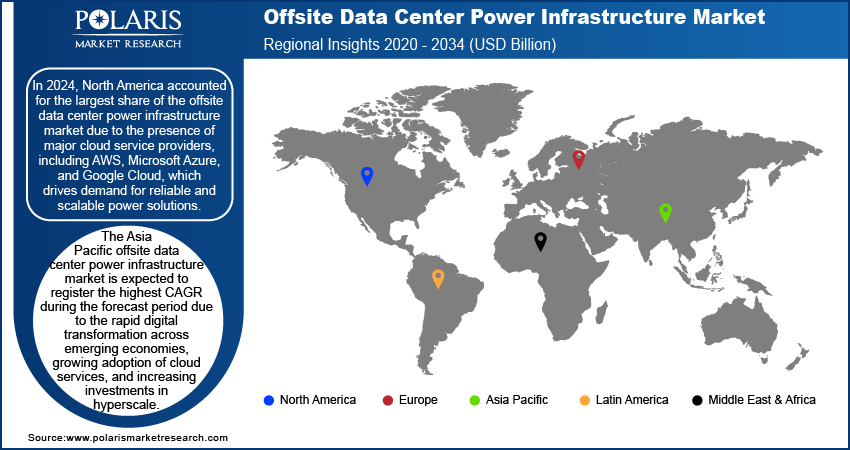

By region, the study provides the offsite data center power infrastructure market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the presence of major cloud service providers, including AWS, Microsoft Azure, and Google Cloud, which drives demand for reliable and scalable power solutions. Additionally, the rapid adoption of advanced technologies such as 5G, IoT, and artificial intelligence has increased the need for robust data processing capabilities, further fueling investments in power infrastructure. Strict regulatory frameworks promoting energy efficiency and sustainability have also encouraged the adoption of renewable energy sources and advanced power management systems. Moreover, North America’s well-established electricity grid, along with investments in modular power systems and energy storage solutions, supports the region’s leadership in maintaining uninterrupted operations and meeting growing data center demands.

The US accounted for the largest share of the offsite data center power infrastructure market in North America in 2024 due to stringent government regulations on energy efficiency and carbon emissions. For instance, in April 2024, the US Environmental Protection Agency finalized regulations to reduce pollution from fossil fuel-fired power plants. Under the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act, these rules aim to enhance public health and environmental integrity while maintaining electricity reliability.

The Asia Pacific offsite data center power infrastructure market is expected to witness the highest CAGR during the forecast period due to the rapid digital transformation across emerging economies, growing adoption of cloud services, and increasing investments in hyperscale. Countries such as China, India, and Southeast Asian nations are experiencing a surge in data traffic driven by the proliferation of IoT devices, e-commerce platforms, and 5G deployments. According to the International Trade Administration US Department of Commerce, cross-border e-commerce development varies across Asia Pacific. China leads with a score of 71.4, followed by South Korea (66.7) and Singapore (65.5), driven by strong digital infrastructure. Japan (61.1) ranks next, while Thailand (58.8), Malaysia (57.7), and Indonesia (54.3) show growth, supported by expanding online markets and rising internet use. Additionally, government initiatives promoting digitalization and smart city projects are fueling the demand for robust data infrastructure.

The China offsite data center power infrastructure market is expected to witness significant growth during the forecast period due to China's push toward smart cities and industrial digitalization, which fuels demand for reliable and efficient power management systems to ensure uninterrupted operations.

Offsite Data Center Power Infrastructure Market – Key Players and Competitive Insights

The competitive landscape of the offsite data center power infrastructure market is characterized by the presence of key global players and regional companies focusing on innovation, energy efficiency, and sustainability. Major companies are investing in advanced power solutions, such as uninterruptible power supply (UPS) systems, modular power units, and energy storage technologies, to meet the growing demand for reliable infrastructure. The competition is further intensified by the rising adoption of renewable energy sources, with companies forming strategic partnerships to integrate solar, wind, and battery solutions.

Major players are also expanding their presence in emerging markets, particularly in Asia Pacific and Latin America, to meet the growing demand driven by hyperscale data centers and cloud service providers. Innovations in power management, such as AI-based monitoring systems, are becoming critical differentiators. Additionally, regulatory compliance with energy efficiency standards adds pressure on companies to develop environmentally sustainable solutions, fostering continuous R&D investments. This dynamic environment encourages mergers, acquisitions, and collaborations as companies aim to enhance their offerings and gain a competitive edge. A few key major players are ABB; Schneider Electric; Eaton; Vertiv; Huawei Digital Power Technologies Co., Ltd.; Comfort Systems USA; Johnson Controls; Yondr; Hubbell; Modubuild; Altron A.S.; InnovIT AG; MAVAB; and Delta Electronics, Inc.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution subsegment. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation cater to various energy and process industries and also offer measurement analytics, machine automation, and robotics.

In March 2024, ABB delivered advanced power distribution systems for data centers globally as they adopted artificial intelligence (AI). In Sichuan province, China, a new facility boasts 500 petaflops of computing power in its first phase, making it one of the largest in the region.

Johnson Controls International plc specializes in the engineering, commissioning, manufacturing, and retrofitting of building developments and systems across the US, Europe, Asia Pacific, and other international markets. The company operates through four main parts—Building Solutions EMEA/LA, Building Solutions North America, Building Solutions APAC, and Global Products. It focuses on the design, installation, sale, and servicing of a wide range of solutions, including heating, controls, ventilation, air conditioning, building management systems, refrigeration, integrated electronic security, fire detection, and suppression systems, as well as fire protection and security products. Johnson Controls serves a diverse clientele, including commercial, industrial, retail, small business, institutional, and governmental customers. In June 2022, Johnson Controls acquired Tempered Networks, a zero-trust cybersecurity provider. Their 'Airwall' technology offers an advanced self-defense system for physical infrastructures, enabling secure network access across various endpoint devices, cloud environments, edge gateways, and service technicians.

Key Companies in the Offsite Data Center Power Infrastructure Market

- ABB

- Schneider Electric

- Eaton

- Vertiv

- Huawei Digital Power Technologies Co., Ltd.

- Comfort Systems USA

- Johnson Controls

- Yondr

- Hubbell

- Modubuild

- Altron A.S.

- InnovIT AG

- MAVAB

- Delta Electronics, Inc.

Offsite Data Center Power Infrastructure Industry Developments

In November 2023, Schneider Electric declared a USD 3 billion multi-year agreement with Compass Datacenters. This deal deepens their collaboration by integrating supply chains for the efficient production and delivery of prefabricated modular data center solutions.

In September 2021, Huawei launched the “Site Virtual Power Plant Distributed Energy Storage System Solution” and “SmartDC, a Large-Scale Data Center Solution.” These innovations support operators in their green and low-carbon energy transition.

Offsite Data Center Power Infrastructure Market Segmentation

By Offering Outlook (Revenue, USD Billion; 2020–2034)

- Solution

- Software

By Vertical Outlook (Revenue, USD Billion; 2020–2034)

- BFSI

- Government and Defense

- IT and telecom

- Manufacturing

- Media and Entertainment

- Retail

- Others

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Offsite Data Center Power Infrastructure Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.37 billion |

|

Market Size Value in 2025 |

USD 15.71 billion |

|

Revenue Forecast by 2034 |

USD 67.68 billion |

|

CAGR |

17.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global offsite data center power infrastructure market value reached USD 13.37 billion in 2024 and is projected to grow to USD 67.68 billion by 2034.

The global market is projected to register a CAGR of 17.6% during the forecast period.

In 2024, North America dominated the offsite data center power infrastructure market share due to the presence of major cloud service providers, including AWS, Microsoft Azure, and Google Cloud, which drives demand for reliable and scalable power solutions.

A few key players in the market are ABB; Schneider Electric; Eaton; Vertiv; Huawei Digital Power Technologies Co., Ltd.; Comfort Systems USA; Johnson Controls; Yondr; Hubbell; Modubuild; Altron A.S.; InnovIT AG; MAVAB; and Delta Electronics, Inc.

In 2024, the solution segment dominated the market share due to the increasing demand for comprehensive and integrated solutions that address various operational challenges faced by organizations.

The IT and telecom segment is expected to witness the highest CAGR during the forecast period due to the rapid expansion of digital technologies and increasing reliance on cloud-based services.