Offshore Wind Energy Market Share, Size, Trends, Industry Analysis Report, By Component (Turbines, Electrical Infrastructure, Substructure, Others); By Location (Shallow Water, Deep Water, Transitional Water); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM2291

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

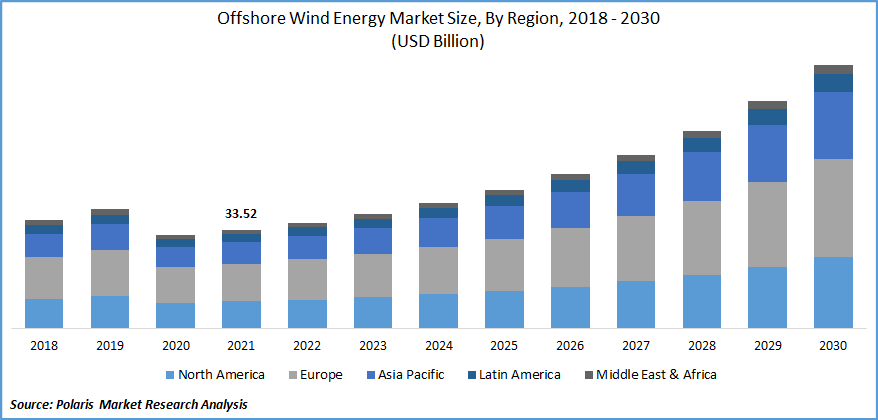

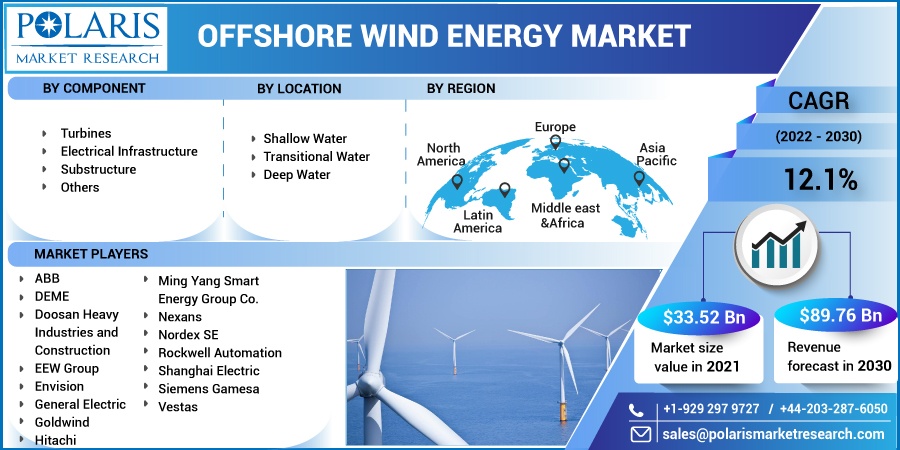

The global offshore wind energy market was valued at USD 33.52 billion in 2021 and is expected to grow at a CAGR of 12.1% during the forecast period. Offshore wind power/energy implies the deployment of offshore wind farms in water bodies. It is clean & renewable power obtained by taking advantage of the wind force.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The market for offshore wind power is expected to expand due to the rising demand for renewable power sources and the increased focus on lowering the global carbon footprint. The market’s growth is projected to be boosted by the expanding attempts by governmental organizations and power corporations to reduce carbon emissions.

According to IRENA (International Renewable Energy Agency), renewables must increase from 25% to 86% by 2050 in the yearly global power generation to satisfy the Paris Agreement's objective. Further, Bloomberg BNEF estimates that over USD 13.3 trillion will be spent on new production assets. According to BNEF, wind & solar is expected to account for half of the global electricity generation by 2050. Additionally, the rising installation of turbines globally is anticipated to drive the growth of the offshore wind energy market.

The spread of the COVID-19 reflects the market growth's downfall due to the global economic slowdown and significant disruptions in the supply chain of the renewable power market. Stringent guidelines issued by government authorities globally have halted most non-essential operations. The interruption in global trade due to the implementation of the lockdown across nations is anticipated to hinder the offshore wind energy market growth.

These disruptions in the supply chain, lockdown measures, and limited corporate spending are anticipated to hamper offshore wind market development. However, the industry is projected to bounce back as governments lift lockdown restrictions across nations. According to the International Energy Agency, the offshore renewable power industry is predicted to grow fast post-pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the key drivers fueling the expansion of the worldwide sector is the increased investment in renewable power. Due to the increased emphasis on environmental sustainability, the power industry has shifted toward green and renewable power to, among other things, slow down the depletion of fossil fuels, regulate climate change, and cut carbon emissions. Additionally, several government rules are being implemented to support renewable energy programs.

Many industrial businesses are making efforts to lower their carbon emissions. For instance, one of the top power companies in Norway, Equinor, plans to cut its carbon emissions by more than 50% by the year 205

The company plans to develop its renewable power business, which is estimated to grow to 6,000 megawatts in 6 years and over 16,000 megawatts in 15 years. Additionally, another energy giant, Total, acquired a 51% stake in SSE Renewable's Seagreen 1 offshore renewable farm project. The company is further estimated to invest over EUR 70 million in this project.

Report Segmentation

The market is primarily segmented on the basis of component, location, and region.

|

By Component |

By Location |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Location

The shallow water segment is recorded to hold the largest revenue share in 2021 and is expected to lead the market in the forecast period. Most of the energy projects are undertaken in shallow water. Installing the offshore wind tower in shallow water is more accessible and requires less capital investment.

This location is the most popular offshore renewable farm development because of the ideal weather conditions and ease of maintenance. Additionally, building an electrical infrastructure in this sector is much simpler. It is predicted that these advantages of shallow water settings would propel the segment's expansion. However, turbines with smaller Megawatt capacities are placed in this area because of the lower offshore wind speed in shallow water.

Deep water installations, where the water is deeper than 30 meters, are becoming increasingly popular nowadays. Additionally, it is projected that rising investments in deep-water, floating offshore wind generating projects would accelerate the segment's growth.

Geographic Overview

Europe accounted for the highest offshore wind energy market shares in 2021. This huge market share can be attributed to the growing investments in renewable energy coupled with favorable government policies. Various key offshore renewable power companies in Europe, such as Vestas, ABB, Siemens, and Nordex SE, are anticipated to boost the market's growth.

Furthermore, EWI supports offshore wind energy market development and a research & development program for renewable power. Additionally, various countries across Europe are increasing their focus on upgrading their electrical infrastructure, and the government in these nations is promoting the use of renewable energy for power generation. Thus, driving the growth of the market.

Additionally, the Asia Pacific market is predicted to have the highest CAGR over the forecasted years. The adoption of favorable government policies regarding renewable energy throughout rising nations such as China, India, and Japan, among others, might be linked to the market expansion in the Asia Pacific region.

China is a worldwide leader and provides more than 40% of the world's offshore wind capacity, according to the Global Wind Energy Council's 2019 report. Over 3 million square kilometers of China's 18,000 km of coastline are ideal for offshore renewable energy development. This offers the area tremendous prospects for offshore wind energy market expansion.

Competitive Insight

Some of the major players operating in the global offshore wind energy market include ABB, DEME, Doosan Heavy Industries and Construction, EEW Group, Envision, General Electric, Goldwind, Hitachi, Ming Yang Smart Energy Group Co., Nexans, Nordex SE, Rockwell Automation, Shanghai Electric, Siemens Gamesa, and Vestas.

Offshore Wind Energy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 33.52 billion |

|

Revenue forecast in 2030 |

USD 89.76 billion |

|

CAGR |

12.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Location, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ABB, DEME, Doosan Heavy Industries and Construction, EEW Group, Envision, General Electric, Goldwind, Hitachi, Ming Yang Smart Energy Group Co., Nexans, Nordex SE, Rockwell Automation, Shanghai Electric, Siemens Gamesa, and Vestas. |