Offshore Mooring Systems Market Size, Share, Trends, Industry Analysis Report: By Type (Spread Mooring, Single Point Mooring, Dynamic Positioning, Tendons & Tension Mooring, and Others), Anchorage, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5193

- Base Year: 2024

- Historical Data: 2020-2023

Offshore Mooring Systems Market Overview

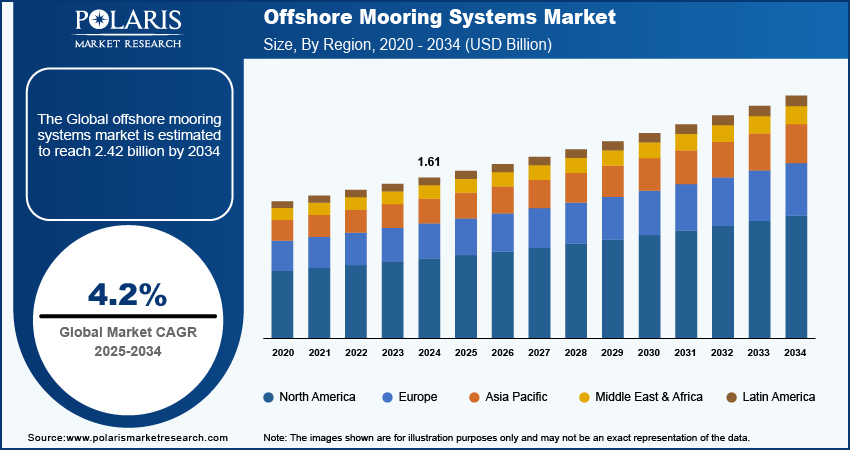

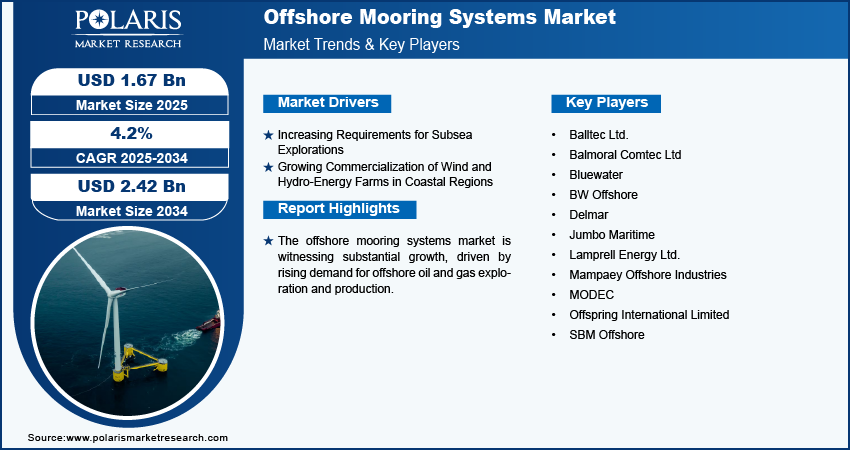

The offshore mooring systems market size was valued at USD 1.61 billion in 2024. The market is projected to grow from USD 1.67 billion in 2025 to USD 2.42 billion by 2034, exhibiting a CAGR of 4.2% during 2025–2034.

Offshore mooring systems are essential for securely anchoring floating structures, such as oil rigs and wind turbines, in marine environments. These systems use various anchorage methods, including drag embedment, suction anchors, and vertical load anchors, to assure stability and safety in challenging ocean conditions.

The offshore mooring systems market is experiencing significant growth due to the increasing demand for offshore oil and gas exploration and production. The expansion of renewable energy sources, particularly offshore wind farms, is driving the need for robust mooring solutions to ensure operational stability. In September 2024, X1 Wind collaborated with FibreMax to enhance its floating offshore wind technology. The partnership will allow X1 Wind to incorporate advanced components and materials into their designs, specifically to increase the mass production of tension leg platform (TLP) tendons. Furthermore, advancements in mooring technology, such as the development of dynamic positioning systems, are improving the efficiency and safety of offshore operations. The rising focus on sustainable energy practices is also encouraging investments in innovative mooring systems that reduce environmental impact. Thus, the combination of growing offshore projects and technological advancements with the increasing adoption of automation in offshore operations is supporting market growth by improving the reliability of mooring systems.

To Understand More About this Research: Request a Free Sample Report

Offshore Mooring Systems Market Drivers

Increasing Requirements for Subsea Explorations

The growing requirements for subsea explorations are driving the offshore mooring systems market, fueled by increasing demand for oil and gas extraction in deeper waters. For instance, Equinor’s Johan Castberg project in the Barents Sea showcases the use of advanced mooring solutions, such as chain-wire lines and suction anchors, to secure floating production storage and offloading (FPSO) units in challenging deep-water conditions. Since the harsh marine environment demands robust anchoring for safe operations, there is a constant need for offshore mooring systems. Additionally, technological advancements are allowing deeper and more complex subsea projects, thus boosting the need for reliable and innovative mooring systems to support expanding offshore energy initiatives.

Growing Need for Reliable Anchoring of Floating Renewable Energy Platforms

The need for reliable anchoring of floating renewable energy platforms is significantly boosting the demand for offshore mooring systems as they utilize advanced mooring technology. For instance, the Hywind Scotland project is the world’s first floating offshore wind farm that operates off the coast of Aberdeenshire. The Hywind has a 30 MW capacity, which supplies power to around 20,000 homes. It utilizes advanced mooring technology, including suction anchors and synthetic fiber mooring lines, to secure the turbines in waters exceeding 100 meters in depth. Additionally, nations are increasingly investing in expanding the country’s offshore wind and hydro-energy capacities to meet renewable energy goals by means of installing floating platforms, which is propelling the market.

Offshore Mooring Systems Market Segment Insights

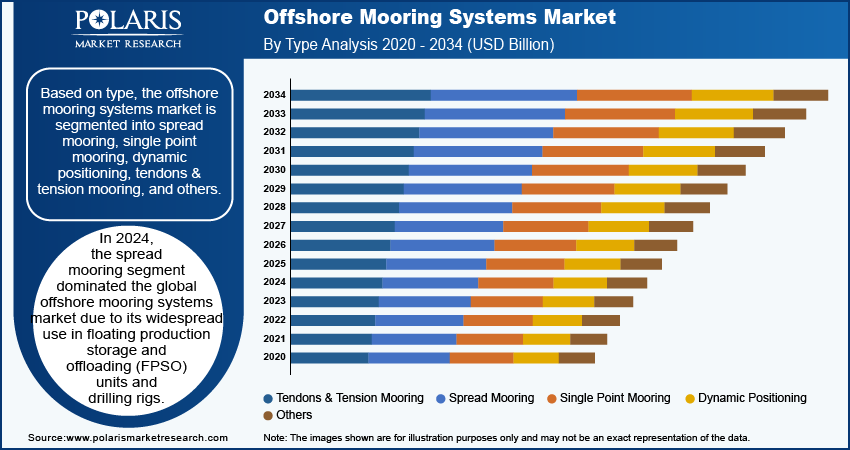

Offshore Mooring Systems Market Breakdown by Type Outlook

The global offshore mooring systems market segmentation, based on type, includes spread mooring, single point mooring, dynamic positioning, tendons & tension mooring, and others. In 2024, the spread mooring segment dominated the global market due to its widespread use in floating production storage and offloading (FPSO) units and drilling rigs. Additionally, it offers greater flexibility and stability in harsh marine environments, making it suitable for deep-water operations. The comparatively lower installation and maintenance costs make spread mooring a preferred choice over other mooring types. Consequently, the increasing deployment of FPSOs and offshore drilling operations continues to boost demand for spread mooring systems.

Offshore Mooring Systems Market Breakdown by Anchorage Outlook

The global offshore mooring systems market, based on anchorage, is segmented into drag embedment anchors, suction anchors, vertical load anchors, driven pile, and others. The vertical load anchors segment is expected to experience the fastest growth in the market due to their efficiency in providing stability in various seabed conditions. Vertical load anchors are particularly effective in deep-water applications where traditional anchoring methods cannot operate. Moreover, their design allows for easy installation and removal, making them suitable for temporary and permanent mooring solutions. Thus, the increasing demand for offshore installations, including renewable energy projects and oil and gas exploration, drives the adoption of vertical load anchors. Consequently, the growth trend reflects the industry's shift toward more reliable and versatile anchoring technologies.

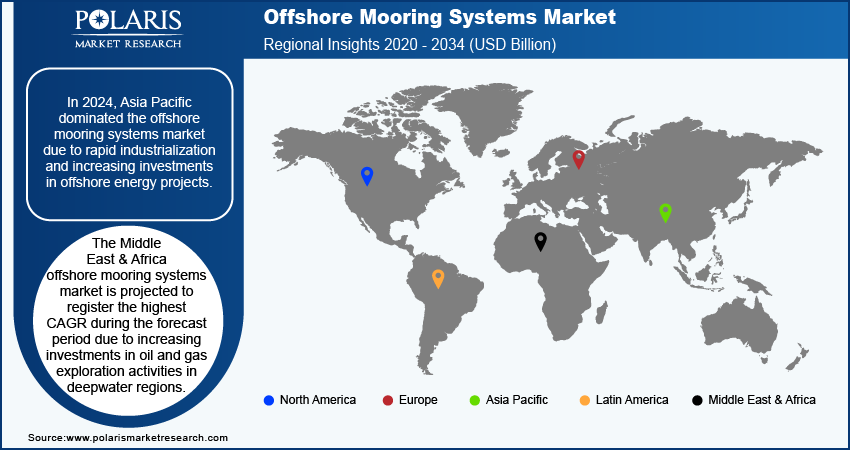

Offshore Mooring Systems Market Breakdown, by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the offshore mooring systems market due to rapid industrialization and increasing investments in offshore energy projects. In August 2023, Inpex Corporation acquired a 74% share in the AC/RL7 block off Western Australia via INPEX Cash Maple Pty Ltd., covering about 418 square kilometers; this acquisition aims to improve the Ichthys LNG Project's resilience and output. It aligns with INPEX’s strategy for cleaner energy and stable production, pending regulatory approvals. Furthermore, the growing focus on renewable energy sources, particularly offshore wind farms, significantly contributes to the need for advanced mooring solutions. The combination of robust economic growth and a shift toward sustainable energy in the Asia Pacific positions it as a leader in the offshore mooring systems market. Consequently, this trend highlights the region's pivotal role in the global energy landscape.

The Middle East & Africa offshore mooring systems market is projected to register the highest CAGR due to increasing investments in oil and gas exploration activities in deep-water regions. Additionally, the region's vast, unused hydrocarbon resources are driving demand for advanced mooring solutions to support floating production storage and offloading (FPSO) units. Thus, the combination of traditional energy exploration and the shift toward renewable resources positions the Middle East & Africa as a major region for growth of the global offshore mooring systems market.

Offshore Mooring Systems Market – Key Players and Competitive Insights

The competitive landscape of the offshore mooring systems market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic collaborations, and geographic expansion. Major companies in the industry, such as Delmar Systems, Jumbo Offshore, and others, capitalize on their robust R&D capabilities and extensive distribution networks to deliver advanced mooring solutions that serve various applications, including oil and gas, offshore renewable energy, and aquaculture. These leading companies prioritize product innovation, focusing on improving stability, efficiency, and reliability to meet the demands of offshore operations. Smaller regional companies are emerging with specialized mooring products tailored to local markets, providing unique solutions and customized applications. Competitive strategies in this market encompass mergers and acquisitions, partnerships with energy firms, and the expansion of product portfolios to strengthen market presence in key regions. A few key market players are Balltec Ltd., Balmoral Comtec Ltd, Bluewater, BW Offshore, Delmar, Jumbo Maritime, Lamprell Energy Ltd., Mampaey Offshore Industries, MODEC, Offspring International Limited, and SBM Offshore.

Delmar, an offshore engineering company based in Texas, USA, specializes in providing innovative anchoring and mooring solutions. The company’s expertise encompasses a wide range of services, including engineering design, mooring analysis, risk assessments, project management, and planning. One of the core areas of specialization for Delmar Systems is mooring technology. The company offers advanced mooring solutions that are critical for the stability and safety of offshore platforms and vessels. The company’s mooring systems are designed to withstand harsh marine environments, providing reliable anchorage for floating structures such as drilling rigs and production platforms. In May 2021, Delmar System acquired Vryhof, which specializes in Deep Sea Mooring and Vryhof Anchors.

Jumbo Maritime, a division of the privately-owned Jumbo Group based in the Netherlands, operates a fleet of specialized offshore transportation and installation crane vessels, serving clients across the globe in the renewables and subsea & offshore sectors. Jumbo Offshore delivers efficient, thoroughly engineered solutions for transport and installation projects. In January 2024, Jumbo Offshore Installation Contractors B.V. secured a contract from MODEC Guyana Inc. to handle the pre-installation of the mooring system for the FPSO Errea Wittu, which will be positioned offshore Guyana. The FPSO will have the capacity to store 2 billion barrels of oil, produce about 250,000 barrels of oil per day, treat 540 billion cubic feet of gas daily, and inject up to 350,000 barrels of water per day.

Key Companies in Offshore Mooring Systems Market

- Balltec Ltd.

- Balmoral Comtec Ltd

- Bluewater

- BW Offshore

- Delmar

- Jumbo Maritime

- Lamprell Energy Ltd.

- Mampaey Offshore Industries

- MODEC

- Offspring International Limited

- SBM Offshore

Offshore Mooring Systems Industry Developments

In September 2021, Imenco's launched Pacu technology, designed for mooring systems. It uses sacrificial anodes to extend the lifespan of mooring chains, filling a critical gap in corrosion protection. It is fully commercialized after successful testing and validation with a major international operator.

In June 2024, MPS collaborated with Associated British Ports to facilitate the deployment of floating offshore wind projects in the Celtic Sea. The collaboration aims to develop solutions that enable the use of MPS's advanced floating platform technology, PelaFlex, from ABP’s Port of Port Talbot, supporting renewable energy initiatives in the region.

Offshore Mooring Systems Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Spread Mooring

- Single Point Mooring

- Dynamic Positioning

- Tendons & Tension Mooring

- Others

By Anchorage Outlook (Revenue, USD Billion, 2020–2034)

- Drag Embedment Anchors

- Suction Anchors

- Vertical Load Anchors

- Driven Pile

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Tension Leg Platforms

- Semi-Submersible Platforms

- SPAR Platforms

- FPSO

- Drill Ships

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Offshore Mooring Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.61 billion |

|

Market Size Value in 2025 |

USD 1.67 billion |

|

Revenue Forecast by 2034 |

USD 2.42 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global offshore mooring systems market size was valued at USD 1.61 billion in 2024 and is projected to grow to USD 2.42 billion by 2034.

The global market is projected to register a CAGR of 4.2% during the forecast period.

In 2024, Asia Pacific dominated the market due to rapid industrialization and increasing investments in offshore energy projects.

A few key players in the market are Balltec Ltd., Balmoral Comtec Ltd, Bluewater, BW Offshore, Delmar, Jumbo Maritime, Lamprell Energy Ltd., Mampaey Offshore Industries, MODEC, Offspring International Limited, and SBM Offshore

The vertical load anchors segment experienced the fastest growth in the global offshore mooring systems market.

In 2024, the spread mooring segment dominated the market due to its widespread use in floating production storage and offloading (FPSO) units and drilling rigs.