OEM Insulation Market Size, Share, Trends, Industry Analysis Report: By Insulation Type (Thermal Insulation and Acoustic Insulation), Material Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5568

- Base Year: 2024

- Historical Data: 2020-2023

OEM Insulation Market Overview

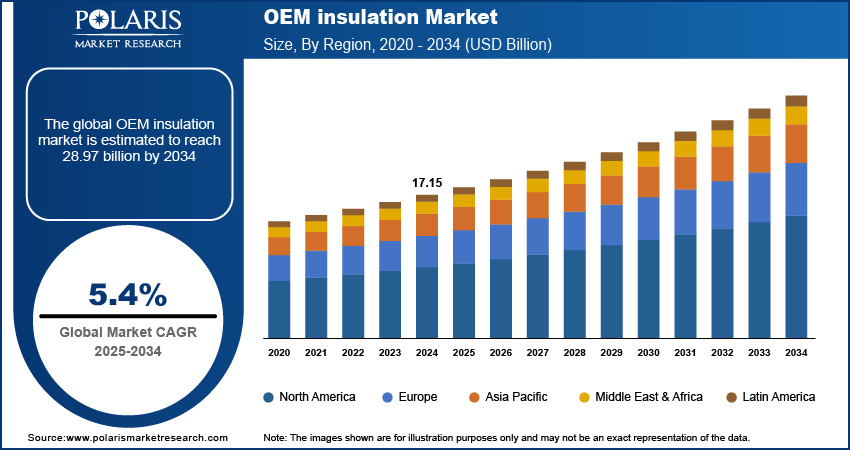

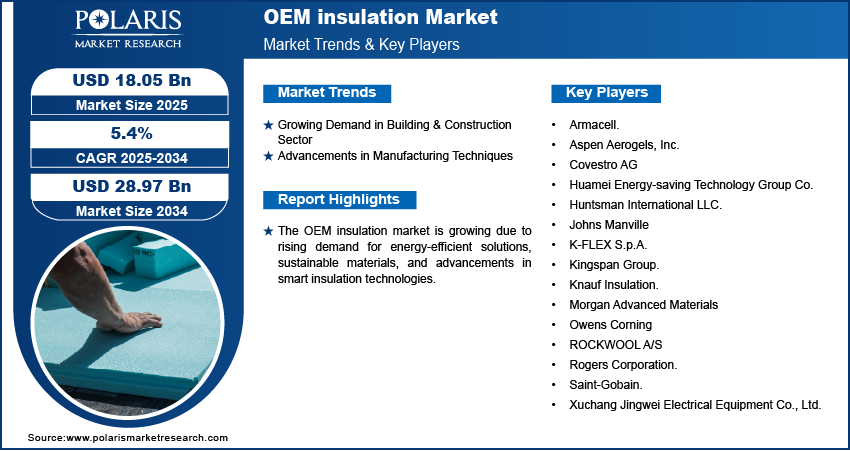

The global OEM insulation market was valued at USD 17.15 billion in 2024. The market is expected to grow from USD 18.05 billion in 2025 to USD 28.97 billion by 2034, at a CAGR of 5.4% during the forecast period.

Original equipment manufacturer (OEM) insulation refers to specialized insulation solutions designed for integration into equipment and machinery during manufacturing. The OEM insulation market is experiencing growth, driven by the rapid pace of urbanization and industrialization. The demand for insulated equipment is growing in sectors such as automotive, construction, HVAC, and electronics as urban centers expand and industries increase production. Urbanization has driven the need for enhanced infrastructure, which in turn requires effective thermal and acoustic insulation solutions to boost energy efficiency and ensure safety. For instance, in January 2025, Saint-Gobain provided energy-efficient solutions for Schneider Electric’s headquarters in Stezzano, Italy, including thermal insulation, roof systems, and solar control glazing. These upgrades support Schneider’s de-carbonization goals, improving energy efficiency and employee comfort while reducing environmental impact. Similarly, industrial expansion has resulted in the need for high-performance insulation in manufacturing equipment, helping to maintain operational efficiency and comply with strict regulatory standards.

Another major driver of the OEM insulation market is the rising popularity of energy-efficient products across industries. Manufacturers are increasingly integrating advanced insulation materials to improve thermal efficiency and reduce energy losses with growing environmental concerns and strict regulations on energy consumption. For instance, in September 2023, Kingspan launched a hydrophobic microporous silica insulation board with a thermal conductivity of 0.020 W/mK and A2-s1, d0 fire rating. Ideal for rain-screen facades, it offers slim, high-performance insulation for modern construction and renovation projects.

To Understand More About this Research: Request a Free Sample Report

OEM Insulation Market Dynamics

Growing Demand in Building & Construction Sector

The construction industry is integrating high-performance insulation materials into HVAC systems, walls, roofing, and piping to improve energy conservation and indoor comfort with increasing urbanization and strict energy efficiency regulations. Additionally, the rising focus on sustainable building practices has led to the adoption of insulation solutions that reduce heat loss and lower carbon footprints. These solutions also improve overall building efficiency, as modern infrastructure projects require advanced thermal and acoustic insulation. For instance, in March 2023, energystore launched Energystore+, a low-carbon insulation product range using BASF’s Neopor BMB. These EPS-based solutions reduce carbon footprints while maintaining high quality and supporting energy efficiency in buildings. OEM insulation plays an essential role in prefabricated construction components, assuring compliance with energy codes and improving the durability of structures. Thus, the rising demand for innovative insulation materials in the construction sector to adhere to green building initiatives continues to drive OEM insulation market growth.

Advancements in Manufacturing Techniques

The development of precision-engineered materials and automated manufacturing processes has improved the quality, consistency, and customization of insulation products, making them more suitable for diverse applications across industries. Innovations such as lightweight composites, aerogels, and nanotechnology-based insulation have improved thermal efficiency while reducing material weight and thickness, allowing the production of high-performance and cost-effective insulation solutions. For instance, in September 2024, Armacell launched ArmaGel XGH, an advanced aerogel insulation technology with a proprietary blanket design, offering superior thermal performance and ASTM C1728 compliance. These advancements optimize insulation performance, and they also contribute to improved ease of installation and long-term durability. Therefore, as manufacturers continue to invest in research and development, the evolution of insulation technologies is expected to further expand the application scope of OEM insulation across multiple end-use industries.

OEM Insulation Market Segment Analysis

OEM Insulation Market Assessment by Material Type Outlook

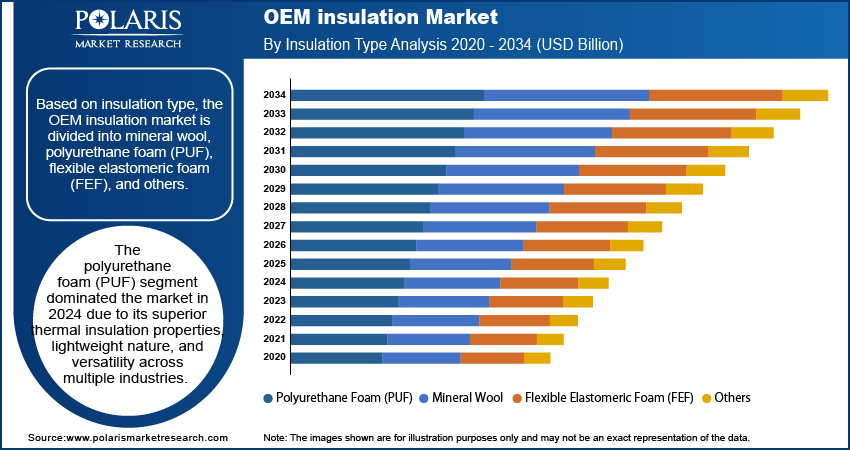

The global OEM insulation market segmentation, based on material type, includes mineral wool, polyurethane foam (PUF), flexible elastomeric foam (FEF), and others. The polyurethane foam (PUF) segment dominated the market in 2024 due to its superior thermal insulation properties, lightweight nature, and versatility across multiple industries. PUF is widely used in applications requiring high energy efficiency, such as HVAC systems, refrigeration, and automotive components, where maintaining thermal stability is essential. Its low thermal conductivity and excellent moisture resistance improve its performance, making it a preferred choice for manufacturers seeking cost-effective insulation solutions. Additionally, advancements in polyurethane formulations have improved fire resistance and durability. The ability of PUF to be customized for various industrial needs, along with its ease of installation, has solidified its position as the leading material in OEM insulation applications.

OEM Insulation Market Evaluation by End Use Outlook

The global OEM insulation market, by end use, is segmented into transportation, industrial & commercial, and consumer. The transportation segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for energy-efficient and lightweight insulation materials in the automotive, aerospace, and railway industries. Manufacturers are incorporating advanced insulation solutions to enhance thermal management, reduce noise, and enhance passenger comfort, with a growing focus on fuel efficiency and emission reduction. The rising adoption of electric vehicles (EVs) has further fueled demand for high-performance insulation to optimize battery efficiency and thermal regulation. Additionally, strict regulatory standards on vehicle energy consumption and emissions have compelled OEMs to integrate innovative insulation technologies

.

.

OEM Insulation Market Regional Insights

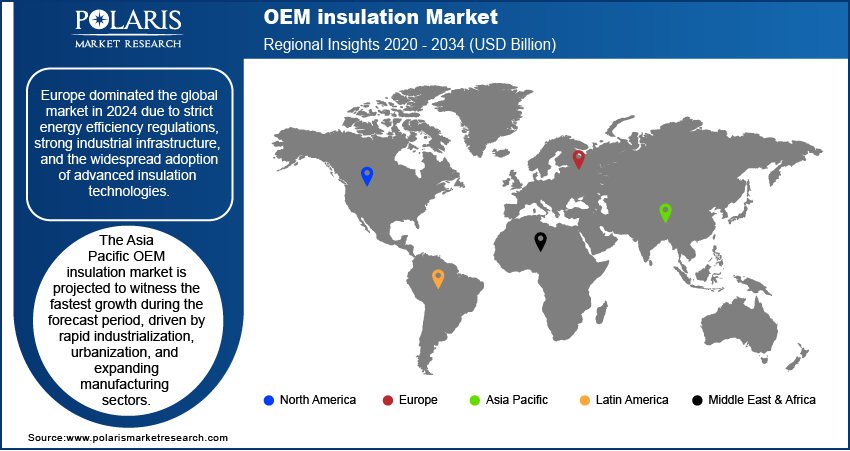

By region, the report provides the OEM insulation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the global market in 2024 due to strict energy efficiency regulations, strong industrial infrastructure, and the widespread adoption of advanced insulation technologies. The region’s well-established automotive, aerospace, and construction industries have significantly contributed to the demand for OEM insulation materials to enhance energy conservation and ensure regulatory compliance. Additionally, rising investments in sustainable manufacturing practices and the adoption of eco-friendly insulation materials have fueled the need for OEM insulation. The presence of leading insulation manufacturers and ongoing research and development initiatives in high-performance insulation solutions have also contributed to Europe’s market leadership.

The Asia Pacific OEM insulation market is projected to witness the fastest growth during the forecast period, driven by rapid industrialization, urbanization, and expanding manufacturing sectors. The region’s booming construction industry, particularly in countries such as China and India, is fueling demand for high-performance insulation solutions in commercial and residential buildings. Additionally, the growing automotive and electronics industries are adopting advanced insulation materials to improve energy efficiency and product durability. Rising investments in smart infrastructure and green building initiatives further support the increasing adoption of OEM insulation. Therefore, as the demand for cost-effective and efficient insulation solutions rises, Asia Pacific is expected to emerge as the fastest growing regional market.

OEM Insulation Market – Key Players and Competitive Insights

The competitive landscape combines global leaders and regional players competing to capture OEM insulation market share through innovation, strategic alliances, and regional expansion. Global players such as Saint-Gobain, Rockwool, Owens Corning, and Johns Manville leverage robust R&D capabilities and extensive distribution networks to deliver advanced insulation materials, solutions, and specialized products. OEM insulation market trends indicate rising demand for sustainable and energy-efficient solutions, such as bio-based insulation materials and smart insulation technologies, reflecting advancements in manufacturing techniques and environmental regulations. According to OEM insulation market analysis, the market is projected to grow, driven by increasing demand from automotive, industrial equipment, and HVAC applications, alongside stricter energy efficiency standards.

Regional companies capitalize on localized needs by offering cost-effective and tailored insulation solutions, especially in emerging markets. OEM insulation market competitive strategies include mergers and acquisitions, partnerships with manufacturing industries, and the introduction of innovative insulation products to address growing environmental concerns and energy efficiency requirements. These developments highlight the role of technological innovation, market adaptability, and regional investments in driving the OEM insulation industry expansion. A few key market players are Armacell; Aspen Aerogels, Inc.; Covestro AG; Huamei Energy-saving Technology Group Co.; Huntsman International LLC; Johns Manville; K-FLEX S.p.A.; Kingspan Group; Knauf Insulation; Morgan Advanced Materials; Owens Corning; ROCKWOOL A/S; Rogers Corporation; Saint-Gobain; and Xuchang Jingwei Electrical Equipment Co., Ltd.

Aspen Aerogels, Inc. specializes in the design, development, and manufacture of aerogel insulation products, primarily targeting the energy infrastructure and sustainable materials markets. Founded in 2001 and headquartered in Northborough, Massachusetts, Aspen has established itself in aerogel technology. It offers a wide range of products, including Pyrogel and Cryogel, that are utilized in various applications, such as building construction, fire barriers, and industrial piping. The company operates through two main segments: Energy Industrial and Thermal Barrier, providing innovative solutions such as PyroThin thermal barriers for lithium-ion batteries and Pyrogel XTE to minimize corrosion under insulation. Aspen's commitment to sustainability is clear in its Aerogel Technology Platform, which aims to improve energy efficiency and support cleaner fuel availability while addressing global challenges in electrification and resource efficiency. Aspen Aerogels continues to leverage its extensive research and development efforts to create high-performance insulation solutions that meet the demands of modern industries.

Kingspan Group plc, an Irish building materials company founded in the 1960s, operates in over 80 countries with more than 210 factories. The company is structured into six divisions: Insulated Panels, Insulation, Light & Air, Water & Energy, Data & Flooring, and Roof & Waterproofing. Kingspan designs manufactures, and markets energy storage solutions, offering products such as rigid insulation boards, insulated roofs, walls, facade systems, and steel and timber frame off-site solutions. They also provide raised access floors, environmental and renewable fuel and water storage solutions, and hot water systems, with a focus on zero and low-carbon solutions for both private and public sectors. Kingspan is committed to sustainability, aiming to achieve a net-zero emissions future. The company launched its 'Planet Passionate' program in 2019, targeting a 90% reduction in carbon emissions by 2030 and upcycling 1 billion PET bottles into insulation by 2025.

List of Key Companies in OEM Insulation Market

- Armacell.

- Aspen Aerogels, Inc.

- Covestro AG

- Huamei Energy-saving Technology Group Co.

- Huntsman International LLC.

- Johns Manville

- K-FLEX S.p.A.

- Kingspan Group.

- Knauf Insulation.

- Morgan Advanced Materials

- Owens Corning

- ROCKWOOL A/S

- Rogers Corporation.

- Saint-Gobain.

- Xuchang Jingwei Electrical Equipment Co., Ltd.

OEM Insulation Industry Developments

October 2024: Ecological Building Systems launched Gramitherm, a sustainable grass-based insulation. It sequesters CO2, regulates humidity, reduces mould, and offers high thermal and acoustic performance, supporting the circular economy with low environmental impact and health safety certifications.

September 2024: Thermore launched Invisiloft, a slim, high-performance insulation made from 100% recycled PET. According to Thermore, the insulation offers exceptional warmth with minimal bulk, ideal for sportswear and everyday wear, combining sustainability with functionality.

OEM Insulation Market Segmentation

By Insulation Type Outlook (Revenue, USD Billion, 2020–2034)

- Thermal Insulation

- Acoustic Insulation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Mineral Wool

- Polyurethane Foam (PUF)

- Flexible Elastomeric Foam (FEF)

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Transportation

- Industrial & Commercial

- Consumer

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

OEM insulation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.15 billion |

|

Market Size Value in 2025 |

USD 18.05 billion |

|

Revenue Forecast by 2034 |

USD 28.97 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global OEM insulation market size was valued at USD 17.15 billion in 2024 and is projected to grow to USD 28.97 billion by 2034.

The global market is projected to register a CAGR of 5.4% during the forecast period.

Europe dominated the global market in 2024.

Some of the key players in the market are Armacell; Aspen Aerogels, Inc.; Covestro AG; Huamei Energy-saving Technology Group Co.; Huntsman International LLC; Johns Manville; K-FLEX S.p.A.; Kingspan Group; Knauf Insulation; Morgan Advanced Materials; Owens Corning; ROCKWOOL A/S; Rogers Corporation; Saint-Gobain; and Xuchang Jingwei Electrical Equipment Co., Ltd.

The polyurethane foam (PUF) segment dominated the market in 2024.