Oceanic Bioluminescent Energy Solutions Market Size, Share, Trends, Industry Analysis Report: By Component (Bioluminescent Organisms, Bioengineered Materials, and Others), Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5444

- Base Year: 2024

- Historical Data: 2020-2023

Oceanic Bioluminescent Energy Solutions Market Overview

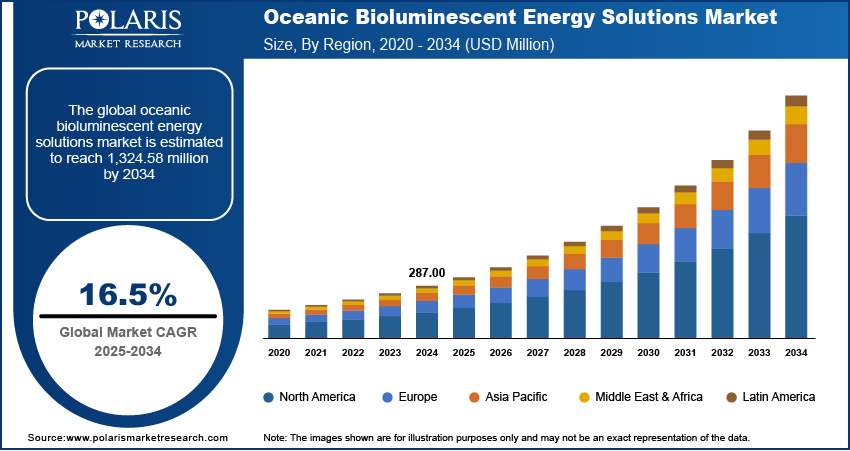

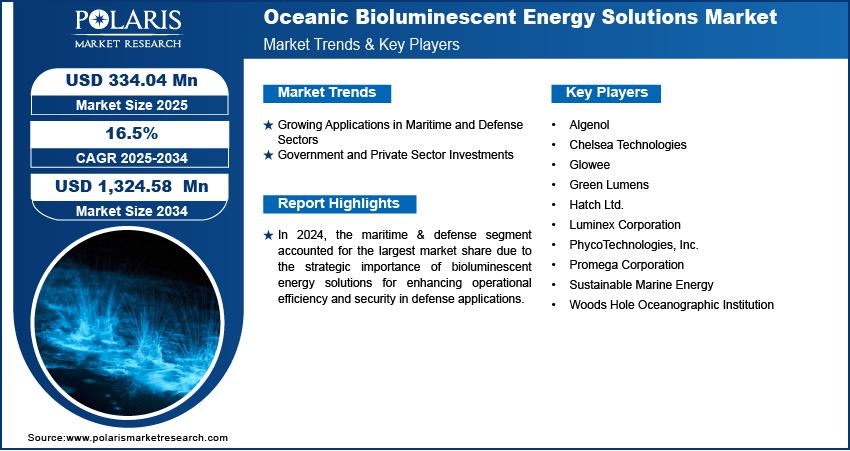

The global oceanic bioluminescent energy solutions market size was valued at USD 287.00 million in 2024 and is expected to reach USD 334.04 million by 2025 and 1,324.58 million by 2034, exhibiting a CAGR of 16.5% during 2025–2034.

Oceanic bioluminescent energy solutions refer to the innovative use of bioluminescent marine organisms to generate sustainable energy and lighting applications. This emerging field explores harnessing biochemical reactions within bioluminescent species, such as certain algae, bacteria, and deep-sea creatures, to produce eco-friendly illumination or convert biochemical energy into usable power.

Innovations in genetic modification and bioengineering are enhancing bioluminescence efficiency, making it viable for energy applications, which is contributing to the oceanic bioluminescent energy solutions market growth. Additionally, expanding deep-sea research and marine conservation initiatives are encouraging investments in bioluminescent technologies for underwater applications, thereby fueling market growth.

To Understand More About this Research: Request a Free Sample Report

Expanding use in environmental monitoring such as detecting oceanic pollution, tracking marine biodiversity, and monitoring climate change impacts are boosting the oceanic bioluminescent energy solutions market development.

Oceanic Bioluminescent Energy Solutions Market Dynamics

Growing Applications in Maritime and Defense Sectors

There is a rising need for enhanced operational efficiency and security in the maritime and defense sectors. Stealth navigation uses bioluminescent markers and natural light to reduce the need for artificial lights, helping submarines and naval vessels operate undetected. This reliance on natural bioluminescence in the maritime and defense sectors drives the oceanic bioluminescent energy solutions market demand. Moreover, bioluminescent organisms react to movement, supporting in the detection of unauthorized activity and potential threats for underwater surveillance. Additionally, emergency lighting applications leverage bioluminescent technology for low-energy, self-sustaining illumination in naval bases, lifeboats, and underwater rescue operations. The integration of bioluminescent energy is rising as defense agencies prioritize sustainable and innovative technologies, enhancing maritime security, reducing power consumption, and improving mission effectiveness in challenging marine environments. For instance, in December 2024, the US Coast Guard supported the FSM Joint Committee Meeting to strengthen partnerships and improve maritime security. This initiative aims to enhance inter-agency coordination and address emerging maritime threats. Thus, the growing applications of bioluminescent energy in maritime and defense sectors fuel the oceanic bioluminescent energy solutions market development.

Government and Private Sector Initiatives

Governments, research institutions, and private investors are increasing funding for bioenergy research and green technology initiatives. For instance, in March 2023, the US Department of Energy declared USD 590 million to expand its four Bioenergy Research Centers. This funding enhanced research into next-generation sustainable and affordable bioproducts and bioenergy technologies. This financial support is fueling advancements in synthetic biology, bioreactor development, and bioengineered luminescent organisms. Further, global sustainability goals push for low-carbon and renewable energy alternatives, particularly in off-grid lighting, marine applications, and smart city infrastructure. Additionally, public and private sector collaboration is encouraging regulatory support and reducing production costs. Thus, the rising government and private sector initiatives are expected to provide lucrative oceanic bioluminescent energy solutions market opportunities during the forecast period

Oceanic Bioluminescent Energy Solutions Market Segment Insights

Oceanic Bioluminescent Energy Solutions Market Assessment by Component Outlook

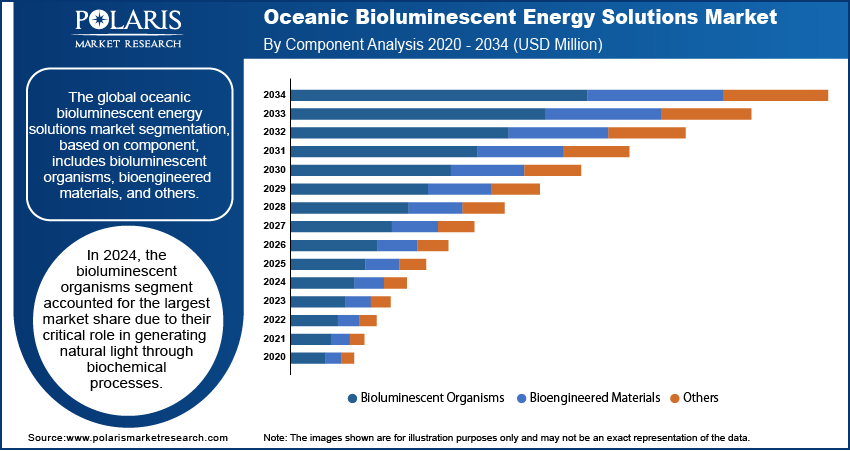

The global oceanic bioluminescent energy solutions market segmentation, based on component, includes bioluminescent organisms, bioengineered materials, and others. In 2024, the bioluminescent organisms segment accounted for the largest market share due to their critical role in generating natural light through biochemical processes. These organisms, such as certain marine bacteria and algae, are central to the development of oceanic bioluminescent energy solutions. Their inherent ability to produce light efficiently and sustainably without external energy sources makes them highly attractive for applications in marine navigation, underwater surveillance, and renewable energy generation. The demand for eco-friendly and sustainable energy solutions boosts the bioluminescent organisms segment growth.

Oceanic Bioluminescent Energy Solutions Market Evaluation by End-Use Industry Outlook

The global oceanic bioluminescent energy solutions market segmentation, based on end-use industry, includes maritime & defense, environmental monitoring, and others. In 2024, the maritime & defense segment accounted for the largest market share due to the strategic importance of bioluminescent energy solutions for enhancing operational efficiency and security in defense applications. Bioluminescent technologies are increasingly being used for stealth navigation, underwater surveillance, and emergency lighting in naval operations, where low energy consumption and minimal detection are critical. Additionally, the ability of bioluminescent organisms to react to environmental stimuli has proven valuable in military reconnaissance. The environmental monitoring sector also contributes significantly to this dominance, as bioluminescent energy is used for tracking oceanic pollution and monitoring marine ecosystems. This rising demand in both sectors is fueling the oceanic bioluminescent energy solutions market growth.

Oceanic Bioluminescent Energy Solutions Market Regional Analysis

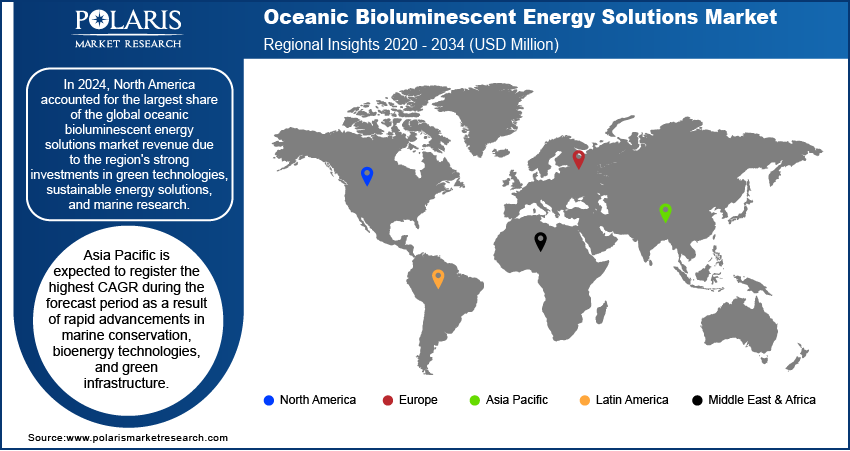

By region, the study provides oceanic bioluminescent energy solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the region's strong investments in green technologies, sustainable energy solutions, and marine research. For instance, in January 2025, the US Environmental Protection Agency allocated USD 2.4 million to support 24 small businesses in advancing environmental technologies, promoting sustainable practices and innovative solutions for critical environmental challenges. North America has seen increasing governmental and private sector funding for bioengineering and biotechnology research, which is accelerating the development and commercialization of bioluminescent energy solutions. The region also benefits from its advanced infrastructure, early adoption of eco-friendly technologies, and a growing demand for renewable energy solutions across various sectors, including defense and environmental monitoring.

Asia Pacific is expected to register the highest CAGR during the forecast period as the region is experiencing rapid advancements in marine conservation, bioenergy technologies, and green infrastructure. Additionally, increasing investments in marine research and sustainable energy innovation, combined with strong support for biotechnology initiatives from governments and private companies, are driving this growth. For instance, in 2024, the Indian government allocated USD 114.3 million to enhance and expedite advancements in the biotechnology sector, aiming to boost innovation and support advanced research and development initiatives. Such initiatives drive the oceanic bioluminescent energy solutions market expansion in Asia Pacific.

Oceanic Bioluminescent Energy Solutions Market – Key Players & Competitive Analysis Report

The competitive landscape of the oceanic bioluminescent energy solutions market is dynamic, with a mix of established players and emerging innovators. Companies in this market are heavily focused on bioengineering, sustainable energy development, and marine biotechnology to capitalize on the growing demand for eco-friendly and renewable energy solutions. Leading players such as Luminex Corporation, Glowee, and Algenol are at the forefront, developing bioluminescent technologies that harness the power of marine organisms and bioengineered materials for diverse applications, including underwater lighting, surveillance, and marine conservation. These companies leverage extensive R&D capabilities, strong partnerships with academic institutions, and collaborations with government agencies to advance bioluminescent energy technologies. Additionally, newer entrants such as Green Lumens are introducing innovative solutions to address niche segments such as low-energy lighting for defense applications and sustainable marine navigation. The competition is also intensified by the influx of venture capital funding, which is enabling players to scale their technologies rapidly and expand their market presence. Moreover, increasing demand from industries such as maritime & defense and environmental monitoring is prompting companies to explore new applications and improve the efficiency of bioluminescent energy systems.

Chelsea Technologies Ltd. is engaged in environmental monitoring sensors and systems for surveying the ocean and other aquatic systems. The company was incorporated in 1964. The registered office is located in Hampshire, UK. Chelsea Technologies manufactures oceanographic sensors, sonar systems, acoustic transducers, towed vehicle systems, and ship’s flow-through sensors. The company’s sensor technology is used to help submariners study the oceanographic environment, monitor water supplies to guard against chemical attacks, monitor oceanic algae and their response to climate change, monitor ballast water to prevent the transfer of invasive marine species, and monitor ship exhaust scrubbing systems, to prevent environmental pollution. The company delivers IT solutions with integrated cybersecurity to companies worldwide. Chelsea Technologies has offices in New York City, Miami, San Francisco, Abu Dhabi, Texas, and other global locations. Chelsea Technologies Ltd. offers Ceanic bioluminescent energy solutions, utilizing marine organisms' natural light emission for sustainable power generation. These innovative systems provide eco-friendly, self-sustaining energy for marine research, underwater sensors, and environmental monitoring.

Promega Corporation, a biotechnology company, manufactures enzymes and other products for molecular biology and biotechnology. The company was founded in 1978 and headquartered in Wisconsin, US. Promega has expanded its portfolio to cover genomics, protein analysis and expression, drug discovery, cellular analysis, and genetic identity. Promega delivers over 4,000 life science products used by researchers, scientists, and life science and pharmaceutical companies. The company's product portfolio includes cloning systems, luciferase reporters, amplification products, and systems for genetic identification based on DNA analysis. Promega's products are used in academic, pharmaceutical, clinical, forensic, and industrial/environmental labs worldwide. Promega Corporation specializes in bioluminescent technologies, including NanoLuc Luciferase and the GloMax Galaxy Bioluminescence Imager, enhancing research applications like live-cell imaging and protein dynamics studies.

List of Key Companies in Oceanic Bioluminescent Energy Solutions Market

- Algenol

- Chelsea Technologies

- Glowee

- Green Lumens

- Hatch Blue

- Luminex Corporation

- PhycoTechnologies, Inc.

- Promega Corporation

- Sustainable Marine Energy

- Woods Hole Oceanographic Institution

Oceanic Bioluminescent Energy Solutions Industry Developments

In February 2024, Light Bio launched bioluminescent Petunia varieties in the US, using firefly genes to create plants that emit a sustained glow.

In January 2022, Eco Wave Power Global AB and Ocean Power Technologies, Inc., wave energy firms, announced a collaboration to leverage their technologies and expertise, aiming to accelerate wave energy project development under a prior agreement.

Oceanic Bioluminescent Energy Solutions Market Segmentation

By Component Outlook (Revenue – USD Million, 2020–2034)

- Bioluminescent Organisms

- Bioengineered Materials

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Marine Navigation

- Underwater Sensing

- Emergency Lighting

- Renewable Energy Generation

- Decorative Illumination

- Others

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- Maritime & Defense

- Environmental Monitoring

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oceanic Bioluminescent Energy Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 287.00 million |

|

Market Size Value in 2025 |

USD 334.04 million |

|

Revenue Forecast by 2034 |

USD 1,324.58 million |

|

CAGR |

16.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 287.00 million in 2024 and is projected to grow to USD 1,324.58 million by 2034.

The global market is projected to register a CAGR of 16.5% during the forecast period.

In 2024, North America accounted for the largest share due to the region's strong investments in green technologies, sustainable energy solutions, and marine research.

A few of the key players in the market are Algenol; Chelsea Technologies; Glowee; Green Lumens; Hatch Blue; Luminex Corporation; PhycoTechnologies, Inc.; Promega Corporation; Sustainable Marine Energy; and Woods Hole Oceanographic Institution.

In 2024, the bioluminescent organisms segment accounted for the largest market share due to their critical role in generating natural light through biochemical processes.

In 2024, the maritime & defense segment accounted for the largest market share due to the strategic importance of bioluminescent energy solutions for enhancing operational efficiency and security in defense applications.