Ocean Economy Market Size, Share, Trends, Industry Analysis Report: By Industry Type (Marine Renewable Energy, Fisheries and Aquaculture, Marine Biotechnology, Marine Transport and Shipping, Marine Tourism and Recreation, Offshore Oil and Gas, Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 106

- Format: PDF

- Report ID: PM5330

- Base Year: 2024

- Historical Data: 2020-2023

Ocean Economy Market Overview

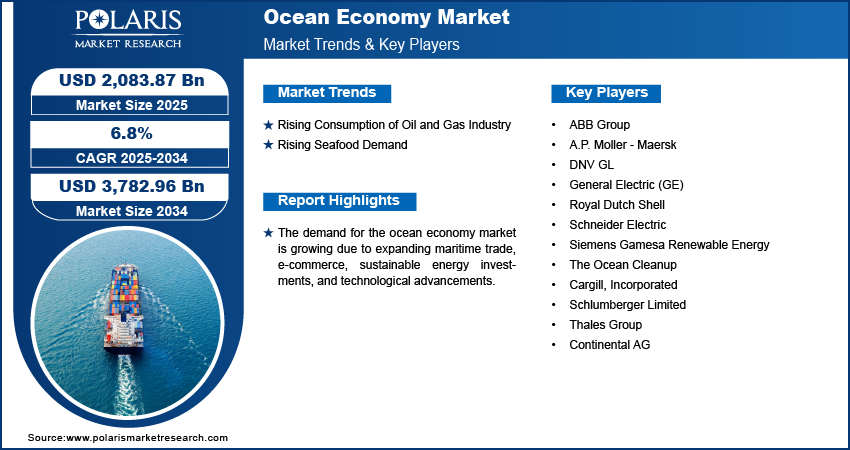

Global ocean economy market size was valued at USD 1,958.52 billion in 2024. The market is projected to grow from USD 2,083.87 billion in 2025 to USD 3,782.96 billion by 2034, exhibiting a CAGR of 6.8% during the forecast period.

The ocean economy, or blue economy, involves economic activities that use and benefit from ocean resources sustainably. It includes sectors such as marine transportation, fisheries, tourism, renewable energy, and marine biotechnology. This market aims to balance economic growth with environmental conservation by leveraging ocean resources while protecting marine ecosystems. The rising popularity of coastal and marine tourism is boosting related industries, including hospitality, recreation, and travel. This sector's expansion is driven by increasing consumer interest in marine experiences, eco-tourism, and beach vacations.

The push for cleaner energy sources has led to significant investments in marine renewable energy, such as offshore wind energy, tidal, and wave energy. These developments are contributing to the growth of the ocean economy by providing sustainable energy solutions and reducing reliance on fossil fuels, thereby fueling the ocean economy market growth.

To Understand More About this Research: Request a Free Sample Report

Advances in marine technology, such as automated fishing techniques, satellite monitoring, and underwater robotics, are enhancing operational efficiency and enabling new capabilities. These innovations drive growth by optimizing resource extraction and management while minimizing environmental impact. Moreover, growing public awareness of the effects of climate changes has led to an increased emphasis on sustainable practices and adaption measures. This includes initiatives to protect marine biodiversity and coastal infrastructure, which are essential for maintaining the health and productivity of ocean resources which are contributing to the growth of the ocean economy market.

Ocean Economy Market Drivers and Trends

Rising Consumption of Oil and Gas Industry

The growing consumption of oil and gas is a significant driver of the ocean economy, reflecting its impact on the ocean economy market expansion. For instance, according to the U.S. Energy Information Administration, petroleum consumption in United States averaged approximately 20.28 million barrels per day (b/d) in 2022. This represents a 2% increase from 2021 and a notable 12% rise from 2020 levels. This upward trend in petroleum consumption underscores the heightened demand for energy resources, which, in turn, stimulates growth within the oil and gas sector. The increased reliance on oil and gas directly translates to heightened activity in offshore exploration and extraction. The demand for offshore drilling, production facilities, and associated infrastructure has escalated, driving significant investments in the marine sectors of the ocean economy. The expansion of these activities contributes to the broader growth of the ocean economy market, as it spurs technological advancements, infrastructure development, and economic benefits associated with increased energy production. Thus, the rising consumption of oil and gas plays a crucial role in fueling the ocean economy market growth.

Rising Seafood Demand

The surging demand for seafood is a crucial growth driver in the ocean economy market, intensely influencing its expansion. In 2023, U.S. seafood import market was valued at approximately USD 25.5 billion. Of this, Canada emerged as the leading supplier, contributing 14.1 percent of total imports with seafood products worth over USD 3.6 billion. Chile followed closely with a 13.0 percent share, while India, Indonesia, and Vietnam contributed 10.0 percent, 7.9 percent, and 6.4 percent, respectively. This substantial import activity underscores the critical role seafood plays in global trade and highlights the increasing demand across various segments of the ocean economy, including fisheries and aquaculture. This robust trade dynamic illustrates the sector's expansion, thereby fueling the ocean economy market growth.

Ocean Economy Market Segment Insights

Ocean Economy Market Assessment by Industry Type Outlook

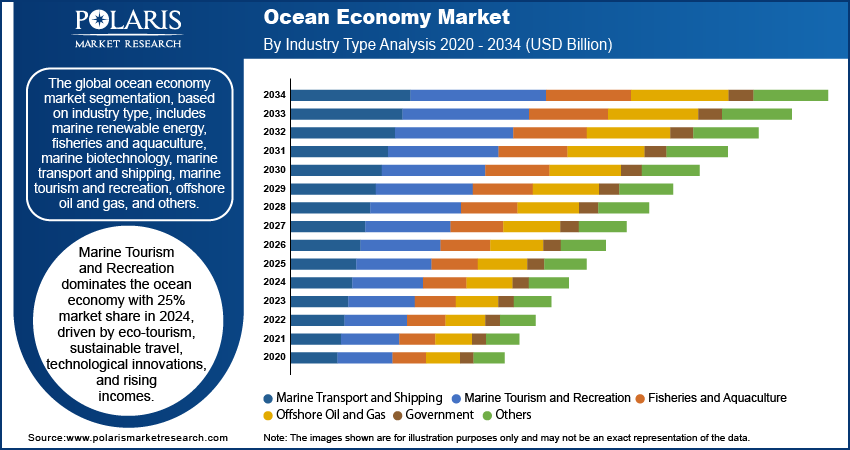

The global ocean economy market segmentation, based on industry type, includes marine renewable energy, fisheries and aquaculture, marine biotechnology, marine transport and shipping, marine tourism and recreation, offshore oil and gas, and others. The marine tourism and recreation segment dominated the ocean economy, holding around 25% of the ocean economy market share in 2024. This segment includes activities such as cruise tourism, water sports, beach tourism, and eco-marine experiences, driven by appealing coastlines, rich biodiversity, and unique underwater ecosystems. The increasing demand for eco-friendly, sustainable travel and technological innovations such as virtual reality snorkeling and underwater drones fuels growth. Coastal infrastructure expansion, government policies promoting sustainable tourism, and rising disposable incomes in emerging economies also support the sector's development. The trend towards eco-tourism and blue certifications emphasizes conservation efforts, further boosting marine tourism's growth as a key part of the global ocean economy.

Ocean Economy Market Evaluation by Region Outlook

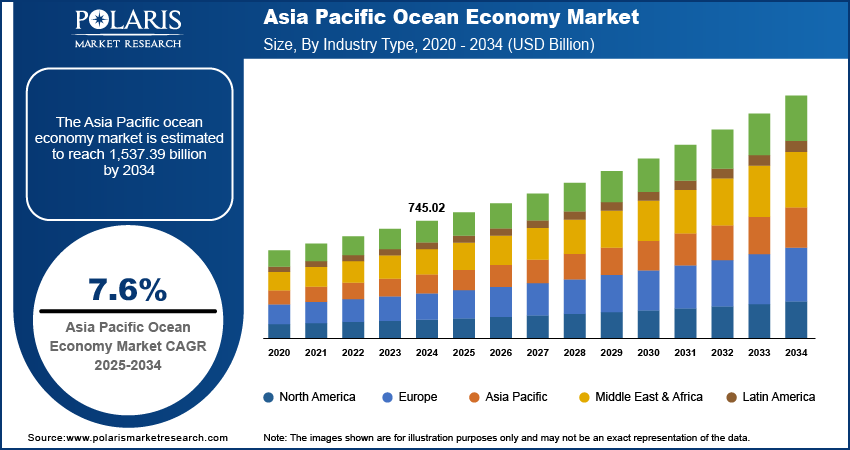

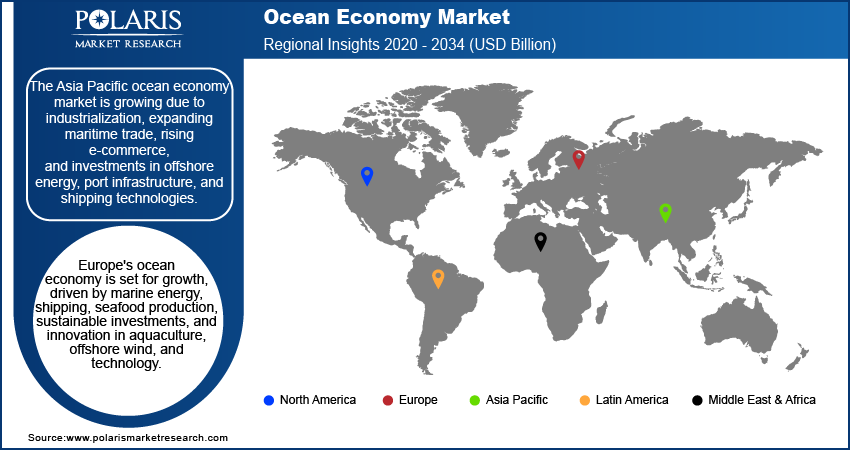

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest ocean economy market share in 2024 due to the region's rapid industrialization, expanding maritime trade, and increasing investments in offshore energy exploration. The rising e-commerce sector is driving an increase in maritime shipping and logistics activities across the region. Furthermore, the surge in online retail has intensified the demand for efficient and large-scale transportation of goods, leading to greater investments in port infrastructure and shipping technologies. For instance, according to IBEF, the Indian e-commerce market is projected to reach a valuation of USD 350 billion by 2030. It demonstrated a robust growth trajectory in 2022, achieving a notable 21.5% increase to reach USD 74.8 billion. Countries such as China, India, and Southeast Asian nations are expanding their maritime capabilities to handle the growing volume of goods being transported via sea routes. This expansion, combined with the region's strategic location as a global trade hub, is significantly contributing to the ocean economy market growth in Asia Pacific.

Europe held a significant ocean economy market share in 2024, covering sectors such as marine energy, shipping, and seafood production, and is poised for substantial growth. According to the Organisation for Economic Cooperation and Development (OECD), the ocean economy could outperform global economic growth by 2030. Investment opportunities within the EU’s sustainable ocean economy are significant, with €124.5 million projected by 2030. Challenges include high-risk perceptions and limited large-scale investment-ready projects. Key EU initiatives such as BlueInvest and the Blue Growth strategy support growth, with aquaculture and offshore wind energy expected to expand. Innovative technologies, such as robotics and sustainable practices, further enhance the sector’s potential for economic growth and job creation.

Ocean Economy Key Market Players & Competitive Insights

The competitive landscape of the ocean economy market is characterized by a diverse array of global and regional players competing for prominence across various segments, including maritime infrastructure, marine biotechnology, and ocean energy. Major market participants are heavily investing in advanced technologies and infrastructure to enhance operational efficiencies and foster sustainable practices. In maritime infrastructure, companies are focusing on developing advanced port facilities and smart shipping technologies, driven by the need for improved logistics and cost reduction. In the marine biotechnology sector, firms are at the forefront of innovation, leveraging marine biodiversity to create new pharmaceuticals, biofuels, and nutraceuticals through extensive research and collaboration with academic institutions. The ocean energy segment is marked by significant investments in tidal, wave, and offshore wind projects, with companies working to enhance the efficiency and scalability of these technologies. Sustainability is a central theme across all segments, with a growing emphasis on minimizing environmental impact and promoting responsible resource management. Major players include DNV GL; Royal Dutch Shell; Siemens Gamesa Renewable Energy; ABB; General Electric; Cargill, Incorporated; Schlumberger Limited; Schneider Electric; Ocean Cleanup; Thales Group; A.P. Moller - Maersk; Continental AG..

A.P. Moller - Maersk, headquartered in Copenhagen, Denmark, is a prominent player in the global ocean transport and logistics industry. The company, along with its subsidiaries, operates extensively in Denmark and internationally, offering a wide array of services. These include container shipping activities such as detention and demurrage, documentation, container services, terminal handling, container services, and container storage. The company also manages transshipment hubs and engages in gateway terminal activities. Moreover, the company provides integrated transportation solutions, including air transportation and landside services, along with fulfillment and management solutions like warehousing, distribution, and depot services. It specializes in supply chain management, cold chain logistics, and custom brokerage services. In December 2023, Nestlé is cutting its ocean logistics GHG emissions by over 80% in 2023 by using Maersk's ECO Delivery for all shipments, with the option to extend into 2024 and beyond.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution subsegment. The Motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics, along with discrete automation, provide solutions for energy and process industries, encompassing measurement analytics, machine automation, and robotics. Some of the prominent end-markets catered by the company are renewables, automotive, food & beverage, distribution, oil & gas, chemicals, mining & metals, buildings, etc. The company’s prominent channel partners include distributors followed by direct sales, engineering, procurement, and construction (EPCs), Original equipment manufacturers (OEMs), system integrators and panel builders. In December 2021, ABB to drive the Red Sea Project with smart energy solutions. Saudi Arabia's Red Sea Project, covering 28,000 square kilometers and set to open in 2030, will operate entirely on renewable energy. ABB's technology, including the ABB Ability Energy and Asset Manager, will deliver real-time data insights to optimize energy efficiency and reduce costs.

List of Key Companies in Ocean Economy Market

- ABB Group

- A.P. Moller - Maersk

- DNV GL

- General Electric (GE)

- Royal Dutch Shell

- Schneider Electric

- Siemens Gamesa Renewable Energy

- The Ocean Cleanup

- Cargill, Incorporated

- Schlumberger Limited

- Thales Group

- Continental AG

Ocean Economy Market Developments

January 2024: ABB acquired DTN Shipping from DTN Europe BV and DTN Philippines Inc., enhancing its maritime software capabilities. This move establishes ABB as an essential player in incorporating vessel routing solutions with advanced analytics and modeling and ship route optimization.

April 2024: DNV acquired Åkerblå, the former majority stakeholder in Ocean Ecology. DNV has established itself as the sole proprietor of Ocean Ecology, further strengthening its leadership in the aquaculture and biodiversity sectors.

July 2021: Shell Offshore Inc., a subsidiary of Royal Dutch Shell plc, invested for the Whale deep-water project in the U.S. Gulf of Mexico, utilizing a 99% replicated hull and 80% topsides replication from the Vito development to enhance efficiency.

Ocean Economy Market Segmentation

By Industry Type Outlook (Revenue - USD billion, 2020-2034)

- Marine Renewable Energy

- Fisheries and Aquaculture

- Marine Biotechnology

- Marine Transport and Shipping

- Marine Tourism and Recreation

- Offshore Oil and Gas

- Others

By Regional Outlook (Revenue - USD billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ocean Economy Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,958.52 billion |

|

Market Size Value in 2025 |

USD 2,083.87 billion |

|

Revenue Forecast in 2034 |

USD 3,782.96 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global ocean economy market size was valued at USD 1,958.52 billion in 2024 and is projected to grow to USD 3,782.96 billion by 2034.

The global market is projected to exhibit a CAGR of 6.8% during the forecast period.

In 2024, Asia Pacific held the largest share in the global market.

The key players in the market ABB Group; A.P. Moller – Maersk; DNV GL; General Electric (GE); MarineBio Technology; Ocean Infinity; Royal Dutch Shell; Schneider Electric; Siemens Gamesa Renewable Energy; and The Ocean Cleanup.

The marine tourism and recreation category dominated the market in 2024.