Nutricosmetics Market Size, Share, Trends, Industry Analysis Report: By Product Type (Tablets & Softgels, Capsules, Gummies & Candies, Powders, Drinks, and Others), Distribution Channels, Applications Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 119

- Format: PDF

- Report ID: PM1350

- Base Year: 2024

- Historical Data: 2020-2023

Nutricosmetics Market Overview

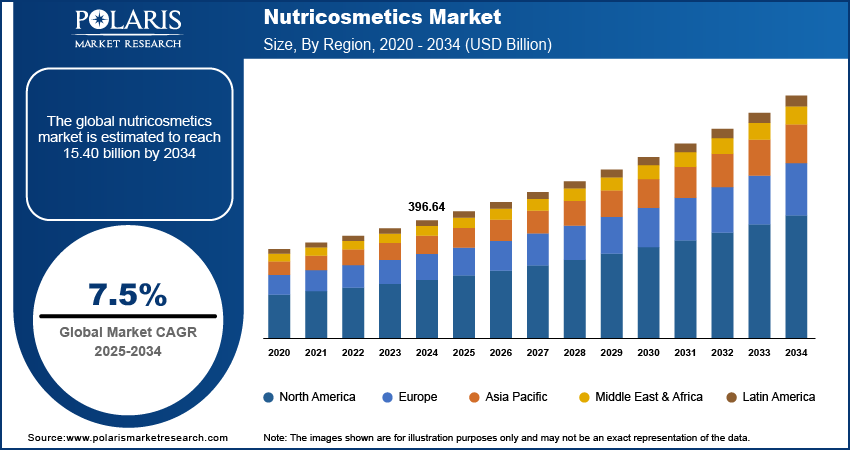

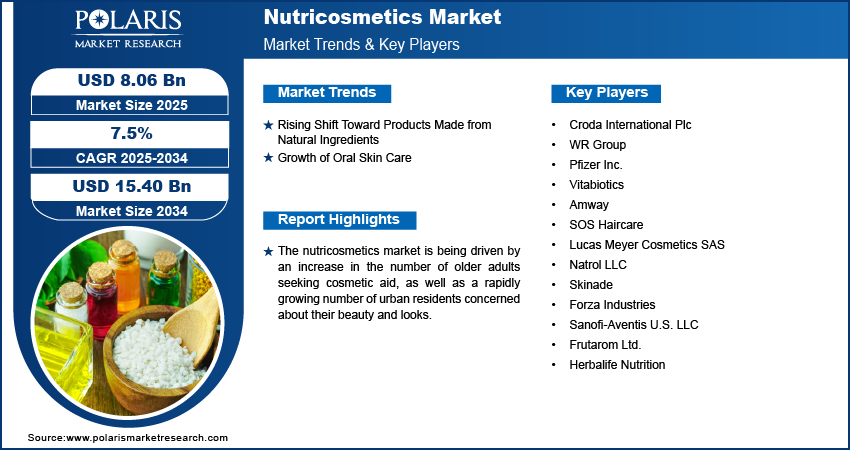

The global nutricosmetics market size was valued at USD 7.51 billion in 2024. The market is projected to grow from USD 8.06 billion in 2025 to USD 15.40 billion by 2034, at a CAGR of 7.5% from 2025 to 2034.

Nutricosmetics are dietary supplements and functional products consumed orally to improve the appearance of the skin, hair, and nails. They combine nutrition and cosmetics and are regarded as a modern trend in the beauty industry. Nutricosmetics are available in many forms, including capsules, tablets, sachets, and drinkable ampoules. Nutricosmetics work internally to increase skin elasticity and slow aging. Nutricosmetics work from the inside to promote beauty.

To Understand More About this Research: Request a Free Sample Report

Nutricosmetics can help protect skin from pollution and blue light from digital devices. Nutricosmetics can help children prevent lifelong skin and gastrointestinal problems. They contain essential antioxidants and components such as vitamins, plant extracts, curcumin, prebiotics, and probiotics. Coenzyme Q10, collagen, hyaluronic acid, and vitamins B, C, and E are among the most widely used components in nutricosmetics. These nutricosmetics come in liquid and solid (pill) forms that are taken orally. These components work as antioxidants, reducing and neutralizing the effects of free radicals, which are byproducts of biochemical reactions, and protecting the skin from UV rays by reducing inflammation.

An increasing number of elderly people seeking cosmetic assistance and the rapidly growing number of urban residents who are concerned about their appearance drive the nutricosmetics market demand. Customers are inclined to try new beauty regimens and experiment to improve their skin and overall health, particularly younger consumers. Less product use contributes to less skin damage, sensitivity, and irritation. As a result, many customers are moving to products, such as nutricosmetics, that support the skin's nourishment and health without being overpowering. Due to these benefits, their appeal to young and old consumers has grown internationally.

Nutricosmetics Market Dynamics

Rising Shift Toward Products Made from Natural Ingredients

The global demand for chemical cosmetics containing harmful preservatives such as parabens is slowing down as consumers are concerned about their health. Numerous skincare issues, such as skin irritations and cancer, have been linked to specific chemical cosmetics preservatives. Natural cosmetics are more adaptable and suitable for a broader spectrum of consumers. The younger and older generations are among the many consumers who use products that promote beauty from within. Additionally, the demand for natural products to enhance health and beauty is being driven by the aging populations, majorly in the US, Japan, and Europe. Thus, the rising shift toward cosmetic products made from natural ingredients boosts the nutricosmetics market growth.

Growing Consumer Interest in Beauty and Wellness

Consumer preferences are changing significantly in the global nutricosmetics market. This is mostly due to the increased focus on wellness and beauty brought on by a greater understanding of the connection between skincare, nutrition, and general health. Social media platforms and influencer partnerships have amplified the beauty and wellness trend; nutricosmetics firms are using strategic social media marketing to increase brand awareness and engagement. Manufacturers are attempting to take advantage of the growing consumer preference for natural, organic, plant-based, vegan, and non-GMO products by introducing new items. Thus, increasing consumer interest in beauty & wellness is driving the market expansion.

Nutricosmetics Market Segment Insights

Nutricosmetics Market Outlook by Product Type

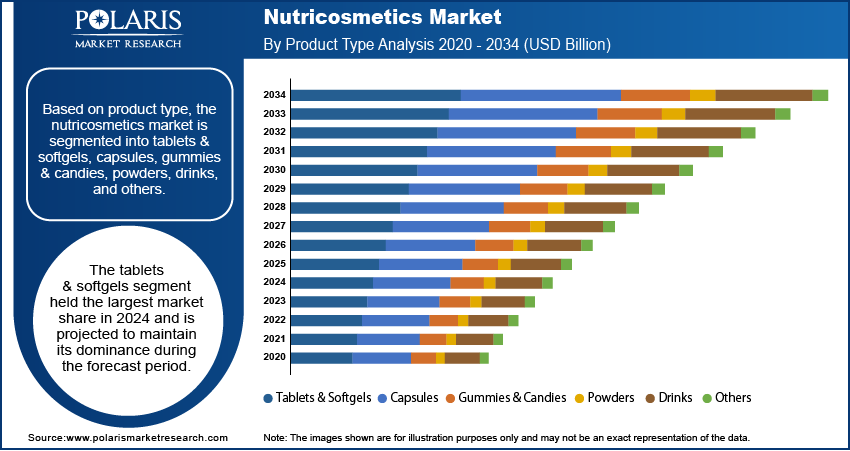

Based on product type, the nutricosmetics market is segmented into tablets and softgels, capsules, gummies & candies, powders, drinks, and others. The tablets and softgels segment dominated the global market by holding the largest share of the nutricosmetics market revenue in 2024. Tablets are becoming more popular among consumers due to their affordability, high active ingredient content, shelf stability, and prolonged potency. However, due to their higher bioavailability and quicker symptom relief, many people prefer nutricosmetics in capsule form.

Nutricosmetics Market Assessment by Application Type

Nutricosmetics market segmentation based on application is made into nailcare, haircare, skincare, and others. In 2024, the skincare segment dominated the market for nutricosmetics globally. It is also expected to maintain its dominance across the globe during the forecast period. The haircare segment is expected to register the fastest growth rate during the forecast period. The hair care products help both men and women keep their hair healthy and clean while also shielding it from harm. Skin care products, in the form of powders, creams, and lotions, improve the skin conditions and health while simultaneously offer nourishment. Both men and women frequently use these products for a variety of purposes, such as hydrating, moisturizing, and cleansing, which contributes to the market's expansion.

Nutricosmetics Market Regional Insights

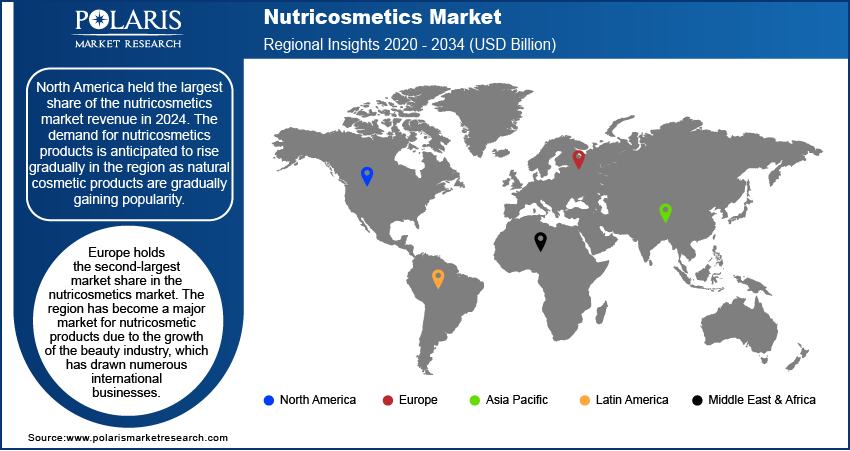

The report offers nutricosmetics market insights by region in North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America held the largest market share in 2024. Growing consumer knowledge of the advantages of natural beauty supplements is propelling the nutricosmetics market in North America. The region has a good market penetration rate, and customers are increasingly incorporating edible beauty products into their daily health regimens. Innovative product introductions and an increasing focus on natural and organic ingredients define the market landscape. Consumer interest in beauty-from-within products is also considerable in this region, especially among Gen Z and millennials.

Europe holds the second-largest nutricosmetics market share. The growth of the beauty industry in the region has drawn numerous international businesses, transforming Europe into a sizable market and enhancing trade in nutricosmetic products.

The nutricosmetics market in Asia Pacific is anticipated to record the highest CAGR during the forecast period. This is because consumers are choosing healthier options for themselves due to changing lifestyles brought about by higher incomes, and the atmosphere for nutricosmetic products that was previously unavailable is one of the factors driving the region's notable growth in nutricosmetics market.

Nutricosmetics Market – Key Players and Competitive Insights

Numerous small manufacturers are vying for a larger market share in this fragmented market. To increase their market share and draw in new customers, large cosmetic companies are introducing new product lines and brands. As a marketing campaign, some companies give free samples to customers so they can test the product on their skin before making a purchase. Croda International Plc, Pfizer Inc., Lucas Meyer Cosmetics SAS, Sanofi-Aventis U.S. LLC, and Frutarom Ltd. are a few of the top companies in the nutricosmetics market.

List of Key Players in Nutricosmetics Market

- Croda International Plc

- WR Group

- Pfizer Inc.

- Vitabiotics

- Amway

- SOS Haircare

- Lucas Meyer Cosmetics SAS

- Natrol LLC

- Skinade

- Forza Industries

- Sanofi-Aventis U.S. LLC

- Frutarom Ltd.

- Herbalife Nutrition

Nutricosmetics Industry Development

In January 2023, The research and development division of Beiersdorf, the skin care firm that owns the NIVEA brand, used its extensive understanding of skin and research skills to create a novel cosmetic sun protection solution. The company stated that special light-scattering pigments added to sunscreen prevent light from reaching the skin.

In September 2023, L'Oréal declared its intention to increase its market share in the beauty and wellness industry by making a strategic investment in five nutricosmetic start-ups. The company's awareness of the increasing need for products that enhance beauty from within is reflected in this initiative.

Nutricosmetics Market Segmentation

By Product Type Outlook

- Tablets & Softgels

- Capsules

- Gummies & Candies

- Powders

- Drinks

- Others

By Distribution Channel Type Outlook

- Non-Store-Based

- Store-Based

By Applications Type Outlook

- Nailcare

- Haircare

- Skincare

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nutricosmetics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.51 Billion |

|

Market Size Value in 2025 |

USD 8.06 Billion |

|

Revenue Forecast by 2034 |

USD 15.40 Billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The nutricosmetics market size is expected to reach USD 15.40 billion by 2034 from USD 8.06 billion in 2025.

The nutricosmetics market is expected to register a CAGR of 7.5% during the forecast period.

North America held the largest market share revenue in 2024.

Vitabiotics, Amway, SOS Haircare, Herbalife Nutrition, Natrol LLC, Skinade, Forza Industries, Croda International Plc, and Pfizer Inc. are among the key players driving the nutricosmetics market.

The tablets and softgels segment held the largest share of the nutricosmetics market revenue in 2024.

The skincare segment held the largest market share of the nutricosmetics market in 2024.