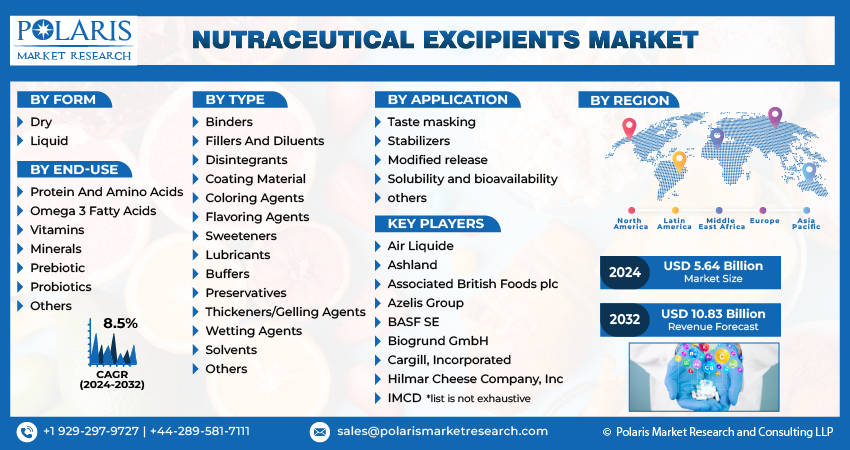

Nutraceutical Excipients Market Share, Size, Trends, Industry Analysis Report, By Form (Dry and Liquid); By Type; By Application; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4286

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

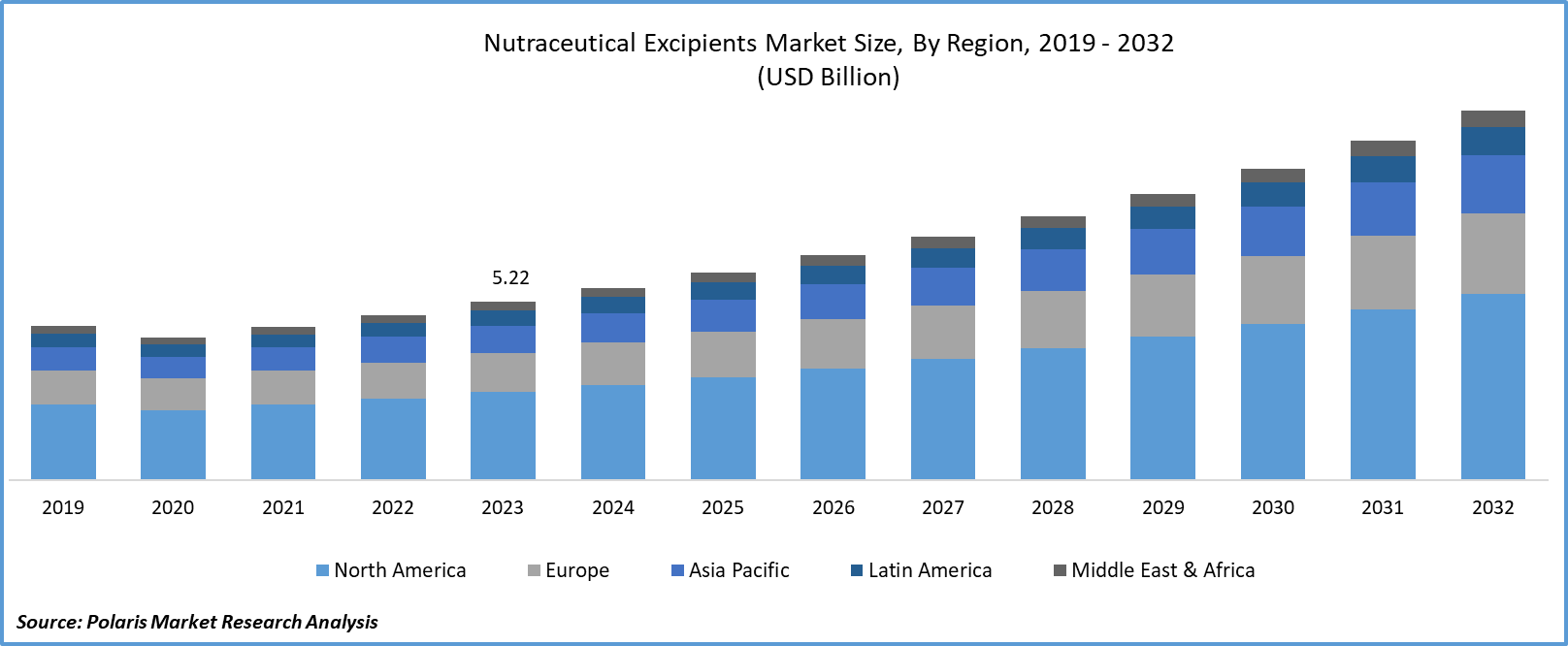

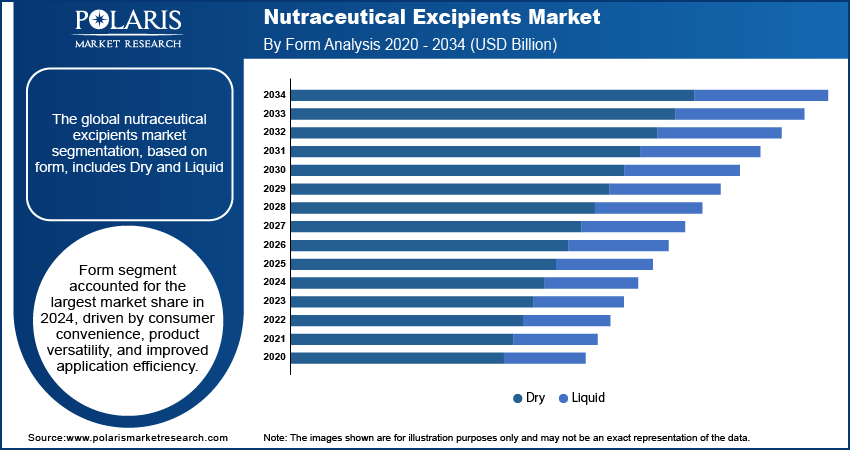

Nutraceutical Excipients Market size was valued at USD 5.22 billion in 2023. The market is anticipated to grow from USD 5.64 billion in 2024 to USD 10.83 billion by 2032, exhibiting a CAGR of 8.5% during the forecast period.

Industry Trends

Excipients with nutraceutical properties are crucial to the creation of medication formulations. Excipients enable the medicine to be delivered to the target place effectively. These molecules assimilate and increase the medicine's efficacy while preventing the drug from being released too soon. Drug integration, which increases drug absorption in the bloodstream, is facilitated by some nutraceutical excipients.

In the nutraceutical industry, using excipients with multifunctional qualities offers a great opportunity. These excipients simplify the formulation process by combining many functions into a single ingredient, increasing operational efficiency and lowering the complexity of formulations. This consolidation lowers production costs while also reducing the quantity of excipients needed. Furthermore, their wide range of functions, which include improving solubility and stability as well as regulating release and hiding disagreeable tastes or smells, allow premium nutraceutical products to be made with optimal performance. This increases the use of nutraceutical excipients market over the forecast period.

Furthermore, traditional companies looking to diversify their product portfolios may find value in the unique offerings of biosciences companies. By incorporating biotechnological advancements into their product lines, they can expand their range of nutraceutical excipients and cater to a broader market. The collaboration with biosciences companies may assist traditional companies in navigating complex regulatory landscapes. Biosciences firms may have a deep understanding of regulatory requirements for biotechnological products, ensuring compliance and faster market entry for nutraceutical excipients.

To Understand More About this Research: Request a Free Sample Report

For instance, IFF and DuPont's Nutrition & Biosciences (N&B) division successfully merged, and a powerful force in the global ingredients and solutions market was formed. Through this combination, a leader in consumer-focused markets like food and beverage, personal care & home, and health & wellness is established. Furthermore, excipients acquired by IFF from the purchase of DuPont's Nutrition & Biosciences division are now available.

Moreover, the growing awareness and interest in health and wellness have led to an increased demand for nutraceuticals. Nutraceutical excipients play a crucial role in the formulation of these products, contributing to their stability, appearance, and overall efficacy. Ongoing research and development efforts in the nutraceutical industry drive the need for innovative excipients.

Key Takeaways

- In 2023, North America dominated the largest market and contributed to 40% of share

- Asia-Pacific (APAC) region projected to grow the fastest CAGR during the forecast period

- By type category, preservatives segment held the largest market share in 2023

- By application category, the taste masking segment expected to witness the highest market share during the forecast period

What Are the Market Drivers Driving the Demand for Nutraceutical Excipients Market?

Increasing Consumer Awareness

The rising consumer awareness and preference for preventive healthcare and wellness drive the demand for nutraceutical products. As consumers seek functional foods, dietary supplements, and other health-promoting products, the need for specialized excipients in their formulation grows. Ongoing research and development efforts lead to the introduction of innovative nutraceutical formulations. Nutraceutical excipients play a crucial role in enhancing the stability, bioavailability, and overall efficacy of these formulations, driving the demand for advanced excipient solutions.

The expanding nutraceutical market globally, driven by lifestyle changes, dietary preferences, and increasing health awareness, creates opportunities for nutraceutical excipient manufacturers to expand their footprint and meet the growing demand in nutraceutical excipients market. Consumer preferences are shifting towards clean-label products with natural ingredients. There is a growing trend towards personalized nutrition, where nutraceutical products are tailored to individual needs. It plays a role in formulating personalized products that address specific nutritional requirements or health conditions.

Which Factor is Restraining the Demand for Nutraceutical Excipients Market?

Limited Consumer Awareness

Limited awareness among consumers regarding the role and benefits of nutraceutical excipients can be a restraining factor. Lack of understanding about the significance of excipients in nutraceutical formulations may affect market growth. Furthermoer, the research, development, and testing of new nutraceutical excipients can be expensive. High development costs can be a barrier, especially for smaller companies, limiting their ability to bring innovative excipients to the market. The presence of numerous small and medium-sized players characterizes the nutraceutical excipients market. This fragmentation can result in intense competition, making it challenging for companies to gain market share and differentiate their products.

Report Segmentation

The market is primarily segmented based on form, type, application, end use, and region.

|

By form |

By type |

By Application |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Analysis

Based on type analysis, the market is segmented on the basis of binders, filler and diluents, disintegrants, coating material, coloring agents and others. In 2023, the preservatives segment held the largest revenue share. Preservatives play a critical role in maintaining the stability and extending the shelf life of nutraceutical products. With consumers looking for products with longer shelf lives, manufacturers often incorporate preservatives into formulations to prevent spoilage and maintain product quality. Preservatives are used in a variety of nutraceutical formulations, including dietary supplements, functional foods, and beverages. Their versatility and ability to address microbial growth make them essential in a broad range of products, contributing to a larger market share. Consumers prioritize product safety and compliance with regulatory standards.

Preservatives help ensure that nutraceutical products meet quality and safety requirements by preventing the growth of harmful microorganisms. This adherence to safety standards can lead to increased consumer trust and market dominance. Preservatives are often used to prevent oxidation and degradation of active ingredients in nutraceuticals. This is crucial for maintaining the efficacy of vitamins, minerals, and other bioactive compounds, ensuring that consumers receive the intended health benefits which contribute to drive the nutraceutical excipients market.

By Application Analysis

Based on application analysis, the market has been segmented on the basis of taste masking, stabilizer, modified release, solubility, and others. The Taste masking segment is expected to witness the highest market share during the forecast period, primarily driven by the increasing number of aesthetic lifestyles and the use of nutraceutical products. Nutraceutical products often contain bioactive ingredients with strong or unpleasant tastes. Taste masking excipients help improve the palatability of these products, making them more acceptable to consumers, especially in the case of chewable tablets, oral liquids, and other oral dosage forms. The taste preferences of children can significantly impact the success of nutraceutical products targeting this demographic. Taste masking excipients are commonly used in pediatric formulations, such as vitamins and minerals, to make them more palatable, leading to increased consumption. Nutraceutical gummies and chews have gained popularity due to their convenience and enjoyable consumption experience. Taste-masking excipients are essential in these formulations to mask the taste of active ingredients and enhance the overall sensory experience. As a result, the Taste masking segment is poised for substantial growth during the forecast period.

Regional Insights

North America

In 2023, North America dominated the largest market share contributor in nutraceutical excipients, with the United States foremost in revenue. The United States, in particular, has a well-developed healthcare infrastructure, which includes research institutions, pharmaceutical companies, and manufacturing facilities. This infrastructure supports the research, development, and production of nutraceutical products, including those utilizing specialized excipients. North America has witnessed a significant emphasis on health and wellness, with consumers increasingly seeking nutraceutical products for preventive healthcare. The demand for functional foods, dietary supplements, and other nutraceuticals, which often require specialized excipients, has contributed to market dominance.

Consumers in North America, especially in the United States, are often well-informed about health-related matters and are proactive in seeking products that contribute to overall well-being. This heightened awareness leads to a greater demand for nutraceuticals, boosting the market for nutraceutical excipients. The region has a strong presence in research and development activities, fostering innovation in nutraceutical formulations. Ongoing research initiatives contribute to the development of novel products that may require specialized excipients, further driving market growth.

Asia Pacific

The adoption of nutraceutical excipients in the Asia-Pacific (APAC) region projected to grow the fastest CAGR during the forecast period, due to the increasing dominance of changing lifestyles and expenditure toward nutraceutical products. Countries such as India, Japan, and China are major contributors to the market revenue in APAC.

There is a growing awareness of health and wellness in the Asia-Pacific region. Consumers are increasingly interested in preventive healthcare and are seeking nutraceutical products to address various health concerns. This heightened health consciousness is driving the demand for innovative and effective nutraceutical formulations, necessitating the use of specialized excipients. Urbanization and changing lifestyles in APAC countries have led to shifts in dietary habits. As people become more conscious of the nutritional content in their diets, there is an increased demand for nutraceuticals. Nutraceutical excipients play a crucial role in formulating products that meet the nutritional needs of diverse consumer populations. These factors anticipate growth of the Nutraceutical excipients market share during the forecast period.

Competitive Landscape

Intense competition defines the landscape of the nutraceutical excipients market, where established players leverage high-quality products and robust brand images to fuel revenue growth. To sustain a competitive edge, these companies deploy diverse strategies, including rigorous research and development initiatives, strategic mergers and acquisitions, and continuous technological innovations. By expanding their product portfolios and enhancing the shelf lives of offerings, market leaders strive to meet evolving consumer demands and maintain prominence in this competitive market.

Some of the major players operating in the global market include:

- Air Liquide

- Ashland

- Associated British Foods plc

- Azelis Group

- BASF SE

- Biogrund GmbH

- Cargill, Incorporated

- Hilmar Cheese Company, Inc

- IMCD

- Ingredion

- Innophos

- International Flavors & Fragrances Inc

- Kerry Group plc

- MEGGLE GmbH & Co. KG

- Roquette Frères

- Sensient Technologies Corporation

Recent Developments

- In September 2022, In Hyderabad, India, DFE Pharma, a pioneer in the pharmaceutical and nutraceutical excipient solutions industry, launched its newest Center of Excellence, "Closer to the Formulator" (C2F). With its proficiency at every stage of pharmaceutical development, C2F assisted pharmaceutical businesses in reducing the time from concept to final commercial product. This has enabled the business to highlight its advancements.

Report Coverage

The Nutraceutical Excipients market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis form, types, applications, end-users their futuristic growth opportunities.

Nutraceutical Excipients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.64 billion |

|

Revenue forecast in 2032 |

USD 10.83 billion |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Form, By type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |