Nucleic Acid Isolation and Purification Market Share, Size, Trends, Industry Analysis Report, By Product (Kits & Reagents, Instruments); By Type; By Method (Column-based, Magnetic Beads, Reagent-based, Others); By Application (Precision Medicine, Diagnostics, Drug Discovery & Development, Agriculture and Animal Research, Others); By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 115

- Format: PDF

- Report ID: PM2099

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

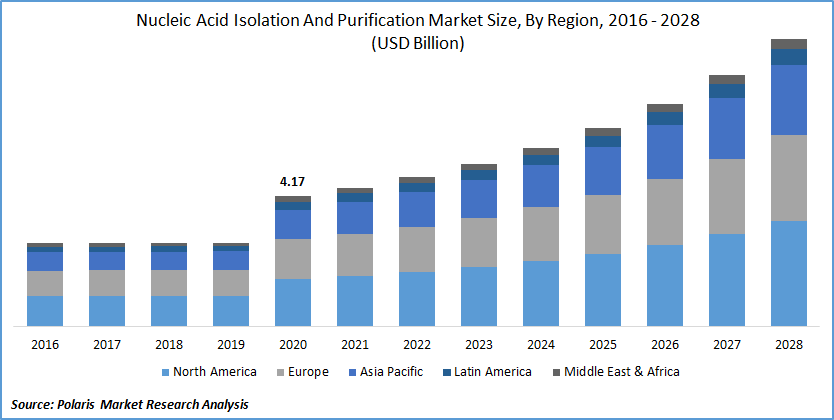

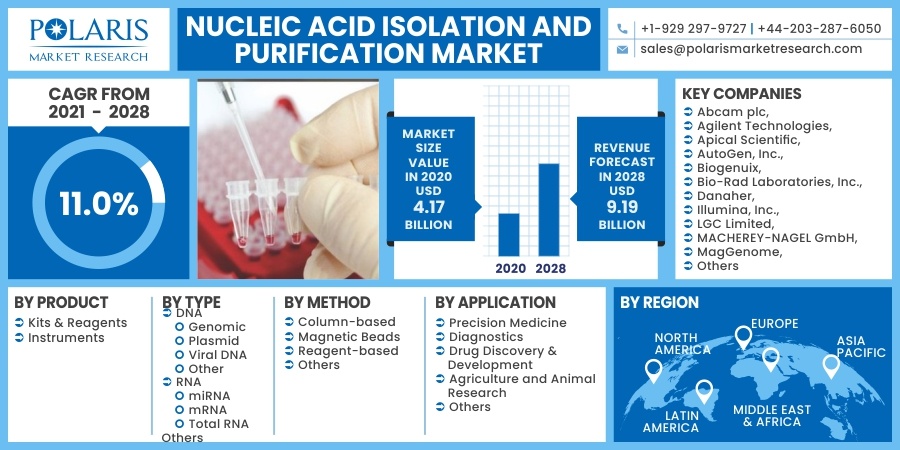

The global nucleic acid isolation and purification market was valued at USD 4.17 billion in 2020 and is expected to grow at a CAGR of 11.0% during the forecast period. The factors responsible for the market growth include a rise in investments in research and development in precision medicine, an increase in the adoption of sequencing platforms in clinical diagnostics, and rapid advances in genomics and proteomics.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Collaboration and agreements between small and big companies in the market are driving the nucleic acid isolating and purification market forward. For instance, in March 2020, the U.S.-based Zymo Research and Tecan signed a partnership agreement to introduce ready-to-use products which can streamline nucleic acid extraction from COVID-19 samples. Its new DreamPrep NAP workstation helped labs to effectively and rapidly scale up several tests being performed in a given time, consequently helping in mitigating the virus infection.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, type, method, application, and region.

|

By Product |

By Type |

By Method |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The kits and reagents nucleic acid isolation and purification segment held the most significant market revenue share in 2020. Such a high share is due to the application of kits and reagents for nucleic acid isolation and purification to prepare samples and libraries for future use. Moreover, an increasing number of structured research studies focused on understanding rare and most common genome-based diseases or indications are increasingly inducing the need for kits and reagents, further boosting the nucleic acid isolation and purification market growth.

However, the instrument nucleic acid isolation and purification segment is projected to witness the highest growth rate over the study period. Such growth is primarily due to automation in technology offerings, rapid advances in innovation, and rapid growth in automated nucleic acid extraction instruments.

In line with this, in April 2020, Thermo Fisher Scientific signed a collaboration agreement with Hamilton Company to develop automated platforms for extraction to be used in forensic studies. The ID NIMBUS Presto facilitates automated DNA extraction from collected samples from the investigation field.

Insight by Type

In 2020, the RNS nucleic acid isolation and purification segment accounted for the largest share in the market of nucleic acid isolation and purification industry due to its rising adoption in COVID-19 diagnostics and increasing consumption of purified mRNA to be used to construct the cDNA library. These libraries are often used in gene expression profiling, clinical diagnosis, and sequencing. Moreover, the wide availability of reagents and kits for extraction and processing viral RNA further boosts the nucleic acid isolation and purification segment growth.

However, DNA nucleic acid isolation and purification is projected to witness a lucrative market growth rate over the assessment period. This is due to the rising application of gene expression profiling. Many pharma and biotechnology companies focus on strategic initiatives such as new product launches to efficiently carry out the isolation process. In line with this, in February 2020, Promega introduced the “Wizard HMW DNA Extraction Kit,” which enabled researchers with large DNA fragments, facilitating steady performance in long-read sequencing applications.

Moreover, viral DNA nucleic acid isolation and purification is expected to gain market traction for therapeutic and diagnostic applications. For instance, these vectors are used for gene therapy and other nano-biological weapons to fight other viruses. The rising use of viral DNA in the concerned isolation and purification market is expected to gain momentum in the coming years.

Geographic Overview

Geographically, the global market of nucleic acid isolation and purification is bifurcated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). North America region is the most significant revenue contributor, followed by Europe and the Asia Pacific region.

In 2020, the North America region accounted for the largest market share of the global nucleic acid isolation and purification market. The key regional factors contributing to the isolation and purification market growth of nucleic acid isolation and purification include the presence of established players with rich experience in clinical diagnostics, the introduction of novel automated instruments, and the presence of well-equipped clinical infrastructure in the region. Moreover, rising investments in biotechnology and pharma are also contributing to the region’s nucleic acid isolation and purification growth.

Competitive Insight

The prominent market players operating in the market of nucleic acid isolation and purification are Abcam plc, Agilent Technologies, Apical Scientific, AutoGen, Inc., Biogenuix, Bio-Rad Laboratories, Inc., Danaher, Illumina, Inc., LGC Limited, MACHEREY-NAGEL GmbH, MagGenome, Merck KgaA, New England Biolabs, Norgen Biotek Corp, PCR Biosystems, Inc., Promega Corporation, QIAGEN, Takara Bio, Inc., and Thermo Fisher Scientific, Inc.

Nucleic Acid Isolation and Purification Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 4.17 billion |

|

Revenue forecast in 2028 |

USD 9.19 billion |

|

CAGR |

11.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Type, By Method, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Abcam plc, Agilent Technologies, Apical Scientific, AutoGen, Inc., Biogenuix, Bio-Rad Laboratories, Inc., Danaher, Illumina, Inc., LGC Limited, MACHEREY-NAGEL GmbH, MagGenome, Merck KgaA, New England Biolabs, Norgen Biotek Corp, PCR Biosystems, Inc., Promega Corporation, QIAGEN, Takara Bio, Inc., and Thermo Fisher Scientific, Inc. |