North America Veterinary Clinical Trials Market Size, Share, Trends, Industry Analysis Report: Information By Animal Type (Livestock Animal, Companion Animal, Other Animals), By Intervention, By Indication, By End User, and By Country (U.S. And Canada) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5008

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

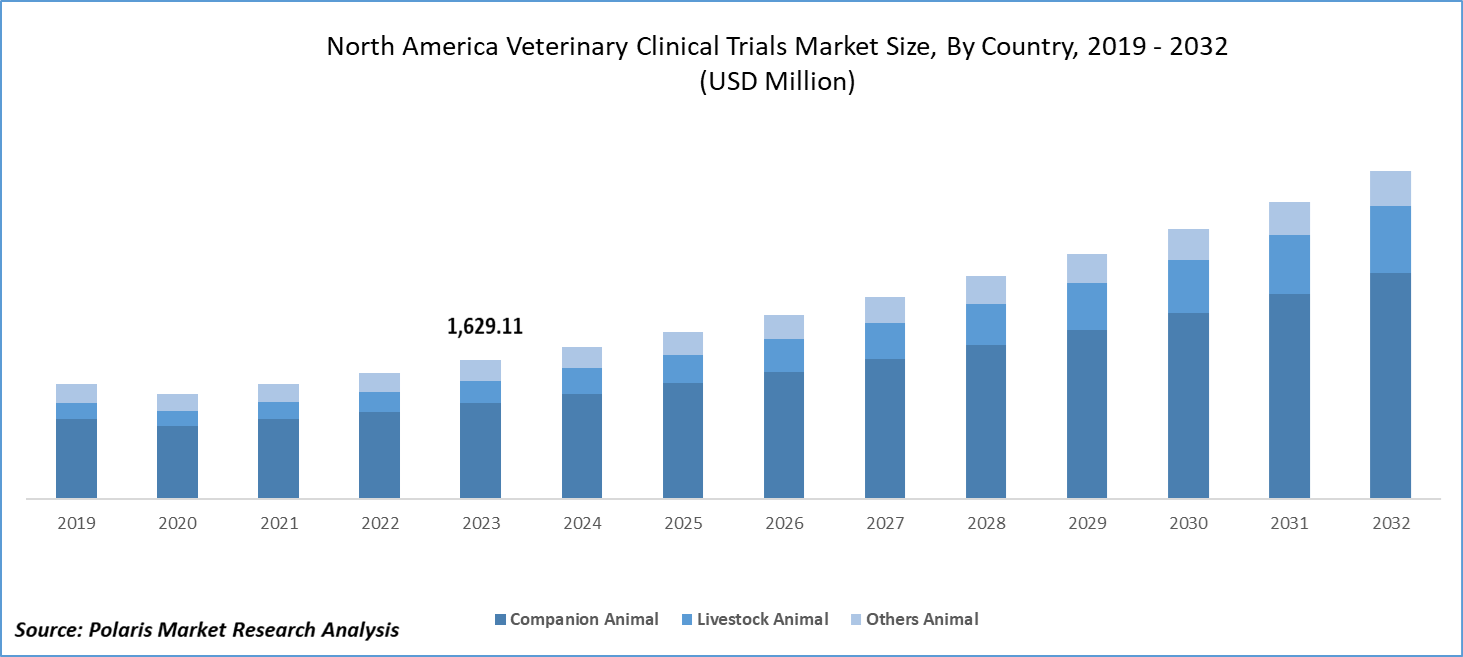

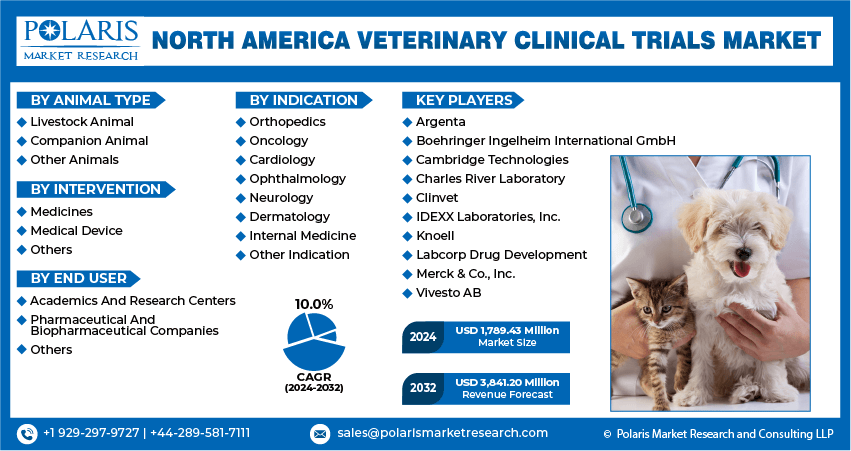

The North America veterinary clinical trials market size was valued at USD 1,629.11 million in 2023. The North America veterinary clinical trials industry is projected to grow from USD 1,789.43 million in 2024 to USD 3,841.20 million by 2032, exhibiting a compound annual growth rate (CAGR) of 10.0% during the forecast period (2024 - 2032).

An increase in the number of pets leads to greater demand for veterinary services and, consequently, more clinical trials for new treatments. Pet owners are increasingly willing to spend more on their pet’s health, including advanced treatments that require clinical trials for validation. Furthermore, growing awareness and concern for animal welfare encourage the development of better veterinary treatments, requiring clinical trials, and contribute to increasing the North America veterinary clinical trials market growth.

The development of new and advanced veterinary therapies, such as biologics and personalized medicine, necessitates rigorous clinical trials to ensure safety and efficacy. Also, regulatory bodies like the FDA require clinical trials for new veterinary drugs and treatments before they can be approved for market use, driving demand for well-structured clinical trials.

To Understand More About this Research: Request a Free Sample Report

The importance of controlling zoonotic diseases (diseases that can be transmitted from animals to humans) has led to increased investment in veterinary research and clinical trials. There is a growing emphasis on improving animal welfare standards, which includes developing better treatments for various animal health conditions.

Major pharmaceutical companies are heavily investing in veterinary R&D to develop new drugs and treatments, which in turn fuels the demand for clinical trials. Additionally, collaborations between companies, research institutions, and the industry enhance the capacity for conducting veterinary clinical trials, driving the growth of the North American veterinary clinical trials market.

North America Veterinary Clinical Trials Market Trends

Rise in Technological Advancements

The North American veterinary clinical trials market is experiencing significant growth due to technological advancements. These advancements have transformed the way veterinary research is conducted, improving the efficiency and effectiveness of clinical trials and ultimately leading to better health outcomes for animals.

Innovations such as MRI, CT scans, and ultrasound technologies allow for precise and non-invasive diagnostic procedures, enhancing the ability to monitor and assess animal health during clinical trials. Also, advancements in genomic sequencing allow researchers to understand the genetic basis of diseases in animals, leading to the development of targeted therapies that require rigorous clinical testing. New biological drugs and gene therapies offer treatments for chronic and genetic conditions in animals, necessitating comprehensive clinical trials to ensure safety and efficacy, which leads to drive the North America veterinary clinical trials market demand.

The availability of new advanced clinical trial listings from authorities such as the AVMA veterinary clinical trials registry underscores the rising trend in technological advancements and veterinary clinical trials in North America.

For instance, in March 2024, according to the American Veterinary Medical Association, the AVMA’s Veterinary Clinical Trials Registry, which used to be called the AVMA animal health studies database, was updated and relaunched in February. This platform connects clinical scientists with veterinarians and pet owners, making it easier to find and share studies, receive notifications for relevant studies, and streamline the submission process. Recent advanced veterinary clinical studies listed include combination radiation and immunotherapy for advanced cancer, a preclinical comparison of hypomethylating nucleosides in tumor-bearing dogs, and a canine osteosarcoma clinical trial. These technological advancements highlight the growing innovation in the North America veterinary clinical trials market.

Increasing Regulatory Support and Framework

The North American veterinary clinical trials market is experiencing significant growth due to regulatory bodies like the FDA's streamlined processes to speed up the approval of new veterinary drugs and treatments. This reduces the time and cost involved in bringing new products to market. The implementation of efficient review systems ensures that clinical trial applications are assessed promptly, encouraging more companies to conduct trials.

Regulatory frameworks ensure that all clinical trials adhere to high safety standards, protecting the well-being of animal participants and building public trust in the process. The FDA CVM is working to improve regulatory pathways for new animal and veterinary products. This includes making the approval process more efficient and predictable, which can attract more investment into clinical trials.

For instance, in February 2024, the American Veterinary Medical Association (AVMA) reported that the FDA Center for Veterinary Medicine (CVM) unveiled an innovation plan for new animal and veterinary products. This plan, part of the Animal and Veterinary Innovation Agenda, aims to address drug shortages and bring innovative products to market. The FDA CVM's chief veterinary officer and deputy director for science policy recently provided AVMA guidance. It focuses on supporting the development of safe and effective new products, fostering innovation, and improving regulatory framework pathways to expedite the market introduction of new animal and veterinary products. This trend is driving the North America veterinary clinical trials market revenue.

North America Veterinary Clinical Trials Market Segment Insights

North America Veterinary Clinical Trials Animal Type Insights

The North America veterinary clinical trials market segmentation, based on animal type, includes companion animals, livestock animals, and other animals. In 2023, the companion animal segment accounted for the largest market share. There has been a steady increase in the number of households owning pets across North America. This growing pet population drives demand for veterinary care, including clinical trials to develop new treatments and medications. The regulatory bodies and major industries often provide funding and grants to support veterinary clinical trials, making it easier for researchers to undertake new studies.

For instance, in October 2023, Mars, Incorporated and Digitalis Ventures unveiled Companion Fund II, a $300 million venture capital fund aimed at supporting founders whose companies utilize cutting-edge science, technology, and design to enhance the well-being of pets, pet owners, and veterinarians. Such substantial funding bolsters the North America veterinary clinical trials market share.

North America Veterinary Clinical Trials End User Insights

The North America veterinary clinical trials market segmentation, based on end users, includes academics and research centers, pharmaceutical and biopharmaceutical companies, and others. The pharmaceutical and biopharmaceutical companies segment accounted for the largest market share in 2023 due to companies investing heavily in research and development (R&D) to develop new drugs, biologics, vaccines, and other treatments for animal health. These companies undertake comprehensive clinical trials to verify the safety and effectiveness of their products prior to regulatory approval.

For instance, in June 2024, Merck Animal Health, a division of Merck & Co., Inc., received USDA approval for NOBIVAC NXT Canine Flu H3N2, an advanced vaccine designed to protect dogs from canine influenza. The product will soon be available at veterinary clinics and hospitals throughout the United States. This approval contributes to the growth of the North American veterinary clinical trials market.

North America Veterinary Clinical Trials Insights

By country, the study provides market insights into the United States and Canada. The North America veterinary clinical trials market accounted for the largest share in 2023. North America encompasses a wide range of research and development activities aimed at advancing veterinary medicine and improving animal health. In addition, the presence of major companies, such as Charles River Laboratory and Argenta, offering their services further strengthens the North America veterinary clinical trials market landscape.

The U.S. veterinary clinical trials market accounted for the largest market share in 2023. There is a continuous demand for clinical trials to evaluate new drugs, vaccines, biologics, and medical devices for treating and preventing animal diseases. Increased funding and investment in veterinary R&D support the expansion of clinical trial activities, fostering innovation and improving animal treatment options.

For instance, in October 2022, the UC Davis School of Veterinary Medicine set new records in research and philanthropic funding for the 2021-2022 fiscal year, receiving $89 million for research and $61.7 million from philanthropic sources. Additionally, the school’s scholarship endowment surpassed $100 million, marking a significant milestone in supporting veterinary medical education. These collectively contribute to the growing demand for veterinary clinical trials in the U.S.

The Canadian veterinary clinical trials market held a significant market share due to its well-developed veterinary healthcare system, which includes numerous advanced veterinary clinics and associations capable of conducting complex clinical trials.

For instance, in June 2024, according to the Canadian Veterinary Medical Association, an Ontario veterinarian was awarded for a pivotal role in advancing telehealth and virtual care in veterinary medicine. This recognition highlights the country's growing focus on veterinary research, which in turn contributes to the increasing demand for veterinary clinical trials in Canada.

North America Veterinary Clinical Trials Key Market Players & Competitive Insights

Leading market players drive innovation and competitiveness in veterinary clinical trials through their investments in research and development, strategic partnerships, market development, and innovation to advance animal health. Also, significant funding in veterinary research is driving the growth of the North American veterinary clinical trials industry.

Key players strive to expand their geographic footprint to tap into the emerging North America veterinary clinical trials industry with growing pet populations and livestock industries. As the demand for advanced veterinary treatments and therapies continues to rise, these companies are well-positioned to meet the evolving needs of the veterinary sector. Major players in the North America veterinary clinical trials market, including Argenta, Boehringer Ingelheim International GmbH., Charles River Laboratory, Clinvet, Cambridge Technologies, Knoell, IDEXX Laboratories, Inc., Labcorp Drug Development, Merck & Co., Inc., and Vivesto AB.

Merck & Co., Inc. is a major research-driven biopharmaceutical company pioneering health solutions that advance disease prevention and treatment for both humans and animals. The company offers a wide range of products tailored for companion animals, equines, swine, poultry, ruminants, and aquaculture. In 2024, Merck Animal Health received approval from the European Commission for BRAVECTO injection for dogs, providing immediate and sustained protection against fleas and ticks.

Vivesto is a research and development company specializing in creating new treatment options for patients with cancers. The company focuses on projects that promise innovative treatments for cancer patients with critical medical needs. Vivesto possesses the expertise and capability to advance drugs from early preclinical stages through clinical trials. Currently, Vivesto is developing the cancer therapies Cantrixil and Docetaxel micellar, along with Paccal Vet (paclitaxel micellar) for veterinary oncology. Pascal Vet aims to treat malignant melanoma and hemangiosarcoma in dogs. In December 2023, Vivesto AB announced that the US Veterinary Review Board Clinical Studies Committee approved its scheduled Paccal Vet open-label pilot clinical study in dogs with splenic hemangiosarcoma post-splenectomy.

Key Companies in the North America Veterinary Clinical Trials market include

- Argenta

- Boehringer Ingelheim International GmbH

- Cambridge Technologies

- Charles River Laboratory

- Clinvet

- IDEXX Laboratories, Inc.

- Knoell

- Labcorp Drug Development

- Merck & Co., Inc.

- Vivesto AB

North America Veterinary Clinical Trials Industry Developments

- April 2024: April 2024: Zoetis announced the U.S. launch of Bonqat (pregabalin oral solution) for cats under an exclusive agreement with Orion Corporation. The FDA approved these Bonqat in November 2023 to help alleviate feline anxiety and fear related to transportation and veterinary visits.

- March 2024: Vivesto AB announced that it has started its Paccal Vet clinical trial by giving the first dose to a dog with splenic hemangiosarcoma after spleen removal surgery.

- April 2022: Charles River Laboratories International, Inc. acquired Explora BioLabs Holdings, Inc., to broaden Charles River's Accelerator and Development Lab (CRADL), a part of its Insourcing Solutions business which offers fully equipped, AAALAC-accredited vivarium rental spaces, supported by Charles River's extensive technical, vivarium, and veterinary capabilities.

North America Veterinary Clinical Trials Market Segmentation

North America Veterinary Clinical Trials Animal Type Outlook

- Livestock Animal

- Companion Animal

- Other Animals

North America Veterinary Clinical Trials Intervention Outlook

- Medicines

- Medical Device

- Others

North America Veterinary Clinical Trials, Indication Outlook

- Orthopedics

- Oncology

- Cardiology

- Ophthalmology

- Neurology

- Dermatology

- Internal Medicine

- Other Indication

North America Veterinary Clinical Trials End User Outlook

- Academics And Research Centers

- Pharmaceutical And Biopharmaceutical Companies

- Others

North America Veterinary Clinical Trials Country Outlook

- North America

- US

- Canada

North America Veterinary Clinical Trials Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,629.11 million |

|

Market size value in 2024 |

USD 1,789.43 million |

|

Revenue Forecast in 2032 |

USD 3,841.20 million |

|

CAGR |

10.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The North America veterinary clinical trials market size was valued at USD 1,629.11 million in 2023 and is expected to grow at USD 3,841.20 million in 2032.

The North America veterinary clinical trials market is projected to grow at a CAGR of 10.0% during the forecast period.

The U.S. veterinary clinical trials market accounted for the largest market share in 2023.

The key players in the North America veterinary clinical trials market are Argenta, Bioagile Therapeutics Pvt. Ltd., Boehringer Ingelheim International GmbH., Charles River Laboratory, Clinvet, IDEXX Laboratories, Inc., Labcorp Drug Development, Merck & Co., Inc., Ondax Scientific, and Vivesto AB.

In 2023, the companion animal segment accounted for the largest market share.

The pharmaceutical and biopharmaceutical companies segment accounted for the largest market share in 2023.