North America SGLT2 Inhibitors Market Share, Size, Trends, Industry Analysis Report: By Indication [Cardiovascular, Chronic Kidney Disease (CKD), Type 2 Diabetes, and Others], Drug, Distribution Channel, and Country (US and Canada) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5192

- Base Year: 2024

- Historical Data: 2020-2023

North America SGLT2 Inhibitors Market Overview

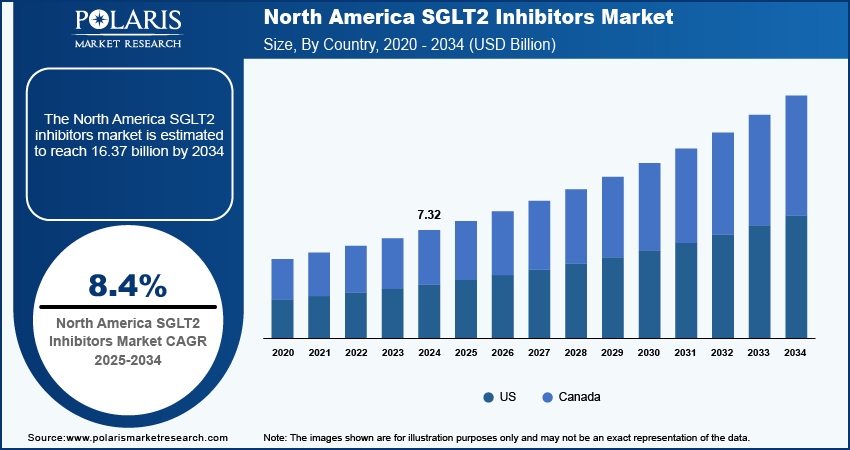

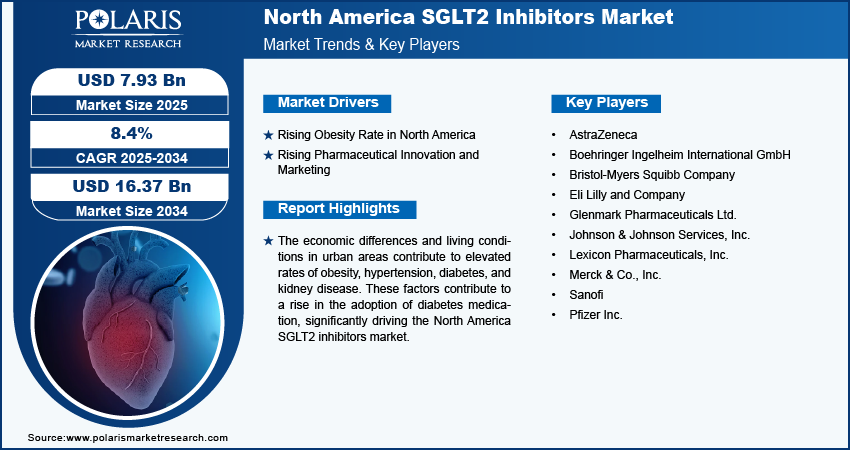

The North America SGLT2 inhibitors market size was valued at USD 7.32 billion in 2024. The market is projected to grow from USD 7.93 billion in 2025 to USD 16.37 billion by 2034, exhibiting a CAGR of 8.4% during 2025–2034.

Increasing urbanization, combined with economic factors, results in high-stress lifestyles, easy access to unhealthy foods, and limited opportunities for physical activity in urban environments. The economic differences and living conditions in urban areas contribute to elevated rates of obesity, hypertension, diabetes, and kidney disease. These factors contribute to increased blood sugar levels, leading to a rise in the adoption of diabetes medication, significantly driving the North America SGLT2 inhibitors market. Additionally, rising consumption of diets high in sodium, sugars, and unhealthy fats across the region, coupled with low intake of fruits, vegetables, and whole grains, significantly contributes to conditions such as hypertension, insulin resistance, and kidney damage, ultimately leading to the onset of chronic diseases. The growing prevalence of chronic diseases, particularly type 2 diabetes, has fueled the North America SGLT2 inhibitors market growth.

To Understand More About this Research: Request a Free Sample Report

North America has a highly advanced healthcare infrastructure that enables rapid identification and efficient management of diabetes. The region's access to advanced medical facilities, experienced healthcare practitioners, and comprehensive healthcare services ensures that patients are equipped with the latest treatments, including SGLT2 Inhibitors. The pharmaceutical industry's ongoing research and development efforts have resulted in the continual introduction of advanced SGLT2 inhibitors. Innovations such as combined therapies with other antidiabetic medications and enhanced formulations are broadening the range of therapeutic choices for patients, consequently fueling market expansion.

North America SGLT2 Inhibitors Market Trends and Driver Analysis

Rising Obesity Rate in North America

Obesity significantly increases the risk of developing type 2 diabetes due to elevated body fat, particularly around the abdomen, which leads to insulin resistance and challenges in regulating blood sugar levels. According to Trust for America's Health, the national adult obesity rate from 2017 to 2020 was 41.9%, with Black and Latino adults exhibiting the highest rates at 49.9% and 45.6%, respectively. Moreover, individuals residing in rural areas have higher obesity rates compared to those in urban and suburban areas. The rise in obesity rates has led to an increase in the incidence of chronic diseases such as type 2 diabetes, driving the demand for effective glucose-lowering therapies such as SGLT2 inhibitors in North America.

Rising Pharmaceutical Innovation and Marketing

Pharmaceutical companies are prioritizing the development and promotion of SGLT2 inhibitors to cater to the increasing number of diabetic patients, particularly in the obese demographic. Continuous research, the creation of new formulations, and aggressive marketing approaches are broadening the accessibility and acceptance of SGLT2 inhibitors. According American Society of Nephrology, in January 2023, the SGLT2 inhibitor bexagliflozin was sanctioned as an additional therapy for reducing blood glucose levels in type 2 diabetes patients. Such advancements in diabetes treatment and marketing strategies by market players boost the North America SGLT2 Inhibitors market growth.

North America SGLT2 Inhibitors Market Segment Analysis

North America SGLT2 Inhibitors Market Breakdown – by Drug Insights

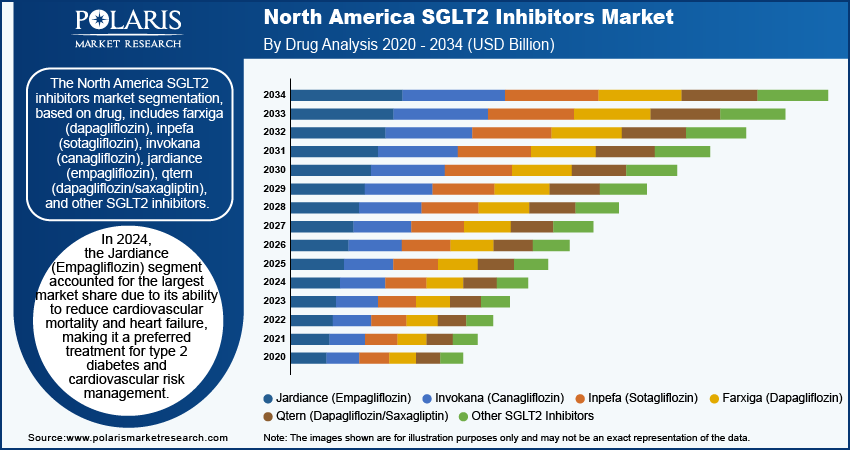

The North America SGLT2 inhibitors market segmentation, based on drug, includes farxiga (dapagliflozin), inpefa (sotagliflozin), invokana (canagliflozin), jardiance (empagliflozin), qtern (dapagliflozin/saxagliptin), and other SGLT2 inhibitors. In 2024, the Jardiance (Empagliflozin) segment accounted for the largest market share. Jardiance demonstrated a robust clinical profile with substantial reductions in cardiovascular mortality and heart failure hospitalizations, making it a preferred cardiovascular and diabetes drug. The FDA's approval of Jardiance for multiple indications, such as heart failure and chronic kidney disease, has expanded its use beyond glycemic control.

North America SGLT2 Inhibitors Market Breakdown, by Indication Insights

The North America SGLT2 inhibitors market segmentation, based on indication, includes cardiovascular, chronic kidney disease (CKD), type 2 diabetes, and others. The type 2 diabetes segment is expected to be the fastest-growing segment during the forecast period. The rising prevalence of type 2 diabetes in North America is largely attributed to lifestyle factors such as poor diet, physical inactivity, and increasing obesity rates. SGLT2 inhibitors, including Jardiance, have emerged as a top choice for managing type 2 diabetes due to their dual benefits of effectively controlling blood sugar levels and providing significant cardiovascular protection, which is essential for addressing common comorbidities in diabetic patients.

Robust clinical evidence supporting the efficacy and safety of SGLT2 drugs in reducing major adverse type 2 diabetes has resulted in widespread acceptance among both healthcare providers and patients. Regulatory approvals, including the endorsement by the FDA, have further expanded the therapeutic use of SGLT2 inhibitors for type 2 diabetes.

North America SGLT2 Inhibitors Market Country Insights

By country, the study provides market insights into the US and Canada. The US accounted for a larger SGLT2 inhibitors market share in North America in 2024. The US hosts a substantial pharmaceutical research and development sector, which has contributed to the prompt adoption of new SGLT2 inhibitors and combination therapies. For instance, in June 2020, Merck and Pfizer's SGLT2 Inhibitor, STEGLATRO (ertugliflozin), met the primary endpoint in the VERTIS CV trial for patients diagnosed with type 2 diabetes and atherosclerotic cardiovascular disease.

Vigorous marketing efforts and educational programs by pharmaceutical firms have successfully raised awareness and reception among healthcare practitioners and patients. Consequently, these factors have established the US as the primary market for SGLT2 inhibitors in North America as of 2023.

The Canada SGLT2 inhibitors market is expected to experience significant growth during the forecast period. The Canadian government, in collaboration with provincial and territorial health authorities, has instituted a range of strategies to combat the diabetes epidemic. These strategies encompass targeted public health campaigns, comprehensive screening initiatives, and robust support for diabetes education and self-management programs. This factor notably drives the demand for SGLT2 inhibitors in treatment, which fuels the Canada SGLT2 inhibitors market growth.

North America SGLT2 Inhibitors Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will boost the North America SGLT2 inhibitors market growth during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their footprint across North America, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market scenario, the North America SGLT2 inhibitors industry players must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the North America SGLT2 inhibitors industry to benefit clients. Major players in the market, including AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi; and TheracosBio, LLC.

Boehringer Ingelheim was established in 1885. The company operates in the human pharmaceutical and animal health sectors. The human pharmaceutical division focuses on therapeutic areas such as heart diseases, metabolic diseases, chronic kidney diseases, cancer, lung diseases, skin and inflammatory diseases, mental disorders, and retinal diseases. In April 2024, Boehringer Ingelheim International GmbH reported that its EMPACT-MI phase 3 clinical trial demonstrated a 10% decrease in the risk of hospitalization for heart failure in patients following the administration of Jardiance (empagliflozin).

Eli Lilly and Company, a global pharmaceutical company, offers a wide range of insulin products such as Basaglar, Humalog, and Humulin for diabetes management. It also provides medications for type 2 diabetes and oncology products. In December 2022, Eli Lilly and Company, in a Phase III trial, stated that Jardiance, as an SGLT2 inhibitor, had achieved a statistically significant reduction in blood glucose levels in pediatric and adolescent patients diagnosed with type 2 diabetes.

Key Companies in North America SGLT2 Inhibitors Market

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.)

- Lexicon Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Sanofi

- Pfizer Inc.

North America SGLT2 Inhibitors Industry Developments

In December 2023, Boehringer Ingelheim received European Commission approval for Jardiance (empagliflozin) 10mg and 25mg tablets to be used as an adjunct to diet and exercise for the treatment of inadequately controlled type 2 diabetes mellitus in children aged ten years and older in the European Union.

In September 2023, Eli Lilly and Company and Boehringer Ingelheim International GmbH announced that the US FDA had approved Jardiance (empagliflozin) for its efficacy in reducing the risk of cardiovascular mortality and hospitalization for heart failure in patients affected by chronic kidney disease.

North America SGLT2 Inhibitors Market Segmentation

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Cardiovascular

- Chronic Kidney Disease (CKD)

- Type 2 Diabetes

- Others

By Drug Outlook (Revenue – USD Billion, 2020–2034)

- Farxiga (Dapagliflozin)

- Inpefa (Sotagliflozin)

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Qtern (Dapagliflozin/Saxagliptin)

- Other SGLT2 Inhibitors

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Country Outlook (Revenue – USD Billion, 2020–2034)

- US

- Canada

North America SGLT2 Inhibitors Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.32 billion |

|

Market Size Value in 2025 |

USD 7.93 billion |

|

Revenue Forecast by 2034 |

USD 16.37 billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The North America SGLT2 Inhibitors market size was valued at USD 7.32 billion in 2024.

The North America market is projected to register a CAGR of 8.4% during 2025–2034.

The US held a larger share of the North America market in 2024

A few key players in the market are AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi; and Pfizer Inc.

The jardiance (empagliflozin) segment dominated the market in 2024.

The type 2 diabetes segment held the largest share of the North America market in 2024.