North America Robot Operating System Market Share, Size, Trends, Industry Analysis Report: By Robot Type (Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots, and Others), Application, End Use, and Country (US and Canada) – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 115

- Format: PDF

- Report ID: PM5073

- Base Year: 2023

- Historical Data: 2019-2022

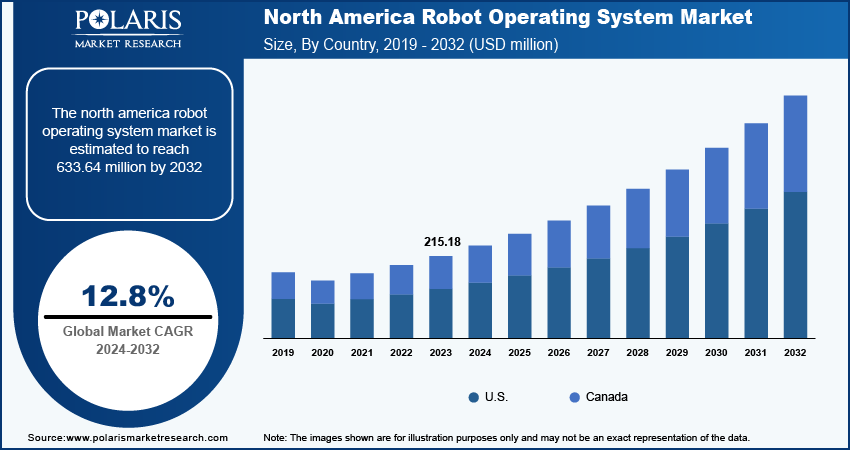

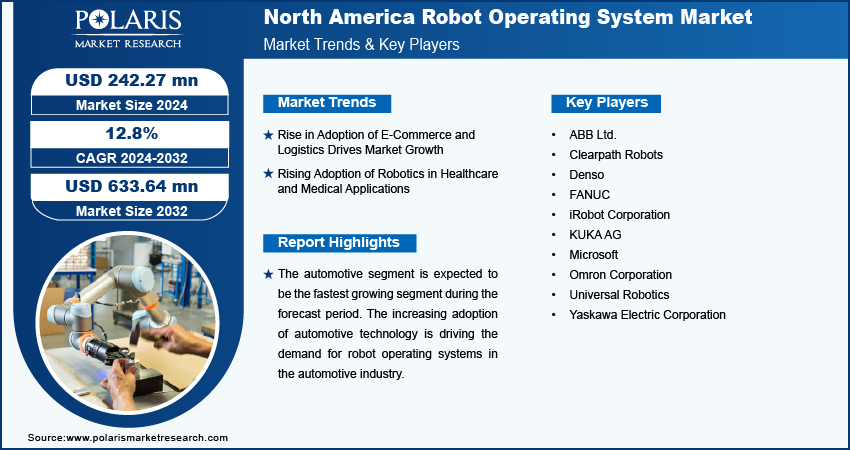

The North America robot operating system market size was valued at USD 215.18 million in 2023. The market is projected to grow from USD 242.27 million in 2024 to USD 633.64 million by 2032, exhibiting a CAGR of 12.8% during 2024–2032.

The rising preference to automate repetitive and risky tasks among companies to boost efficiency and prioritize worker safety is fueling the need for robotics and robot operating systems. Moreover, in logistics, automated systems are used for tasks such as item sorting, packaging, and transportation. This implementation significantly enhances operational efficiency and accuracy in the process of demand completion. Therefore, the increasing demand for automated operating systems drives the growth of the North America robot operating system market.

To Understand More About this Research: Request a Free Sample Report

The continuous advancement of robotics, particularly in artificial intelligence (AI), machine learning (ML), and sensor technologies, is significantly enhancing the capabilities of robots, making them more efficient and adaptable. Furthermore, governments are increasingly utilizing robot operating systems across various sectors to improve productivity, safety, and service delivery. In defense and security, ROS-based robots play crucial roles in surveillance and explosive ordnance disposal, contributing to border monitoring, intelligence gathering, and safe neutralization of explosives. Consequently, the growing demand for defense and security services propels the growth of the North America robot operating system market.

North America Robot Operating System Market Trends

Rise in Adoption of E-Commerce and Logistics Drives Market Growth

The rapid expansion of the e-commerce industry has created a greater need for efficient logistics and warehousing solutions. Robotics operating system-equipped robots play a crucial role in automating tasks. Moreover, the surge in online shopping necessitates scalable and adaptable solutions, which robotics operating system offers through its capability for effortless reprogramming and adjustment to meet diverse operational requirements.

According to the Census Bureau of the Department of Commerce, in the US, retail e-commerce sales for Q1 2024 reached an estimated USD 289.2 billion, representing a 2.1% increase from Q4 2023. Thus, the growing adoption of e-commerce and logistics propels the demand for advanced robotics systems, thereby fueling the North America robot operating system market.

Rising Adoption of Robotics in Healthcare and Medical Applications

Healthcare institutions are increasingly adopting robot operating system-based robots for surgeries, patient care, and rehabilitation, resulting in enhanced precision and efficiency. These advanced robots facilitate minimally invasive surgeries, assist with patient care tasks, and help alleviate the workload on healthcare professionals. The rising demand for medical robotics is largely driven by an aging population and the need for more efficient healthcare delivery systems.

To address these evolving needs, medical institutions and research facilities are investing significantly in advanced robotic technologies. This trend is expected to accelerate the adoption of robot operating system-based systems, particularly in North America, where the market is poised for growth. According to the US Census Bureau, in 2021, surgical hospitals and general medical facilities allocated USD 490 million to robotic equipment, which accounted for 69.6% of total spending in the healthcare and social assistance sector. Such substantial investment is anticipated to further propel market growth during the forecast period.

North America Robot Operating System Market – Segment Insights

North America Robot Operating System Market: Application-Based Insights

The North America robot operating system market, based on application, is segmented into end of line packaging, home automation and security, inventory management, mapping and navigation, metal sampling and press trending, personal assistance, pick and place, plastic injection and blow molding, and testing and quality inspection. In 2023, the mapping and navigation segment accounted for the significant market share. The increasing need for autonomous vehicles such as self-driving cars, drones, and unmanned aerial vehicles (UAVs) has led to the widespread adoption of robot operating systems for mapping and navigation. Robot operating system offers a comprehensive framework for the development and seamless integration of navigation systems into these autonomous platforms. Collaborations between robot operating system developers and sensor manufacturers, such as LiDAR, cameras, and inertial measurement units, play a pivotal role in integrating sensing capabilities into robot operating system-based navigation systems. These collaborations primarily revolve around streamlining sensor data processing, calibration, and synchronization within the robot operating system framework to improve mapping precision and navigation stability.

In August 2021, Velodyne LIDAR, Inc. and MOV.AI partnered to provide robot manufacturers with advanced automation solutions. The MOV.AI's Robotics Engine Platform with Velodyne's LIDAR sensors combined offer enhanced capabilities, including navigation, mapping, obstacle avoidance, and risk mitigation, meeting the demand for automation in dynamic environments such as e-commerce, logistics, manufacturing, and healthcare, thereby contributing to the expansion of the North American robot operating system market.

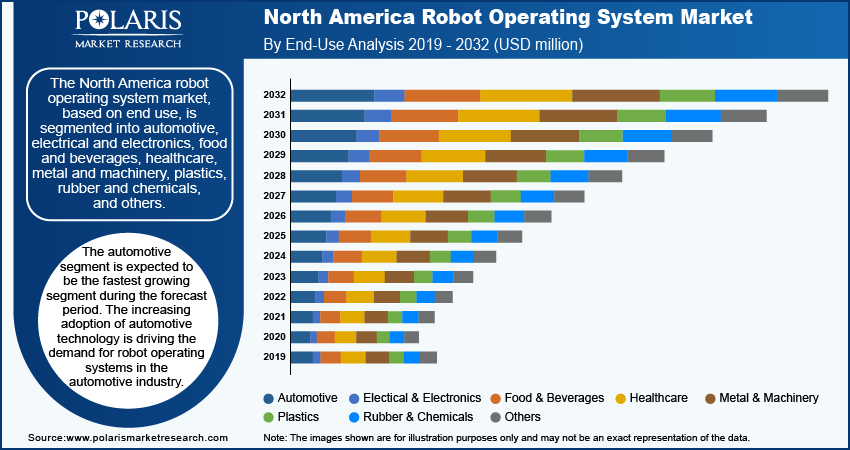

North America Robot Operating System Market: End-Use-Based Insights

The North America robot operating system market, based on end use, is segmented into automotive, electrical and electronics, food and beverages, healthcare, metal and machinery, plastics, rubber and chemicals, and others. The automotive segment is expected to be the fastest growing segment during the forecast period. The increasing adoption of automotive technology is driving the demand for robot operating systems in the automotive industry. According to EIA, in the US, the combined sales of hybrid vehicles, plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs) accounted for 16.3% of total new light-duty vehicle (LDV) sales in 2023, up from 12.9% in 2022. This surge in sales is indicative of the growing demand for robot operating systems in North America. The primary driver of robot operating system demand in the automotive sector is the development of autonomous vehicles. Moreover, the rising demand for advanced driver assistance systems (ADAS), which includes features such as adaptive cruise control, lane-keeping assist, and automated parking, is fueling the use of robot operating systems. Due to its flexibility and capability to handle complex robotic applications, it is extensively utilized in the development and testing of ADAS systems. This increasing demand is accelerating the adoption of robot operating system in the automotive industry.

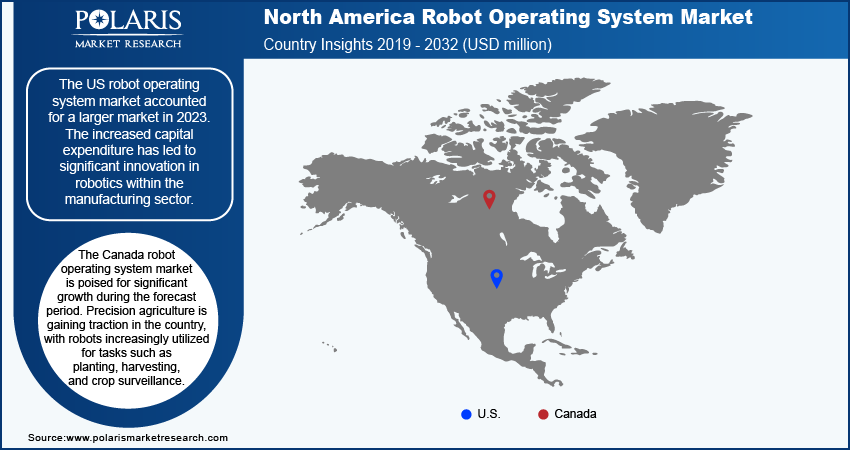

North America Robot Operating System Market Size: by Country Insights

By country, the study provides market insights into US and Canada. The US robot operating system market accounted for a larger market in 2023. The increased capital expenditure has led to significant innovation in robotics within the manufacturing sector. Companies are using robotics operating systems to develop advanced robotic systems for tasks such as assembly and quality control. In the US, the manufacturing sector emerged as the primary contributor, responsible for 74.4% of total expenditures on robotic equipment. Capital investments in robotic equipment within the manufacturing sector increased by about 73.6% from 2020 to 2021, subsequently driving the expansion of the US robot operating system market.

The Canada robot operating system market is poised for significant growth during the forecast period. Precision agriculture is gaining traction in the country, with robots increasingly utilized for tasks such as planting, harvesting, and crop surveillance. These robot operating system-based systems facilitate the creation of advanced agricultural robots, enhancing both productivity and sustainability in the sector. As the demand for efficient and eco-friendly farming solutions continues to rise, the adoption of these technologies is expected to accelerate, driving further growth in the market.

North America Robot Operating System Market: Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the North America robot operating system market grow. Market participants are also undertaking a variety of strategic activities to expand their footprint across the region, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations. To expand and survive in a more competitive and rising market climate, the North America robot operating system industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the North America robot operating system industry to benefit clients and boost business growth. In recent years, the market has offered some technological advancements. Major players in the North America robot operating system market are ABB Ltd., Clearpath Robots, Denso, FANUC, iRobot Corporation, KUKA AG, Microsoft, Omron Corporation, Universal Robotics, and Yaskawa Electric Corporation.

Fanuc is a global factory automation solution provider, offering a range of CNC series products, lasers, robots, servo motors, compact machining centers, wire electrical discharge machines, electric injection molding machines, and ultra-precision machines. Additionally, the company provides the FANUC intelligent edge link and drive system, which serves as an open platform tailored for the manufacturing industry. In April 2021, FANUC America launched SR-12iA/C Food Grade SCARA robot, specifically designed for food packaging, processing, and cleanroom environments.

ABB operates as a technology company worldwide. The company operates in segments such as electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers the product portfolio of switchgears under distribution solution subsegment. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation cater various energy and process industries and also offer measurement analytics, machine automation, and robotics. In June 2024, ABB launched OmniCore, its latest robotics control platform. The platform introduces a modular and futureproof control architecture. This architecture is designed to facilitate seamless integration of AI, sensor, cloud, and edge computing systems, thereby releasing the potential for highly advanced and autonomous robotic applications.

Key Companies in North America Robot Operating System Market

- ABB Ltd.

- Clearpath Robots

- Denso

- FANUC

- iRobot Corporation

- KUKA AG

- Microsoft

- Omron Corporation

- Universal Robotics

- Yaskawa Electric Corporation

North America Robot Operating System Industry Developments

- In May 2022, iRobot Corp., a consumer robotics company, launched iRobot OS, which represents the next stage in the development of its Genius Home Intelligence platform. The company claims that iRobot OS offers enhanced customer experience, aiming to optimize home cleanliness, health, and automation.

- In December 2021, ABB launched Omnicore robot controllers. The company states that the controllers offer improved speed, precision, and autonomy, enhancing the overall efficiency of automation processes.

- In April 2021, Open Robotics and Canonical partnered to offer enterprise support and robot operating system extended security maintenance as a part of Ubuntu Advantage, which is Canonical's service package for Ubuntu.

North America Robot Operating System Market Segmentation

By Robot Type Outlook

- Articulated Robots

- Cartesian Robotics

- Collaborative Robots

- SCARA Robots

- Others

By Application Outlook

- End of Line Packaging

- Home Automation and Security

- Inventory Management

- Mapping and Navigation

- Metal Sampling and Press Trending

- Personal Assistance

- Pick and Place

- Plastic Injection and Blow Molding

- Testing and Quality Inspection

By End Use Outlook

- Automotive

- Electrical and Electronics

- Food and Beverages

- Healthcare

- Metal and Machinery

- Plastics

- Rubber and Chemicals

- Others

By Country Outlook

- US

- Canada

North America Robot Operating System Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 215.18 million |

|

Market Size Value in 2024 |

USD 242.27 million |

|

Revenue Forecast in 2032 |

USD 633.64 million |

|

CAGR |

12.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The North America robot operating system market size was valued at USD 215.18 million in 2023.

The market is projected to register a CAGR of 12.8% during the forecast period.

The US held a larger share of the North America market in 2023.

ABB Ltd., Clearpath Robots, Denso, FANUC, iRobot Corporation, KUKA AG, Microsoft, Omron Corporation, Universal Robotics, and Yaskawa Electric Corporation are a few key market players.

The mapping and navigation segment dominated the market in 2023.

The automotive segment held the largest share in the North America market in 2023