North America Plastic Injection Molding Machine Market Share, Size, Trends, Industry Analysis Report, By Technology (Hydraulic, Electric, And Hybrid); By Technological Sophistication; By Clamping Force; By End-Use; and By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4638

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

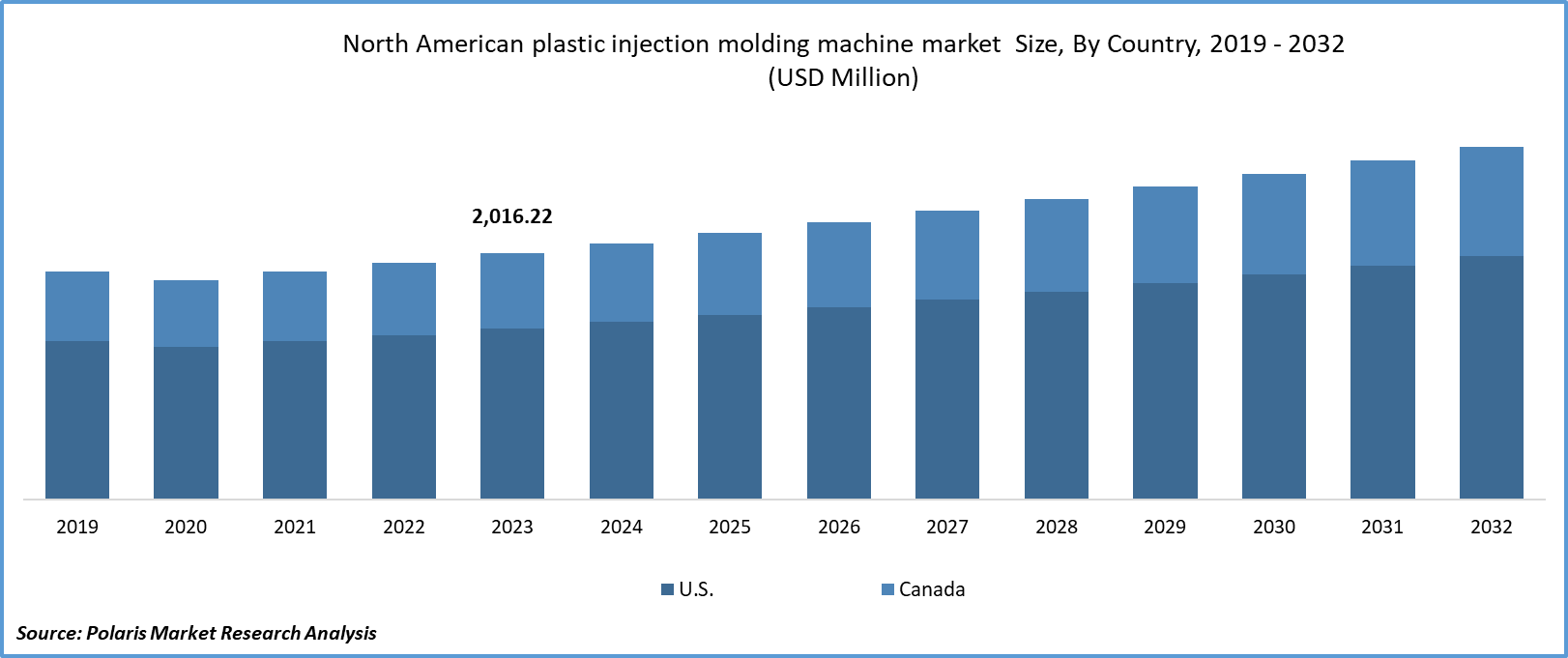

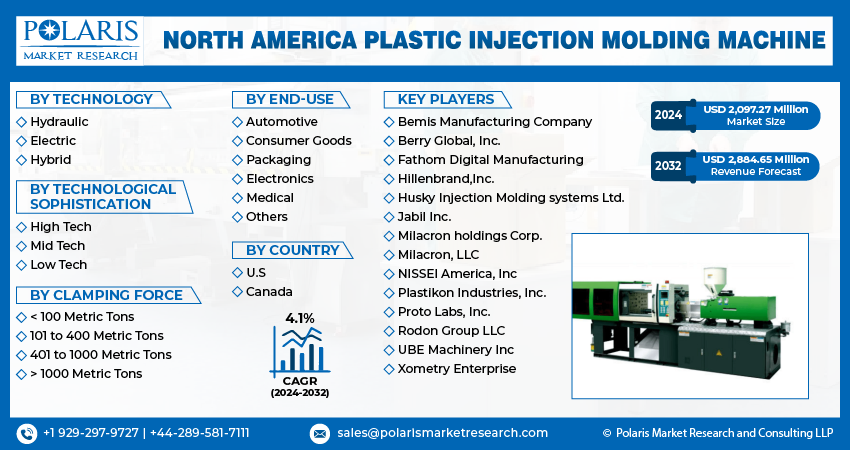

North America Plastic Injection Molding Machine Market size was valued at USD 2,016.22 Million in 2023. The market is anticipated to grow from USD 2,097.27 million in 2024 to USD 2,884.65 million by 2032, exhibiting a CAGR of 4.1% during the forecast period

Industry Trend

The surge in demand for plastic injection molding machinery is propelled by various end-use sectors such as healthcare, automotive, consumer goods, electrical & electronics, packaging, and others. Particularly in the automotive industry, plastic injection molding machines are indispensable, facilitating the efficient mass production of intricate and tailor-made plastic parts utilized in vehicles. These machines are extensively deployed in automotive manufacturing for the production of interior components like dashboards, door panels, and steering wheel parts, as well as exterior elements including bumpers and body panels.

The machines also provide numerous benefits, including swift production cycles, cost efficiency, and the capacity to handle a diverse range of plastic materials. This versatility allows for the creation of lightweight components with exceptional efficiency and affordability. Moreover, these machines boast high design flexibility, a crucial feature in contemporary automotive manufacturing. The burgeoning demand for automotive components has driven automobile production, leading to an increased need for plastic injection molded parts within the automotive sector, as a result, the North American plastic injection molding machine market size is expected to grow during the forecast period.

To Understand More About this Research: Request a Free Sample Report

In response to the increasing need for North America expansion and innovation, the company has recently injected significant capital into a pioneering investment initiative. This initiative aims to foster collaboration and leverage cutting-edge technology to revolutionize its operations. This forward-thinking strategy not only aims to enhance existing services and products but also to pioneer innovative solutions that will set new industry standards. With a holistic approach focused on expanding market presence, attracting new customer demographics, and promoting sustainable growth in a rapidly evolving business landscape, the company is primed for success. Through the integration of investment, technology, innovation, and strategic planning, it is positioned to maintain competitiveness and emerge as a leader in its field.

For Instance, In December 2023, Husky Technologies inaugurated a state-of-the-art service center in Jeffersonville, Indiana. This facility offers a comprehensive range of readily available OEM parts, showcasing the company's commitment to its customers in the Americas region.

As the automotive industry expands, propelled by factors such as rising consumer demand, technological advancements, and a focus on sustainability, the requirement for precise, efficient, and adaptable plastic components within vehicles continues to grow. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle sales in the U.S. experienced a decline from 2,512,780 units in 2019 to 1,926,795 units in 2020 due to COVID-19 lockdown measures, hence the North America plastic injection molding machine market size is estimated to grow tremendously in the upcoming years.

Key Takeaway

- United States dominated the largest market and contributed to more than 35% of share in 2023.

- By Technology category, Hydraulic segment accounted for the largest market share in 2023.

- By End-use category, the automotive segment is projected to grow at a high CAGR during the projected period.

What are the Market Drivers Driving the Demand for the North America Plastic Injection Molding Machine Market?

The Increasing Industrialization is Projected to Spur Product Demand

The demand for advanced injection molding machines capable of delivering high precision is driven by industries like automotive, healthcare, and electronics, which require intricate components. Additionally, the trend toward product customization intensifies the need for versatile machines that can cater to unique design specifications. Continuous technological advancements are pivotal in shaping the plastic injection molding machine market. Integration of automation, digitalization, and Industry 4.0 technologies enhances operational efficiency, reduces production time, and minimizes errors. Smart manufacturing practices, real-time monitoring, and predictive maintenance further enhance manufacturers' competitiveness in this space. As a result, the North American plastic injection molding machine market is expected to grow during the forecast period.

Moreover, Mass production capabilities are a focal point in the plastic injection molding machine market. Industries such as consumer packaging and goods rely on cost-effective manufacturing processes. Injection molding machines play a major role in achieving economies of scale, enabling manufacturers to produce large volumes of identical or similar components with high efficiency and cost-effectiveness. Environmental consciousness is increasingly influential in the market, prompting a shift towards sustainable practices. Manufacturers are adopting eco-friendly materials and processes to reduce the environmental impact of plastic production. This includes exploring biodegradable polymers and implementing recycling initiatives, aligning with efforts to address plastic waste concerns. However, the North America plastic injection molding machine market analysis shows the rapid growth in the upcoming years.

With increasing emphasis on fuel efficiency and sustainability, there is a rising demand for lightweight materials in various industries such as aerospace, automotive, and consumer goods. Plastic injection molding machines has major role in manufacturing lightweight components, presenting opportunities for market growth. Hence, the North American plastic injection molding machine market share is anticipated to grow during the forecast period.

Which Factor is Restraining the Demand for North America Plastic Injection Molding Machine?

High Initial Investment are Likely to Impede the Market Growth

The acquisition and installation expenses associated with procuring plastic injection molding machinery, particularly those integrating cutting-edge technologies, pose a formidable financial obstacle for small and medium-sized enterprises (SMEs). These sophisticated technologies, encompassing features like automation, digitalization, and Industry 4.0 integration, are often accompanied by premium price points owing to their intricate nature and advanced functionalities.

For SMEs constrained by limited financial resources, embarking on such a substantial initial investment can be a daunting prospect. Such endeavors may necessitate a considerable portion of their available capital, thereby presenting challenges in terms of financing arrangements and the management of cash flow dynamics. Moreover, SMEs, inherently more risk-averse compared to their larger counterparts, may exhibit reluctance in committing to such substantial investments devoid of assured returns. Consequently, the steep initial investment prerequisites associated with acquiring plastic injection molding machinery endowed with advanced technologies may dissuade SMEs from venturing into the market or expanding their existing operations. This could potentially curtail competition within the industry, impede innovation, and hamper overall market expansion.

To mitigate this predicament, SMEs might contemplate exploring alternative financing avenues such as lease agreements, equipment loans, or forging strategic partnerships with larger corporations.

Additionally, governmental incentives, grants, or subsidies tailored to bolster SMEs in embracing advanced technologies could serve to alleviate the financial strain. Collaborative endeavors among industry associations, financial institutions, and governmental bodies could further facilitate the provision of resources and expertise, thereby empowering SMEs to surmount barriers and flourish within the plastic injection molding domain. Ultimately, the amelioration of financial impediments hindering SMEs' entry and expansion possibilities holds the promise of cultivating a more diverse and fiercely competitive landscape, thereby catalyzing innovation and propelling overall industry progression. Hence the North America plastic injection molding machine market is expected to imped the market growth.

Report Segmentation

The market is primarily segmented based on technology, technological sophistication, clamping force, end-use, and country.

|

By Technology |

By Technological Sophistication |

By Clamping Force |

By End-use |

By Country |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Technology Insights

Based on Technology analysis, the market is segmented into hydraulic, electric and hybrid. The Hydraulic segment held the largest market in 2023. A hybrid injection molding machine amalgamates the strengths of both hydraulic and electric injection molding machines. These hybrid machines offer the robust clamping force of hydraulic models and the reduced noise, precision, energy efficiency, and repeatability of electric counterparts. These attributes contribute to the high-quality production of plastic parts, whether thick- or thin-walled. Furthermore, a hybrid injection molding machine facilitates swift return on investment (ROI), allows for continual adjustments, and provides flexibility in product design options.

By End-use Insights

Based on End-use industry analysis, the market has been segmented based on, automotive, consumer goods, packaging, electronics, medical, and others. The automotive segment is expected to be the fastest-growing CAGR during the forecast period. the increasing demand for lightweight automotive components and the continuous growth in automotive production are anticipated to further drive the growth of this segment. Plastic injection molding machines play a pivotal role in the automotive industry, particularly in the manufacturing of exterior parts. These components encompass a wide range of applications, including door panels, car door trim, bumpers, trunk trims, front and rear covering, floor rails, sensor holders, grilles, wheel arches, fenders, and mudguards.

Country Insights

United States

United States dominated in the North America plastic injection molding machine market, In 2023. The rapid economic growth and industrialization witnessed in country have fueled the demand for plastic injection molding machine across various industries. rapid economic growth and industrialization experienced in the country have significantly fueled the demand for plastic injection molding machines across various industries. As the United States continues to expand its manufacturing base and infrastructure, there is an increasing need for advanced machinery to support production processes, including plastic injection molding.

Additionally, the United States boasts a diverse and robust industrial landscape, encompassing sectors such as automotive, healthcare, electronics, consumer goods, and packaging, among others. Each of these industries relies heavily on plastic injection molding technology for the production of a wide range of components and products. The growing demand within these sectors further drives the adoption of plastic injection molding machines in the country. Furthermore, the United States is home to numerous innovative and technologically advanced companies that continuously seek to improve manufacturing processes and product quality. These companies invest heavily in the latest machinery and technologies, including plastic injection molding machines equipped with automation, digitalization, and Industry 4.0 capabilities, to maintain their competitive edge in the market.

Moreover, the United States benefits from a well-developed infrastructure, skilled labor force, and favorable business environment, which further support the growth of the plastic injection molding machine market. Access to capital, research and development facilities, and a robust supply chain ecosystem also contribute to the country's dominance in the market.

Competitive Landscape

The landscape of the North America plastic injection molding machine market is characterized by its fragmentation, with competition stemming from a multitude of players. Key service providers within this sector are committed to continuously enhancing their technological capabilities to maintain a competitive edge, prioritizing efficiency, reliability, and safety as core attributes. In their pursuit of substantial market presence, these entities place significant emphasis on forging strategic partnerships, continually improving their product offerings, and engaging in collaborative endeavors to outpace industry counterparts.

Some of the major players operating in the North America market include:

- Bemis Manufacturing Company

- Berry Global, Inc.

- Fathom Digital Manufacturing

- Hillenbrand,Inc.

- Husky Injection Molding systems Ltd.

- Jabil Inc.

- Milacron holdings Corp.

- Milacron, LLC

- NISSEI America, Inc

- Plastikon Industries, Inc.

- Proto Labs, Inc.

- Rodon Group LLC

- UBE Machinery Inc

- Xometry Enterprise

Recent Developments

- In November 2023, ARBURG extended its global presence by inaugurating a new subsidiary in Vietnam. The principal aim was to improve access to ARBURG products and services for customers in Vietnam. This establishment underscores the company's dedication to delivering products and services with heightened convenience, efficiency, and reliability.

- In June 2023, Haitian International unveiled a state-of-the-art manufacturing facility in Mexico, strategically aimed at bolstering local production capacity, streamlining delivery times, and providing cutting-edge solutions tailored to the technical requirements of customers across North and South America. This endeavour represents a noteworthy achievement in Haitian International's expansion strategy, involving a substantial investment totalling approximately USD 50 million.

Report Coverage

The North American plastic injection molding machine market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis about various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, technological sophistication, clamping force, end-use, and their futuristic growth opportunities.

North America Plastic Injection Molding Machine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,097.27 million |

|

Revenue forecast in 2032 |

USD 2,884.65 million |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Technological Sophistication, By Clamping Force, By End-Use, and By Region |

|

Regional scope |

North America |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in North America Plastic Injection Molding Machine Market are Bemis Manufacturing Company, Berry Global, Inc., Fathom Digital Manufacturing, Hillenbrand,Inc., Husky Injection Molding systems Ltd

North America Plastic Injection Molding Machine Market exhibiting a CAGR of 4.1% during the forecast period

The North America Plastic Injection Molding Machine report covering key segments are technology, technological sophistication, clamping force, end-use, and country.

key driving factors in North America Plastic Injection Molding Machine Market are Growing Demand for automotive Industry

The North America plastic injection molding machine market size is expected to reach USD 2,884.65 Million by 2032