North America Microcrystalline Cellulose Market Size, Share, Trends, Industry Analysis Report: By Source Type (Wood Based, Non-Wood Based), By Form, By Grade, By End Use, and By Country – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5005

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

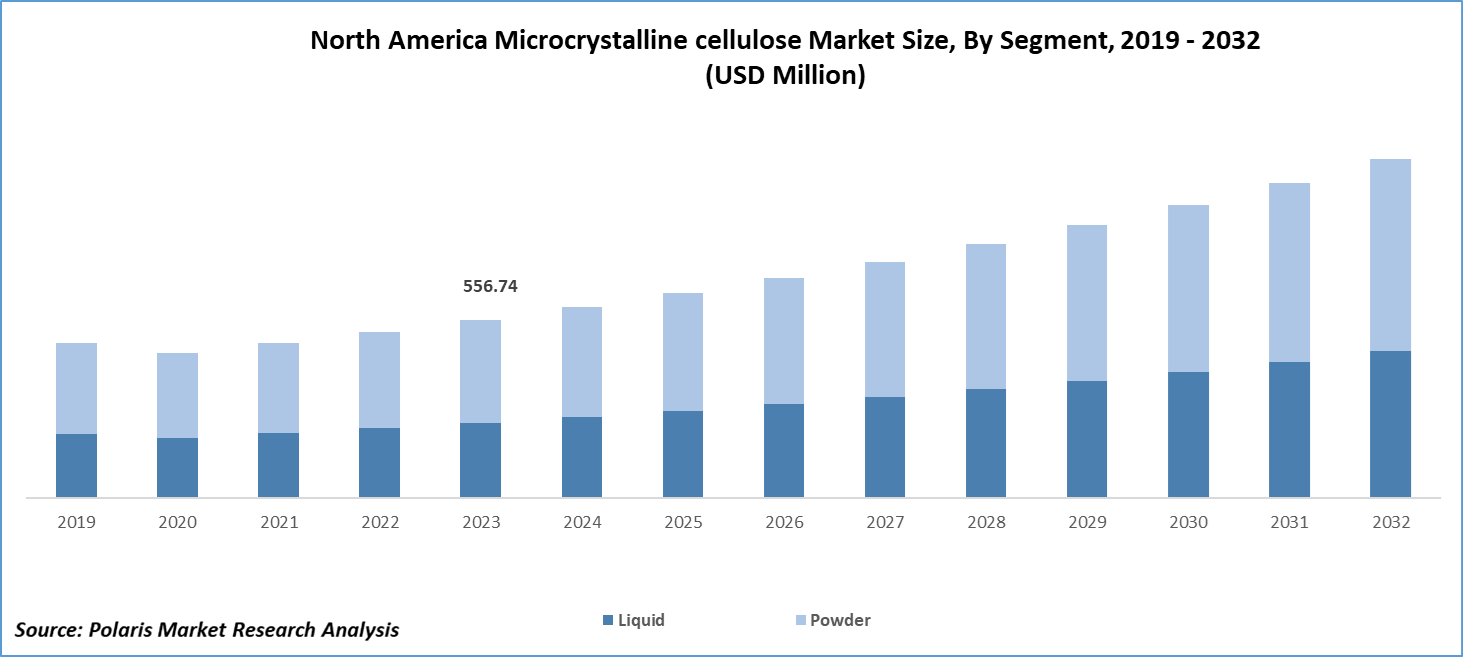

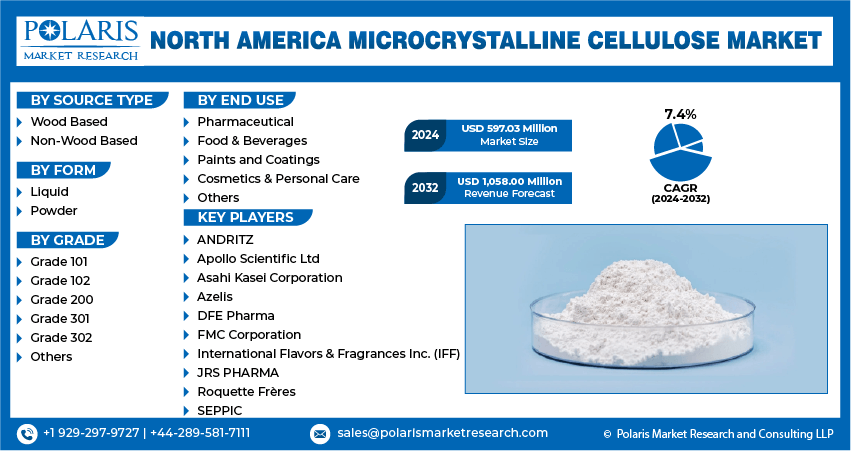

North America microcrystalline cellulose market size was valued at USD 556.74 million in 2023. The industry is projected to grow from USD 597.03 million in 2024 to USD 1,058.00 million by 2032, exhibiting a compound annual growth rate (CAGR) of 7.4% during the forecast period (2024 - 2032).

Microcrystalline cellulose (MCC) is a refined wood pulp derivative renowned for its high crystallinity and purity. It is primarily used as an excipient in the pharmaceutical sector. Additionally, MCC is utilized in the food and beverage industry as a stabilizer, emulsifier, and anti-caking agent, and in cosmetics for its texturizing and bulking properties. The versatile nature of MCC, coupled with its non-toxic, non-reactive, and stable characteristics, makes it an essential ingredient across various industries.

The market is experiencing robust growth driven by the rising pharmaceutical industry. Moreover, the rising food and beverage sector also plays a crucial role. The increasing consumer health consciousness and demand for processed and convenience foods boosts the North America microcrystalline cellulose market demand.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the growth of end-use industries and emerging trends, such as the increasing popularity of vegan and gluten-free products, present new opportunities for MCC applications. The rising consumer preference for natural and sustainable products further propels the competition among key players and drives the growth of the North America microcrystalline cellulose market.

North America Microcrystalline Cellulose Market Trends

Rising Personal Care & Cosmetics Demand is Driving the Market Growth

The increasing demand for personal care and cosmetics is fueling the growth of the microcrystalline cellulose market in North America. This is because microcrystalline cellulose serves as a texturizing and bulking agent, improving the texture and consistency of creams, lotions, and other cosmetic products, making them more attractive to consumers. Additionally, the growing need for high-quality and visually appealing personal care products is driving the demand for microcrystalline cellulose in North America.

Further, there is a growing consumer preference for personal care products containing natural and sustainable ingredients. MCC’s natural origin and non-toxic properties make it an attractive ingredient for formulators aiming to meet consumer demand for clean and green beauty products. The expansion and diversification of the personal care market, with the emergence of new product lines and categories, create additional opportunities for MCC applications. As companies explore new market segments, the demand for MCC in various personal care products continues to grow.

For instance, in November 2022, the SOFW Journal reported that solid foundation formulations were tested for pay-off, powderiness, tackiness, mattifying effect, and coverage. The results indicated that microcrystalline cellulose positively impacts the sensory profile and texture of these formulations. Being 100% plant-based, microcrystalline cellulose helps manufacturers create environmentally friendly, future-oriented products that effectively replace microplastics, increasing the North America microcrystalline cellulose market demand.

Further, rising consumer awareness about cosmetics that are organic, vegan, natural, and environmentally friendly has prompted manufacturers to introduce new products and expand their presence in the North America microcrystalline cellulose market. For example, in June 2021, SO'BiO étic, a French beauty company, established its organic beauty line in the U.S. to provide eco-friendly and healthy beauty products. Such development addresses the growing consumer demand for organic and vegan products while also driving growth in the North America microcrystalline cellulose market share.

Growing Pharmaceutical Industry Boosts Market Demand

The growing pharmaceutical industry significantly impacts the demand for the North America microcrystalline cellulose market due to being widely used as an excipient in the pharmaceutical industry. It serves as a disintegrant, binder, and filler in tablet production, ensuring that the tablets have the appropriate consistency, strength, and stability. As the pharmaceutical industry expands, driven by an aging population and increasing prevalence of chronic diseases, the demand for microcrystalline cellulose industry rises correspondingly.

Various pharmaceutical manufacturers in North America are increasingly developing new medications to address drug shortages, which shows the rising incorporation of MCC to create products that meet the demands of microcrystalline cellulose.

For instance, in March 2024, the Wilson Center reported that the U.S. pharmaceuticals sector is experiencing significant medication deficiencies, with over 300 active drug shortages in 2023, including several key antibiotics and intensive care unit drugs. These shortages underscore the need to reassess America’s critical pharmaceutical dependencies and boost drug development within the U.S. Additionally, Mexico’s Federal Commission for Protection Against Health Risks (COFEPRIS) plays a crucial role in ensuring that drugs and their component materials are produced safely. Such drug shortages and regulations indicate the growing pharmaceutical development, resulting in rising North America microcrystalline cellulose market revenue.

North America Microcrystalline Cellulose Market Segment Insights

Microcrystalline Cellulose Source Type Insights

The North America microcrystalline cellulose market segmentation, based on source type, includes non-wood-based and wood-based. In 2023, the wood-based segment accounted for a significant market share due to its high purity and consistent quality. The manufacturing processes for wood pulp involve refining techniques that yield MCC with uniform particle size distribution and disintegrating properties. This makes it suitable for a wide range of applications across various industries.

The wood-based MCC industry benefits from well-established infrastructure and technological advancements in wood pulp processing and MCC production. Manufacturers have optimized processes to ensure efficient extraction and refinement of MCC from wood pulp, thereby enhancing product quality and reducing production costs. Due to the essential role of wood-based MCC in different applications, companies often collaborate to ensure a stable and reliable supply of wood-based MCC.

For instance, in November 2023, BASF Pharma Solutions and IFF Pharma Solutions initiated a collaboration on the Virtual Pharma Assistant platform ZoomLab for IFF’s Avicel microcrystalline cellulose. Avicel, derived from specialty wood pulp through acid hydrolysis, offers high purity and is partially depolymerized. This partnership expands formulators' and ZoomLab users' access to excipients, enabling them to address formulation challenges effectively. Such collaboration underscores the growing demand for microcrystalline cellulose as a crucial excipient across various industries, driving microcrystalline cellulose market growth.

Microcrystalline Cellulose End Use Insights:

The North America microcrystalline cellulose market segmentation, based on end use, includes pharmaceuticals, food and beverages, paints and coatings, cosmetics & personal care, and others. The pharmaceutical segment accounted for the largest market share in 2023 due to advanced healthcare infrastructure and facilities, supporting extensive pharmaceutical research, development, and production activities.

Various key players expanded their production capacities and developed new microcrystalline cellulose for moisture-sensitive active pharmaceutical and nutraceutical ingredients, maintaining their dominant position in the North American market.

For instance, in October 2023, Roquette introduced three new excipient grades to its extensive portfolio of solutions designed for moisture-sensitive active nutraceutical and pharmaceutical ingredients, which includes LYCATAB CT-LM, a partially pregelatinized starch, along with MICROCEL 113 SD and MICROCEL 103 SD microcrystalline cellulose products. Such products indicate the rising innovation in MCC in the pharmaceutical industry, catering to the increasing demand in the North America microcrystalline cellulose market.

Microcrystalline Cellulose Country Insights

By country, the study provides market insights into the U.S. and Canada. The U.S. microcrystalline cellulose market is expected to witness steady growth during the forecast period due to the rising demand in the pharmaceutical, cosmetics, and food & beverages industries.

The growing consumer demand for processed foods, functional foods, and dietary supplements is likely to boost the use of MCC in the food & beverages sector. On the other hand, in cosmetics, MCC is utilized for its texture-modifying and bulking properties in products such as creams, lotions, and powders. As consumer preferences shift towards natural and sustainable ingredients in personal care products, the demand for the MCC market is expected to increase in the U.S.

addition, the presence of major companies, such as Roquette Frères and Asahi Kasei Corporation, offering their products further strengthens the North America microcrystalline cellulose market landscape.

For instance, Roquette Frères offers MICRCOCEL, a pure form of microcrystalline cellulose that is 100% insoluble fiber, physiologically inert, safe, and free from sugar and gluten. It is utilized in developing extruded healthy snacks, hamburgers, grated cheese, and dietary supplements. Additionally, Roquette provides variants like MICROCEL FG 101, MICROCEL FG 1030, and MICROCEL FG-102. The introduction of these diverse products highlights the increasing development efforts by companies, which in turn heightens competition among market players and drives demand in the North America microcrystalline cellulose market.

Further, the Canadian microcrystalline cellulose market held a significant market share in 2023 due to the growing pharmaceutical industry, driven by rising healthcare needs. Key players actively seek to expand their market by tapping into the North America region.

Also, the key players in Canada's MCC market drive industry growth through their manufacturing capabilities, innovation, market expansion strategies, regulatory compliance, sustainability initiatives, and customer support. Their efforts ensure the consistent supply of high-quality MCC, meeting the diverse needs of various industries and contributing to the overall North America microcrystalline cellulose market development.

For instance, Silverline Chemicals manufactures microcrystalline cellulose in Canada and supplies it to various industries. Their MCC product line includes MCC PH - 200 USP/BP/EP, MCC PH - 112 USP/BP/EP, MCC PH - 102 USP/BP/EP, MCC PH - 101 USP/BP/EP, and more. Such developments indicate the rising demand for MCC products, which in turn drives the competition among market players.

Microcrystalline Cellulose Key Market Players & Competitive Insights

Leading market players are making substantial investments in research and development, a move that is set to revolutionize the microcrystalline cellulose industry. These investments are aimed at innovating new MCC products and enhancing existing ones, thereby catering to specific industry requirements and meeting evolving customer needs. The focus on innovation is a promising sign for the industry's future. Collaboration between manufacturers, suppliers, and end-users is a common strategy to expand market reach and product offerings. Partnerships help companies leverage each other's strengths, share expertise, and enhance their market development.

Companies are actively seeking to expand their industry footprint both domestically and internationally, and by strengthening their distribution networks, they can increase their customer base and drive sales growth. Major players in the North America microcrystalline cellulose market include ANDRITZ, Apollo Scientific Ltd, Asahi Kasei Corporation, Azelis, FMC Corporation, International Flavors & Fragrances Inc. (IFF), JRS PHARMA, Roquette Frères, SEPPIC, and DFE Pharma, etc.

Azelis, a North America provider of innovation services in the specialty chemicals and food ingredients sectors, operates through a robust network of over 70 application laboratories. Their services span diverse markets, including animal nutrition, food & nutrition, home care & industrial cleaning, personal care, pharma & healthcare, and agricultural & environmental solutions. In November 2023, Azelis introduced the S-Tab from SPI Pharma, a standout player in swallow tablet formulations. S-Tab utilizes an optimized platform incorporating a blend of materials such as sodium stearyl fumarate, silicon dioxide, sodium starch glycolate, silicified MCC, and microcrystalline cellulose, among others, showcasing the versatility of MCC in various industries.

The Asahi Kasei Group, founded in 1922, employs over 48,000 people worldwide. The company contributes to a sustainable society by addressing global challenges through its three business sectors: material, homes, and health care. The material sector includes environmental solutions, mobility & industrial, and life innovation and offers a diverse range of products such as battery separators, biodegradable textiles, engineering plastics, and sound solutions. Asahi Kasei strategically locates its operating bases around the world to ensure the efficient supply of products and services to major markets. In February 2024, Asahi Kasei introduced Ceolus microcrystalline cellulose, a pharmaceutical excipient with nitrite levels reduced to 0.1 μg/g (ppm) or less, aiming to lower the risk of potentially carcinogenic nitrosamine impurities in pharmaceuticals and nutritional supplements.

Key companies in the North America microcrystalline cellulose market include

- ANDRITZ

- Apollo Scientific Ltd

- Asahi Kasei Corporation

- Azelis

- DFE Pharma

- FMC Corporation

- International Flavors & Fragrances Inc. (IFF)

- JRS PHARMA

- Roquette Frères

- SEPPIC

Microcrystalline Cellulose Industry Developments

- September 2023: IFF announced that it would showcase its Avicel PH LN portfolio, a high-quality, low-nitrite microcrystalline cellulose designed to minimize the hazard of nitrosamine appearance in finalized drug products, addressing the needs of the pharmaceutical industry.

- July 2021: DFE Pharma announced the launch of Pharmacol sMCC 90, silicified microcrystalline cellulose developed as a synergistic solution for challenging oral solid dosage formulations.

North America Microcrystalline Cellulose Market Segmentation

Microcrystalline Cellulose Source Type Outlook

- Wood Based

- Non-Wood Based

Microcrystalline Cellulose Form Outlook

- Liquid

- Powder

Microcrystalline Cellulose Grade Outlook

- Grade 101

- Grade 102

- Grade 200

- Grade 301

- Grade 302

- Others

Microcrystalline Cellulose End Use Outlook

- Pharmaceutical

- Food & Beverages

- Paints and Coatings

- Cosmetics & Personal Care

- Others

Microcrystalline Cellulose Country Outlook

- North America

- US

- Canada

Microcrystalline Cellulose Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 556.74 million |

|

Market Size Value in 2024 |

USD 597.03 million |

|

Revenue Forecast in 2032 |

USD 1,058.00 million |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

The North America microcrystalline cellulose market size was valued at USD 556.74 million in 2023 and is expected to grow to USD 1,058.00 million in 2032.

The North America market is projected to grow at a CAGR of 7.4% during the forecast period, 2024-2032.

The U.S. microcrystalline cellulose market is expected to witness steady growth during the forecast period.

The key players in the market are ANDRITZ, Apollo Scientific Ltd, Asahi Kasei Corporation, Azelis, FMC Corporation, International Flavors & Fragrances Inc. (IFF), JRS PHARMA, Roquette Frères, SEPPIC and DFE Pharma.

In 2023, the wood-based segment accounted for a significant market share

The pharmaceutical segment held the largest share in the North America market.