North America Flexible Foam Mold Release Agents Market For Transportation Size, Share, Trends, Industry Analysis Report: By Vehicle Type [Automotive, Aerospace, Marine, Recreational Vehicles (RVs) & Specialty Vehicles, and Agricultural & Off-Road Vehicles], Foam Type, Mold Release Agent Type, and Country (US, Canada, and Mexico) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 170

- Format: PDF

- Report ID: PM5392

- Base Year: 2024

- Historical Data: 2020-2023

North America Flexible Foam Mold Release Agents Market For Transportation Overview

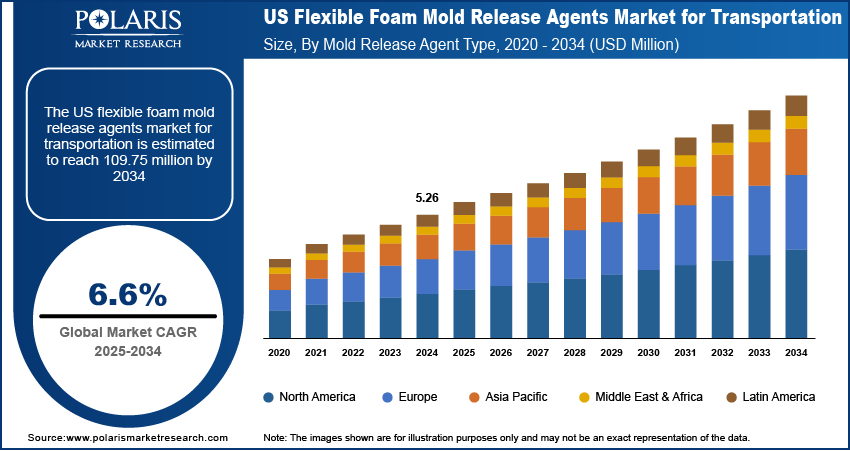

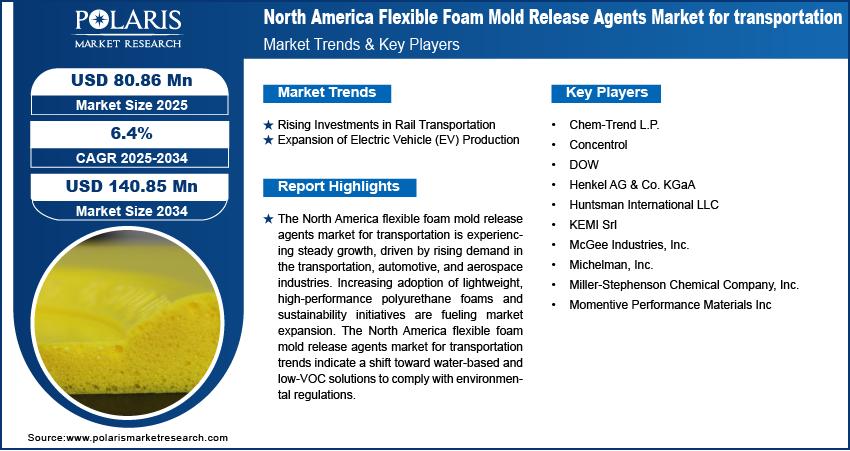

The North america flexible foam mold release agents market for transportation size was valued at USD 73.50 million in 2024. The market is projected to grow from USD 80.86 million in 2025 to USD 140.85 million by 2034, exhibiting a CAGR of 6.4% during 2025–2034.

Flexible foam release agents are specialized chemical formulations that prevent polyurethane and other flexible foams from sticking to molds during manufacturing. In the transportation industry, these agents are essential for producing seats in cars, buses, trains, planes, boats, and recreational or agricultural vehicles. They enhance surface quality, improve production efficiency, and extend mold life while minimizing defects. The flexible foam mold release agents are available in water- and solvent-based forms. They ensure smooth demolding, reduce waste, and support compliance with environmental and safety regulations in foam manufacturing.

One key driver for the North america flexible foam mold release agents market for transportation growth in transportation is the increasing demand for lightweight, comfortable, and durable seating solutions. Automakers and other vehicle manufacturers prioritize high-quality foam components that enhance passenger comfort while reducing vehicle weight for improved fuel efficiency and sustainability. Effective release agents play a critical role in ensuring defect-free foam parts that meet stringent industry standards. Another driving factor of this market is the growing focus on environmentally friendly and regulatory-compliant solutions. As manufacturers shift toward water-based and low-VOC release agents to meet stringent emission norms, the demand for advanced, non-hazardous formulations continues to rise in transportation foam production.

To Understand More About this Research: Request a Free Sample Report

North america flexible foam mold release agents market for transportation Dynamics

Expansion of Electric Vehicle (EV) Production

The increasing number of electric vehicles (EVs) on road is significantly boosting the North america flexible foam mold release agents market for transportation growth. In 2024, US consumers purchased 1.3 million EVs, a 7.3% increase from the previous year, with EVs comprising 8.1% of total US light vehicle sales. Surge in EV production is driving the North america flexible foam mold release agents market for transportation demand as manufacturers seek high-performance solutions for defect-free foam components that ensure superior comfort and durability. Additionally, the shift toward sustainable manufacturing processes has led to a preference for water-based and non-hazardous solutions. This trend aligns with environmental regulations and the automotive industry’s commitment to reducing its ecological footprint. All these factors are driving the North america flexible foam mold release agents market for transportation growth.

Rising Investments in Rail Transportation

The rising investments in rail transportation are fueling the North america flexible foam mold release agents market for transportation development. As per the data published by the Railway Association of Canada, the Railway of Canada invested USD 2.9 billion in 2023, bringing the total to more than USD 22.7 billion over the past decade. Increased investments drives governments and private firms to expand rail networks. This propels rail manufacturers to increase the production of train seats, armrests, and insulation materials, which rely on flexible polyurethane foam and mold release agents for comfort and durability.

The rising focus to decarbonize the transportation sector in Canada is propelling the North america flexible foam mold release agents market for transportation expansion. For instance, the Government of Canada committed to achieving 100% zero-emission vehicle sales by 2035 to help decarbonize the transportation sector. Decarbonization of the transportation sector increases demand for flexible foam mold release agents by driving the adoption of lightweight and energy-efficient materials. Automakers, rail manufacturers, and aerospace companies prioritize fuel efficiency and lower emissions by incorporating advanced polyurethane foams in vehicle interiors, seats, and insulation. These foams reduce overall weight, enhance energy efficiency, and improve passenger comfort. To meet production demands, manufacturers rely on mold release agents that ensure smooth molding, minimize defects, and enhance material performance. Therefore, as the focus on decarbonizing the transportation sector in Canada increases, the North america flexible foam mold release agents market for transportation demand also increases.

North America Flexible Foam Mold Release Agents Market For Transportation Segment Insights

North america flexible foam mold release agents market for transportation Outlook by Mold Release Agent Type Insights

By mold release agent type, the North america flexible foam mold release agents market for transportation has been segmented into water-based release agents, silicone-based release agents, solvent-based release agents, wax-based release agents, and others.

In 2024, the water-based release agents segment dominated the market, accounting for 36.6% of the North america flexible foam mold release agents market for transportation revenue share. Stringent environmental policies worldwide are pushing manufacturers to reduce volatile organic compound (VOC) emissions, leading to a surge in demand for eco-friendly alternatives. Water-based release agents are directly linked to reducing VOC emissions as they replace or minimize the use of solvent-based chemicals that contain high levels of VOCs. Water-based release agents comply with these regulations and also enhance worker safety by minimizing exposure to hazardous chemicals. Therefore, the benefits associated with water-based release agents will surge their usage in the manufacturing process, further driving the North america flexible foam mold release agents market for transportation growth.

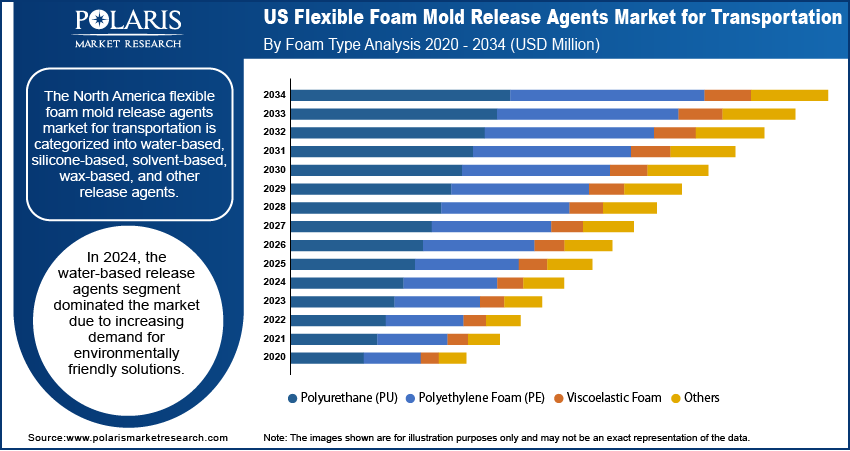

North america flexible foam mold release agents market for transportation Assessment by Foam Type Insights

On the basis of foam type, the North america flexible foam mold release agents market for transportation has been segmented into polyurethane (PU), polyethylene foam (PE), viscoelastic foam, and others. Polyurethane (PU) segment dominated the North america flexible foam mold release agents market for transportation for transportation in 2024. In the transportation industry, PU foam plays a crucial role in seating, headrests, armrests, insulation, and interior panels. These components require precision molding to meet stringent comfort and performance standards. The North america flexible foam mold release agents market for transportation demand continues to rise as manufacturers seek solutions that prevent defects such as tearing, sticking, or surface imperfections. By facilitating smooth mold release, these agents improve production efficiency and extend mold lifespan, reducing maintenance costs and downtime.

In recreational vehicles (RVs) such as motorhomes and campers, PU foam is widely used in mattresses, seats, and insulation, enhancing both comfort and energy efficiency. As the RV industry expands, the North america flexible foam mold release agents market for transportation is also expanding to meet the growing demand for high-quality foam components.

North America Flexible Foam Mold Release Agents Market For Transportation Breakdown by Country Insights

The North america flexible foam mold release agents market for transportation consists of the US, Canada, and Mexico. The US dominates the North america flexible foam mold release agents market for transportation share, driven by increasing demand across various industries, particularly in aviation. The growing number of airline travelers in the US is significantly boosting the market growth. According to the Bureau of Transportation Statistics, the US airlines carried 853 million passengers in 2022, a substantial increase from 658 million in 2021 and 388 million in 2020.

As air travel increases, airlines are focusing on enhancing passenger comfort by upgrading seat cushions, armrests, and headrests with high-performance polyurethane foams. Thus, the surge in airline travelers is prompting manufacturers to produce more airplanes, further driving the North america flexible foam mold release agents market for transportation growth.

North America Flexible Foam Mold Release Agents Market For Transportation – Key Players & Competitive Insights

The North america flexible foam mold release agents market for transportation for transportation is highly competitive, with key players such as DOW; Huntsman International LLC; Chem‑Trend L.P.; Henkel AG & Co. KGaA; Michelman, Inc.; McGee Industries, Inc.; Miller-Stephenson Chemical Company, Inc.; Concentrol; KEMI Srl; and Momentive Performance Materials Inc. These companies focus on product innovation, strategic collaborations, and geographic expansion to strengthen their market position. The market is witnessing increased competition from new entrants and accelerating advancements in mold release technologies.

Chem‑Trend L.P. is a chemical manufacturing company. The company specializes in the development of mold release agents, cleansing compounds, and process chemical specialties. Chem-Trend serves industries such as aerospace, automotive, construction, consumer goods, electronics, energy, marine, medical equipment, packaging, and sporting goods. Their solutions support a wide range of applications, including composite molding, die casting, foundry, friction products, paper impregnation, polyurethane molding, rubber molding, thermoplastic processing, tire curing, tire retreading, and more. Chem-Trend’s product portfolio includes mold release agents, purging compounds, and other molding auxiliaries designed to optimize manufacturing processes, enhance productivity, and reduce operational costs. The company's mold release agents and process chemical specialties offer solutions that enhance productivity, extend tool life, improve part quality, and reduce defects. Their portfolio includes conventional, semi-permanent, and silicone-free release agents, along with purging compounds and molding ancillaries tailored for industries such as aerospace, automotive, construction, and medical.

Henkel AG & Co. KGaA is a multinational company that is primarily involved in the designing, manufacturing, and sale of home care & laundry, and beauty care products along with adhesive technologies. It is a global leader in adhesives, sealants, and functional coatings, playing a significant role in the flexible foam mold release agents market. The company offers a range of high-performance mold release agents designed to improve the manufacturing efficiency of polyurethane (PU) foam components used in the transportation, furniture, and aviation industries. Henkel’s innovative solutions ensure smooth mold release, preventing defects such as sticking, tearing, and surface imperfections, thereby enhancing product quality and extending mold lifespan.

List of Key Companies in North america flexible foam mold release agents market for transportation

- Chem‑Trend L.P.

- Concentrol

- DOW

- Henkel AG & Co. KGaA

- Huntsman International LLC

- KEMI Srl

- McGee Industries, Inc.

- Michelman, Inc.

- Miller-Stephenson Chemical Company, Inc.

- Momentive Performance Materials Inc

North America Flexible Foam Mold Release Agents Industry Developments

November 2023: Chem-Trend acquired the Mavcoat brand from Maverix Solutions, enhancing its mold release product portfolio and expanding local supply and service for global manufacturers across various molding industries.

North America Flexible Foam Mold Release Agents Market For Transportation Segmentation

By Vehicle Type Outlook (Revenue, USD Million, 2021–2034)

- Automotive

- Aerospace

- Marine

- Recreational Vehicles (RVs) & Specialty Vehicles

- Agricultural & Off-Road Vehicles

By Foam Type Outlook (Revenue, USD Million, 2021–2034)

- Polyurethane (PU)

- Polyethylene Foam (PE)

- Viscoelastic Foam

- Others

By Mold Release Agent Type Outlook (Revenue, USD Million, 2021–2034)

- Water-Based Release Agents

- Silicone-Based Release Agents

- Solvent-Based Release Agents

- Wax-Based Release Agents

- Others

By Country Outlook (Revenue, USD Million, 2021–2034)

- North America

- US

- Canada

- Mexico

North America Flexible Foam Mold Release Agents Market For Transportation Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 73.50 Million |

|

Market Size Value in 2025 |

USD 80.86 Million |

|

Revenue Forecast by 2034 |

USD 140.85 Million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2024–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The North America flexible foam mold release agents market size was valued at USD 73.50 million in 2024 and is projected to grow to USD 140.85 million in 2034.

The North America market is expected to register a CAGR of 6.4% during the forecast period.

A few key players in the market are DOW; Huntsman International LLC; Chem?Trend L.P.; Henkel AG & Co. KGaA; Michelman, Inc.; McGee Industries, Inc.; Miller-Stephenson Chemical Company, Inc.; Concentrol; KEMI Srl; and Momentive Performance Materials Inc.

The water-based release agents segment dominated the market in 2024