North America Crop Protection Chemicals Market Share, Size, Trends, Industry Analysis Report: By Type (Herbicides, Insecticides, Fungicides & Bactericides, Other), By Origin, By Form, By Mode of Application, By Crop Type, and By Country (United States, and Canada) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM5089

- Base Year: 2023

- Historical Data: 2019-2022

North America Crop Protection Chemicals Market Overview

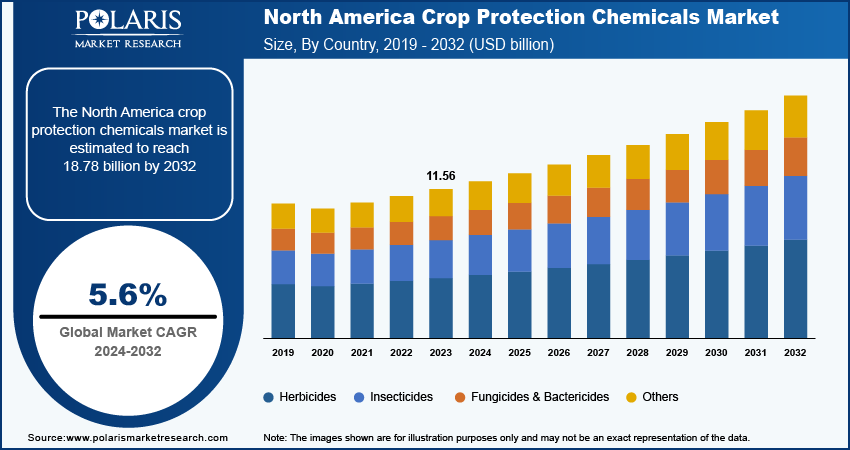

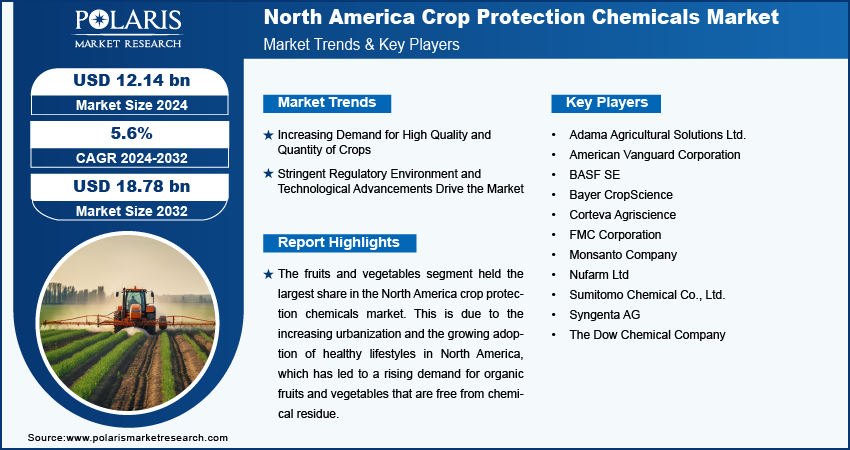

North America crop protection chemicals market size was valued at USD 11.56 billion in 2023. The industry is projected to grow from USD 12.14 billion in 2024 to USD 18.78 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.6% during the forecast period.

The crop protection chemicals are involved in the production and distribution of chemical substances used in agriculture to protect crops from pests, diseases, and weeds. These chemicals are crucial for enhancing crop yield and quality and encompass a variety of products, including insecticides, herbicides, fungicides, and nematicides.

The growing emphasis on sustainable agricultural practices, such as integrated pest management (IPM) and organic farming, is driving a preference for biological crop protection chemicals in the North American market. These biological options are favored for their eco-friendliness and host-specific nature, aligning with the goals of reducing environmental impact and promoting sustainable farming.

To Understand More About this Research: Request a Free Sample Report

The North America crop protection chemicals market is undergoing significant transformation due to the rising adoption of precision agriculture technologies. Innovations such as data analytics, drones, and AI are revolutionizing farming practices by enabling more precise and efficient application of crop protection inputs. This not only optimizes yields but also minimizes environmental impact through targeted use of chemicals. For instance, the news published by BBC in March 2024, US farms are increasingly embracing artificial intelligence to address labor shortages and enhance agricultural efficiency, potentially transforming global food production capabilities.

North America Crop Protection Chemicals Market Trends

Increasing Demand for High Quality and Quantity of Crops

Market CAGR for crop protection chemicals is being driven by the increasing global population and income levels, resulting in a growing need for higher quantities and quality of crops. According to projections by the United Nations, the world's population is expected to rise from 7.7 billion in 2021 to 9.7 billion by 2050. In response, farmers worldwide are ramping up crop production either by expanding agricultural land or by enhancing productivity on existing lands through the use of fertilizers, pesticides, irrigation, and other innovative methods. This surge in demand for freshly grown, premium crops has consequently boosted the need for crop protection chemicals, leading to increased yields of high-quality crops.

Additionally, proper use of crop protection chemicals significantly enhances wheat production by protecting crops from pests, diseases, and weeds, leading to higher yields and quality. However, successful wheat cultivation also relies on improved seed varieties, agronomic practices, and favorable environmental conditions. According to the United States Department of Agriculture (USDA), Canada's wheat production for the marketing years 2022 and 2023 stands at 34.0 million metric tons (mmt), marking a 3 percent increase from the previous month, a 57 percent jump from last year, and a 12 percent rise above the five-year average.

Stringent Regulatory Environment and Technological Advancements Drive the Market

The crop protection chemicals market in North America operates within a strong regulatory framework. Agencies such as the EPA and USDA closely monitor the registration and use of pesticides. This strict regulatory environment has encouraged innovation in the development of more sustainable crop protection solutions. The regulations ensure that pesticides are safe for human health and the environment, leading to the advancement of eco-friendly pest control methods. For instance, the EPA assesses pesticides to ensure they pose no harm to human health or the environment, and the USDA monitors pesticide residues in food to maintain food safety standards.

Technological advancements in farming methods have also significantly contributed to the growth of the North America crop protection chemicals market. The adoption of integrated pest management (IPM) and biological seed treatments has presented substantial growth opportunities for manufacturers.

North America Crop Protection Chemicals Market Segment Insights

North America Crop Protection Chemicals Crop Type Insights

The North America crop protection chemicals market segmentation, based on crop type, includes cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The fruits and vegetables segment held the largest share in the North America crop protection chemicals market. This is due to the increasing urbanization and the growing adoption of healthy lifestyles in North America, which has led to a rising demand for organic fruits and vegetables that are free from chemical residue. Consumers are becoming more health and environmentally conscious about the use of pesticides, leading to a higher demand for organic produce. This has consequently increased the need for crop protection chemicals that can effectively control pests and diseases while minimizing chemical residues.

Additionally, fruit and vegetable crops are highly susceptible to various diseases and pests, which can lead to significant financial losses for farmers. Crop protection chemicals play a crucial role in safeguarding fruit and vegetable crops and ensuring stable yields. The growing awareness among farmers about the benefits of using effective crop protection solutions has further propelled the demand in the fruits & vegetables segment.

North America Crop Protection Chemicals Type Insights

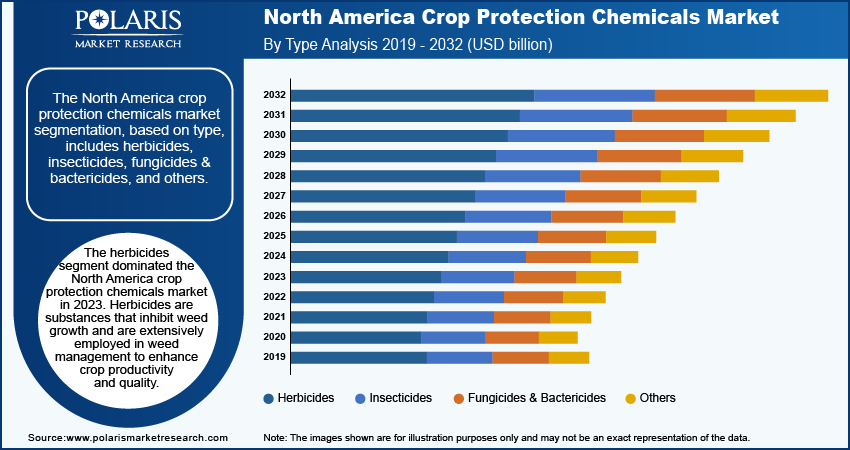

The North America crop protection chemicals market segmentation, based on type, includes herbicides, insecticides, fungicides & bactericides, and others. The herbicides segment dominated the North America crop protection chemicals market in 2023. Herbicides are substances that inhibit weed growth and are extensively employed in weed management to enhance crop productivity and quality. Herbicides also contribute to improved soil fertility and increased crop yields while reducing soil erosion.

Additionally, herbicides are utilized to promote native species diversity in natural habitats and have widespread applications in agriculture and turfgrass maintenance. These attributes underscore herbicides are favored over other types of crop protection chemicals, driving growth within this segment.

North America Crop Protection Chemicals Country Insights

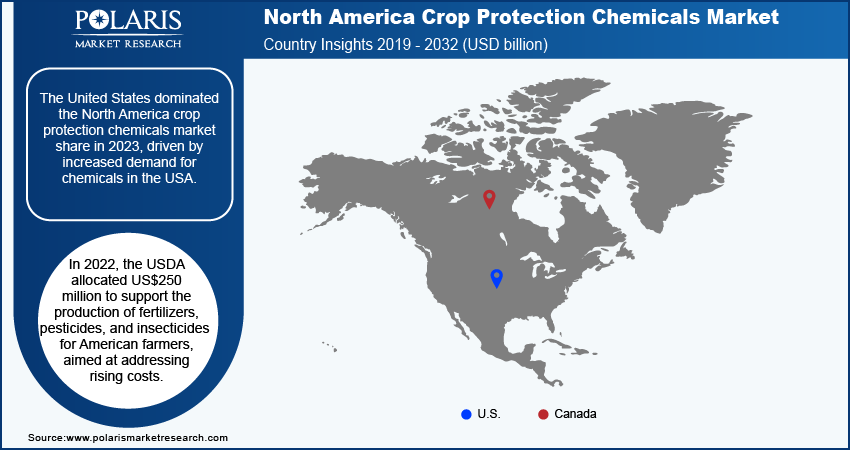

By region, the study provides market insights into the United States and Canada. The United States dominated the North America crop protection chemicals market share in 2023, driven by increased demand for chemicals in the USA. In 2022, the USDA allocated US$250 million to support the production of fertilizers, pesticides, and insecticides for American farmers, aimed at addressing rising costs.

The expansion of the organic food industry in the USA has contributed to market growth. In 2021, the USDA's National Institute of Food and Agriculture (NIFA) announced an investment exceeding US$30 million across 33 grants to assist farmers in promoting high-quality organic food, fiber, and other organic products. Therefore, the increasing demand for these chemicals across various crops has significantly bolstered the North American crop protection chemicals market size in the region.

North America Crop Protection Chemicals Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the crop protection chemicals market grow even more. Market participants are also undertaking a variety of strategic activities to expand their North America footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the crop protection chemicals industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the North America crop protection chemicals industry to benefit clients and increase the market sector. In recent years, the crop protection chemicals industry has offered some technological advancements. Major players in the crop protection chemicals market include Adama Agricultural Solutions Ltd., American Vanguard Corporation, BASF SE, Bayer CropScience, Corteva Agriscience, FMC Corporation, Monsanto Company, Nufarm Ltd, Sumitomo Chemical Co., Ltd., Syngenta AG, and The Dow Chemical Company.

BASF SE is a chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In February 2024, BASF's Surtain herbicide, recently EPA-approved in the U.S., offers flexible application timing and robust control of 79 key broadleaf and grass weeds in field corn through innovative solid encapsulation technology.

FMC Corporation is a global company in agricultural sciences that supports growers in feeding a growing global population sustainably. The company offers solutions in crop protection, including biologicals, crop nutrition, and digital agriculture, empowering growers and professionals to manage challenges effectively while promoting environmental stewardship. In March 2024, FMC Corporation expanded its biological crop protection platform in Canada through a strategic collaboration with Novonesis, enhancing offerings for Canadian farmers with innovative solutions.

Key Companies in the Crop Protection Chemicals market include

- Adama Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer CropScience

- Corteva Agriscience

- FMC Corporation

- Monsanto Company

- Nufarm Ltd

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- The Dow Chemical Company

Crop Protection Chemicals Industry Developments

May 2024: Vive Crop Protection secured Series C extension funding to accelerate agricultural innovation through its Precision Chemistry platform, reinforcing its position in sustainable crop protection solutions for new markets.

January 2024: Bayer announced EPA registration of Vios FX herbicide, offering wheat growers enhanced weed management flexibility with dual active ingredients targeting tough grass and broadleaf weeds, pending approval in some states.

January 2023: Sumitomo Chemical acquired FBSciences to bolster its biostimulant business and expand its biorational offerings in the U.S., aiming to meet the growing demand for sustainable crop protection solutions globally.

North America Crop Protection Chemicals Market Segmentation

By Type Outlook (USD billion, 2019–2032)

- Herbicides

- Insecticides

- Fungicides & Bactericides

- Other

By Origin Outlook (USD billion, 2019–2032)

- Synthetic

- Biopesticides

By Form Outlook (USD billion, 2019–2032)

- Liquid

- Solid

By Application Outlook (USD billion, 2019–2032)

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Other

By Crop Type Outlook (USD billion, 2019–2032)

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Country Outlook (USD billion, 2019–2032)

- North America

- US

- Canada

North America Crop Protection Chemicals Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 11.56 billion |

|

Market size value in 2024 |

USD 12.14 billion |

|

Revenue Forecast in 2032 |

USD 18.78 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The North America crop protection chemicals market size was valued at USD 11.56 billion in 2023 and is projected to hold USD 18.6 billion in 2032.

The North America market is projected to grow at a CAGR of 5.6% during the forecast period, 2024-2032.

United States had the largest share of the North America market.

The key players in the market are Adama Agricultural Solutions Ltd., American Vanguard Corporation, BASF SE, Bayer CropScience, Corteva Agriscience, FMC Corporation, Monsanto Company, Nufarm Ltd, Sumitomo Chemical Co., Ltd., Syngenta AG, and The Dow Chemical Company.

The fruits & vegetables category dominated the market in 2023

The herbicides had the largest share in the North America market.