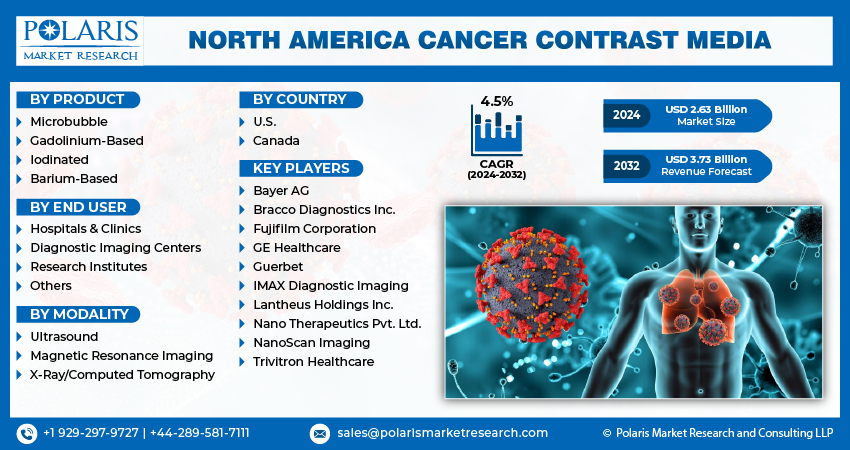

North America Cancer Contrast Media Market Share, Size, Trends, Industry Analysis Report, By Product (Microbubble, Gadolinium-Based, Iodinated, and Barium-Based); By Modality; By End User; By Country; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4587

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

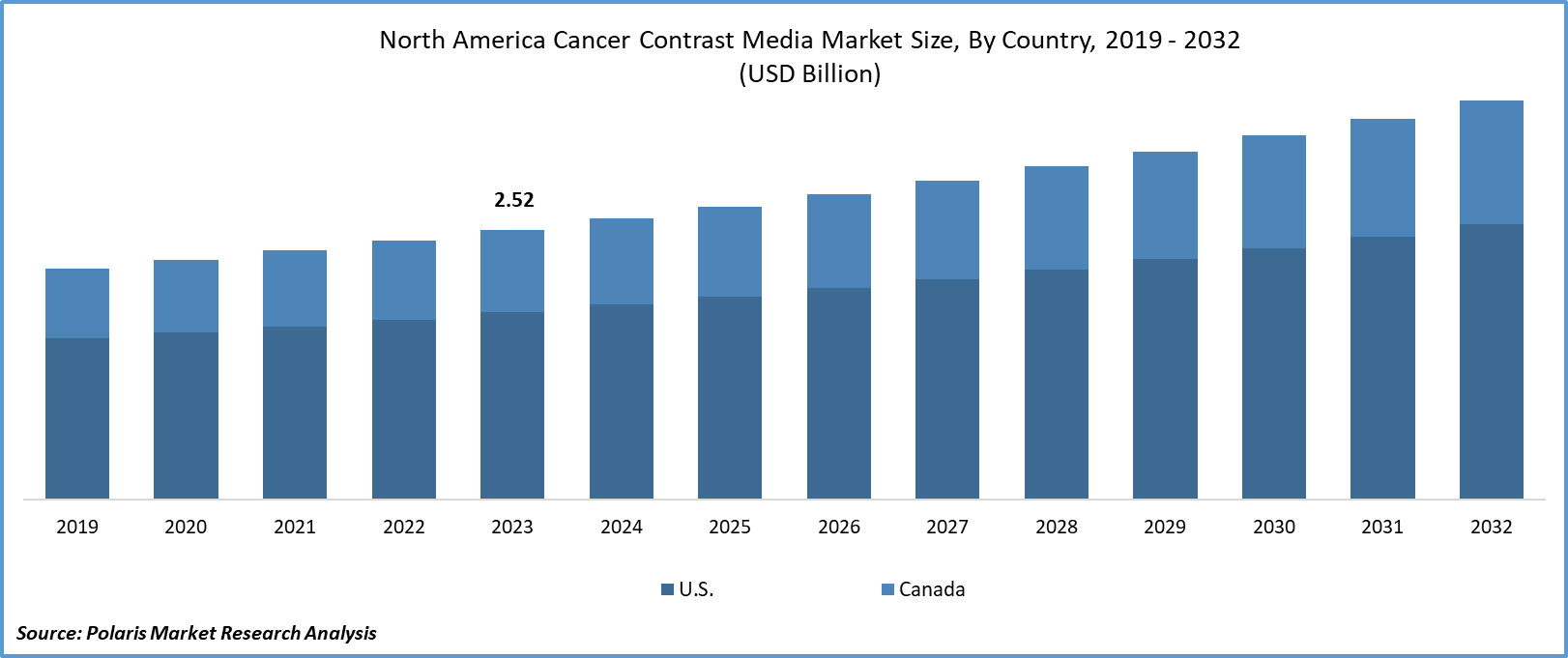

The north america cancer contrast media market size was valued at USD 2.52 billion in 2023. The market is anticipated to grow from USD 2.63 billion in 2024 to USD 3.73 billion by 2032, exhibiting the CAGR of 4.5% during the forecast period.

Market Overview

The rising penetration of advanced imaging technology in developed or high-income countries and the emergence of imaging tests such as MRI (magnetic resonance imaging) and CT (computed tomography) scans as an integral part of cancer diagnosis are major factors fostering the market’s growth. In addition, several regulatory bodies, including the US Food and Drug Administration (FDA), focus on the approval of advanced medical imaging contrast agents and implement grants to ensure contrast media availability and address supply shortages.

- For instance, in August 2022, Bracco Diagnostics Inc. announced that the US FDA granted the import of Bracco’s Iodinated Contrast Medium Iomeron into the United States with the aim of addressing the shortage of iodinated contrast media.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the rapid advances and emergence of photoacoustic imaging as a highly successful clinical imaging platform for the management of cancer, as well as many other health conditions, further contribute to the need for contrast agents as contrast agents are being widely used to improve photoacoustic imaging with fewer side effects, improved target specificity, and lower accumulation.

Growth Factors

Rising healthcare expenditure and focus on early diagnosis propelling the market’s growth

As healthcare expenditures in countries like the U.S. and Canada are growing significantly, leading to a drastic rise in domestic healthcare spending, both publicly funded and out-of-pocket, the demand for effective diagnosis solutions also rises. The rising focus on early diagnosis of diseases including cancer encouraging companies to bring innovations to diagnostic technologies like nuclear imaging and radiographic tests, also contributes to the demand for contrast media.

For instance, according to the American Medical Association, spending on healthcare in the U.S. rose by 2.7% in 2021 to around USD 4.3 trillion or approx. USD 12,194 per capita compared to previous year.

Rising number of MRI and CT scans in the region to drive market growth

The substantial increase in the volume of MRI and CT scans across the region has a significant impact on the cancer contrast media demand. In contrast, media are often used to improve and enhance the visibility during the scans that aid in more accurate diagnosis. Thus, the increase in the number of these scans positively influences the need for contrast media. For instance, according to a recent study on MRIs, more than 30 million MRI scans are performed by medical professionals every year in the United States.

Restraining Factors

Regulatory hurdles and side effects associated with contrast agent to hinder growth

The stringent regulatory requirements and standards and complex approval process for contrast media create significant challenges and hurdles for key market companies. Also, some contrast agents might have side effects or safety concerns with use that limit their adoption by healthcare professionals and patients as well.

Report Segmentation

The market is primarily segmented based on product, modality, end user, and country.

|

By Product |

By Modality |

By End User |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

Iodinated segment accounted for the largest share in 2023

The iodinated segment accounted for the largest share of the market and is likely to maintain its dominance over the North America cancer contrast media market forecast period. Segment’s dominance is due to its significant use in X-ray based imaging because of its ability to provide greater quality images of X-ray scans. Also, ionic-based contrast agents have a better propensity to dissociate into the ions on dissolution into a polar solvent, which results in the introduction of a large number of particles per molecule, thereby fostering the demand for iodinated contrast agents.

The microbubble segment is expected to witness the highest growth. Segment’s growth is accelerated by the numerous benefits associated with microbubble imaging, such as improved imaging quality of ultrasounds, real-time imaging, biocompatibility, and precise imaging. Also, this type of contrast media can effectively reflect the ultrasound waves to appear brighter and clear.

By Modality Insights

X-ray/computed tomography segment captured largest share in 2023

The X-ray/computed tomography segment captured the largest share of the market. This dominance is attributed to the rising volume of X-ray and CT scans across the region that often require different types of contrast media, such as barium-based and iodinated. Additionally, the growing awareness among the general public about the importance of early diagnosis of cancer leads to a surge in the number of imaging procedures for early disease detection, which, in turn, influences the need for contrast media, which significantly improves the accuracy of diagnostic techniques.

The ultrasound sound segment is projected to grow fastest. This growth is attributable to the rising popularity of ultrasound imaging as a non-invasive and safer imaging modality as compared to other imaging techniques available in the market. Moreover, rapid advancements in ultrasound imaging technologies, such as enhanced contrast agents and better resolution, also contributed to the segment’s growth.

By End User Insights

Hospitals & clinics segment led the market in 2023

The hospitals & clinics segment led the market. Segment’s dominance is fueled by a rapid boost in the number of patient admissions and a greater proliferation of MRI and CT scans in hospitals due to the availability of the most advanced and latest medical equipment and technologies. Various government agencies and private entities are investing heavily in healthcare infrastructure that includes the development of modern clinics and hospitals equipped with advanced state-of-the-art facilities, also supporting the growth of the market.

Regional Insights

United States dominated the market in 2023

The United States dominated the region’s market. This dominance is due to a continuous increase in the incidences of cancer in the country and the robust presence of favorable government initiatives that are mainly aimed at improving early cancer diagnosis and treatment. In addition, the United States also accounts for the largest share in terms of sales of contrast media formulations with approx. USD 1.6 billion as of June 2023.

Canada is projected to emerge as the fastest-growing region with a healthy CAGR. The country’s growth is accelerated by the rising number of people diagnosed with cancer, and the focus of government authorities on promoting early cancer diagnosis influences the adoption of contrast media for accurate imaging of scans. For instance, according to a report by the Canadian Cancer Society, the number of new cancer cases was expected to be around 239,100 in 2023, and approximately 86,700 deaths were estimated in 2023. On average, 655 people in Canada were diagnosed with cancer, with 238 deaths in 2023.

Key Market Players & Competitive Insights

Increasing clinical trials and adherence to regulatory standards to drive competition

The North America cancer contrast media market is moderately competitive in nature with the robust presence of some of the world’s leading healthcare companies. Major companies in the market are competing on factors such as improving diagnostic accuracy, compliance or adherence with regulatory standards and obtaining necessary approvals, investing on clinical trials, and expanding their market presence.

Some of the major players operating in the global market include:

- Bayer AG

- Bracco Diagnostics Inc.

- Fujifilm Corporation

- GE Healthcare

- Guerbet

- IMAX Diagnostic Imaging

- Lantheus Holdings Inc.

- Nano Therapeutics Pvt. Ltd.

- NanoScan Imaging

- Trivitron Healthcare

Recent Developments in the Industry

- In June 2023, Bayer announced that the U.S. Food and Drug Administration approved Ultravist, a new iodine-based contrast agent developed for enhanced mammography. This FDA-approved solution aligns with the growing focus on supplemental imaging needs for women who are at higher risk of breast cancer.

- In July 2023, NorthStar Medical Radioisotopes announced the supply agreement with Nucleus RadioPharma for therapeutic radioisotope actiium-225. It is a high-energy alpha-emitting radioisotope that directly delivers therapeutic doses of the radiation to destroy cancer cells in the patients.

Report Coverage

The North America cancer contrast media market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, modality, end user, and their futuristic growth opportunities.

North America Cancer Contrast Media Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.63 billion |

|

Revenue forecast in 2032 |

USD 3.73 billion |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The north america cancer contrast media market size is expected to reach USD 3.73 billion by 2032

Key players in the market are Bayer AG, GE Healthcare, IMAX Diagnostic Imaging

The north america cancer contrast media market exhibiting the CAGR of 4.5% during the forecast period.

The North America Cancer Contrast Media Market report covering key segments are product, modality, end user, and country.