North America Automated Breach and Attack Simulation Market Size, Share, Trends, Industry Analysis Report: Information By Offering (Platforms and Tools, Services), By Deployment Mode, By Application, By End-User, and By Country (U.S. and Canada) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 118

- Format: PDF

- Report ID: PM5003

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

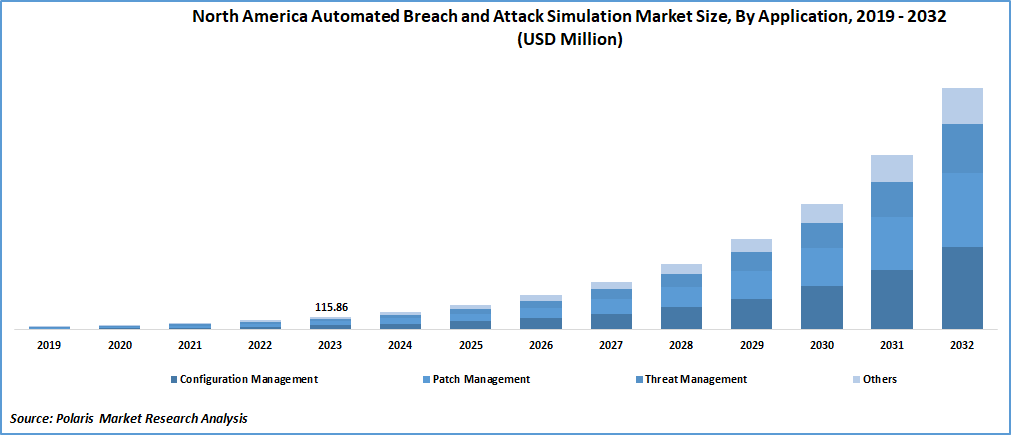

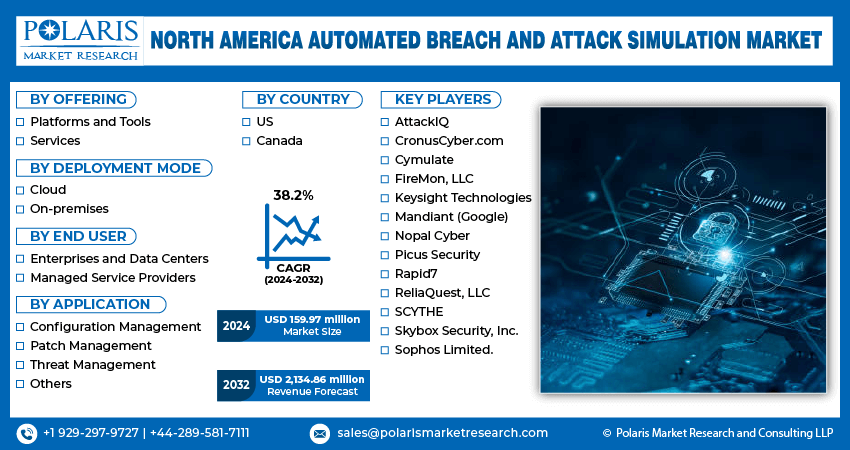

North America automated breach and attack simulation market size was valued at USD 115.86 million in 2023. The North America automated breach and attack simulation industry is projected to grow from USD 159.97 million in 2024 to USD 2,134.86 million by 2032, exhibiting a compound annual growth rate (CAGR) of 38.2% during the forecast period (2024 - 2032).

The North America automated breach and attack simulation market growth is driven by the increase in cybersecurity spending and its role in enhancing the defensive capabilities of organizations. Companies and governments are allocating more resources to protect against cyber threats. For instance, according to Computer Integration Technologies, the United States increased its cybersecurity budget to USD 20 billion in 2023, up from USD 18 billion in 2022, underscoring a heightened governmental dedication to safeguard digital assets and infrastructure against cyber threats. This spending for cybersecurity has increased the adoption of automated breach and attack simulation solutions as an essential tool for proactive security testing and validation. Thus, the rise in cybersecurity spending is fueling the demand for automated breach and attack simulation solutions in the North America region.

Moreover, the increase in fraudulent activities in the region is a significant driver for the market growth. For instance, according to the Canadian Anti-Fraud Centre, more than 150,000 reported cases of fraud in Canada have resulted in a total loss of over USD 600 million since January 2021. This increased number of fraudulent activities has created the need for effective cybersecurity solutions. Thus, organizations are adopting attack simulation services to test the performance of their security solutions as a proactive measure, thereby driving North America automated breach and attack simulation market growth.

To Understand More About this Research:Request a Free Sample Report

North America Automated Breach and Attack Simulation Market Trends:

Increased Data Breaches in Healthcare is Boosting the Market Size

The surge in data breaches affecting healthcare institutions is significantly driving the North America automated breach and attack simulation market, as the region has a vast healthcare industry with the presence of several hospitals and pharmaceutical companies. As a result, healthcare infrastructures are getting heavily affected by cyber threats. For instance, in July 2023, a Tennessee-based hospital and clinic operator experienced a security breach, resulting in unauthorized access and extraction of data from an external storage location containing emails and calendar reminders sent to patients. The compromised data included names, birth dates, email addresses, and other personally identifiable information (PII) of over 11 million patients from 20 states of the U.S. This increased prevalence of data breaches in the healthcare sector demands an effective data security solution to mitigate the risk of cyberattacks. Consequently, the escalating incidents of data breaches in the healthcare sector in the United States are stimulating organizations to invest in data security solutions, thereby driving the North America automated breach and attack simulation market size.

Regulatory Compliance is Propelling the North America Market Growth

Organizations across various sectors, including finance, healthcare, and IT, face increasing pressure to comply with government regulations. These regulations, such as the Cybersecurity and Infrastructure Security Agency and the California Consumer Privacy Act, demand robust data protection measures and prompt breach response capabilities. Thus, automated breach and attack simulation solutions play a pivotal role by enabling organizations to continuously assess and strengthen cybersecurity defenses through automated simulations of attack scenarios. As regulatory pressures intensify, the installation of these simulations is becoming essential for ensuring data privacy and maintaining compliance standards throughout the region, thereby driving the North America automated breach and attack simulation market.

North America Automated Breach and Attack Simulation Market Segment Insights:

North America Automated Breach and Attack Simulation Offering Insights:

North America automated breach and attack simulation market segmentation, based on offering, includes platforms and tools, and services. The platforms and tools segment dominated the North American market in 2023 because of the growing demand for comprehensive security solutions capable of simulating potential cyber threats and assessing the effectiveness of security measures in real time. Organizations are recognizing the need for defense mechanisms to identify vulnerabilities. Platforms and tools offer refined automated processes that enhance the efficiency and accuracy of security postures, making them essential for cybersecurity. As a result, several companies are shifting towards platforms and tools as an essential and effective solution for enterprise security, thereby contributing to the dominance of the platforms and tools segment in the North America automated breach and attack simulation market.

North America Automated Breach and Attack Simulation End User Insights:

North America automated breach and attack simulation market segmentation, based on end user, includes enterprises and data centers, and managed service providers. The managed service providers segment of the North American market is expected to grow significantly because cybersecurity threats have become frequent & complex, and organizations lack the internal resources to manage the risks effectively. Managed service providers offer specialized and comprehensive services that enable businesses to implement advanced security protocols without the need for extensive in-house capabilities. Further, the cost-efficiency, 24x7 coverage, and scalability of security services are attracting several enterprises seeking to optimize cybersecurity investments. As a result, several companies are embracing managed service providers to simulate the breach and attack, thereby driving the growth of managed service providers segment in the North American market over the forecast period.

North America Automated Breach and Attack Simulation Market, Segmental Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

North America Automated Breach and Attack Simulation Country Insights:

By country, the study provides market insights into the U.S. and Canada. The U.S. automated breach and attack simulation market is anticipated to dominate the market over the forecast period due to the widespread adoption by the country's defense sector. The surge in adoption is fueled by the emphasis on leveraging breach and attack simulation platforms to bolster the security of stored data. For instance, in February 2024, AttackIQ, a vendor of breach and attack simulation (BAS) solutions and founding research partner of MITRE Ingenuity Center for Threat-Informed Defense (CTID), received a conditional Authority to Operate (cATO) from the U.S. Marine Corps Recruiting Command (MCRC). The approval allowed the deployment of AttackIQ's BAS platform within the MCRC following a comprehensive risk-based security assessment. The strategic adoption of automated breach and attack simulation solutions underscores the country's emphasis on safeguarding critical data. Consequently, the U.S. is dominating the North America market size.

North America Automated Breach and Attack Simulation Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the North America automated breach and attack simulation market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including innovative product launches, higher investments, international collaborations, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the North America automated breach and attack simulation industry must offer cost-effective solutions.

In North America, the major players are dominating the market with comprehensive automated breach and attack simulation platforms that offer features such as scenario-based simulations, continuous security testing, and vulnerability assessments. Major players in the automated breach and attack simulation market include AttackIQ, CronusCyber.com, Cymulate, FireMon, LLC, Keysight Technologies, Mandiant (Google), Nopal Cyber, Picus Security, Rapid7, ReliaQuest, LLC, SCYTHE, Skybox Security, Inc., and Sophos Limited.

AttackIQ is a provider of breach and attack simulation products for security control validation. AttackIQ's platform emulates adversary tactics, techniques, and procedures aligned with the MITRE ATT&CK framework, providing organizations with visibility into their security program performance and clear data-driven analysis for mitigation. AttackIQ offers self-service, fully managed, and customer-managed options to suit the unique requirements of each organization. In October 2019, AttackIQ introduced AttackIQ Ready! a fully managed breach and attack simulation service. The service utilizes advanced content and actionable reporting to enhance the security posture and performance of security programs of organizations.

Cymulate is a provider of breach and attack simulation solutions that empower organizations to validate cybersecurity posture continuously. Cymulate's comprehensive platform offers a range of capabilities, including Attack Surface Management, Breach and Attack Simulation, Continuous Automated Red Teaming, and Exposure Analytics. These integrated solutions enable organizations to discover attack surfaces, validate security controls, test for immediate threats, and measure their cyber resilience in alignment with business priorities. In October 2019, Cymulate launched an Agentless APT (Advanced Persistent Threat) Simulation as part of its SaaS-based Breach and Attack Simulation (BAS) platform. The simulation is designed to closely replicate the experience of a genuine APT attack on an organization's network, allowing for comprehensive identification of security gaps throughout the entire kill chain.

Key companies in the North America automated breach and attack simulation market include:

- AttackIQ

- CronusCyber.com

- Cymulate

- FireMon, LLC

- Keysight Technologies

- Mandiant (Google)

- Nopal Cyber

- Picus Security

- Rapid7

- ReliaQuest, LLC

- SCYTHE

- Skybox Security, Inc.

- Sophos Limited.

North America Automated Breach and Attack Simulation Industry Developments

- April 2024: BDO Digital, the technology advisory arm of BDO USA, integrated OnDefend's breach and attack simulation technology, BlindSPOT, into its IT security service offering, Active Assure.

- May 2024: Resilience, a cyber-risk solutions company, elevated the bar in the cyber insurance sector by introducing advanced integrated features. These capabilities allow businesses to consistently monitor and assess their cyber risk mitigation and transfer efforts.

- October 2019: ReliaQuest acquired Threatcare, a firm that focuses on simulating cyberattacks, to integrate its simulation abilities into its GreyMatter cyber threat response platform.

North America Automated Breach and Attack Simulation Market Segmentation:

North America Automated Breach and Attack Simulation Offering Outlook

- Platforms and Tools

- Services

- Training

- On-demand Analyst

- Others

North America Automated Breach and Attack Simulation Deployment Mode Outlook

- Cloud

- On-premises

North America Automated Breach and Attack Simulation Application Outlook

- Configuration Management

- Patch Management

- Threat Management

- Others

North America Automated Breach and Attack Simulation End User Outlook

- Enterprises and Data Centers

- Managed Service Providers

North America Automated Breach and Attack Simulation Country Outlook

- US

- Canada

North America Automated Breach and Attack Simulation Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 115.86 million |

|

Market Size Value in 2024 |

USD 159.97 million |

|

Revenue Forecast in 2032 |

USD 2,134.86 million |

|

CAGR |

38.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The North America automated breach and attack simulation market size was valued at USD 115.86 million in 2023 and is projected to grow to USD 2,134.86 million by 2032

The North America market is projected to grow at a CAGR of 38.2% during the forecast period, 2024-2032.

The U.S. had the largest share of the North America market

The key players in the North America market are AttackIQ, CronusCyber.com, Cymulate, FireMon, LLC, Keysight Technologies, Mandiant (Google), Nopal Cyber, Picus Security, Rapid7, ReliaQuest, LLC, SafeBreach Inc., SCYTHE, Skybox Security, Inc., Sophos Limited., and XM Cyber.

The platform and tools segment held the highest share in the North America market

The managed service providers category had the highest CAGR in the North America automated breach and attack simulation market