Nonmydriatic Fundus Cameras Market Size, Share, Trends, Industry Analysis Report: By Type (Tabletop and Handheld), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5215

- Base Year: 2024

- Historical Data: 2020-2023

Nonmydriatic Fundus Cameras Market Overview

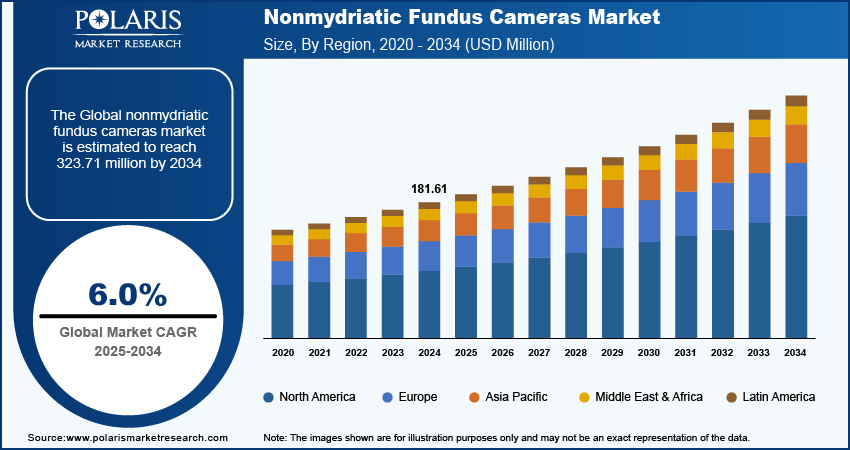

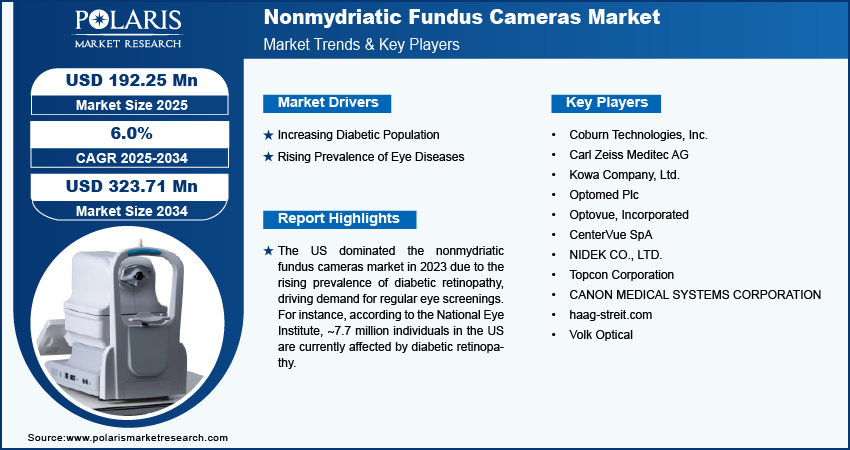

The nonmydriatic fundus cameras market size was valued at USD 181.61 million in 2024. The market is projected to grow from USD 192.25 million in 2025 to USD 323.71 million by 2034, exhibiting a CAGR of 6.0% during 2025–2034.

Nonmydriatic fundus cameras are specialized imaging devices used to capture high-resolution images of the retina without pupil dilation (mydriasis). Nonmydriatic fundus cameras are particularly beneficial in diabetic retinopathy screening and other retinal examinations. The growth of healthcare infrastructure, particularly in emerging markets, is increasing the requirement for advanced diagnostic tools. As healthcare facilities expand and upgrade their technology, the adoption of nonmydriatic fundus cameras is expected to rise. Furthermore, governments and healthcare organizations are increasingly recognizing the importance of eye health and are providing funding and support for eye care programs. This financial backing leads to increased investments in diagnostic tools such as nonmydriatic fundus cameras, which is driving the nonmydriatic fundus cameras market growth.

The nonmydriatic approach enhances patient comfort and satisfaction during eye examinations, leading to higher patient compliance with screening protocols. This focus on comfort is driving the preference for nonmydriatic fundus cameras over traditional mydriatic options. Moreover, the rise of telemedicine, accelerated by the COVID-19 pandemic, has led to greater adoption of nonmydriatic fundus cameras. The cameras facilitate remote screenings and consultations, allowing eye care providers to reach patients in underserved areas, further driving the nonmydriatic fundus cameras market expansion.

To Understand More About this Research: Request a Free Sample Report

Nonmydriatic Fundus Cameras Market Drivers Analysis

Increasing Diabetic Population

The escalating global prevalence of diabetes necessitates a heightened focus on regular eye examinations, particularly given the significant ocular complications associated with the condition, such as diabetic retinopathy. According to the International Diabetes Federation, ∼537 million individuals were affected by diabetes worldwide in 2021, with more than 75% of adult diabetes cases occurring in low and middle-income countries. According to predictions, the number of new diabetes cases is expected to reach 643 million by 2030 and 783 million by 2045. Thus, the growing diabetic population is driving demand for effective monitoring tools, thereby fueling the nonmydriatic fundus camera market growth.

Rising Prevalence of Eye Diseases

The prevalence of eye diseases, particularly diabetic retinopathy, age-related macular degeneration (AMD), and glaucoma, is increasing across the world. According to the National Eye Institute, AMD affects about 2.1 million Americans at an advanced stage; the case count is expected to increase to 3.7 million by 2030. Glaucoma currently impacts around 2.7 million people, with projections rising to roughly 4.3 million by 2030. The rising cases of eye diseases fuel the demand for effective screening and diagnostic tools. Nonmydriatic fundus cameras provide a quick and effective means to detect these conditions early. Thus, the increasing prevalence of eye conditions contributes to the nonmydriatic fundus cameras market expansion.

Nonmydriatic Fundus Cameras Market Segment Analysis

Nonmydriatic Fundus Cameras Market Breakdown by Type Outlook

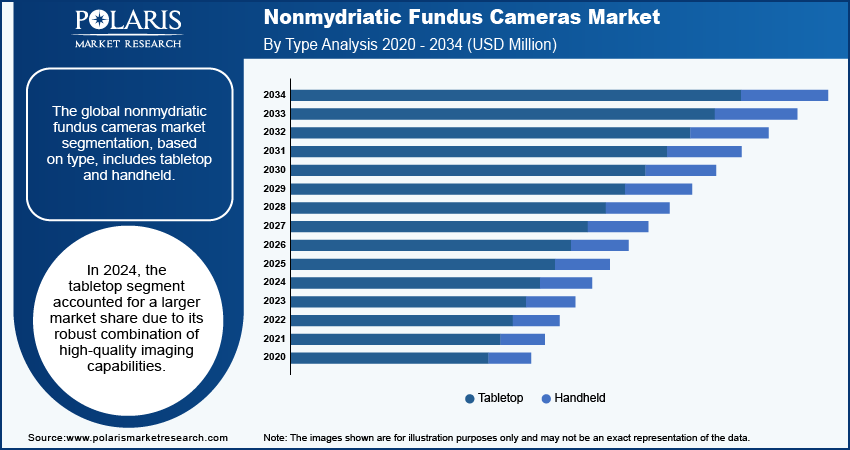

The global nonmydriatic fundus cameras segmentation, based on type, includes tabletop and handheld. In 2024, the tabletop segment accounted for a larger market share due to its robust combination of high-quality imaging capabilities, user-friendly interfaces, and advanced technological features that make it ideal for clinical settings. Tabletop design allows for stable and consistent imaging, ensuring that healthcare professionals obtain precise retinal images required for accurate diagnoses. Additionally, tabletop fundus cameras are often equipped with automated functionalities, such as image capture and alignment, which streamline workflows and reduce the time required for examinations. The growing emphasis on comprehensive eye care services, coupled with the increasing prevalence of eye diseases, has driven healthcare facilities to invest in reliable, high-performance tabletop systems.

Nonmydriatic Fundus Cameras Market Breakdown by End Use Outlook

The global nonmydriatic fundus cameras market segmentation, based on end use, includes hospitals, ophthalmology clinics, and ophthalmic & optometrist offices. The ophthalmic & optometrist offices segment is expected to register the highest CAGR during the forecast period. The increasing prevalence of eye-related conditions, such as diabetic retinopathy and age-related macular degeneration, is driving demand for regular eye examinations and screenings in ophthalmic & optometrist offices. Ophthalmic and optometrist offices are at the forefront of providing preventive care, making them ideal venues for the deployment of nonmydriatic fundus cameras, which facilitate quick and accurate assessments without the discomfort associated with pupil dilation. Additionally, advancements in technology have led to the development of more user-friendly and efficient nonmydriatic fundus cameras, making them increasingly accessible to smaller practices and encouraging adoption.

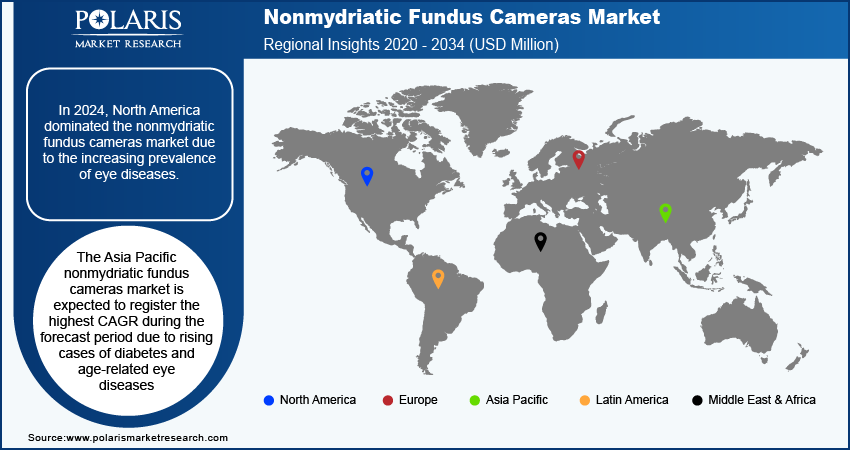

Nonmydriatic Fundus Cameras Market Breakdown, by Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the nonmydriatic fundus cameras market share. The increasing prevalence of eye diseases has created a heightened demand for effective diagnostic tools in North America. This rise in eye health concerns has prompted healthcare providers to adopt advanced imaging technologies, including nonmydriatic fundus cameras, to facilitate early detection and management of eye health conditions. The presence of key market players and ongoing innovations in imaging technology further contribute to the region's dominance. Moreover, government initiatives aimed at promoting eye health awareness and the importance of regular screenings have spurred patient engagement and increased the utilization of nonmydriatic fundus cameras in clinical settings across the region.

The US dominated the North America nonmydriatic fundus cameras market share in 2024 due to the rising prevalence of diabetic retinopathy, driving demand for regular eye screenings. According to the National Eye Institute, ∼7.7 million individuals in the US are currently affected by diabetic retinopathy, with projections indicating that this number could rise to an estimated 11.3 million by 2030. Nonmydriatic fundus cameras enable quick, noninvasive retinal imaging, essential for early diagnosis and intervention. The country’s strong healthcare infrastructure and focus on preventative care support the widespread adoption of nonmydriatic fundus cameras, further contributing to the market growth.

The Asia Pacific nonmydriatic fundus cameras market is expected to register the highest CAGR during the forecast period. The rising cases of diabetes and age-related eye diseases, such as diabetic retinopathy and glaucoma, are driving demand for regular eye screenings. According to the Asia Development Bank, in May 2024, Asia Pacific is projected to experience a significant demographic shift, with the population of individuals aged 60 and above nearly doubling to reach 1.2 billion by 2050. This demographic group is anticipated to constitute ∼25% of the total population in the region. Additionally, expanding healthcare infrastructure, increasing government initiatives promoting eye health, and greater adoption of telemedicine are accelerating the use of nonmydriatic fundus cameras.

The China nonmydriatic fundus cameras market is expected to register the largest CAGR during the forecast period due to the growing awareness of early diagnosis, which is driving demand for nonmydriatic fundus cameras.

Nonmydriatic Fundus Cameras Market – Key Players and Competitive Insights

The competitive landscape of the nonmydriatic fundus cameras market is characterized by the presence of several key players focused on innovation, strategic partnerships, and product differentiation. Companies are increasingly investing in research and development to enhance imaging quality, automation, and ease of use, aiming to meet the growing demand for early diagnosis of retinal diseases. Market leaders are introducing advanced models with features such as AI integration for automated screening and telemedicine compatibility, catering to remote healthcare needs. Additionally, firms are expanding their distribution networks through collaborations with ophthalmic clinics, optometry chains, and hospitals to strengthen their market presence.

Regional players, particularly in emerging markets, are focusing on offering cost-effective devices to compete with established brands. The competitive environment is intensified by mergers and acquisitions, and partnerships aimed at expanding product portfolios and market reach. A few key major players are Augean; Coburn Technologies, Inc.; Carl Zeiss Meditec AG; Kowa Company, Ltd.; Optomed Plc; Optovue, Incorporated; CenterVue SpA; NIDEK CO., LTD.; Topcon Corporation; CANON MEDICAL SYSTEMS CORPORATION; haag-streit.com; and Volk Optical.

Carl Zeiss Meditec AG is a medical technology company based in Germany, operating in Europe, North America, and Asia. The company operates across two main segments—ophthalmology and microsurgery. The ophthalmology segment focuses on diagnosing and treating chronic eye conditions such as ametropia, cataracts, glaucoma, and retinal disorders. Zeiss offers advanced equipment such as slit lamps, refractometers, tonometers, optical coherence tomography devices, and fundus cameras, as well as functional diagnostics tools and digital platforms for clinical data management. In the surgical ophthalmology area, Zeiss provides surgical microscopes, biometers, phacoemulsification systems, vitrectomy instruments, intraocular lenses for cataract surgery, and laser eye surgery systems and consumables. In October 2023, ZEISS enhanced its clinical workflows and digital offerings, showcasing advanced tools and solutions at AAO 2023. The latest innovations in the ZEISS Retina Workflow are designed to improve diagnosis and treatment protocols for age-related macular degeneration (AMD), geographic atrophy (GA), and diabetic retinopathy (DR). These advancements facilitate more streamlined management of these complex retinal conditions.

Topcon Corporation specializes in the development and distribution of advanced positioning, ophthalmic, and smart infrastructure solutions worldwide. The company provides a wide range of total stations, including automatic tracking, motorized and manual options, laser scanners, theodolites, and electronic levels. For civil engineering and precision agriculture, Topcon offers GNSS receivers, integrated machine control displays, and reference station systems. In ophthalmic technology, the company presents diagnostic instruments such as 3D retinal imaging devices, non-contact tonometers, slit lamps, and optical axial length measurement systems. Their software suite, including IMAGEnet, facilitates data management and electronic charting. In January 2023, Topcon launched the NW500 Non-Mydriatic Retinal Camera to the US market. This advanced imaging device enhances diagnostic capabilities by enabling high-resolution retinal imaging without the need for dilating the pupils, thus streamlining patient examination processes while maintaining accuracy and efficiency in detecting retinal diseases.

Key Companies in Nonmydriatic Fundus Cameras Industry Outlook

- Coburn Technologies, Inc.

- Carl Zeiss Meditec AG

- Kowa Company, Ltd.

- Optomed Plc

- Optovue, Incorporated

- CenterVue SpA

- NIDEK CO., LTD.

- Topcon Corporation

- CANON MEDICAL SYSTEMS CORPORATION

- haag-streit.com

- Volk Optical

Diffractive Optical Element Industry Developments

In October 2024, Siloam Vision, Inc. received a USD 0.77 million NIH grant to develop portable ultrawide field nonmydriatic retinal imaging for pediatric use. The project aims to enhance pediatric retinal diagnostics through two advanced laser-based imaging systems powered by artificial intelligence.

In June 2023, Coburn Technologies launched the HFC-1 Non-Mydriatic Fundus Camera from Huvitz, Co. Ltd. This advanced device utilizes precise autodetection technology for rapid and accurate retinal imaging and measurements, enhancing ophthalmic diagnostics.

Nonmydriatic Fundus Cameras Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Tabletop

- Handheld

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ophthalmology Clinics

- Ophthalmic & Optometrist Offices

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nonmydriatic Fundus Cameras Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 181.61 Million |

|

Market Size Value in 2025 |

USD 192.25 Million |

|

Revenue Forecast by 2034 |

USD 323.71 Million |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global nonmydriatic fundus cameras market size was valued at USD 181.61 million in 2024 and is projected to grow to USD 323.71 million by 2034

The global market is projected to register a CAGR of 6.0% during the forecast period

In 2024, North America dominated the market due to the increasing prevalence of eye diseases, such as diabetic retinopathy.

A few key players in the market are Coburn Technologies, Inc.; Carl Zeiss Meditec AG; Kowa Company, Ltd.; Optomed Plc; Optovue, Incorporated; CenterVue SpA; NIDEK CO., LTD.; Topcon Corporation; CANON MEDICAL SYSTEMS CORPORATION; haag-streit.com; and Volk Optical.

In 2024, the tabletop segment dominated the market share due to its robust combination of high-quality imaging capabilities.

The ophthalmic & optometrist offices segment is expected to exhibit the highest CAGR during the forecast period due to the increasing prevalence of eye-related conditions.