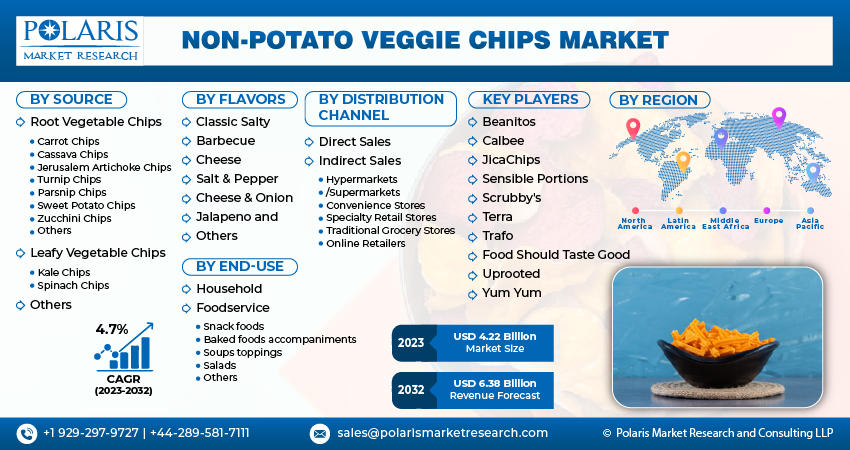

Non-Potato Veggie Chips Market Share, Size, Trends, Industry Analysis Report, By Source (Root Vegetable Chips, Leafy Vegetable Chips, Others); By Flavors; By End-Use; By Distribution Channel; By Region; Segment Forecast, 2023- 2032

- Published Date:Dec-2023

- Pages: 117

- Format: PDF

- Report ID: PM4114

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

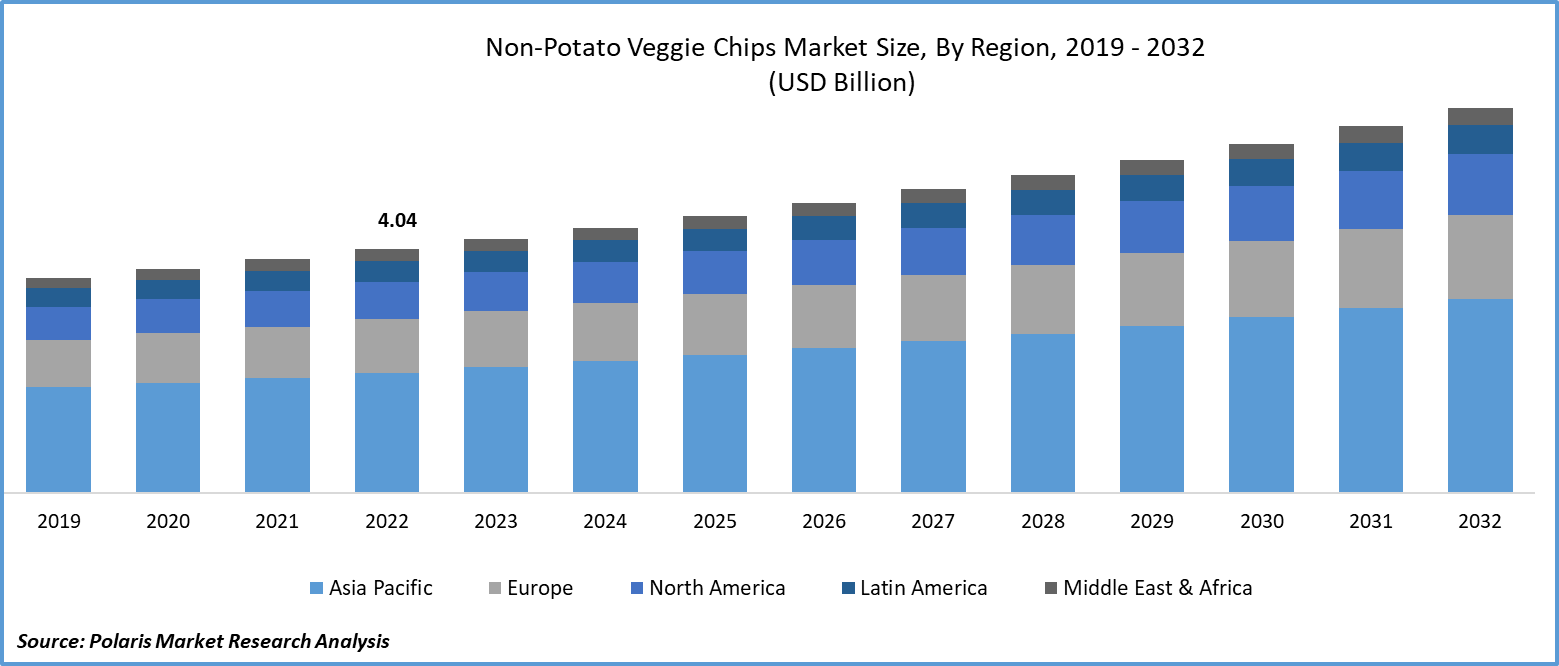

The global non-potato veggie chips market was valued at USD 4.04 billion in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period.

The growing population at the global level, along with the rising disposable income among consumers, is driving the demand for convenience foods, including chips. The increased awareness about healthy snacks driven by the availability of information through mobile networks is propelling the expansion of the non-potato veggie chips market. The increasing studies on the product design of snacks by companies are further boosting demand for the product by catering to changing consumer preferences.

To Understand More About this Research: Request a Free Sample Report

- For instance, in March 2023, Beanitos, a producer of chips and puffs, introduced a new packaging design and upgraded its chips recipe. This product improvement results in lighter and crispier chips than earlier.

Moreover, the growing vegetarian population is creating new growth opportunities for non-potato veggie chips, as they have fueled the demand for gluten-free and vegan diets, which is contributing to the growth of non-potato veggie chips in the coming years.

However, the existence of a strong consumer base for potato chips in the marketplace, primarily among children, is hampering the product adoption of non-potato veggie chips due to their taste and flavor addiction.

For Specific Research Requirements: Request for Customized Report

Growth Drivers

- The growing awareness about healthy snacks

Most people in the world are focusing on their food intake and calorie consumption to control their weight, driven by growing obesity cases. This is stimulating the demand for non-potato veggie chips adoption among a wider audience due to the existence of lower calories. The availability of information about the ingredients used in the snacks on the product packaging, along with the calories, is building trust among consumers to consume non-potato veggie chips. Companies are stepping forward to cater to the ongoing shift in consumer preferences.

For instance, Yochabi unveiled its new finger chips with lotus root and cassava in 2022. The rising product innovations in the marketplace will further enhance the adoption of non-potato veggie chips among the population.

Report Segmentation

The market is primarily segmented based on source, flavors, end-use, distribution channel and region.

|

By Source |

By Flavors |

By End-Use |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

- Root vegetable chips segment is expected to witness the highest growth during the forecast period

The root vegetable chips segment is projected to grow at a CAGR during the projected period due to growing health consciousness among the people and the evolution of health issues due to the lower consumption of nutritional food among the population. As children are not interested in taking root vegetables, parents are showing interest in giving nutritional food in the form of ready-to-eat products like chips. This will further create new growth opportunities for non-potato veggie chips in the coming years. Furthermore, the sweet potato sub-segment is expected to witness higher growth attributable to its effective texture and flavor compared to other vegetables, driving demand for sweet potato chips soon.

The leafy vegetable chips segment led the industry market with a substantial revenue share in 2022, largely attributable to its higher nutritional profile. Leafy vegetables are likely to be consumed at a lower level in urban areas due to the busy work schedule driving lower cooking time. This will likely create demand for non-potato veggie chips as consumers consume vitamins and minerals associated with leafy vegetables by purchasing convenience foods, including chips. Furthermore, the kale chips segment is gaining traction, driven by growing adoption from consumers. These factors are contributing to the growth and demand for non-potato veggie chips in the coming years.

By Flavors Analysis

- Classic salty segment accounted for the largest market share in 2022

The classic salty segment accounted for the largest share. Consumers are showing profound interest in classic salty chips, driven by comfort and nostalgia as they remind them of traditional potato chips, stimulating a rapid shift from potato to vegetable chips. Furthermore, the familiarity of classic salty flavors among the larger consumer base, including children and elders, is boosting demand for the product in the coming years.

The barbecue segment is expected to grow at the fastest rate over the next few years on account of seasonal popularity. This flavor fueled the adoption of non-potato veggie chips in the marketplace due to its unique taste, which is a combination of sweet, savory, and smoky. The rising adoption from children and students is boosting the expansion of barbecue-based, non-potato veggie chips at the global level.

By End-Use Analysis

- Household segment held the significant market revenue share in 2022

The household segment held a significant market share in revenue in 2022 due to the rising family members' interest in providing healthy snacks to their children. Non-potato chips are known to be a healthier snacking option compared to potato chips due to the presence of higher amounts of calories. In addition, the rising female working population is widening the demand for ready-to-eat and convenience foods. This is necessary for individuals who are trying to control their weight by limiting their intake of calories, fostering its demand in the coming years.

By Distribution Channel Analysis

- Indirect sales segment registered the significant growth rate in 2022

The indirect sales segment witnessed significant growth in revenue share in 2022, which was highly accelerated due to the broader outreach of the product to the target audience, primarily people with geographical barriers. Indirect sales, specifically online sales, provide convenience for consumers to purchase anytime and everywhere without any time constraints driven by working hours. Furthermore, the availability of similar products from a wide range of brands on e-commerce platforms is further propelling the expansion of the market.

Regional Insights

- North America region registered the largest share in the global market in 2022

The North American region witnessed the largest market share in the global market in 2022 and is expected to maintain its dominance over the anticipated period. The prevalence of higher obesity cases among children necessitates the consumption of lower-calorie foods. According to the State of Obesity 2022: Better Policies for a Healthier America report released by the Trust for America's Health (TFAH), 4 in 10 American adults suffer from obesity, and this is projected to continue in the next few years. This exemplifies the need for consumers to avoid junk food and higher calorie consumption. Ongoing shifts in consumer tastes and preferences may facilitate the demand for non-potato veggie chips in the coming years.

The Europe region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing snacking culture in the region. Consumers are showing profound interest in the purchase of healthy snacks, with growing awareness about junk foods. According to a YouGov survey of consumers in the US, UK, France, and Germany, 53% of people eat snacks to satisfy their hunger. 46% of respondents stated they are looking for a snack to "keep me going." This ongoing trend will create new growth opportunities for the market in the coming years.

Key Market Players & Competitive Insights

The non-potato veggie chips market is gaining popularity among consumers, driven by ongoing product launches and rising research studies to cater to consumer preferences. The key market players are working on collaborations, partnerships, mergers, and acquisitions to increase their share in the global market and gain a competitive advantage.

Some of the major players operating in the global market include:

- Beanitos

- Calbee

- Food Should Taste Good

- JicaChips

- Sensible Portions

- Scrubby's

- Terra

- Trafo

- Uprooted

- Yum Yum

Recent Developments

- In November 2022, Dirt Kitchen Snacks introduced its carrot-based chips alternatives to its vegetable snacks product line with a view to fulfilling health-conscious consumer needs. In addition to being vegan, non-GMO, gluten-free, and kosher, the air-dried carrot crisps have no artificial flavors or preservatives and only 35 calories per serving. They are coated in olive oil and a smoky barbecue sauce.

Non-Potato Veggie Chips Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.22 billion |

|

Revenue forecast in 2032 |

USD 6.38 billion |

|

CAGR |

4.7% from 2022 – 2030 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Source, By Flavors, By End-Use, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |