Non-Automotive Rubber Transmission Belts Market Share, Size, Trends, Industry Analysis Report, By Product (Raw Edged Belts, V-Belts, Timing Belts, Specialty Belts, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 118

- Format: PDF

- Report ID: PM4876

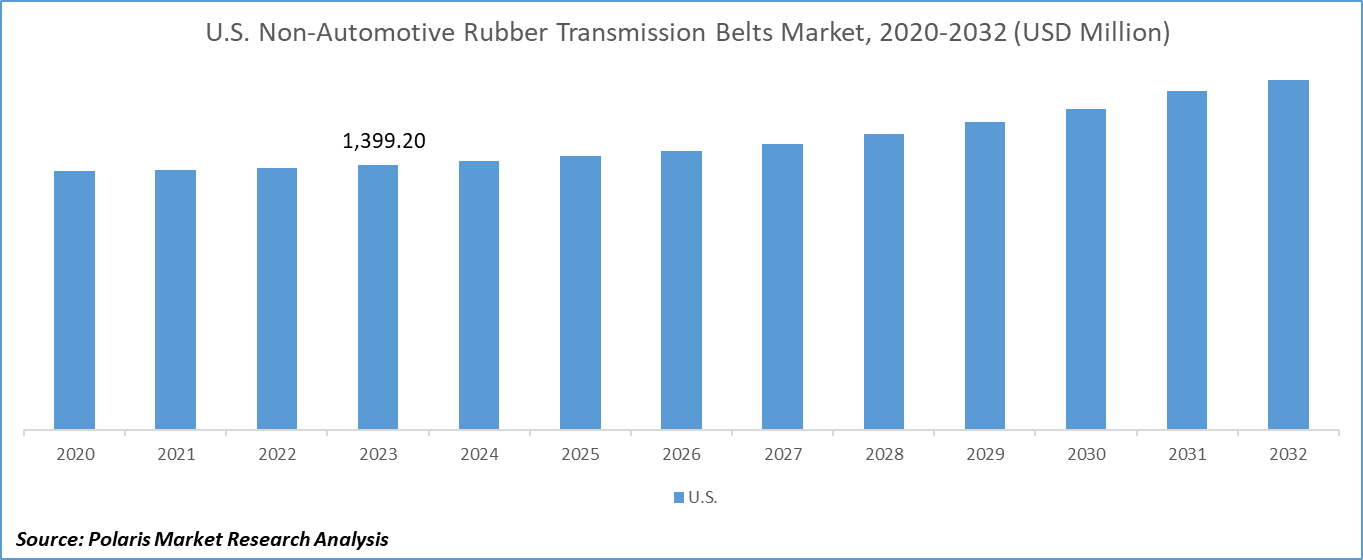

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Non-Automotive Rubber Transmission Belts Market size was valued at USD 5,421.6 million in 2023. The market is anticipated to grow from USD 5,505.1 million in 2024 to USD 7,502.6 million by 2032, exhibiting the CAGR of 3.9% during the forecast period.

Industry Trends

Non-automotive rubber transmission belts efficiently transmit power and motion in various industrial applications. These belts feature durable rubber compounds engineered to withstand heavy loads and harsh operating conditions. Utilizing friction and tension, they transfer rotational energy between pulleys with precision and reliability. Non-automotive rubber transmission belts play a critical role in enhancing operational efficiency across industries such as agriculture, mining, construction, and aerospace.

In the past, the Non-Automotive Rubber Transmission Belts Market experienced robust growth driven by several key factors. Firstly, increasing industrialization and infrastructural development activities worldwide fueled the demand for conveyor systems and power transmission equipment, consequently boosting the adoption of non-automotive rubber transmission belts across various industries. Moreover, technological advancements in belt manufacturing processes and materials enhanced product performance, durability, and reliability, thereby expanding the application scope and driving market growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, in April 2020, Gates introduced the utilization of Ethylene Elastomer (EE) compounds in wrapped V-belt technology, catering to original equipment manufacturers (OEMs) within the agriculture, forestry, and heavy industrial sectors.

Additionally, growing awareness regarding energy efficiency and the need for sustainable solutions encouraged industries to invest in advanced transmission belts designed to minimize energy consumption and improve operational efficiency, further stimulating market demand. Furthermore, the rise of emerging economies, particularly in the Asia-Pacific region, presented lucrative opportunities for market players to capitalize on the burgeoning demand for industrial equipment and machinery, driving market expansion.

Despite the favorable market conditions, the Non-Automotive Rubber Transmission Belts Market faced several challenges and constraints in the past. Fluctuating prices of raw materials, including rubber and synthetic compounds, posed significant challenges for manufacturers, impacting production costs and profit margins. The volatility in raw material prices necessitated effective cost management strategies and supply chain optimization initiatives to mitigate the adverse effects on profitability.

Key Takeaways

- Asia Pacific dominated the market and contributed over 36% market share of the non-automotive rubber transmission belts market size in 2023

- By product category, the V-belts segment dominated the global non-automotive rubber transmission belts market size in 2023

- By type category, the mining segment is projected to grow with a significant CAGR over the non-automotive rubber transmission belts market forecast period

What are the market drivers driving the demand for market?

Industrial Growth

Industrial growth emerged as a significant driver propelling the non-automotive rubber transmission belts market forward. Industries across the globe, ranging from manufacturing to construction, mining, and aerospace, experienced consistent expansion, creating a robust demand for transmission belts. These belts served as indispensable components in the intricate machinery and systems powering industrial operations, facilitating the transfer of power and motion with precision and reliability.

One of the primary contributors to industrial growth was the increasing globalization of trade and manufacturing. As companies expanded their operations to tap into emerging markets and capitalize on cost advantages, the demand for non-automotive rubber transmission belts surged. Industries leveraged transmission belts to drive conveyor systems, power machinery, and facilitate material handling processes, thereby enhancing production efficiency and throughput.

Moreover, advancements in manufacturing technologies and processes played a pivotal role in driving industrial growth and, consequently, the demand for transmission belts. Innovations in materials science led to the development of high-performance rubber compounds and synthetic materials, offering enhanced durability, resistance to wear, and load-bearing capacities. Manufacturers embraced these advancements to produce transmission belts capable of withstanding the rigors of industrial applications, further fueling market expansion. The evolution of industrial automation and robotics also contributed significantly to the demand for non-automotive rubber transmission belts. As industries embraced automation to improve productivity, precision, and efficiency, transmission belts became integral components in automated production lines and robotic systems. These belts facilitated the smooth movement of components, materials, and products within manufacturing facilities, enabling seamless integration of automated processes and enhancing overall operational performance.

Which factor is restraining the demand for Non-Automotive Rubber Transmission Belts?

Fluctuating Raw Material Prices

Fluctuating raw material prices have historically posed significant challenges for manufacturers in the non-automotive rubber transmission belts market. The market heavily relies on raw materials such as rubber compounds, synthetic fibers, and other additives, whose prices are subject to volatility due to various factors including supply-demand dynamics, geopolitical tensions, and currency fluctuations. One of the primary challenges associated with fluctuating raw material prices is the unpredictability it introduces into production costs. Manufacturers often face sudden and substantial increases in the prices of key raw materials, which significantly impact the overall cost of producing transmission belts. Such fluctuations erode profit margins, especially in markets where pricing competition is intense and margins are already tight. Moreover, the uncertainty surrounding raw material prices makes it challenging for manufacturers to plan and forecast effectively. Rapid changes in raw material prices disrupt production schedules, inventory management, and supply chain operations. Manufacturers find themselves grappling with inventory shortages or excess inventory as they try to navigate the volatile market conditions, leading to inefficiencies and increased costs.

Fluctuating raw material prices also pose challenges in terms of pricing strategies and customer relationships. Manufacturers are forced to pass on the increased costs to customers through price adjustments, risking customer dissatisfaction and potential loss of business. Alternatively, absorbing the higher costs squeeze profit margins and hinder the ability to invest in innovation, research, and development, which are critical for long-term competitiveness. Furthermore, the impact of fluctuating raw material prices extends beyond the manufacturing sector to the broader economy. Industries that rely heavily on non-automotive rubber transmission belts, such as manufacturing, construction, mining, and agriculture, experience cost pressures and operational challenges as a result of higher input costs. This disrupts the supply chain, affecting businesses of all sizes and contributing to economic uncertainty.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product category analysis, the market has been segmented on the basis of raw edged belts, V-belts, timing belts, specialty belts, and others. In 2023, the V-belts segment has emerged as the dominant segment in the global market. V-belts are widely utilized in industrial applications across various sectors, such as manufacturing, agriculture, mining, and construction, owing to their versatility and efficiency in power transmission. These belts offer superior traction, durability, and resistance to wear and tear, making them ideal for heavy-duty applications where reliability is paramount. Additionally, advancements in belt manufacturing technologies have led to the development of high-performance V-belts with enhanced features such as heat resistance, oil resistance, and reduced maintenance requirements, further boosting their appeal to end-users.

As industries continue to prioritize productivity and operational efficiency, the demand for V-belts in the non-automotive sector is expected to remain robust, maintaining its dominant position in the market.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of industrial, agricultural equipment, building & construction, mining, aerospace, food and processing industry, textile industry, and others. The mining segment within the non-automotive rubber transmission belts market is anticipated to grow substantially over the forecast period due to the industry relies heavily on conveyor systems for the transportation of bulk materials such as coal, ore, and minerals within mining operations. Rubber transmission belts play a critical role in these conveyor systems, providing efficient and reliable power transmission while withstanding the harsh operating conditions encountered in mining environments, including abrasive materials, high temperatures, and heavy loads.

Also, as mining operations strive for increased productivity, safety, and cost-effectiveness, there is a growing demand for advanced conveyor belt solutions that offer higher durability, longer service life, and reduced maintenance requirements. With a focus on optimizing operational efficiency and mitigating downtime, mining companies are increasingly turning to innovative belt technologies and solutions to enhance their productivity and competitiveness, thereby fueling the growth of the mining segment within the non-automotive rubber transmission belts market.

Regional Insights

Asia Pacific

In 2023, the Asia Pacific region dominated the global market and is anticipated to continue its dominance with a significant CAGR over the forecast period. The region is home to rapidly expanding industrial sectors, including manufacturing, mining, agriculture, construction, and logistics. These major consumers of rubber transmission belts for various applications such as conveyor systems, power transmission, and material handling equipment. As these industries continue to grow and modernize, there is a corresponding increase in the demand for efficient and reliable belt solutions to support their operational needs.

Also, favorable government initiatives, infrastructure investments, and ongoing industrialization efforts in countries like China, India, and Southeast Asian nations are driving the demand for rubber transmission belts across diverse end-user sectors. Moreover, the Asia Pacific region benefits from a large population base, rising urbanization, and increasing disposable incomes, which stimulate demand for consumer goods and drive investments in industries such as textiles, packaging, and food processing, further fueling the demand for non-automotive rubber transmission belts.

Competitive Landscape

Some of the key players in the non-automotive rubber transmission belts market include Continental AG, Gates Industrial Corporation plc, SKF, and Mitsuboshi Belting Ltd. The market is a highly fragmented industry, with a multitude of players competing for market share. The market is characterized by a large number of small and medium-sized enterprises, which pose a significant threat to larger players. In addition, the presence of various local players in different regions intensifies competition, as they offer customized products and services tailored to the unique demands of their respective customer bases. The market is marked by intense competition, with players vying for market share through continuous advancements in technology, strategic collaborations, and a commitment to innovation. To remain competitive, companies are focusing on product innovation, customer satisfaction, and strategic partnerships while keeping an eye on emerging trends and technologies.

Some of the major players operating in the global market include:

- CHIORINO S.p.A.

- Continental AG

- Gates Industrial Corporation plc

- Habasit

- Hanna Rubber Company

- HIC International Co. Inc.

- JONSON RUBBER

- Mitsuboshi Belting Ltd

- Optibelt GmbH

- SKF

Recent Developments

- In November 2019, Continental has introduced an extensive array of multi-V belts with OEM quality to the agricultural spare parts market. This implies that farmers will enjoy a dual advantage when replacing their multi-V belts in the future: receiving robust belts as originally installed by the manufacturer and achieving cost-efficiency.

- In April 2020, Gates introduced the utilization of Ethylene Elastomer (EE) compounds in wrapped V-belt technology, catering to original equipment manufacturers (OEMs) within the agriculture, forestry, and heavy industrial sectors.

- In February 2020, Continental and Menke Agrar, a subsidiary of the Agravis Group, have entered into a strategic partnership for the sale of drive belts. The drive belts within the Agridur portfolio are accessible to specialist dealers and repair workshops supported by Menke Agrar in Germany, as well as in Central and Eastern Europe.

- In December 2019, Habasit acquired and integrated Namil Belt Industrial Co. Ltd. and Korea Belt Services, two South Korean belt companies. Through this investment, Habasit intends to expand its existing range of high-quality, customized solutions for customers in South Korea.

Report Coverage

The non-automotive rubber transmission belts market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, and their futuristic growth opportunities.

Non-Automotive Rubber Transmission Belts Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5,505.1 million |

|

Revenue forecast in 2032 |

USD 7,502.6 million |

|

CAGR |

3.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Non-Automotive Rubber Transmission Belts Market report covering key segments are product, application, and region.

Non-Automotive Rubber Transmission Belts Market Size Worth USD 7,502.6 Million by 2032

Non-Automotive Rubber Transmission Belts Market exhibiting the CAGR of 3.9% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Non-Automotive Rubber Transmission Belts Market are technological advancements