Non-alcoholic Steatohepatitis Treatment Market Size, Share, Trends, Industry Analysis Report: By Drug, Disease Stage, Distribution Channel (Hospital Pharmacies, Retail and Specialty Pharmacies, and Other Pharmacies), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5283

- Base Year: 2024

- Historical Data: 2020-2023

Non-alcoholic Steatohepatitis Treatment Market Overview

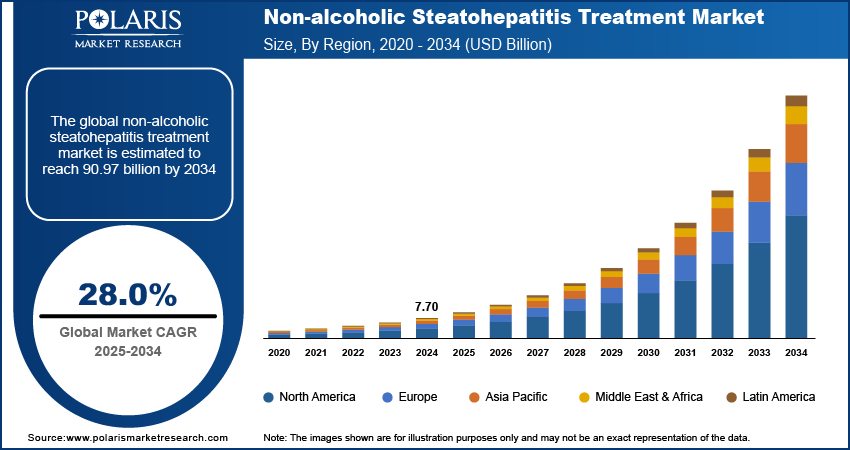

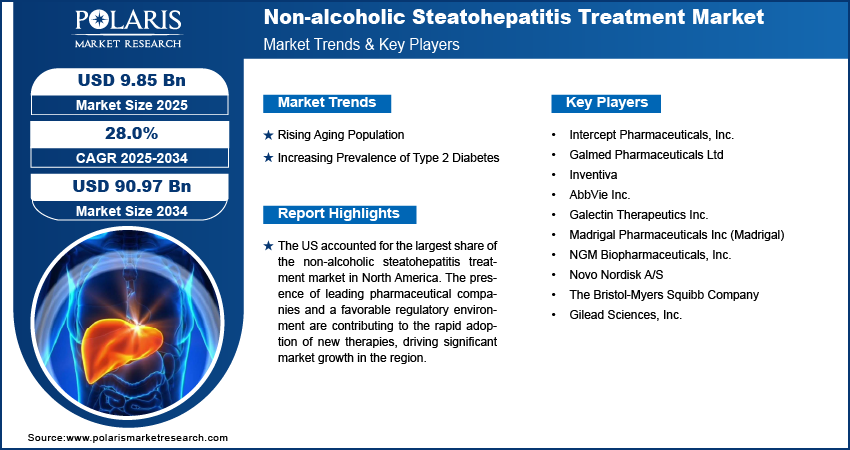

The non-alcoholic steatohepatitis treatment market size was valued at USD 7.70 billion in 2024. The market is projected to grow from USD 9.85 billion in 2025 to USD 90.97 billion by 2034, exhibiting a CAGR of 28.0% during 2024–2034.

Non-alcoholic steatohepatitis treatment is aimed at managing a serious form of fatty liver disease where inflammation and liver cell damage occur alongside fat accumulation in the liver, unrelated to alcohol use. This condition, if untreated, leads to fibrosis, cirrhosis, liver cancer, and even liver failure. The rising prevalence of non-alcoholic steatohepatitis is a key driver of the non-alcoholic steatohepatitis treatment market expansion. The global increase in prevalence of obesity is significantly contributing to the growing demand for NASH therapies, as obesity are major risk factors for NASH development. Governments and health organizations are intensifying efforts to address liver diseases, including NASH, through public health campaigns, research funding, and enhanced access to diagnostic tools. This focus is driving greater recognition of NASH as a significant and growing health concern, further boosting the non-alcoholic steatohepatitis treatment market demand. Moreover, advancements in diagnostic methods are enhancing the early detection of NASH, a critical factor for effective treatment. The development of noninvasive tools such as elastography and biomarkers has improved diagnostic accuracy, fueling increased demand for NASH treatments.

To Understand More About this Research: Request a Free Sample Report

Non-alcoholic Steatohepatitis Treatment Market Trend Analysis

Rising Aging Population

The rising aging population across the world increases the incidence of NASH-related liver disease, with older adults at higher risk for conditions such as diabetes and hypertension linked to NASH. According to the World Health Organization, from 2015 to 2050, the percentage of the global population aged 60 and above is projected to nearly double from 12% to 22%, highlighting critical implications for social, economic, and healthcare systems. This demographic trend further accelerates demand for NASH-targeted treatments. Thus, surging aging population is expected to drive the NASH treatment market expansion during the forecast period.

Increasing Prevalence of Type 2 Diabetes

Insulin resistance, a common feature in diabetes, leads to fat accumulation in the liver, setting the stage for liver inflammation and fibrosis associated with NASH. The International Diabetes Federation reported that ∼537 million individuals were suffering from diabetes worldwide in 2021. Projections anticipate this number will rise to 643 million by 2030 and 783 million by 2045, highlighting an urgent need for effective public health strategies. The surge in type 2 diabetes cases globally, fueled by sedentary lifestyles and high-calorie diets, is significantly expanding the NASH patient population. Thus, the rising prevalence of type 2 diabetes is majorly contributing to the NASH treatment market development.

Non-alcoholic Steatohepatitis Treatment Market Segment Insights

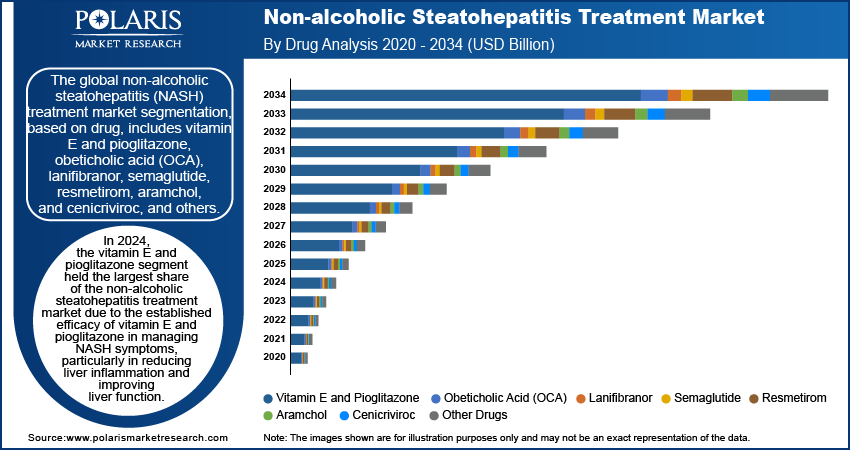

Non-alcoholic Steatohepatitis Treatment Market Assessment by Drug Outlook

The global non-alcoholic steatohepatitis treatment market segmentation, based on drug, includes vitamin E and pioglitazone, obeticholic acid (OCA), lanifibranor, semaglutide, resmetirom, aramchol, and cenicriviroc, and others. In 2024, the vitamin E and pioglitazone segment held the largest share of the market due to the established efficacy of vitamin E and pioglitazone in managing NASH symptoms, particularly in reducing liver inflammation and improving liver function. Additionally, vitamin E and pioglitazone are more widely accessible and cost-effective compared to newer, experimental drugs, which enhances their appeal among healthcare providers and patients. Vitamin E and pioglitazone are frequently recommended due to their safety profile and familiarity with clinical practice.

Non-alcoholic Steatohepatitis Treatment Market Evaluation by Distribution Channel Outlook

The global non-alcoholic steatohepatitis treatment market segmentation, based on distribution channels, includes hospital pharmacies, retail and specialty pharmacies, and other pharmacies. The retail and specialty pharmacies segment is expected to witness the highest CAGR during the forecast period due to increased accessibility and convenience for patients seeking non-alcoholic steatohepatitis treatments. Additionally, the growth of specialty pharmacies, which focus on complex and high-cost medications, enhances patient support and adherence to NASH therapies, further driving retail and specialty pharmacies segment expansion.

Non-alcoholic Steatohepatitis Treatment Market Regional Analysis

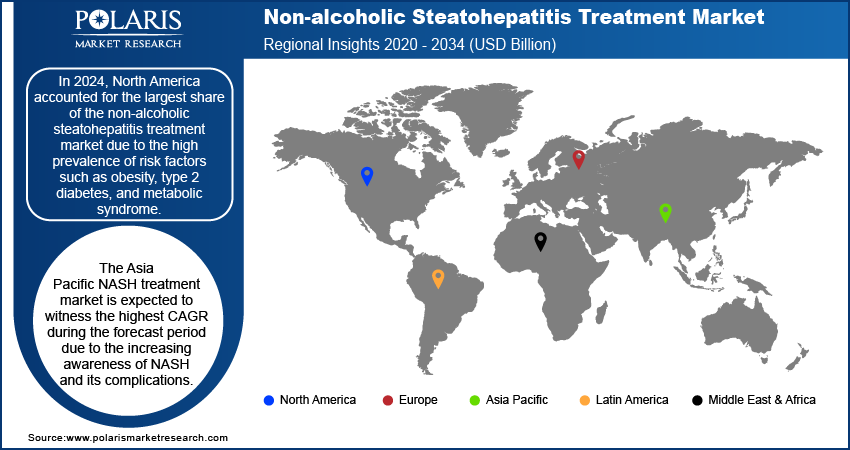

By region, the study provides non-alcoholic steatohepatitis treatment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the market due to the high prevalence of risk factors such as obesity, type 2 diabetes, and metabolic syndrome, which are major contributors to the rise in NASH cases. According to the Centers for Disease Control and Prevention (CDC), adult obesity prevalence in the US was 40.3% from August 2021 to August 2023, with no significant gender differences. Higher rates were observed in adults aged 40–59 compared to those aged 20–39 and 60+. Additionally, advanced healthcare infrastructure, high healthcare expenditure, and significant investments in research and development for NASH therapies have positioned North America as a dominant market. The region also benefits from a growing awareness of NASH among healthcare professionals and patients, further fueling the North America non-alcoholic steatohepatitis treatment market growth.

The US accounted for the largest share of the non-alcoholic steatohepatitis treatment market in North America. The presence of leading pharmaceutical companies and a favorable regulatory environment contribute to the rapid adoption of new therapies, driving significant market growth in the region.

The Asia Pacific non-alcoholic steatohepatitis treatment market is expected to witness the highest CAGR during the forecast period. The increasing awareness of NASH and its complications, combined with improving healthcare infrastructure and expanding access to advanced treatment options, is contributing to the market’s rapid growth in the region. The rising economic development in countries such as China and India, along with greater investments in healthcare, further supports the region's robust market expansion.

The China non-alcoholic steatohepatitis treatment market is expected to witness significant growth during the forecast period. The aging population in China is contributing to the non-alcoholic steatohepatitis (NASH) treatment market growth, as older adults are more prone to developing conditions such as type 2 diabetes and hypertension, which are major risk factors for NASH. According to the World Health Organization (WHO), in 2019, there were 254 million individuals aged 60 and older, including 176 million aged 65 and above. This demographic in China is projected to grow to around 402 million by 2040, constituting 28% of the total population.

Non-alcoholic Steatohepatitis Treatment Market – Key Players and Competitive Analysis Report

The competitive landscape of the non-alcoholic steatohepatitis (NASH) treatment market is marked by a dynamic and evolving environment, with several key players leading the way in drug development and treatment innovation. Leading pharmaceutical companies, including Intercept Pharmaceuticals, Bristol-Myers Squibb, Gilead Sciences, and Novo Nordisk, are at the forefront, actively involved in clinical trials and launching new therapies. Major companies are exploring various treatment options, such as obesity medications, anti-fibrotic drugs, and insulin-sensitizers, to address the complex pathophysiology of NASH.

The NASH treatment market is also witnessing the entry of biotech firms developing novel, noninvasive treatments and biomarker-based therapies, which are gaining attention for their potential to revolutionize NASH management. Strategic collaborations, mergers and acquisitions, and partnerships are common in this space, as companies look to expand their product portfolios and gain a competitive edge in the rapidly growing market. Additionally, the competitive dynamics are influenced by factors such as regulatory approvals, pricing strategies, and market access, with a strong emphasis on improving treatment efficacy and patient outcomes. A few key major players are Intercept Pharmaceuticals, Inc.; Galmed Pharmaceuticals Ltd; Inventiva; AbbVie Inc.; Galectin Therapeutics Inc.; Madrigal Pharmaceuticals Inc (Madrigal); NGM Biopharmaceuticals, Inc.; Novo Nordisk A/S; The Bristol-Myers Squibb Company; and Gilead Sciences, Inc.

Novo Nordisk A/S and its subsidiaries specialize in the research, manufacturing, development, and distribution of pharmaceutical products across various regions worldwide. The company has established 10 research and development centers across 5 countries, and it boasts 16 production facilities located in 9 countries. The company operates in two primary segments—Diabetes and Obesity Care and Rare Disease. The Diabetes and Obesity Care segment provides an extensive range of products for obesity, cardiovascular disease, diabetes, and other emerging therapy areas. The Rare Disease segment provides products for endocrine disorders, rare blood disorders, and hormone replacement therapy. In November 2024, Semaglutide 2.4 mg from Novo Nordisk A/S showed significant efficacy in promoting liver fibrosis improvement and facilitating the resolution of metabolic associated steatotic hepatitis (MASH) in the ESSENCE trial.

Gilead Sciences, Inc. is a biopharmaceutical company that specializes in the research, development, and commercialization of innovative medicines to treat life-threatening diseases. In 2017, Gilead Sciences, Inc. completely acquired Kite Pharma, Inc. Gilead Sciences is recognized for its pioneering work in antiviral therapies, especially in the area of HIV and hepatitis B and C. The company's first major success came in 1996 when it launched Viread, a treatment for HIV. Since then, Gilead Sciences has developed several bestseller drugs, including Atripla, Truvada, and Harvoni, which have transformed the treatment of HIV and hepatitis C.

Key Companies in Non-alcoholic Steatohepatitis Treatment Market

- Intercept Pharmaceuticals, Inc.

- Galmed Pharmaceuticals Ltd

- Inventiva

- AbbVie Inc.

- Galectin Therapeutics Inc.

- Madrigal Pharmaceuticals Inc (Madrigal)

- NGM Biopharmaceuticals, Inc.

- Novo Nordisk A/S

- The Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

Non-alcoholic Steatohepatitis Treatment Market Developments

In March 2024, the FDA approved Rezdiffra (resmetirom) for adults with noncirrhotic NASH and moderate to advanced hepatic fibrosis to be used alongside diet and exercise.

In June 2023, Echosens, a leader in hepatic diagnostic technologies, partnered with Novo Nordisk A/S to enhance early detection of non-alcoholic steatohepatitis (NASH) and increase awareness among patients, healthcare professionals, and stakeholders. The collaboration aims to improve diagnostic approaches and educational outreach regarding NASH.

Non-alcoholic Steatohepatitis Treatment Market Segmentation

By Drug Outlook (Revenue, USD Billion; 2020–2034)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Other Drugs

By Disease Stage Outlook (Revenue, USD Billion; 2020–2034)

- NASH Stage F0

- NASH Stage F1

- NASH Stage F2

- NASH Stage F3

- NASH Stage F4

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Other Pharmacies

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Non-alcoholic Steatohepatitis Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.70 billion |

|

Market Size Value in 2025 |

USD 9.85 billion |

|

Revenue Forecast by 2034 |

USD 90.97 billion |

|

CAGR |

28.0% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global NASH treatment market size was valued at USD 7.70 billion in 2024 and is projected to grow to USD 90.97 billion by 2034.

The global market is projected to register a CAGR of 28.0% during the forecast period.

In 2024, North America dominated the market due to the high prevalence of risk factors such as obesity, type 2 diabetes, and metabolic syndrome.

A few key players in the market are Intercept Pharmaceuticals, Inc.; Galmed Pharmaceuticals Ltd; Inventiva; AbbVie Inc.; Galectin Therapeutics Inc.; Madrigal Pharmaceuticals Inc (Madrigal); NGM Biopharmaceuticals, Inc.; Novo Nordisk A/S; The Bristol-Myers Squibb Company; and Gilead Sciences, Inc.

In 2024, the vitamin E and pioglitazone segment held the largest market share due to the established efficacy of vitamin E and pioglitazone in managing NASH symptoms, particularly in reducing liver inflammation and improving liver function.

The retail and specialty pharmacies segment is expected to witness the highest CAGR during the forecast period due to increased accessibility and convenience for patients seeking NASH treatments.