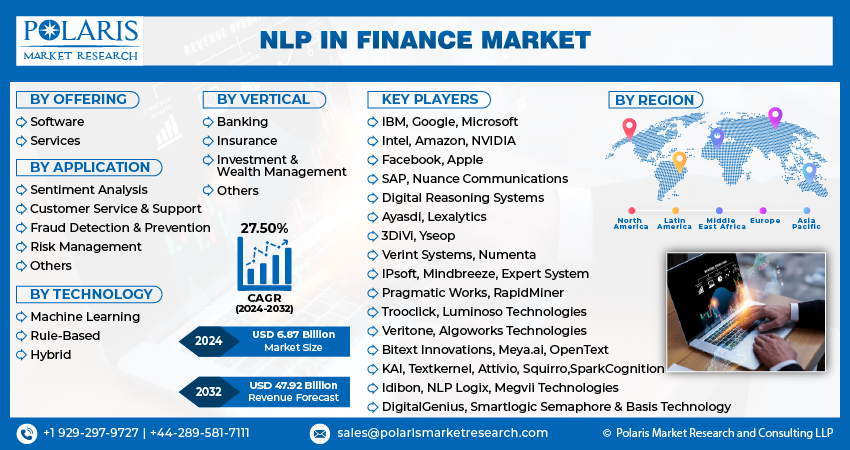

NLP in Finance Market Share, Size, Trends, Industry Analysis Report, By Offering (Software, Services); By Application; By Technology (Machine Learning, Rule-Based, Hybrid); By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3563

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

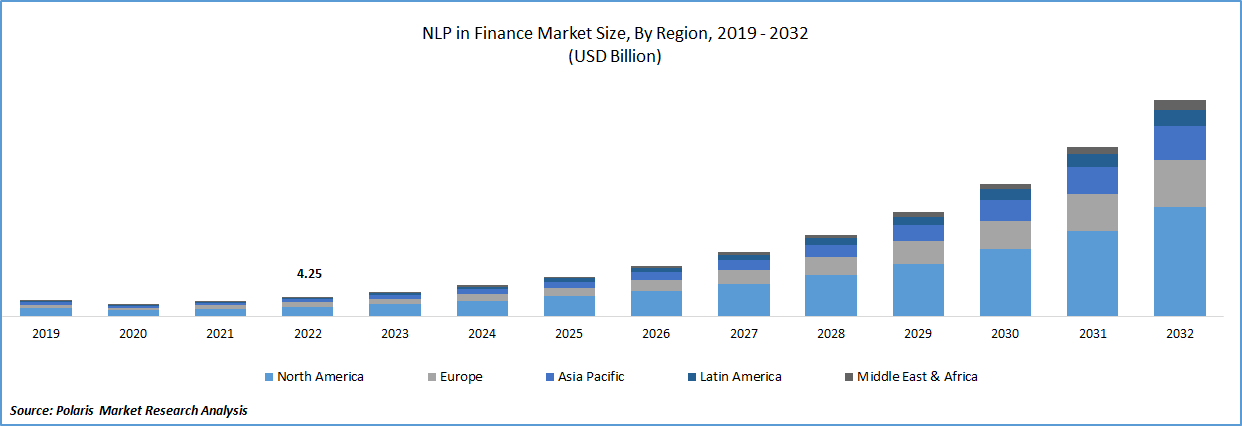

The global NLP in finance market was valued at USD 5.4 billion in 2023 and is expected to grow at a CAGR of 27.50% during the forecast period. Increasing adoption of AI-based anti-fraud technologies in the finance industry is the driving factor for the growth of the market. In 2021, 10% of financial service companies claimed to utilize AI-based anti-fraud technologies, according to the NVIDIA survey.

To Understand More About this Research: Request a Free Sample Report

This percentage increased to 31% by 2022, more than tripling year over year. The rise in financial fraud incidents has compelled financial service companies to seek more effective fraud detection solutions. AI-based technologies, including NLP, offer enhanced capabilities to analyze large volumes of textual data and identify patterns associated with fraudulent activities. This will further create a wide range of opportunities for the growth and demand for the market in coming years.

Industry Dynamics

Growth Drivers

The application of sentiment analysis in the finance industry is one of the driving factors behind the growth of the NLP (Natural Language Processing) market in finance. According to Credgenics, sentiment analysis has allowed lending institutions to recover between 70 and 95 percent of their bad debts and increase their debt collection rates by 15 to 20 percent. Sentiment analysis allows financial institutions to understand customer sentiment and feedback on a granular level.

By analyzing customer interactions, surveys, and social media data, companies can identify customer preferences, pain points, and satisfaction levels. This knowledge helps in improving customer experiences by tailoring financial products, services, and marketing strategies to meet customer expectations. Enhanced customer experiences drive customer loyalty, acquisition, and retention, ultimately leading to business growth.

Report Segmentation

The market is primarily segmented based on offering, application, technology, vertical and region.

|

By Offering |

By Application |

By Technology |

By Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Service segment registered with the faster growth in the study period

Service segment is expected to have faster growth for the market due to the increasing demand for professional services, system integration, and implementation services. Professional services, such as training and consulting, are essential for financial institutions to fully leverage the capabilities of NLP technology. As financial institutions seek to integrate NLP technology into their operations, they require expert guidance to ensure that they are utilizing the technology effectively and efficiently. This is driving the demand for training and consulting services. System integration and implementation services are also expected to have a higher growth rate due to the increasing adoption of NLP technology in the financial industry.

Fraud Detection & Prevention segment accounted for the largest market share in 2022

Fraud Detection & Prevention segment holds the largest market share for the market in the study period due to the increasing need for financial institutions to detect and prevent fraudulent activities. Fraud is a significant concern for financial institutions, and it is estimated that businesses lose billions of dollars every year due to fraudulent activities. NLP technology is being used to analyze large volumes of data from various sources such as transactional data, social media, emails, chat logs, and other text data to identify patterns and anomalies that may indicate fraudulent activities. By analyzing this data, NLP algorithms can flag potentially fraudulent transactions for further investigation, reducing false positives and improving fraud detection rates.

Machine Learning segment holds the higher growth rate in the study period

Machine Learning segment, particularly the Natural Language Processing (NLP) Algorithms sub-segment, is projected to witness higher growth for the market in coming years. The financial industry is dealing with a massive amount of unstructured data in the form of customer feedback, news articles, social media posts, and other text-based data sources. NLP algorithms are specifically designed to handle such unstructured data and extract valuable insights from it. These insights can help financial institutions to make better decisions about investments, manage risks, and improve customer experiences. This will further fuel the growth of the market in coming years.

Banking segment is expected to hold the larger revenue share

Banking segment is projected to witness the larger revenue share for the market due to the increasing need for advanced technologies to handle large amounts of unstructured data generated by various banking processes. NLP technology can help banks analyze customer feedback, improve customer engagement, automate compliance processes, and detect fraudulent activities. It can also help banks in risk management and decision-making by analyzing market trends, financial news, and other relevant data. Furthermore, with the increasing adoption of digital banking and mobile payments, banks are leveraging NLP to offer personalized and contextualized services to their customers. These factors are expected to drive the growth of the market in the banking segment.

Asia Pacific registered with the highest growth in the study period

This region is known for its rapid adoption of new and advanced technologies, including NLP in Finance. The increasing demand for more sophisticated financial services and solutions is driving the adoption of NLP in the finance industry in the region. The increasing use of digital platforms for financial services, such as online banking and mobile payments, is also driving the adoption of NLP in the finance industry in the region.

The demand for more efficient and convenient financial services is encouraging financial institutions to adopt advanced technologies like NLP to provide better customer experiences. As per the Mastercard survey, consumers in the industry innovative digital payment solutions in the region, with 93% likely to have done so in the past year (2021). The growth of digital payments creates a larger volume of data and a need for advanced technologies like NLP to process and derive insights from that data. This will further create new growth potential for the market in coming years.

North America garnered with the larger revenue share in the forecast time frame

North America is expected to witness a larger revenue share for the market. The region has a well-established financial sector with many banks, financial institutions, and insurance companies that are increasingly adopting NLP technology to enhance their operations. According to KPMG, Canada's fintech investment climbed to $6.4 billion with 162 agreements in 2021, setting records for both deal value and deal count. The NLP technology plays a pivotal role in various fintech applications, including customer support, data analysis, risk management, and automation.

With Canadian fintech firms channeling investments into NLP technology, it propels the development and adoption of sophisticated NLP solutions specifically tailored to the finance sector. This, in turn, accelerates the growth of the NLP in Finance market as an increasing number of financial institutions and fintech startups recognize the value and seek to harness the capabilities of NLP.

Competitive Insight

Some of the major players operating in the global market include IBM, Google, Microsoft, Intel, Amazon, NVIDIA, Facebook, Apple, SAP, Nuance Communications, Digital Reasoning Systems, Ayasdi, Lexalytics, 3DiVi, Yseop, Verint Systems, Numenta, IPsoft, Mindbreeze, Expert System, Pragmatic Works, RapidMiner, Trooclick, Luminoso Technologies, Veritone, Algoworks Technologies, Bitext Innovations, Meya.ai, OpenText, KAI, Textkernel, Attivio, Squirro,SparkCognition, Idibon, NLP Logix, Megvii Technologies, DigitalGenius, Smartlogic Semaphore & Basis Technology.

Recent Developments

- In April 2023, NLP Logix unveiled an innovative service. This service empowers companies and organizations to construct extensive language models using their proprietary data and engage with them in a manner akin to ChatGPT.

- In November 2022, Babel Street announced its acquisition of the Rosette. This will combine with the Rosette's natural language processing capabilities, resulting in the development of an advanced platform for risk mitigation, & threat intelligence.

NLP in Finance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.87 billion |

|

Revenue forecast in 2032 |

USD 47.92 billion |

|

CAGR |

27.50% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By offering, By Application, By Technology, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

IBM, Google, Microsoft, Intel, Amazon, NVIDIA, Facebook, Apple, SAP, Nuance Communications, Digital Reasoning Systems, Ayasdi, Lexalytics, 3DiVi, Yseop, Verint Systems, Numenta, IPsoft, Mindbreeze, Expert System, Pragmatic Works, RapidMiner, Trooclick, Luminoso Technologies, Veritone, Algoworks Technologies, Bitext Innovations, Meya.ai, OpenText, KAI, Textkernel, Attivio, Squirro,SparkCognition, Idibon, NLP Logix, Megvii Technologies, DigitalGenius, Smartlogic Semaphore & Basis Technology. |

FAQ's

key companies in NLP in finance market are IBM, Google, Microsoft, Intel, Amazon, NVIDIA, Facebook, Apple, SAP, Nuance Communications, Digital Reasoning Systems.

The global NLP in finance market is expected to grow at a CAGR of 27.4% during the forecast period.

The NLP in finance market report covering key segments are offering, application, technology, vertical and region.

key driving factors in NLP in finance market are growing demand for financial services that are automated and efficient, as well as a need for accurate and real-time analysis of complex financial data.

The global NLP in finance market size is expected to reach USD 47.92 billion by 2032.