Nitrogen Gas Springs Market Size, Share, Trends, Industry Analysis Report: By Type, Material, Function (Compression Springs, Tension Springs, and Others), End Use, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5272

- Base Year: 2024

- Historical Data: 2020-2023

Nitrogen Gas Springs Market Overview

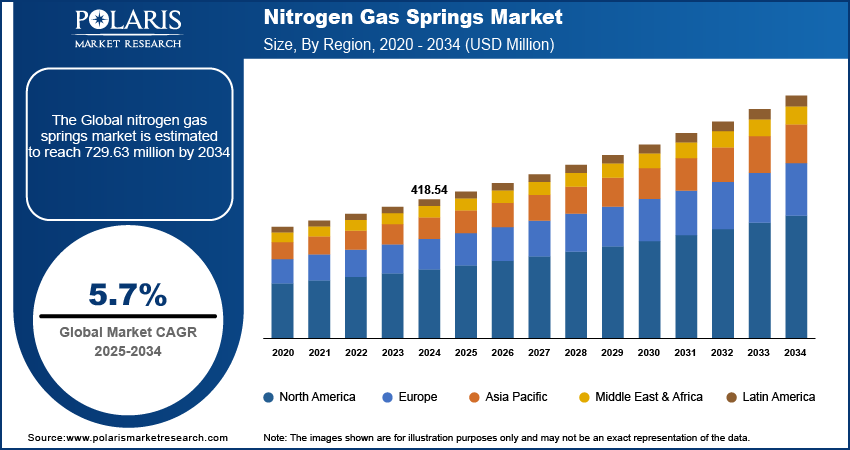

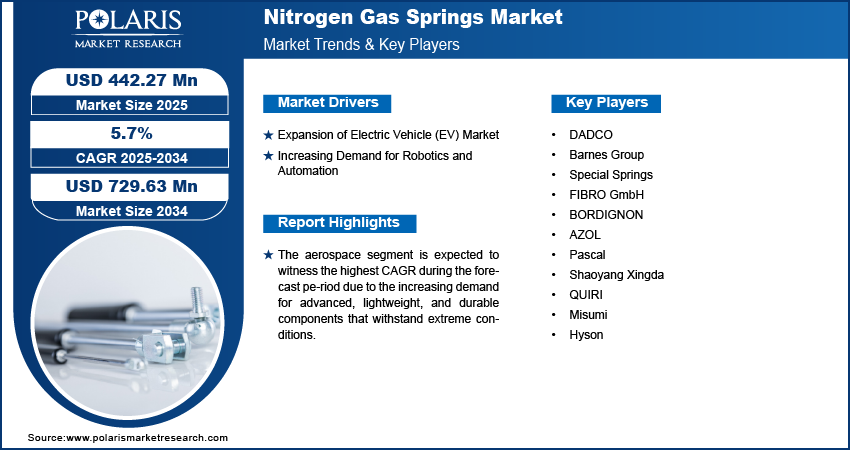

The nitrogen gas springs market size was valued at USD 418.54 million in 2024. The market is projected to grow from USD 442.27 million in 2025 to USD 729.63 million by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

Nitrogen gas springs are mechanical devices that use nitrogen gas to provide a spring-like force or resistance. Nitrogen gas springs consist of a sealed cylinder containing nitrogen gas, which is compressed when the spring is compressed or loaded. When the force is removed, the nitrogen gas expands, pushing the spring back to its original position. The growing demand for advanced suspension systems in industries such as automotive, aerospace, and heavy machinery is driving the adoption of nitrogen gas springs due to their consistent resistance and durability in varying conditions. Nitrogen gas springs are preferred over traditional metal springs for their compact and lightweight design, making them ideal for industries such as aerospace and automotive, where space and weight are critical. Advancements in materials science and spring design are improving the performance and cost-effectiveness of nitrogen gas springs, making them increasingly appealing to a wider range of industries, further fueling the nitrogen gas springs market expansion. Furthermore, nitrogen gas springs are gaining traction in medical equipment, including hospital beds, patient lifts, and diagnostic machinery, where precise control and reliability are essential for safe operation.

To Understand More About this Research: Request a Free Sample Report

Nitrogen Gas Springs Market Trend Analysis

Rising Sales of Electric Vehicles

The expansion of the electric vehicles (EV) market is significantly driving the demand for nitrogen gas springs, particularly in the development of specialized suspension and shock absorption systems. The US Energy Information Administration (EIA) reported that the electric vehicle (EV) market witnessed the sale of over 14 million units in 2023, increasing its market share from about 4% in 2020 to 18%. In Q1 2024, EV sales surged past 3 million units, marking a 25% growth compared to the same period last year. This reflects the growing consumer shift toward electric mobility. Nitrogen gas springs, providing adjustable force and consistent performance across a range of temperatures and conditions, are well-suited to meet the requirements of EV-specific suspension systems and shock absorbers. Nitrogen gas springs play a major role in enhancing drive quality, supporting heavier battery packs, and improving overall vehicle dynamics, which is increasingly critical in the design of high-performance electric vehicles. Thus, the rising EV sales boost the nitrogen gas springs market growth.

Increasing Demand for Robotics and Automation

Nitrogen gas springs are increasingly used in robotic arms, actuators, and other moving parts. In October 2024, ABB Robotics launched an Energy Efficiency Service that provides manufacturers with consultative and analytical tools to optimize robot energy use, potentially achieving savings of up to 30% in energy costs. This initiative targets the high energy costs affecting 58% of surveyed global manufacturers and aims to enhance their competitiveness. Advantages of nitrogen gas springs such as adjustable force, precise control, and smooth operation enhance performance and longevity, making them ideal for high-precision tasks in automated environments where reliability and efficiency are critical. Hence, rising demand for robotics and automation propels the nitrogen gas springs market expansion.

Nitrogen Gas Springs Market Segment Insights

Nitrogen Gas Springs Market Assessment by Type Outlook

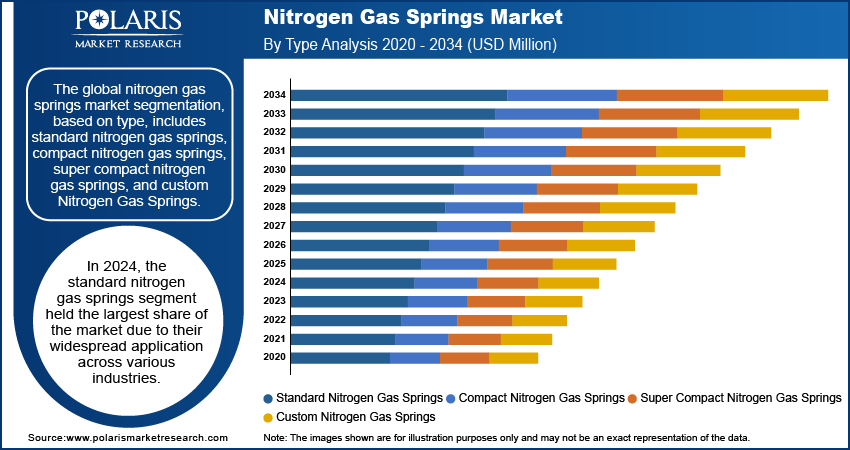

The global nitrogen gas springs market segmentation, based on type, includes standard nitrogen gas springs, compact nitrogen gas springs, super compact nitrogen gas springs, and custom nitrogen gas springs. In 2024, the standard nitrogen gas springs segment held the largest share of the market due to their widespread application across various industries. Standard nitrogen gas springs are favored for their versatility, durability, and cost-effectiveness in standard suspension systems, shock absorbers, and actuators. They are used in automotive, aerospace, and industrial machinery, where consistent resistance and performance in varying conditions are essential.

Nitrogen Gas Springs Market Evaluation by End Use Outlook

The global nitrogen gas springs market segmentation, based on end use, includes automotive, aerospace, industrial machinery, electronics, and others. The aerospace segment is expected to witness the highest CAGR during the forecast period due to the increasing demand for advanced, lightweight, and durable components that withstand extreme conditions. Additionally, the growth of the aerospace industry, driven by rising air travel and defense investments, is further fueling the demand for nitrogen gas springs. According to the IATA’s June 2024, the global airline industry reported a revenue increase from USD 838 billion in 2019 to USD 996 billion in 2024. This expansion reflects rising air travel demand and technology advancements, fueling the need for high-performance components such as nitrogen gas springs in aerospace applications.

Nitrogen Gas Springs Market Regional Outlook

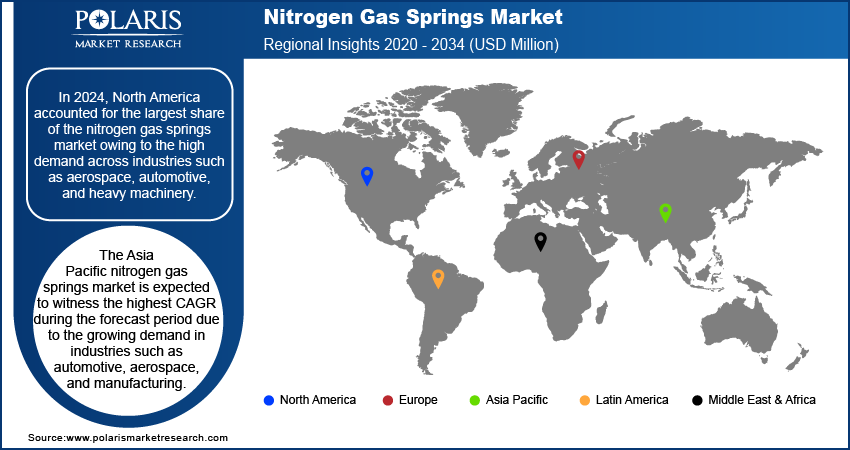

By region, the study provides nitrogen gas springs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the market, primarily driven by high demand across industries such as aerospace, automotive, and heavy machinery, all of which require reliable and durable spring components for critical applications. The region's robust aerospace sector, in particular, relies on nitrogen gas springs for shock absorption and precise motion control in aircraft systems. Additionally, North America’s focus on technological advancements and automation, along with substantial investments in R&D, enables manufacturers to innovate and adopt high-performance nitrogen gas springs across various applications. Further, the presence of major manufacturers in the region contributes to the supply stability and market dominance of North America in the global nitrogen gas springs market.

The US dominated the North America nitrogen gas springs market share in 2024. The US aerospace industry, led by companies such as Boeing and Lockheed Martin, relies heavily on nitrogen gas springs for critical applications requiring precise force control and durability under extreme conditions, which further propels market growth in the US.

The Asia Pacific nitrogen gas springs market is expected to witness the highest CAGR during the forecast period due to the growing demand in industries such as automotive, aerospace, and manufacturing, which is a major contributor. Additionally, the rapid industrialization across countries such as China, India, and Japan is accelerating the demand for advanced engineering solutions, further boosting the market. According to the National Bureau of Statistics of China, the Industrial Production Operation report for August 2024 shows industrial robots grew by 20.0% to 47,947 units, while power generation equipment increased by 43.4%, reaching 2,318 ten-thousand kilowatt-hours. Industries require high-performance components for precision machinery, suspension systems, and other applications, which are well-served by the unique properties of nitrogen gas springs. Thus, the Asia Pacific nitrogen gas springs market is expected to witness the highest growth in the coming years.

The China nitrogen gas springs market is expected to witness significant growth during the forecast period. Rising focus on technological advancements, automation, and environmental sustainability is boosting the adoption of nitrogen gas springs in the country, which offer better efficiency and eco-friendly benefits compared to traditional alternatives.

Nitrogen Gas Springs Market – Key Players and Competitive Analysis Report

The competitive landscape of the nitrogen gas springs market is characterized by a mix of established global players and emerging regional companies, each competing for market share through technological innovation, product differentiation, and strategic partnerships. Key players in the market focus on offering high-performance nitrogen gas springs that cater to industries such as automotive, aerospace, manufacturing, and heavy machinery. Major companies emphasize product reliability, sustainability, and customization to meet specific industry needs, which gives them a competitive edge.

Companies are increasingly investing in R&D to improve the efficiency and environmental sustainability of nitrogen gas springs, as well as exploring new applications in various sectors. Additionally, collaborations with original equipment manufacturers (OEMs) and Tier 1 suppliers are common strategies to strengthen market presence. The competitive rivalry is also influenced by factors such as cost-effectiveness, supply chain optimization, and the ability to meet rising demand for energy-efficient and eco-friendly solutions. A few key major players are DADCO, Barnes Group, Special Springs, FIBRO GmbH, BORDIGNON, AZOL, Pascal, Shaoyang Xingda, QUIRI, Misumi, and Hyson.

Barnes Group is engaged in the design, manufacturing, and sale of highly engineered products and solutions. The company provides a wide range of products, including precision springs, fasteners, and other critical components, serving industries such as aerospace, industrial, automotive, and healthcare. Barnes Group's offerings include compression springs; torsion springs; extension springs; and other specialized products such as nitrogen gas springs, dampers, and mounting hardware. The company is known for delivering innovative solutions that cater to diverse needs in industries requiring precision, reliability, and performance, and it operates a global network of manufacturing facilities to support its customers' requirements across multiple sectors.

Hyson, headquartered in Brecksville, Ohio, is an engineering and manufacturing company specializing in high-quality, safety-engineered force and motion control solutions. The company serves a broad range of industries, including automotive, aerospace, medical, steel production, and heavy industry. Hyson’s product offerings include nitrogen gas spring cylinders, accessories, manifold systems, hose systems, delay systems, high-speed stamping solutions, and others. Hyson’s nitrogen gas springs are used for various applications, from standard uses to heavy-duty, high-force, and contamination-resistant needs.

Key Companies in Nitrogen Gas Springs Market Outlook

- DADCO

- Barnes Group

- Special Springs

- FIBRO GmbH

- BORDIGNON

- AZOL

- Pascal

- Shaoyang Xingda

- QUIRI

- Misumi

- Hyson

Nitrogen Gas Springs Market Developments

In September 2024, FIBRO launched a new generation of gas springs. New gas springs featured several improvements, including enhanced load capacity and upgraded safety features.

In July 2022, Bordignon’s nitrogen gas springs achieved nearly double the speed of direct competitors in recent high-speed durability tests. Enhanced by nanotechnology, these springs exceeded 250 strokes per minute and speeds of 12.5 meters per minute, showcasing superior reliability and efficiency for high-speed applications compared to traditional wire springs.

Nitrogen Gas Springs Market Segmentation

By Type Outlook (Revenue, USD Million; 2020–2034)

- Standard Nitrogen Gas Springs

- Compact Nitrogen Gas Springs

- Super Compact Nitrogen Gas Springs

- Custom Nitrogen Gas Springs

By Material Outlook (Revenue, USD Million; 2020–2034)

- Steel Nitrogen Gas Springs

- Alloy Nitrogen Gas Springs

- Composite Nitrogen Gas Springs

By Function Outlook (Revenue, USD Million; 2020–2034)

- Compression Springs

- Tension Springs

- Others (Torsion Springs, etc.)

By End Use Outlook (Revenue, USD Million; 2020–2034)

- Automotive

- Aerospace

- Industrial Machinery

- Electronics

- Others (Medical Devices, Consumer Goods, etc.)

By Distribution Channel Outlook (Revenue, USD Million; 2020–2034)

- Direct Sales

- Distributors and Dealers

- Online

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nitrogen Gas Springs Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 418.54 million |

|

Market Size Value in 2025 |

USD 442.27 million |

|

Revenue Forecast by 2034 |

USD 729.63 million |

|

CAGR |

5.7% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global nitrogen gas springs market size was valued at USD 418.54 million in 2024 and is projected to grow to USD 729.63 million by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

In 2024, North America held the largest share of the market due to high demand across industries such as aerospace, automotive, and heavy machinery.

A few key players in the market are DADCO, Barnes Group, Special Springs, FIBRO GmbH, BORDIGNON, AZOL, Pascal, Shaoyang Xingda, QUIRI, Misumi, and Hyson.

In 2024, the standard nitrogen gas springs segment held the largest share of the market due to their widespread application across various industries.

The aerospace segment is expected to witness the highest CAGR during the forecast period due to the increasing demand for advanced, lightweight, and durable components that withstand extreme conditions.