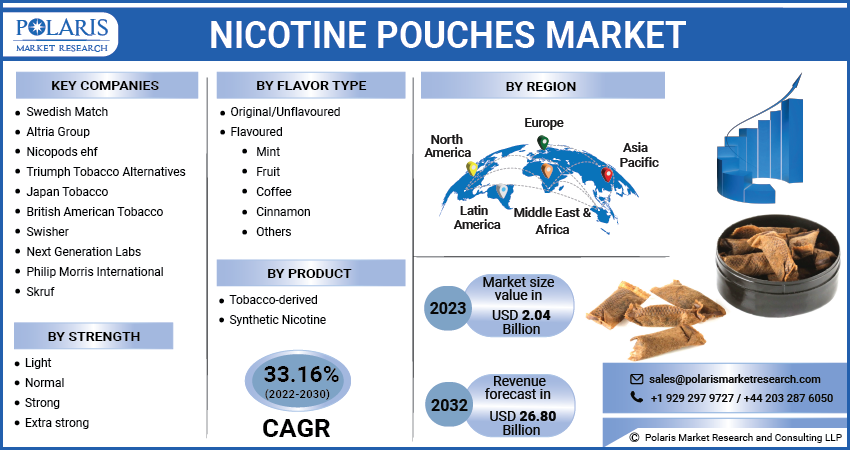

Nicotine Pouches Market Size, Share, Trends, Industry Analysis Report By Product (Tobacco-derived, Synthetic Nicotine), By Flavor Type, By Strength, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM3659

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

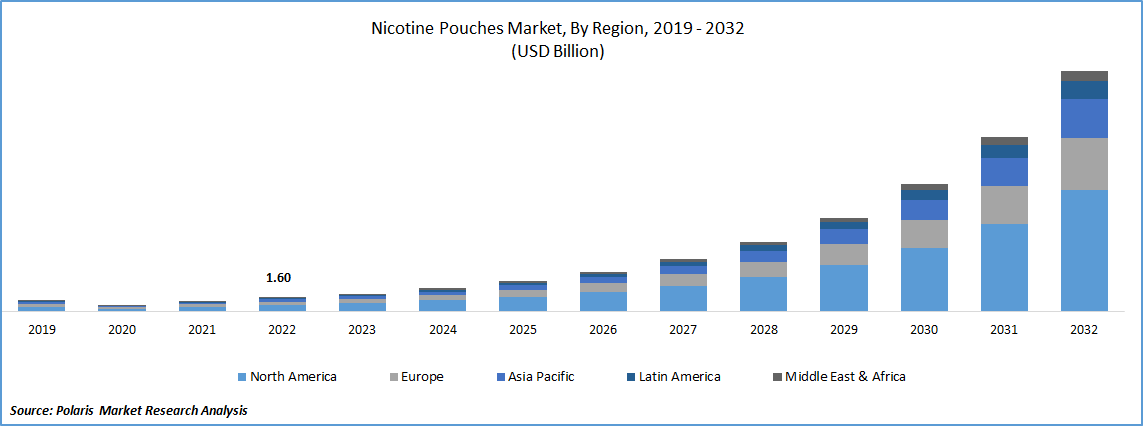

The nicotine pouches market was valued at USD 2.84 billion in 2024 and is expected to register a CAGR of 31.06% from 2025 to 2034. The growth is driven by rising demand for smoke-free alternatives, expansion of e-commerce and retail availability, introduction of various flavors and strengths, and the rising number of smokers.

Nicotine pouches are small, smokeless, tobacco-free products placed between the gum and lip to deliver nicotine. They are available in various flavors and strengths, offering an alternative to smoking or chewing tobacco.

Consumers are searching for safer alternatives as they become more aware of the health risks linked to smoking and chewing tobacco. Nicotine pouches offer a smokeless and tobacco-free option, making them attractive to users trying to quit or reduce their tobacco use. These pouches don't create smoke, ash, or strong odors, which makes them more acceptable in social and public settings. More users are turning to nicotine pouches as health organizations and governments continue campaigns against tobacco consumption, fueling the growth.

To Understand More About this Research: Request a Free Sample Report

Modern consumers often prefer products that fit easily into their busy lifestyles. Nicotine pouches are discreet and easy to use, as there is no need to light up or spit. This convenience allows users to enjoy nicotine in places, such as offices, public transport, and restaurants, where smoking is banned. The simple packaging and ease of disposal also appeal to users who want a mess-free and socially acceptable way to consume nicotine. This convenience factor is a major reason for the industry growth.

Industry Dynamics

Availability of Flavors and Strength

Companies operating in the nicotine pouch industry are offering the variety of flavors and strengths available. Unlike traditional tobacco products, these pouches come in mint, citrus, berry, coffee, and other unique flavors, which attract both new and experienced users. Companies further offer different nicotine strengths, letting users choose based on their comfort level. This wide selection makes nicotine pouches more appealing, especially to younger adults who are looking for personalized and enjoyable alternatives to smoking. The ability to tailor the experience helps expand the customer base, thereby driving the demand for nicotine pouches.

Rising Number of Smokers

The number of smokers is increasing due to population growth, urbanization, and lifestyle changes. According to the Center for Disease Control and Prevention, in the US alone, 49.2 million people were reported using tobacco products. The need for harm-reduction products such as nicotine pouches increases as smoking rates rise. These pouches offer a cleaner, smoke-free alternative, which can appeal to smokers looking to switch to a less harmful option. Additionally, as awareness of smoking-related health risks spreads, even in emerging regions, smokers seek safer nicotine options. This growing base of smokers presents a large opportunity for nicotine pouch brands to enter new regions and expand their presence, thereby driving the growth.

Segmental Insights

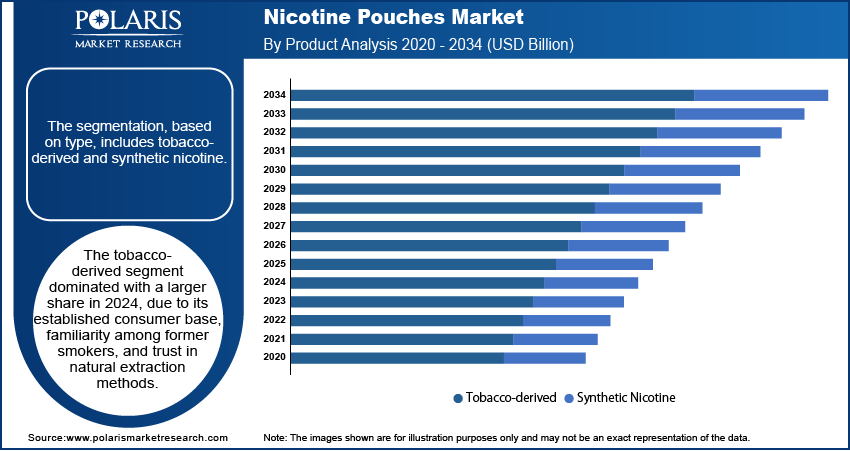

Product Analysis

The segmentation, based on type, includes tobacco-derived and synthetic nicotine. The tobacco-derived segment dominated with a larger share in 2024, due to its established consumer base, familiarity among former smokers, and trust in natural extraction methods. Tobacco-derived nicotine pouches benefit from robust distribution networks, consistent product quality, and regulatory clarity in many regions. Their association with well-known brands adds to consumer confidence, while their effectiveness in aiding smoking cessation boosts adoption. Additionally, traditional users prefer the natural origin of tobacco-derived nicotine, seeing it as a more authentic experience. Long-standing usage patterns, coupled with marketing support from legacy tobacco companies, drive the segment growth.

The synthetic nicotine segment is expected to witness significant growth during the forecast period, due to rising demand for tobacco-free alternatives, particularly among health-conscious and younger consumers. These pouches appeal to users seeking clean-label, plant-free options with consistent nicotine levels. Their increasing popularity is supported by innovation in formulation, flexible branding, and fewer restrictions in some regulatory environments. Synthetic variants are perceived as modern, safer choices that align with wellness trends as awareness grows. Convenient online availability, social media marketing, and flavor variety further improve visibility and adoption, thereby driving the segment growth.

By Flavor Type Analysis

The segmentation, based on flavor type, includes original/unflavored and flavored. The original/unflavored segment dominated with a larger share in 2024, due to its simplicity, minimalism, and appeal to users focused solely on nicotine delivery. Original/unflavored nicotine is favored by individuals seeking a pure experience without flavor distractions, especially among users transitioning from traditional tobacco. The straightforward formulation is seen as cleaner and more purpose-driven, making it popular among health-focused users. Their regulatory ease, as they avoid restrictions tied to flavored products, supports broader access. Moreover, unflavored pouches are commonly used in professional settings where discreet and odorless usage is important, further increasing their preference.

By Strength Analysis

The segmentation, based on strength, includes light, normal, strong, and extra strong. The strong segment is expected to record the fastest growth due to increasing demand from experienced users seeking higher nicotine satisfaction. These products deliver faster and more intense effects, making them ideal for heavy smokers or those with higher tolerance levels. Their popularity is driven by the need for effective smoking alternatives that replicate the strength of traditional tobacco. Strong variants also cater to consumers seeking for quick relief from cravings, enhancing their appeal in stress-prone environments. Consumers gain more personalized choices as brands diversify offerings based on strength, which fuels the segment growth.

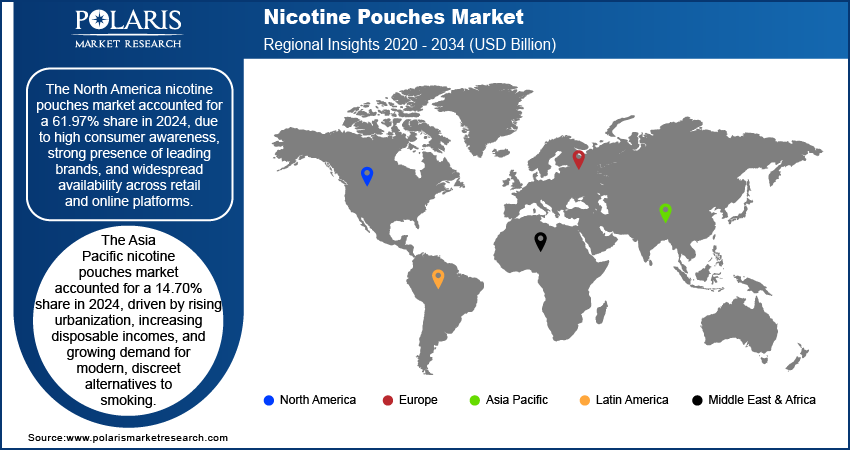

Regional Analysis

North America Nicotine Pouches Market Trends

The North America market accounted for a 61.97% share in 2024, due to high consumer awareness, strong presence of leading brands, and widespread availability across retail and online retail platforms. Supportive regulatory frameworks and growing acceptance of smokeless tobacco products encourage consumer adoption. The region benefits from a well-developed tobacco industry that’s rapidly embracing innovation. Increasing demand for convenient, discreet, and odorless nicotine delivery fuels consistent growth. Marketing campaigns, product variety, and rising interest in harm-reduction solutions further play a major role. Moreover, a health-conscious population and advanced distribution channels drive the industry growth in North America.

US Nicotine Pouches Market Assessment

The US market accounted for 81.16% of regional share due to strong consumer demand for tobacco-free and smoke-free alternatives. The industry is expanding quickly with a rise in flavored and synthetic options catering to younger, tech-savvy users. High awareness, innovative branding, and the presence of major industry players support rapid growth. Retail expansion, e-commerce accessibility, and growing interest in wellness-focused products are key drivers. Government efforts to reduce smoking have further encouraged shifts toward modern oral nicotine products, thereby driving the growth.

Asia Pacific Nicotine Pouches Market Overview

The Asia Pacific market accounted for 14.70% share in 2024, driven by rising urbanization, increasing disposable incomes, and growing demand for modern, discreet alternatives to smoking. Younger consumers in countries such as India, South Korea, and Australia are showing interest in innovative nicotine formats. Expanding awareness through digital marketing, health-focused choices, and international brand entry are fueling growth. The region’s large population base and rapid shift in lifestyle habits support long-term growth. Technological advancements and retail modernization contribute to easier access and higher adoption, thereby driving the growth of industry in region.

Japan Nicotine Pouches Market Insights

The Japan market is expected to experience significant growth during the forecast period, due to its openness to smokeless innovations and early adoption of reduced-risk products. Consumers favor discreet and clean options, making nicotine pouches an attractive choice. The country’s tech-forward culture and strong interest in wellness trends support this growth. Urban consumers are particularly drawn to the convenience and minimal odor of pouches. Growth is further driven by existing familiarity with non-combustible nicotine delivery systems, which eases market entry for new products, thereby driving the growth.

Europe Nicotine Pouches Market in Overview

The Europe market accounted for 17.43% share in 2024, driven by strong demand for smoke-free alternatives and increasing awareness about harm reduction. The region benefits from favorable consumer attitudes toward tobacco alternatives, along with widespread acceptance of modern oral products. Scandinavian countries, especially Sweden, have played a major role in popularizing nicotine pouches. Continued innovation, a variety of strengths and flavors, and support from public health initiatives encourage growth. Retail and e-commerce networks are well-developed, improving access across urban and rural areas and thereby driving the regional market growth.

Germany Nicotine Pouches Market Outlook

The Germany nicotine pouches market is expected to experience significant growth during the forecast period, due to rising demand for tobacco-free nicotine solutions and increasing consumer preference for cleaner, odorless options. Younger adults and former smokers are driving adoption, attracted by the convenience and discretion of pouches. The industry benefits from strong brand presence, innovative product offerings, and growing availability in retail and digital channels. Public focus on wellness and reduced-risk alternatives is further driving the demand. Ongoing consumer education and product visibility through marketing campaigns contribute to the rapid uptake of this products, thereby driving the growth.

Key Players and Competitive Analysis

The nicotine pouches market features a competitive landscape, driven by innovation, branding, and global expansion. Key players such as Altria Group, British American Tobacco, and Japan Tobacco International leverage strong distribution networks and established consumer trust. NIQO Co. (Swedish Match AB) and Skruf Snus AB lead in Scandinavia with diverse product portfolios. Companies such as Black Buffalo Inc. and Nicopods ehf. focus on niche markets and tobacco-free formulations. GN Tobacco, Swisher International, and SnusCentral cater to varied preferences across regions. New entrants and specialized brands, such as Tobacco Concept Factory, drive competition through flavor innovation, strength options, and targeted marketing.

Key Players

- Altria Group, Inc.

- Black Buffalo Inc.

- British American Tobacco

- GN Tobacco Sweden AB

- Japan Tobacco International

- Nicopods ehf.

- NIQO Co. (Swedish Match AB)

- Skruf Snus AB

- SnusCentral

- Swisher International Inc.

- Tobacco Concept Factory

Industry Developments

April 2025: Emplicure launched its innovative KLAR nicotine pouches in the UK. Unlike traditional cellulose-based pouches, KLAR uses a bioceramic-based powder for controlled nicotine and flavor release. It is available in mint and citrus flavors with strengths of 3mg, 6mg, and 9mg. The product is available in 700 UK retail stores and online via Haypp.com, with further international expansion planned.

February 2025: Nic Pouches launched its new UK-based online store, offering over 300 high-quality nicotine pouch products. The platform provided adult consumers with access to a wide selection of brands such as ZYN, Velo, Killa, and Pablo in various flavors and strengths.

Nicotine Pouches Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Tobacco-derived

- Synthetic Nicotine

By Flavor Type Outlook (Revenue, USD Billion, 2020–2034)

- Original/Unflavored

- Flavored

- Mint

- Fruit

- Coffee

- Cinnamon

- Others

By Strength Outlook (Revenue, USD Billion, 2020–2034)

- Light

- Normal

- Strong

- Extra strong

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nicotine Pouches Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.84 Billion |

|

Market Size in 2025 |

USD 3.54 Billion |

|

Revenue Forecast by 2034 |

USD 40.39 Billion |

|

CAGR |

31.06% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regions Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.84 billion in 2024 and is projected to grow to USD 40.39 billion by 2034.

The market is projected to register a CAGR of 31.06% during the forecast period.

North America dominated the nicotine pouches market share in 2024.

A few of the key players in the market are Altria Group, Inc.; Black Buffalo Inc.; British American Tobacco; GN Tobacco Sweden AB; Japan Tobacco International; Nicopods ehf.; NIQO Co. (Swedish Match AB); Skruf Snus AB; SnusCentral; Swisher International Inc.; and Tobacco Concept Factory.

The tobacco derived segment dominated the market share in 2024.

The strong segment is expected to witness the fastest growth during the forecast period.