Next Generation Sequencing Market Share, Size, Trends, Industry Analysis Report, By Application; By Technology; By Product; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1100

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

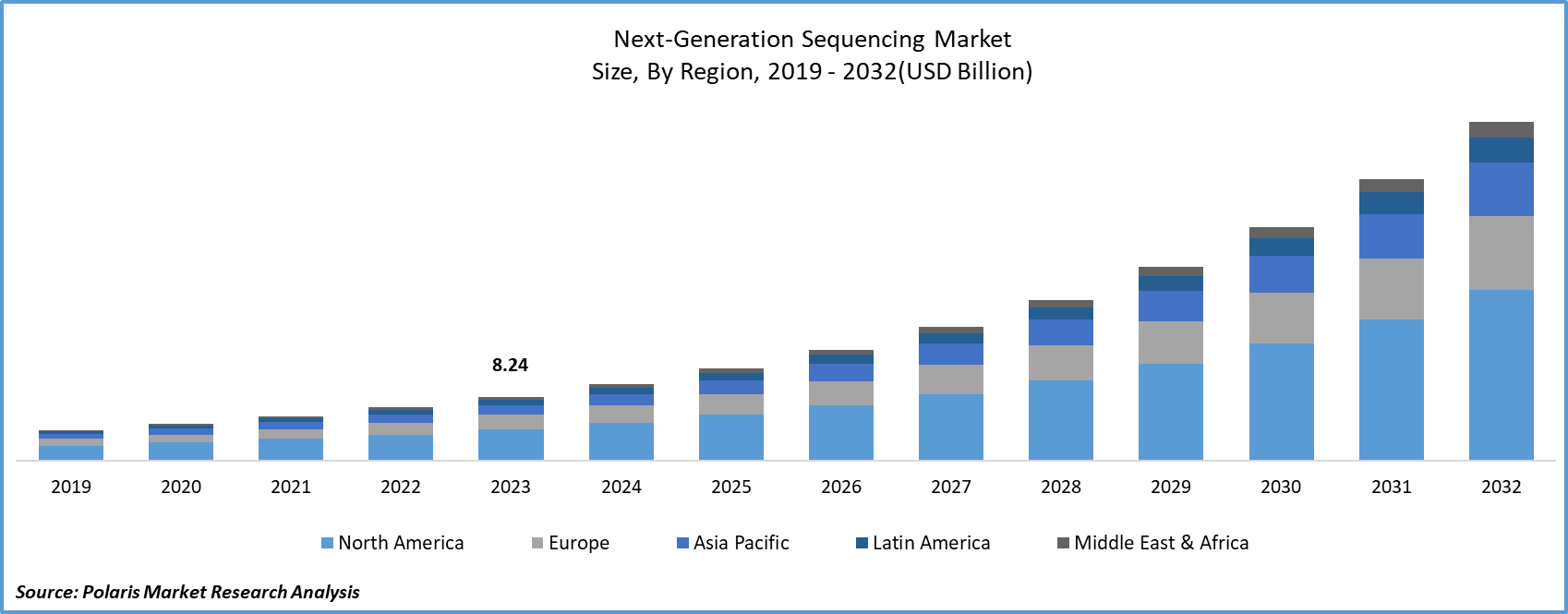

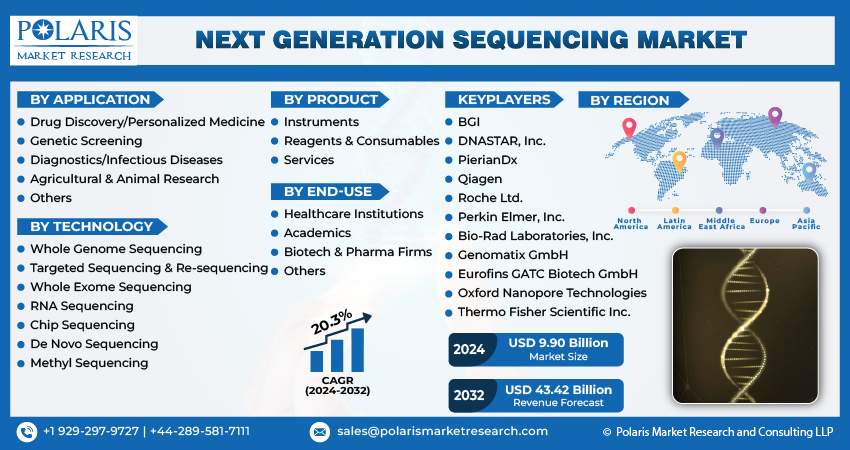

Global Next-Generation Sequencing Market Size was valued at USD 8.24 Billion in 2023. The Next-Generation Sequencing Industry is projected to grow from USD 9.90 Billion in 2024 to USD 43.42 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 20.3% during the forecast period (2024 - 2032).

The increasing prevalence of cancer and genetic disorders is driving the market for next-generation sequencing. For instance, according to WHO, in 2022, an estimated 20 million new cancer cases and 9.7 million cancer-related deaths were reported. It is estimated that 53.5 million people were living within five years of being diagnosed with cancer. Around 1 in 5 individuals will develop cancer at some point in their lives, with approximately 1 in 9 men and 1 in 12 women. Further, the rising use of next-generation sequencing technology in research and clinical applications is also driving the future demand and outlook of the next-generation sequencing market.

The growing application of NGS in clinical diagnostics, oncology, reproductive health, and infectious disease management further propels next-generation sequencing market market growth. In reproductive health, NGS is employed in preimplantation genetic testing and prenatal screening, providing valuable information about genetic conditions that could affect embryos or fetuses. This application helps in making informed decisions regarding family planning and managing potential hereditary diseases.

To Understand More About this Research: Request a Free Sample Report

Next-Generation Sequencing Market Trends

Improvements In The Sequencing Technologies is Driving The Market Growth

Market CAGR for next-generation sequencing is being driven by the improvements in the sequencing technologies in the forecasted period. NGS, which includes advanced techniques such as whole-genome sequencing, exome sequencing, and targeted sequencing, has revolutionized the field of genomics by enabling the rapid and cost-effective analysis of genetic material. For example, In the medical field, NGS is instrumental in identifying genetic mutations associated with diseases, enabling early diagnosis and personalized treatment plans. It is also pivotal in cancer research, where it helps in understanding the genetic basis of different cancers, leading to the development of targeted therapies. Additionally, NGS plays a crucial role in detecting rare genetic disorders, prenatal screening, and tracking infectious disease outbreaks by analyzing pathogen genomes.

Increasing Utilization Of Next-Generation Sequencing Technology by A Pharmaceutical and Biopharmaceutical Companies

Pharmaceutical and biopharmaceutical companies are leveraging NGS for a variety of applications, including the identification of genetic mutations, the understanding of disease mechanisms, and the development of targeted therapies driving the next-generation sequencing market. NGS provides a detailed view of the genetic underpinnings of diseases, facilitating the creation of more effective and personalized treatment plans. For example, in cancer research, NGS is used to identify specific genetic alterations in tumors, allowing for the development of targeted therapies that are tailored to the genetic profile of individual patients. Recent advancements in NGS technology have further propelled its adoption, such as improvements in sequencing accuracy, speed, and cost-effectiveness for a broader range of applications. Additionally, the integration of artificial intelligence and machine learning with NGS is enhancing data analysis and interpretation, leading to more robust and insightful findings driving next-generation sequencing market revenue. For instance, in 2023, Illumina launched the NovaSeq X Series, which promises to deliver higher throughput and lower sequencing costs, making NGS more scalable and affordable for large-scale projects.

Next-Generation Sequencing Market Segment Insights

Next-Generation Sequencing Application Insights

The global Next-Generation Sequencing Market segmentation, based on application, includes drug discovery/personalized medicine, genetic screening, diagnostics/infectious diseases, agricultural & animal research, and others. In 2023, the diagnostics/infectious diseases segment dominated the market, owing to an advancement in liquid biopsies in the diagnosis of cancer and the rise of COVID-19 disease across the world. The next-generation sequencing-based liquid biopsy utilizes a circulation tumor DNA as a cancer biomarker for a real-time diagnosis of cancer.

Furthermore, next-generation sequencing provides exceptional sensitivity with low error rates when diagnosing low-level circulating tumor DNA (ctDNA) in the bloodstream. For instance, Fulgent Genetics, Inc., a company specializing in next-generation sequencing services based in the United States, unveiled a COVID-19 test based on next-generation sequencing technology in March 2020.

Next-Generation Sequencing Product Insights

The global Next-Generation Sequencing Market segmentation, based on product, includes healthcare institutions, academics, biotech & pharma firms, and others. The instruments category holds the largest market share during the forecast period due to providing accurate and reliable genetic information in clinical diagnosis and illness treatment, highlighting a significant demand for advanced sequencing equipment. Continuous technological advancements have resulted in the development of high-throughput sequencing tools, allowing for faster and more efficient DNA and RNA sequencing.

On the other hand, the services segment is anticipated to witness the fastest growth throughout the forecast period. As the demand for data analysis and interpretation services grows, these services are becoming more crucial for understanding complex genetic information. The ability of researchers and healthcare professionals to access and analyze vast amounts of genetic data, facilitated by the availability of cloud-based computing systems, is attributed to the increase in next-generation sequencing market demand.

Global Next-Gen Sequencing Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Next-Generation Sequencing Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. North America held the largest market share in the next-generation sequencing market in 2023. Several factors contribute to the widespread adoption of next-generation sequencing technologies in the region. These include a well-established healthcare infrastructure, an increasing prevalence of chronic diseases, and government funding for genomics research. Also, the presence of key market players in the region, as well as easy access to advanced genomic research technology, are anticipated to drive the growth of the next-generation sequencing market in the region.

Further, In North America, the U.S. is expected to dominate the market in 2023, propelled by advancements in genomic research, decreasing costs of sequencing technologies, and the increasing application of NGS in personalized medicine. NGS's ability to provide comprehensive insights into genetic variations and mutations is revolutionizing diagnostics, particularly in oncology, where it enables precise tumor profiling and targeted therapies. Additionally, the rise in research activities related to genetic disorders, infectious diseases, and pharmacogenomics is further fueling the next-gen sequencing market industry outlook.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

GLOBAL NEXT-GENERATION SEQUENCING MARKET, REGIONAL COVERAGE, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The Asia Pacific region is expected to witness the fastest growth in the next-generation sequencing market during anticipated years due to increased investments in research and development activities, the surging prevalence of chronic diseases, and government funding for genomics research. The availability of advanced genomics technologies and the presence of key players in the region are also expected to drive the growth of the next-generation sequencing market regional revenue forecast.

Next-Generation Sequencing Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Next-Generation Sequencing Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Next-Generation Sequencing industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Next-Generation Sequencing industry to benefit clients and increase the market sector. In recent years, the Next-Generation Sequencing industry has offered some technological advancements. Major players in the Next-Generation Sequencing Market, including BGI, Bio-Rad Laboratories, Inc., DNASTAR, Inc., Eurofins GATC Biotech GmbH, Genomatix GmbH, Oxford Nanopore Technologies, Perkin Elmer, Inc., PierianDx, Qiagen, Invitae Corporation, Roche Ltd., Thermo Fisher Scientific Inc., and Illumina Inc.

Qiagen is a global provider of sample and assay technologies for molecular diagnostics, applied testing, academic and pharmaceutical research. Founded in 1984 and headquartered in Hilden, Germany, Qiagen specializes in offering a comprehensive range of products and services that enable the extraction, purification, and analysis of DNA, RNA, and proteins. In January 2023, QIAGEN has partnered with Helix, a prominent population genomics company based in California, aimed at progressing the development of next-generation sequencing companion diagnostics for hereditary diseases.

Illumina Inc. is a biotechnology company specializing in the development and commercialization of advanced sequencing and array-based solutions for genetic and genomic analysis. Illumina's product portfolio includes a range of sequencing systems, genotyping arrays, and informatics solutions designed to support various applications, from basic research and clinical diagnostics to agricultural genomics and consumer genomics. The company is known for its high-throughput sequencing platforms, such as the NovaSeq, NextSeq, and MiSeq systems, which offer scalable solutions for diverse sequencing needs. In September 2022, Illumina Inc. has launched the NovaSeq X Series (including the NovaSeq X and NovaSeq X Plus), innovative next-generation sequencers developed to improve sequencing speed, capability, and sustainability on a larger production scale.

Key Companies in the Next-Generation Sequencing Market include

- BGI

- Bio-Rad Laboratories, Inc.

- DNASTAR, Inc.

- Eurofins GATC Biotech GmbH

- Genomatix GmbH

- Illumina Inc.

- Invitae Corporation

- Oxford Nanopore Technologies

- Perkin Elmer, Inc.

- PierianDx

- Qiagen

- Roche Ltd.

- Thermo Fisher Scientific Inc.

Next-Generation Sequencing Industry Developments

- March 2022: Thermo Fisher Scientific has launched the Ion Torrent Genexus Dx Integrated Sequencer, a CE-IVD-marked next-generation sequencing (NGS) platform. This automated system can deliver results in a single day.

- February 2022: Invitae Corporation introduced LiquidPlex Dx and FusionPlex Dx in Europe. These tools facilitate genomic profiling and companion diagnostics for solid tumor neoplasms. They are compatible with Illumina's Next Generation Sequencing platforms for in vitro diagnostic (IVD) testing.

- February 2022: Agilent Technologies, Inc. collaborated with Element Biosciences, Inc. to integrate Element Biosciences' AVITI System with Agilent's SureSelect target enrichment panels. This partnership aims to improve customer access to genomic tools.

Next-Generation Sequencing Market Segmentation

Next-Generation Sequencing Application Outlook

- Drug Discovery/Personalized Medicine

- Genetic Screening

- Diagnostics/Infectious Diseases

- Agricultural & Animal Research

- Others

Next-Generation Sequencing Technology Outlook

- Whole Genome Sequencing

- Targeted Sequencing & Re-sequencing

- Whole Exome Sequencing

- RNA Sequencing

- Chip Sequencing

- De Novo Sequencing

- Methyl Sequencing

Next-Generation Sequencing, Product Outlook

- Instruments

- Reagents & Consumables

- Services

Next-Generation Sequencing End-Use Outlook

- Healthcare Institutions

- Academics

- Biotech & Pharma Firms

- Others

Next-Generation Sequencing Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Next-Generation Sequencing Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 8.24 billion |

|

Market size value in 2024 |

USD 9.90 billion |

|

Revenue Forecast in 2032 |

USD 43.42 billion |

|

CAGR |

20.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Next-Gen Sequencing Market size was valued at USD 8.24 Billion in 2023.

The global market is projected to grow at a CAGR of 20.3% during the forecast period, 2023-2032

North America had the largest share in the global market

The key players in the market are BGI, Bio-Rad Laboratories, Inc., DNASTAR, Inc., Eurofins GATC Biotech GmbH, Genomatix GmbH, Oxford Nanopore Technologies, Perkin Elmer, Inc., PierianDx, Qiagen, Invitae Corporation, Roche Ltd., Thermo Fisher Scientific Inc., and Illumina Inc.

The diagnostics/infectious diseases category dominated the market in 2023

The instruments had the largest share in the global market