Neuromorphic Computing Market Size, Share, Trends, Industry Analysis Report: By Component, By Deployment (Edge and Cloud), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM3061

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

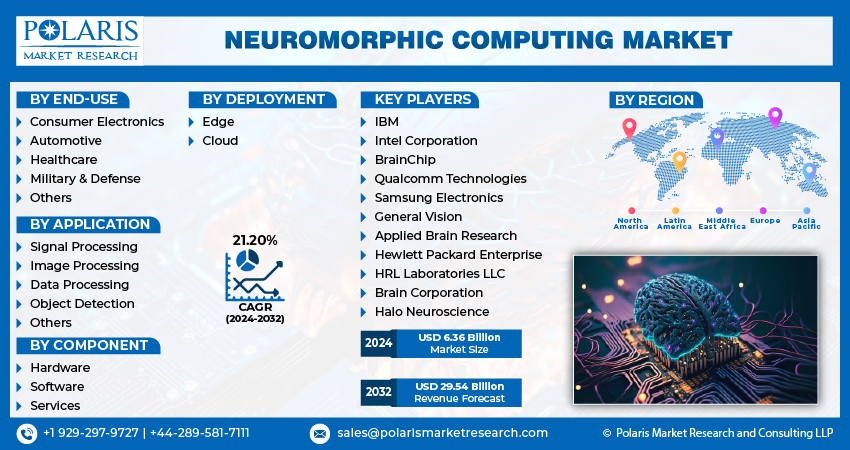

The neuromorphic computing market size was valued at USD 6.06 billion in 2024. It is projected to grow from USD 7.24 billion in 2025 to USD 37.18 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 19.9% during 2025–2034.

Neuromorphic computing is a technology that mimics the structure and functioning of the human brain to process information more efficiently, using spiking neural networks and specialized hardware. It aims to enhance computing power, energy efficiency, and speed, particularly for tasks such as artificial intelligence and machine learning.

Global energy consumption is rising, due to which the demand for energy-efficient computing systems is increasing. Traditional computers require substantial power, especially when dealing with large AI workloads or performing complex calculations. According to a report from the University College of London, Neuromorphic computers are estimated to consume 100,000 times less power than conventional computers. Neuromorphic computing provides a solution by mimicking the brain’s neural architecture, substantially lowering energy consumption during data processing. This technology is majorly used for industries aiming to reduce energy use and carbon footprints, particularly in areas such as data science platform, AI research, and mobile applications. The need for energy-efficient systems is growing as the focus on sustainability is increasing, thereby driving market growth.

To Understand More About this Research: Request a Free Sample Report

Traditional computing systems have certain limitations in speed and energy efficiency. The separation between the processing unit and memory results in delays and energy inefficiencies as data moves back and forth. The growing computational demands in areas such as AI and big data processing highlight these constraints of traditional computing. Neuromorphic computing tackles these challenges by integrating processing and memory into a single unit, which eliminates bottlenecks and boosts performance. This, in turn, is driving demand for neuromorphic computing in areas such as AI and big data processing, thereby driving market growth.

Market Dynamics

Expanding Use of IoT and Edge Computing

The use of the Internet of Things (IoT) and edge computing is rising, which has created new neuromorphic computing market opportunities. IoT devices, such as smart sensors and autonomous cars, often need to process data locally in real time without relying on cloud computing. Neuromorphic systems are ideal for these applications, as they can perform complex tasks efficiently while consuming minimal power. Neuromorphic chips allow these devices to make decisions and react instantly by mimicking how the brain processes information, which is crucial for applications such as smart homes, robotics, and autonomous vehicles. Additionally, the rise in the deployment of IoT technologies in smart homes, robotics, and autonomous vehicles is driving the need for neuromorphic computing. According to the Autonomous Vehicle Industry Association, AVIA reported that more than 44 million autonomous miles are driven by autonomous vehicles in the US alone. The growth of IoT and edge computing is fueling the demand for neuromorphic solutions.

Rising Demand for AI in Business Operations

The demand for artificial intelligence and deep learning in applications such as computer vision, natural language processing, and data refining is propelling the demand for neuromorphic computing. To meet this rising demand, major players in the market are launching products to enable more scalable and sustainable AI. For instance, in April 2024, Intel built the world’s largest neuromorphic system to enable more sustainable AI with the industry’s first 1.15 billion neurons neuromorphic system. Such product launches are driving the appeal of neuromorphic computing to the consumer who wants to integrate AI into business operations, thereby driving the growth of the market.

Segment Analysis

Market Assessment by Component

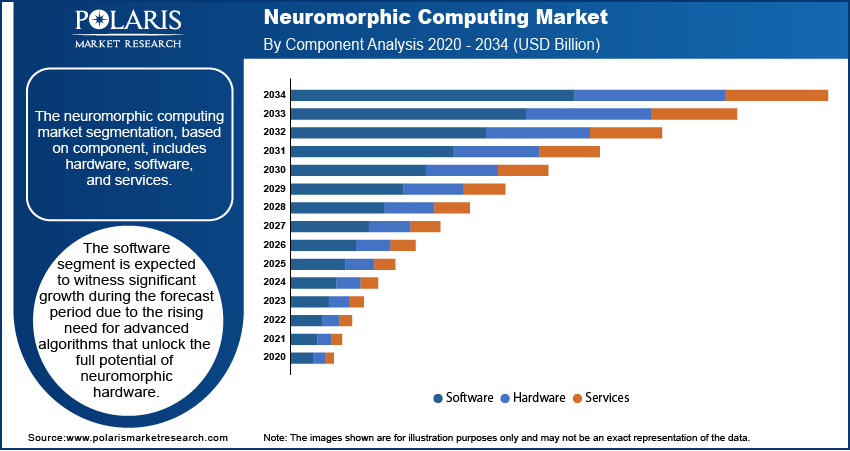

The neuromorphic computing market segmentation, based on component, includes hardware, software, and services. The software segment is expected to witness significant growth during the forecast period due to rising need for advanced algorithms that unlock the full potential of neuromorphic hardware. Industries adopting brain-inspired computing increasingly require software capable of supporting real-time learning, adaptive behavior, and efficient data handling. Developers are working on building flexible and scalable platforms to cater to evolving hardware needs. Growing adoption across sectors and continuous innovation are expected to accelerate the segment growth during the forecast period.

Market Evaluation by End Use

The market segmentation, based on end use, includes consumer electronics, automotive, healthcare, military & defense, and others. The consumer electronics segment dominated the neuromorphic computing market share in 2024 due to rising demand for smarter, faster, and more energy-efficient devices such as smartphones, wearable tech, and smart home systems. Neuromorphic chips improve performance while consuming less power, making them ideal for everyday electronics. Manufacturers are increasingly integrating these brain-inspired technologies to enable real-time learning and improved user experiences, thereby driving segmental growth.

Regional Insights

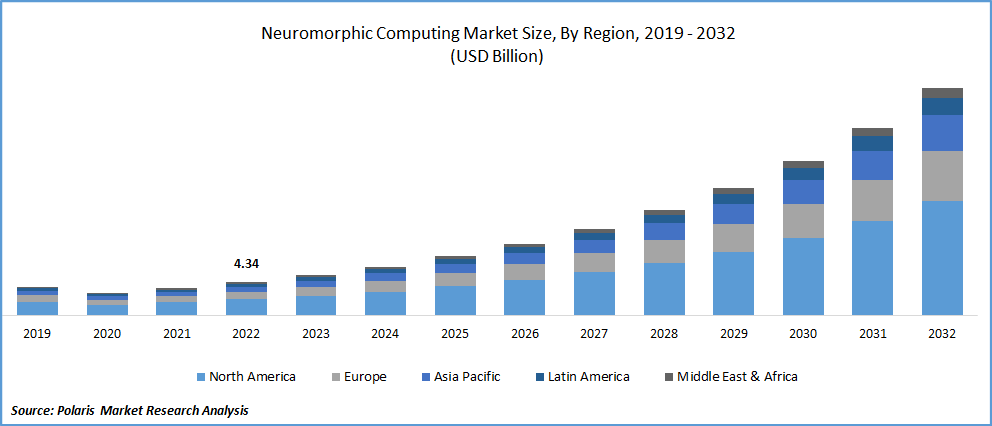

The study provides the neuromorphic computing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its strong research infrastructure and early adoption of advanced technologies. The US is home to major tech giants such as IBM, HP, and Intel, which are actively investing in brain-inspired computing for AI, defense, and robotics. Supportive government initiatives, high R&D spending, and a growing demand for smarter, energy-efficient AI systems contribute to the industry growth in the region.

Asia Pacific is expected to record the highest CAGR during the forecast period due to increasing investments in AI and semiconductor development. Countries such as China, Japan, and South Korea are focusing on neuromorphic research for smart manufacturing, autonomous systems, and consumer electronics. The region benefits from a strong electronics manufacturing base and government-led initiatives supporting AI innovation. Educational institutions and startups are also exploring neuromorphic computing for real-world applications. Asia Pacific is expected to witness rapid growth as demand for efficient computing solutions rises.

The Indian neuromorphic computing demand is growing rapidly, driven by growing interest in AI and brain-inspired technologies. Research institutions and startups are exploring neuromorphic systems for applications in healthcare, robotics, and smart infrastructure. Increasing government support for AI, digital transformation, and Make-in-India initiatives is encouraging domestic development. Collaborations with international tech companies and academic research are helping to build expertise in this field, thereby driving market growth.

Key Players and Competitive Analysis

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market includes International Business Machines Corporation (IBM); Intel Corporation; BrainChip; Qualcomm Technologies; Samsung Electronics; General Vision; Applied Brain Research; Hewlett Packard Enterprise; HRL Laboratories, LLC; and Synsense.

International Business Machines Corporation (IBM) is an American multinational technology company headquartered in Armonk, New York. Established in 1911 and renamed IBM in 1924, the company operates in over 175 countries. It has a long history of research and development, holding the record for the most US patents granted to a business for nearly three decades. IBM’s operations are divided into five main segments. The global technology services (GTS) segment, which accounts for over one-third of the company’s revenue, provides IT infrastructure, cloud services, and outsourcing. The global business services (GBS) segment offers consulting and application management services. The systems & technology segment includes mainframe computers, power systems, storage solutions, and quantum computing products. The software segment delivers solutions in artificial intelligence, cloud computing, data analytics, cybersecurity, and blockchain, supporting hybrid cloud environments with products such as IBM Storage Fusion. The global financing segment offers financing and asset management services to clients and operates in more than 55 countries. IBM’s global presence includes operations in more than 170 countries and 19 research facilities. Its cloud data centers are located across several regions such as North America (US), Europe (Germany, UK, Italy, Norway, and France), Asia Pacific (India, Australia, Hong Kong, China, South Korea, Singapore, and Japan), and South America (Brazil). IBM’s Neuromorphic Computing project develops brain-inspired, energy-efficient hardware and algorithms to optimize next-generation AI’s learning and computational efficiency, addressing scalability and sustainability challenges in advanced cognitive applications.

Intel Corporation, an American multinational technology company, is engaged in the design and manufacturing of computer processors, chipsets, and various semiconductor components. Intel produces various products and services, including microprocessors, system-on-chip (SoC) products, chipsets, and memory and storage solutions. The company's processors are used in multiple devices, from personal computers and laptops to servers and data centers. Intel's chipsets connect processors and other components, while its memory and storage solutions include solid-state drives (SSDs) and other storage devices. In addition to its hardware products, Intel also offers a range of software and services. These include software development tools, operating systems, and security solutions. Intel also provides consulting and support services to help customers optimize their computing systems and applications. The company invests heavily in R&D to develop new technologies and improve its products. The company has also been at the forefront of several key technological advances in the industry, including developing the first microprocessor and introducing the x86 architecture, which has become the standard for most personal computers. It has also significantly contributed to advancing artificial intelligence and deep learning. The company has developed several specialized processors specifically designed for AI applications, such as the Intel Movidius Neural Compute Stick and the Intel Nervana Neural Network Processor. Intel has also invested in AI startups and has collaborated with universities and research institutions to advance the field of AI. Intel’s neuromorphic computing initiative, featuring Hala Point and Loihi 2 processors, delivers brain-inspired, energy-efficient AI hardware and software, enabling scalable, adaptive, and sustainable AI for advanced research and real-world applications.

List of Key Companies in Neuromorphic Computing Market

- Applied Brain Research

- BrainChip

- General Vision

- Hewlett Packard Enterprise

- HRL Laboratories, LLC

- Intel Corporation

- International Business Machines Corporation (IBM)

- Qualcomm Technologies

- Samsung Electronics

- SynSense

Neuromorphic Computing Industry Developments

In April 2024, Intel launched the world’s largest neuromorphic system, Hala Point. Built using 1,152 Loihi 2 processors, it was designed to advance brain-inspired AI research, supporting sustainable and efficient deep learning capabilities.

In November 2024, VDE launched neuromorphic computing new SPEC. It standardized terms and developed an NMC layer model to bridge the gap between research and practical application, aiming to accelerate the development of energy-efficient AI technologies.

Neuromorphic Computing Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Deployment Outlook (Revenue USD Billion, 2020–2034)

- Edge

- Cloud

By Application Outlook (Revenue USD Billion, 2020–2034)

- Signal Processing

- Image Processing

- Data Processing

- Object Detection

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Consumer Electronics

- Automotive

- Healthcare

- Military & Defense

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Neuromorphic Computing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.06 billion |

|

Market Size Value in 2025 |

USD 7.24 billion |

|

Revenue Forecast in 2034 |

USD 37.18 billion |

|

CAGR |

19.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 6.06 billion in 2024 and is projected to grow to USD 37.18 billion by 2034.

The global market is projected to record a CAGR of 19.9% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are International Business Machines Corporation (IBM); Intel Corporation; BrainChip; Qualcomm Technologies; Samsung Electronics; General Vision; Applied Brain Research; Hewlett Packard Enterprise; HRL Laboratories, LLC; and Synsense.

The consumer electronics segment dominated the market in 2024 due to rising demand for smarter, faster, and more energy-efficient devices such as smartphones, wearable tech, and smart home systems.

The software segment is expected to witness significant growth during the forecast period due to rising need for advanced algorithms that unlock the full potential of neuromorphic hardware.