Neural Interface Wearable Devices Market Size, Share, Trends, Industry Analysis Report: By Product Type, Application, End Users (Individuals, Enterprises, and Medical Settings), Technology, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5450

- Base Year: 2024

- Historical Data: 2020-2023

Neural Interface Wearable Devices Market Overview

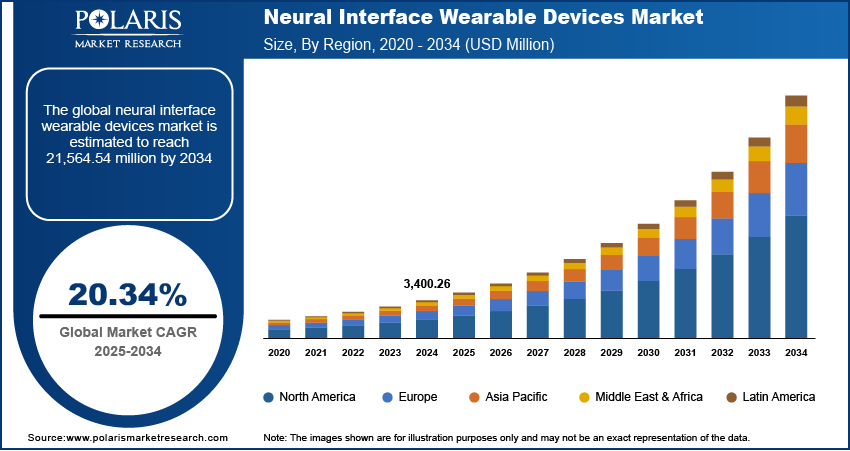

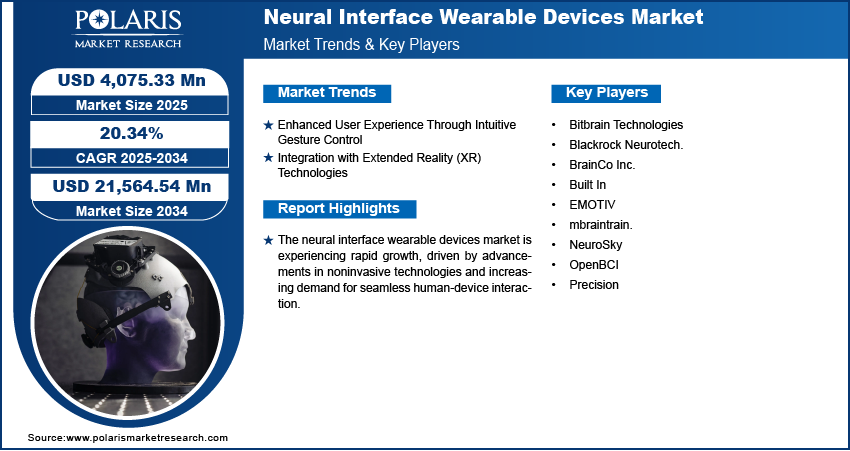

The global neural interface wearable devices market size was valued at USD 3,400.26 million in 2024. The market is expected to grow from USD 4,075.33 million in 2025 to USD 21,564.54 million by 2034, at a CAGR of 20.34% during 2025–2034.

Neural interface wearable devices are advanced technologies that enable direct communication between the human brain and external systems, enhancing user interaction with digital environments. A major driver for the neural interface wearable devices market growth is the need to overcome the limitations of camera-based systems. Traditional camera-based systems, which rely on external sensors to track movements and gestures, often face challenges such as limited accuracy in low-light conditions, obstructions, and latency issues. Neural interface wearables address these limitations by capturing neural signals directly from the brain or peripheral nervous system, enabling faster and more precise control without being influenced by environmental factors. In September 2024, Wearable Devices Ltd. released a report highlighting its Mudra Band neural interface wristband, which integrates gesture-control technology for XR devices. The report sets new standards for gesture-control wearables, highlighting improved user experience and collaborations with Qualcomm and Lenovo. This capability improves user experience and also expands the applicability of these devices in areas such as healthcare, gaming, and assistive technologies, making them a promising alternative to camera-based systems.

To Understand More About this Research: Request a Free Sample Report

Another driver shaping the neural interface wearable devices market demand is the growing trend of collaboration with industry leaders to expand functionality. Leading technology companies and healthcare providers are increasingly partnering with neural interface developers to integrate these devices into a broader range of applications. For instance, in May 2024, Allianz Trade collaborated with Inclusive Brains to develop Prometheus, a brain-machine interface using AI and neuro-technologies. The technology aims to improve autonomy for people with disabilities by enabling digital navigation and workstation operation without physical or vocal input. Such collaborations facilitate access to advanced resources, funding, and expertise, accelerating innovation and the commercialization of new features. Neural interface wearable manufacturers enhance the interoperability of their devices with existing digital ecosystems by leveraging the strengths of established players, making them more appealing to end users. This collaborative approach boosts product capabilities, and it also fosters a supportive environment for regulatory approvals and standardization, further propelling the neural interface wearable devices market opportunities.

Neural Interface Wearable Devices Market Dynamics

Enhanced User Experience Through Intuitive Gesture Control

Neural interfaces allow users to control devices through natural and intuitive gestures by interpreting neural signals directly, bypassing the need for physical controllers or complex input methods. This seamless interaction improves user satisfaction and accessibility, making these devices particularly appealing for applications in gaming, healthcare, and assistive technologies as it especially improves the way users interact with digital systems. Neural interface wearables attract tech-savvy consumers, and it also opens new opportunities in industries focused on personalized and effortless control mechanisms by offering a more immersive and responsive user experience. In January 2025, Pison Technology shifted from hardware to software, focusing on neurocognitive technology by collaborating with Samsung Ventures and Timex to integrate Pison’s software into wearable devices, improving capabilities for health monitoring and athletic performance. Major players are adopting neural interface technology to create smarter, more accessible solutions, further driving technological assessment in the wearable tech industry. Thus, enhanced user experience through intuitive gesture control propels the neural interface wearable devices market growth.

Integration with Extended Reality (XR) Technologies

The ability to interpret neural signals directly allows users to interact with augmented, virtual, or mixed-reality environments more naturally, eliminating the need for handheld controllers or physical gestures that can disrupt immersion. This integration improves the realism and fluidity of XR applications in fields such as gaming, training simulations, and remote collaboration, as neural interface wearables significantly elevate XR experiences by providing precise and real-time control capabilities. In June 2024, Qualcomm showcased its XR innovations, such as wireless AR glasses and 4K VR/MR devices, highlighting Snapdragon’s AI capabilities and leadership in spatial computing. Therefore, as XR witnesses technological advancement, the synergy with neural interface wearables is expected to play a crucial role in driving their adoption and expanding neural interface wearable devices market revenue.

Neural Interface Wearable Devices Market Segment Insights

Neural Interface Wearable Devices Market Assessment by Product Type Outlook

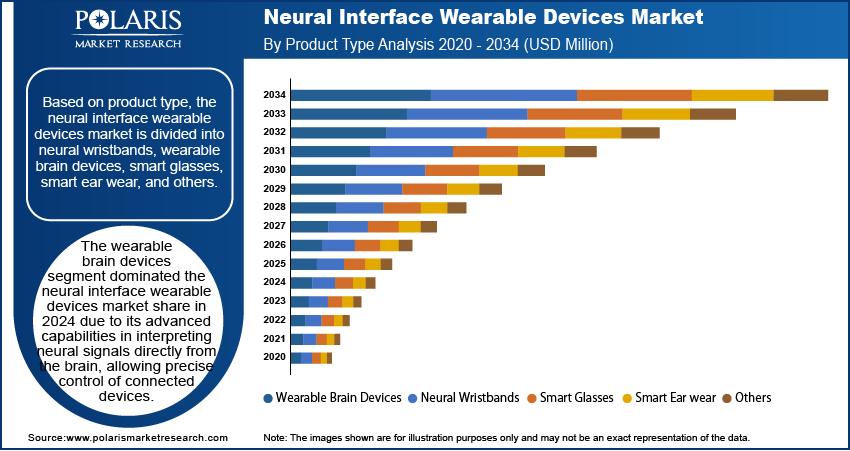

The global neural interface wearable devices market segmentation, based on product type, includes neural wristbands, wearable brain devices, smart glasses, smart ear wear, and others. The wearable brain devices segment dominated the neural interface wearable devices market share in 2024 due to its advanced capabilities in interpreting neural signals directly from the brain, allowing precise control of connected devices. The devices, such as headsets and brain caps, offer superior accuracy and responsiveness compared to other product types, making them highly suitable for applications in healthcare, rehabilitation, and gaming. The ability of wearable brain devices to facilitate hands-free and intuitive interactions has especially contributed to their adoption among both medical professionals and consumers. Additionally, ongoing technological advancements in sensor technology and signal processing have improved the reliability and functionality of these devices, solidifying their revenue opportunity in the market.

Neural Interface Wearable Devices Market Evaluation by Technology Outlook

The global neural interface wearable devices market segmentation, based on technology, includes surface nerve conductance (SNC) and brain-computer interface (BCI). The brain-computer interface (BCI) segment is expected to witness the fastest growth during the forecast period, driven by its potential to revolutionize human-device interaction. BCIs allow direct communication between the brain and external devices without the need for physical movement, making them particularly valuable in medical applications such as neurorehabilitation and assistive technologies for individuals with disabilities. The increasing focus on improving user experience and autonomy, combined with continuous innovations in noninvasive BCI technologies, is accelerating their adoption. Moreover, the expanding scope of BCI applications in fields such as gaming, defense, and augmented reality is further propelling this segment's growth.

Neural Interface Wearable Devices Market Regional Analysis

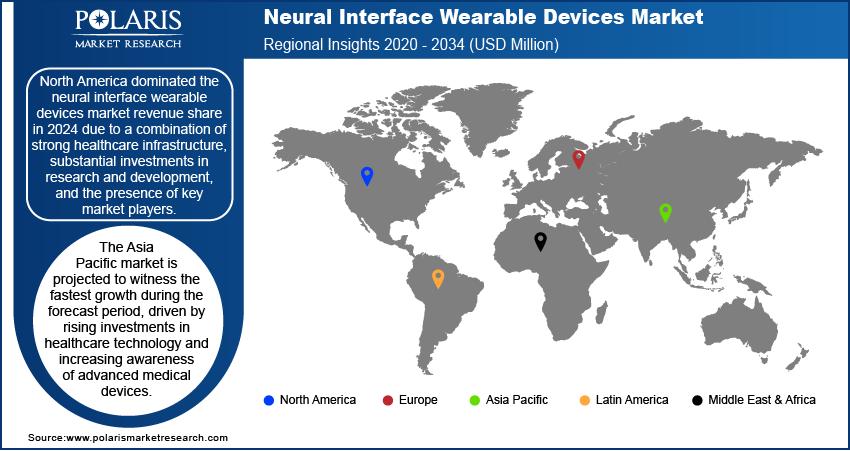

By region, the report provides neural interface wearable devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the neural interface wearable devices market revenue share in 2024 due to a combination of strong healthcare infrastructure, substantial investments in research and development, and the presence of key market players. The region's advanced technological ecosystem, supported by favorable regulatory frameworks, has facilitated the rapid commercialization and adoption of neural interface technologies. In April 2023, the DOD expanded its RATE program, using AI-powered wearable devices to predict infectious diseases up to 48 hours before symptoms appear. The program, now device-agnostic, aims to improve military readiness and health monitoring for service members, showcasing the region's commitment to leveraging advanced technologies for healthcare innovation. High consumer acceptance of innovative wearables and increasing funding for neurological research have also played crucial roles in driving the neural interface wearable devices market application. Additionally, collaborations between technology companies and healthcare institutions have accelerated the integration of neural interfaces in medical and consumer applications, reinforcing North America's leadership position.

The Asia Pacific neural interface wearable devices market is projected to witness the fastest growth during the forecast period, driven by rising investments in healthcare technology and increasing awareness of advanced medical devices. The expanding middle-class population, coupled with the growing demand for improved user experiences in gaming and consumer electronics, is boosting the regional market growth. Moreover, government initiatives supporting digital healthcare and the proliferation of research and development activities in countries such as China, Japan, and South Korea are creating a conducive environment for the neural interface wearable devices market expansion. The presence of a large pool of tech-savvy consumers is further expected to accelerate the adoption of these devices across various applications.

Neural Interface Wearable Devices Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for neural interface wearable device market development through innovation, strategic alliances, and regional expansion. Global players leverage strong R&D capabilities, technological advancements, and extensive distribution networks to deliver innovative solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Neural interface wearable devices market trends highlight rising demand for emerging technologies, such as brain-computer interfaces (BCIs), digitalization, and business transformation, driven by advancements in neuroscience, healthcare needs, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing rapid technological advancements, such as AI-driven neural interfaces, miniaturization of wearable devices, and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, ensuring sustained growth in a hypercompetitive global market. A few key major players are Bitbrain Technologies, Blackrock Neurotech, BrainCo Inc, Built In, EMOTIV, mbraintrain, NeuroSky, OpenBCI, and Precision.

Bitbrain Technologies, founded in 2010, is a neuro-technology and neuroscience applications company. Specializing in advanced brain-computer interfaces (BCIs) and wearable neural devices, Bitbrain develops innovative solutions for human behavior research, health, and neuro-marketing. Its product portfolio includes mobile EEG systems, biosignal amplifiers, and eye-tracking tools complemented by software platforms for data acquisition and analysis. These technologies enable the measurement of emotional, cognitive, and behavioral metrics with high scientific validity. Bitbrain’s wearable devices, such as water-based, dry, and textile EEGs, are designed for usability and multimodal monitoring across various applications. The company also integrates AI into its software for complex physiological data processing. With a strong foundation in R&D from European programs like FP7 and H2020, Bitbrain has become a global reference in B2B neuro-technology solutions. It supports industries such as automotive, marketing, and healthcare by providing tools to assess consumer perceptions and user experiences objectively. Headquartered in Zaragoza, Spain, Bitbrain continues to bridge neuroscience and technology to create practical solutions that positively impact society.

BrainCo Inc., founded in 2015 and headquartered in Somerville, Massachusetts, specializes in developing neural interface wearable devices and cognitive training technologies. The company integrates neuroscience, machine learning, and design to create innovative brain-machine interface (BMI) solutions. Its products are designed to improve focus, detect brainwave activity, and provide applications in education, wellness, and research. BrainCo has also gained recognition for its advancements in brainwave detection and analog-digital systems, holding eight patents in related fields. BrainCo has successfully entered markets such as China and the US, leveraging its technology to build one of the largest brainwave databases globally. The company’s efforts include pilot studies and partnerships aimed at expanding its applications across industries while maintaining a competitive edge through data-driven algorithm improvements.

List of Key Companies in Neural Interface Wearable Devices Market

- Bitbrain Technologies

- Blackrock Neurotech.

- BrainCo Inc.

- Built In

- EMOTIV

- mbraintrain.

- NeuroSky

- OpenBCI

- Precision

Neural Interface Wearable Devices Industry Development

In January 2025, Wearable Devices launched Mudra Link, the first neural wristband compatible with Android, macOS, and Windows. Using Surface Nerve Conductance sensors, it translates finger movements into device commands, expanding touchless control for AR glasses, smart TVs, and more.

In October 2023, Apollo Neuro launched SmartVibes, a wearable using predictive AI to enhance sleep and reduce stress. It provides scientifically validated vibrations for nervous system balance and supports real-time sleep and stress recovery, integrating with devices such as Oura Ring.

Neural Interface Wearable Devices Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Neural Wristbands

- Wearable Brain Devices (Single-Channel, Multichannel)

- Smart Glasses

- Smart Ear wear

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Healthcare

- Gaming and Entertainment

- Industrial Applications

- Automotive

- Military and Defense

- Others

By End Users Outlook (Revenue, USD Million, 2020–2034)

- Individuals

- Enterprises

- Medical Settings

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Surface Nerve Conductance (SNC)

- Brain-Computer Interface (BCI)

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Neural Interface Wearable Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,400.26 million |

|

Market Size Value in 2025 |

USD 4,075.33 million |

|

Revenue Forecast in 2034 |

USD 21,564.54 million |

|

CAGR |

20.34% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global neural interface wearable devices market size was valued at USD 3,400.26 million in 2024 and is projected to grow to USD 21,564.54 million by 2034.

The global market is projected to register a CAGR of 20.34% during the forecast period.

North America dominated the market revenue in 2024.

The Asia Pacific neural interface wearable devices market is projected to witness the fastest growth during the forecast period.

A few of the key players in the market are Bitbrain Technologies, Blackrock Neurotech, BrainCo Inc, Built In, EMOTIV, mbraintrain, NeuroSky, OpenBCI, and Precision.

The wearable brain devices segment dominated the market share in 2024.

The brain-computer interface (BCI) segment is expected to witness the fastest market growth during the forecast period.