Network Point-of-Care Glucose Testing Market Size, Share, Trends, Industry Analysis Report: By Product (Accu-Chek Inform II, StatStrip, HemoCue, BAROzen H Expert Plus, i-STAT, and CareSens Expert Plus), Modality, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 119

- Format: PDF

- Report ID: PM2137

- Base Year: 2024

- Historical Data: 2020-2023

Network Point-of-Care Glucose Testing Market Overview

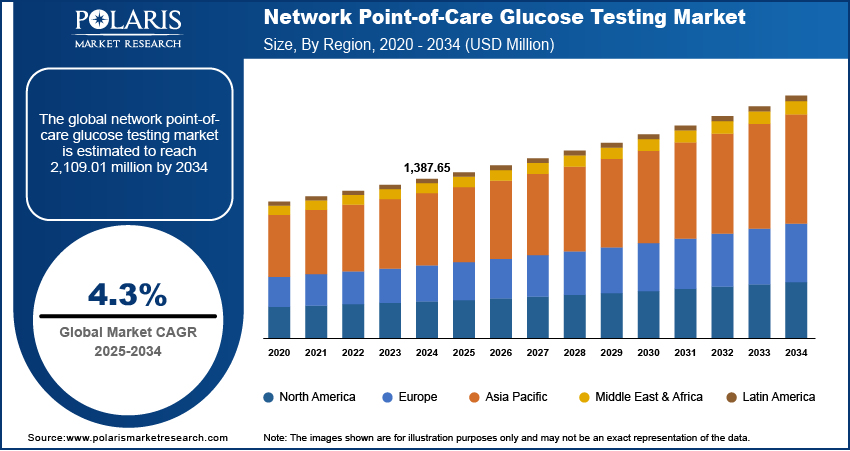

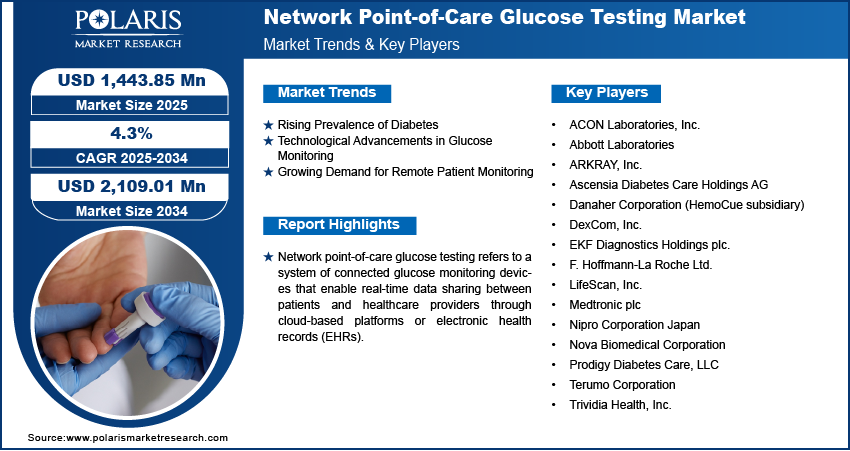

The network point-of-care glucose testing market size was valued at USD 1,387.65 million in 2024. The market is projected to grow from USD 1,443.85 million in 2025 to USD 2,109.01 million by 2034, exhibiting a CAGR of 4.3% during 2025–2034.

The network point-of-care glucose testing market focuses on glucose monitoring systems that provide real-time data connectivity for effective diabetes management in hospitals, clinics, and home care settings. The market is driven by the rising prevalence of diabetes, increasing demand for rapid and accurate glucose monitoring, and advancements in connectivity solutions that integrate with electronic health records.

The adoption of wireless and cloud-based technologies is a key network point-of-care glucose testing market trend, enabling remote monitoring and streamlined data management. Additionally, regulatory support for point-of-care testing and growing investments in healthcare infrastructure are contributing to market growth.

To Understand More About this Research: Request a Free Sample Report

Network Point-of-Care Glucose Testing Market Dynamics

Rising Prevalence of Diabetes

The increasing global incidence of diabetes significantly propels the network point-of-care glucose testing market growth. According to the International Diabetes Federation, approximately 537 million adults had diabetes in 2021, and the number of cases is projected to rise to 643 million by 2030. This surge highlights the escalating demand for efficient and accessible glucose monitoring solutions to manage and mitigate diabetes-related health complications, thereby contributing to market expansion.

Technological Advancements in Glucose Monitoring

Innovations in glucose monitoring technologies are transforming patient care. The development of continuous glucose monitors (CGMs) that provide real-time data and integrate seamlessly with other health devices encourages their adoption. For instance, Abbott's Lingo and Dexcom's Stelo are over-the-counter CGMs designed for individuals not on insulin therapy, reflecting a trend toward more user-friendly and widely accessible monitoring options. Thus, rising technological advancements in glucose monitoring devices propel the network point-of-care glucose testing market development.

Growing Demand for Remote Patient Monitoring

The shift toward remote patient monitoring (RPM) is a significant driver in the network point-of-care glucose testing market demand. RPM enables healthcare providers to track patients' health data in real time, facilitating timely interventions and personalized care plans. This approach enhances patient outcomes and reduces the burden on healthcare facilities by minimizing the need for in-person visits. The integration of networked glucose testing devices into RPM systems exemplifies this trend, offering patients and providers efficient tools for managing diabetes remotely.

Network Point-of-Care Glucose Testing Market Segment Insights

Network Point-of-Care Glucose Testing Market Assessment by Product

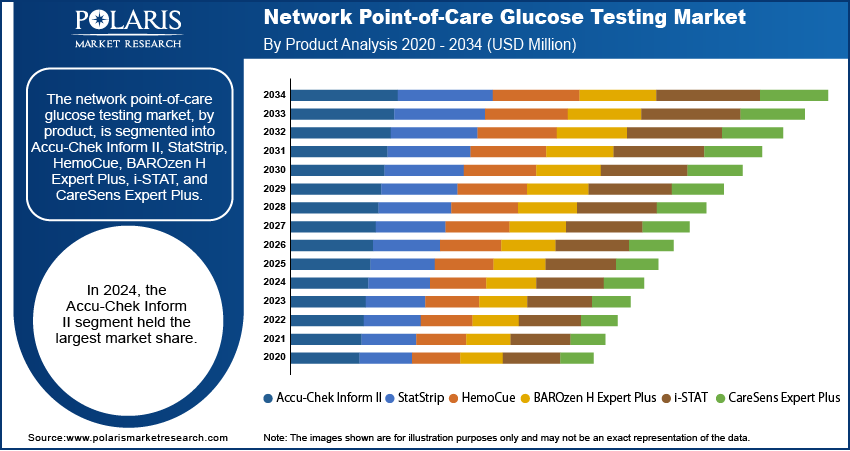

The network point-of-care glucose testing market, based on product, is divided into Accu-Chek Inform II, StatStrip, HemoCue, BAROzen H Expert Plus, i-STAT, and CareSens Expert Plus. In 2024, the Accu-Chek Inform II segment held the largest market share. This prominence is attributed to its widespread adoption among healthcare professionals for efficient blood glucose monitoring across various sample types, including capillary, venous, neonatal, arterial, and whole blood. The device's design further caters to the rigorous demands of clinical environments, ensuring reliable and rapid glucose assessments.

The CareSens Expert Plus segment is anticipated to experience the highest growth rate in the coming years. This projection is based on the device's advanced features, such as automatic strip recognition for both glucose and β-ketones, and its seamless real-time data transfer capabilities via multiple connectivity options, including Wi-Fi, Ethernet, USB, and NFC. These functionalities enhance user experience and facilitate integration with broader healthcare systems, making it a preferred choice in healthcare settings that prioritize advanced data management and connectivity.

Network Point-of-Care Glucose Testing Market Evaluation by Modality

The network point-of-care glucose testing market, by modality, is segmented into handheld/portable devices, wearable devices, and benchtop devices. Wearable devices have emerged as the dominant segment in 2024, capturing a significant share due to their user-friendly design and continuous monitoring capabilities. These devices, such as continuous glucose monitors (CGMs), offer real-time data transmission, enabling patients and healthcare providers to manage blood glucose levels more effectively. The convenience and improved patient compliance associated with wearables have contributed to their widespread adoption in various healthcare settings.

The handheld/portable devices segment is experiencing the highest growth rate within this market. Their portability and ease of use make them particularly suitable for point-of-care settings, allowing for rapid glucose assessments in diverse environments, including remote and underserved areas. The increasing demand for immediate and accurate glucose measurements, coupled with advancements in device connectivity and integration with electronic health records, has fueled the expansion of the segment. The adoption of handheld devices is expected to rise as healthcare systems continue to prioritize accessibility and efficiency.

Network Point-of-Care Glucose Testing Market Regional Outlook

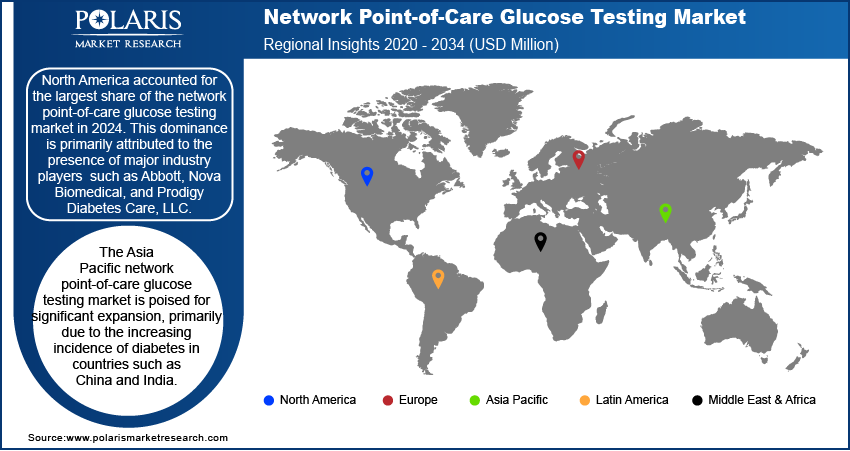

By region, the report provides network point-of-care glucose testing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest network point-of-care glucose testing market share in 2024. This dominance is primarily attributed to the presence of major industry players such as Abbott, Nova Biomedical, and Prodigy Diabetes Care, LLC, which have significantly increased the availability of glucose-testing products in the region. Additionally, higher healthcare expenditure by governments on diabetes management contributes to this substantial market share.

The Europe network point-of-care glucose testing market is experiencing substantial growth, driven by the increasing prevalence of diabetes and a rising demand for rapid diagnostic tools. The market growth is further supported by government initiatives aimed at enhancing diabetes care and the widespread adoption of advanced glucose monitoring technologies across the region.

The Asia Pacific network point-of-care glucose testing market is poised for significant expansion, primarily due to the increasing incidence of diabetes in countries such as China and India. The rising healthcare expenditures, greater awareness of early disease detection, and the need for rapid and accurate diagnostic results are further fueling the network point-of-care glucose testing market expansion in Asia Pacific. Additionally, improvements in healthcare infrastructure and increased accessibility to point-of-care testing devices are facilitating market development in the region.

Network Point-of-Care Glucose Testing Market – Key Players and Competitive Analysis Report

In the network point-of-care glucose testing market, several key players are actively contributing to advancements in diabetes management. Abbott Laboratories has developed the FreeStyle Libre system, offering continuous glucose monitoring to patients. F. Hoffmann-La Roche Ltd. provides the Accu-Chek Inform II, a device designed for rapid and accurate blood glucose testing in clinical settings. Nova Biomedical offers the StatStrip Glucose Hospital Meter, known for its precision in point-of-care testing. Ascensia Diabetes Care Holdings AG, formerly part of Bayer AG, delivers the Contour Next system, focusing on user-friendly interfaces and reliable readings. LifeScan, Inc., under Platinum Equity Advisors, LLC, markets the OneTouch Verio Flex meter, emphasizing simplicity and accuracy.

Abbott Laboratories, established in 1888, is a diversified healthcare company that develops and markets diagnostics products, medical devices, nutritionals, and branded generic pharmaceuticals. The company offers a comprehensive range of diagnostic solutions, including blood screening, immunoassays, and clinical chemistry systems. Abbott's global presence allows it to expand its reach in both established and emerging markets. The company stays ahead through continuous innovation and a focus on research and development.

F. Hoffmann-La Roche Ltd, founded in 1896, is a biotechnology company and a provider of in-vitro diagnostics, as well as a supplier of transformative innovative solutions across major disease areas. The company offers drugs for the treatment of cancer, autoimmune diseases, central nervous system disorders, ophthalmological disorders, infectious diseases, and respiratory diseases. Roche also provides in vitro diagnostics, tissue-based cancer diagnostics, and diabetes management solutions. The company conducts research to identify novel methods to prevent, diagnose, and treat diseases.

List of Key Companies in Network Point-of-Care Glucose Testing Market

- ACON Laboratories, Inc.

- Abbott Laboratories

- ARKRAY, Inc.

- Ascensia Diabetes Care Holdings AG

- Danaher Corporation (HemoCue subsidiary)

- DexCom, Inc.

- EKF Diagnostics Holdings plc.

- F. Hoffmann-La Roche Ltd.

- LifeScan, Inc. (Platinum Equity Advisors, LLC subsidiary)

- Medtronic plc

- Nipro Corporation Japan

- Nova Biomedical Corporation

- Prodigy Diabetes Care, LLC

- Terumo Corporation

- Trividia Health, Inc.

Network Point-of-Care Glucose Testing Industry Developments

- June 2024: Abbott Laboratories obtained FDA clearance for two over-the-counter glucose monitoring devices, Libre Rio and Lingo. Libre Rio is designed for type 2 diabetes patients who do not use insulin, whereas Lingo monitors glucose levels and offers personalized insights.

- March 2024: Nova Biomedical introduced its next-generation StatStrip Glucose Hospital Meter System, which received FDA 510(k) clearance. The updated meter includes improved cybersecurity, wireless charging, RFID data entry, and a durable casing, ensuring precise and secure glucose testing for critically ill patients.

Network Point-of-Care Glucose Testing Market Segmentation

By Product Outlook

- Accu-Chek Inform II

- StatStrip

- HemoCue

- BAROzen H Expert Plus

- i-STAT

- CareSens Expert Plus

By Modality Outlook

- Handheld/Portable Devices

- Wearable Devices

- Benchtop Devices

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Network Point-of-Care Glucose Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,387.65 million |

|

Market Value in 2025 |

USD 1,443.85 million |

|

Revenue Forecast by 2034 |

USD 2,109.01 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The network point-of-care glucose testing market has been broadly segmented on the basis of product and modality. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the network point-of-care glucose testing market focus on expanding their product portfolios through technological advancements, including continuous glucose monitoring and real-time data integration. Strategic collaborations with healthcare providers and digital health platforms enhance market penetration. Regulatory approvals and compliance with healthcare standards drive product adoption in hospitals and home care settings. Companies invest in direct-to-consumer marketing and partnerships with insurance providers to improve accessibility. Geographic expansion, particularly in emerging markets, supports long-term growth by addressing rising diabetes prevalence.

FAQ's

The market size was valued at USD 1,387.65 million in 2024 and is projected to grow to USD 2,109.01 million by 2034.

The market is projected to register a CAGR of 4.3% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include ACON Laboratories, Inc.; Abbott Laboratories; ARKRAY, Inc.; Ascensia Diabetes Care Holdings AG; Danaher Corporation (HemoCue subsidiary); DexCom, Inc.; EKF Diagnostics Holdings plc.; F. Hoffmann-La Roche Ltd.; LifeScan, Inc. (Platinum Equity Advisors, LLC subsidiary); Medtronic plc; and Nipro Corporation Japan.

The Accu-Chek Inform II segment accounted for the largest share of the market in 2024.

Network point-of-care glucose testing refers to a system where glucose testing devices are connected through a network, enabling real-time data sharing between healthcare providers and patients. These systems typically include handheld, wearable, and benchtop glucose meters integrated with electronic health records (EHRs) and cloud-based platforms. This connectivity enhances diabetes management by allowing immediate access to blood glucose readings, facilitating remote monitoring, and improving clinical decision-making. The adoption of networked glucose testing is increasing due to the demand for accurate, rapid, and accessible diabetes monitoring solutions in hospitals, clinics, and home care settings.

A few key trends in the market are described below: Increased Adoption of Continuous Glucose Monitoring (CGM): The shift from traditional glucose meters to CGMs enhances real-time monitoring and reduces the need for frequent finger pricks. Integration with Digital Health and EHR Systems: Connectivity with electronic health records (EHRs) and mobile applications improves data accessibility and patient management. Advancements in Wearable Glucose Monitoring Devices: The development of compact, sensor-based wearable devices is improving user convenience and long-term glucose tracking. Growing Use of Artificial Intelligence (AI) and Data Analytics: AI-powered predictive analytics help in early diagnosis and better glucose level management.

A new company entering the market must focus on developing cost-effective and highly accurate continuous glucose monitoring (CGM) systems with seamless digital integration. Innovations in noninvasive glucose testing, AI-driven predictive analytics, and cloud-based remote monitoring solutions can provide a competitive edge. Partnering with healthcare providers and insurers to enhance accessibility and reimbursement options can drive adoption. Expanding into emerging markets with affordable, portable, and user-friendly devices can help capture underserved populations. Ensuring regulatory compliance and maintaining high data security standards will be critical for market acceptance and long-term success.