Netherlands Industrial MRO Market Size, Share, Trends, Industry Analysis Report: By Product & Services (Products and Services) and End Use – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 114

- Format: PDF

- Report ID: PM5137

- Base Year: 2023

- Historical Data: 2019-2022

Netherlands Industrial MRO Market Overview

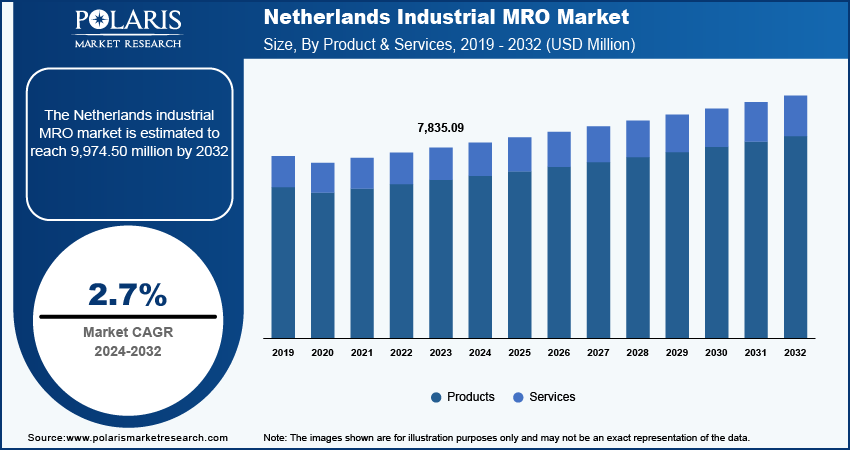

The Netherlands industrial MRO market size was valued at USD 7,835.09 million in 2023. The market is projected to grow from USD 8,045.36 million in 2024 to USD 9,974.50 million by 2032, exhibiting a CAGR of 2.7% during 2024–2032.

Industrial Maintenance, Repair, and Operations (MRO) refers to the processes and services required to ensure the continuous operation of industrial equipment, machinery, and infrastructure. Industrial MRO includes activities such as routine maintenance, equipment breakdown repair, and parts or machinery replacement that support operational efficiency in industries.. MRO services are essential in sectors such as manufacturing, energy, transportation, and logistics. The demand for industrial MRO services has been steadily increasing, driven by several factors such as technological advancements, the need for higher operational efficiency, and the growth of the manufacturing and logistics sectors.

To Understand More About this Research: Request a Free Sample Report

Internet of Things (IoT) solutions are being adopted at a slower pace in the Netherlands compared to the average of other European countries. However, they are gaining popularity among companies and having a positive impact on the MRO sector. According to the Centre for the Promotion of Imports from Developing Countries (CBI), only 21% of Dutch companies used IoT solutions in 2021, lagging behind the European average of 29%. However, this gap is filling as industries recognize the benefits of IoT in predictive maintenance, which is a part of MRO that allows for real-time monitoring of equipment to prevent unexpected breakdowns and avoid repair costs. Thus, the emerging trend of integrating IoT in MRO solutions is expected to contribute significantly to the Netherlands industrial MRO market growth during the forecast period.

The Dutch government has been proactive in fostering innovation within the industrial MRO market to support this growing demand for the services. Various initiatives have been introduced, focusing on digitization, sustainability, and automation. The government has been promoting the adoption of smart technologies such as IoT, artificial intelligence (AI), and robotics through subsidies and tax incentives. These technologies are crucial for enhancing the efficiency of maintenance operations by enabling predictive maintenance and real-time analytics. Additionally, programs aimed at upskilling the workforce in emerging digital technologies are ensuring that the labor market meets the rising demand for specialized MRO services.

Netherlands Industrial MRO Market Drivers and Trends

Rising Adoption of Automation, Robotics, and Smart Maintenance Systems

The Netherlands industrial MRO market is expected to experience significant growth in the coming years owing to the increasing adoption of automation, robotics, and smart maintenance systems. According to the International Federation of Robotics (IFR) reports, the country ranks 13th globally in robot density, with 224 robots per 10,000 workers in manufacturing. The demand for specialized MRO services to ensure smooth operation is expanding as industries increasingly depend on automated systems. The Netherlands' strong position as a supplier of robotics, particularly in agriculture, also boosts the need for smart maintenance solutions. This trend emphasizes condition monitoring and predictive maintenance, reflecting a broader shift toward operational efficiency, which would drive the market during the forecast period.

Increased Need for Equipment Repairs and Upgrades

The aging infrastructure in the Netherlands is significantly propelling the demand for the industrial MRO systems. Machinery and equipment reach the end of their operational lifespans, and they increasingly require repairs and upgrades to maintain efficiency and safety standards. This growing need is prompting companies to invest more in MRO solutions to extend the longevity of their assets and minimize downtime.

The challenge of maintaining older equipment is compounded by the rapid pace of technological advancements. New technologies and systems emerge, and older infrastructure often needs updates or retrofits to integrate with modern solutions. This necessity drives the demand for specialized MRO services that can handle complex upgrades and ensure compatibility with contemporary technologies.

The rising emphasis on maintaining operational efficiency and compliance with regulatory standards fuels the need for regular maintenance and repairs. Industries strive to meet stringent safety and performance regulations, and they turn to MRO providers to ensure their equipment adheres to current standards, thereby boosting the Netherlands's industrial MRO market growth.

Netherlands Industrial MRO Market – Segment Insights

Netherlands Industrial MRO Market: Product & Services-Based Insights

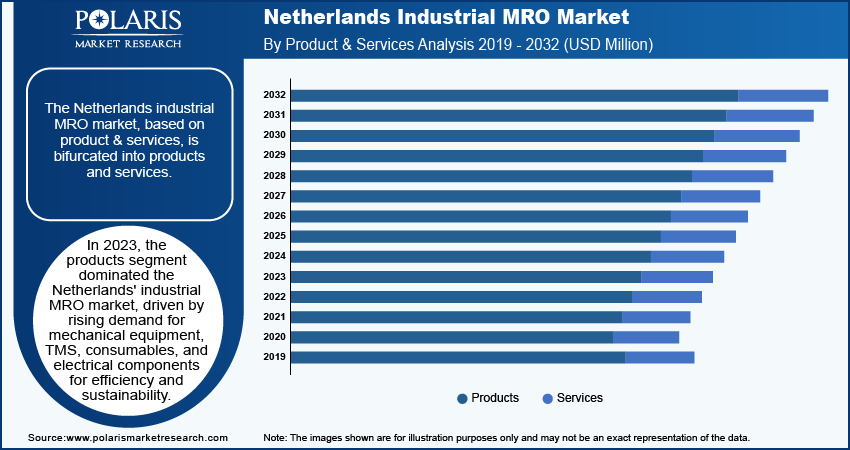

The Netherlands industrial MRO market, based on product & services, is bifurcated into products and services. In 2023, the product segment dominated the market, accounting for more than 80% of market revenue share. The product segment is further segmented into mechanical equipment, TMS & consumables, electrical, and others. Mechanical equipment dominates the industrial MRO market in the Netherlands, driven by the need for advanced machinery and components such as seals, valves, and actuators to maintain operational efficiency. TMS and consumables are essential for routine maintenance, while electrical components play a vital role in automation and energy-efficient operations. The growing complexity of industrial processes and the push for sustainable practices contribute to the rising demand for high-quality lubricants, coolants, and other MRO supplies, solidifying this segment's market dominance.

Netherlands Industrial MRO Market: End Use-Based Insights

The Netherlands industrial MRO market, based on end use, is segmented into food, beverages, and tobacco industry; chemical & pharmaceutical industry; base metals & metal products industry; electric & electronics industry; plastics & building material industry; transportation industry; wood, paper, and graphics industry; petroleum industry; textile, clothing, and leather industry; and others. The chemical & pharmaceutical industry segment is expected to register a CAGR of 3.2% during the forecast period. Industrial MRO services are essential for ensuring operational efficiency and minimizing downtime in the chemical & pharmaceutical industries. These sectors rely heavily on complex machinery, leading to a growing demand for reliable MRO services, including maintenance of pumps, valves, rotating equipment, and heat exchangers.

In the Netherlands, home to a significant concentration of chemical plants and pharmaceutical manufacturers, tailored MRO solutions are crucial for preventing unexpected breakdowns, optimizing equipment performance, and ensuring compliance with stringent regulations. The European Chemical Industry Council reported that the chemical industry turnover in the Netherlands was USD 87 billion in 2022, driven by the participation of 400 companies. Additionally, the integration of predictive maintenance technologies, such as IoT and AI-driven diagnostics, is transforming the MRO landscape, enabling real-time monitoring of equipment health. This trend minimizes downtime and mitigates potential financial losses, positively impacting the Netherlands industrial MRO market outlook.

Netherlands Industrial MRO Market: Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Netherlands industrial MRO market grow in the coming years. Market participants are also undertaking a variety of strategic activities, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations, to expand their footprint across the region. To expand and survive in a more competitive and rising market climate, the Netherlands industrial MRO market players must offer cost-effective solutions and services.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Netherlands industrial MRO market to benefit clients and boost business growth.. A few major players in the market are ERIKS Group, Aalberts N.V., Honeywell International Inc., Wurth Nederland N.V., Henkel AG & Co. KGaA, Air Liquide, ABB, SKF, Schneider Electric, RUBIX, RS Integrated Supply, IT’s Me, KLINGER, Dexis Ibérica, and IP IndustriePartner.

ERIKS is an industrial service provider specializing in technical products and engineering solutions. The company focuses on enhancing product performance and reduce ownership costs through comprehensive services, including design, installation, maintenance, condition monitoring, and integrated supply chain management across various industrial sectors.

Aalberts N.V. specializes in mission-critical technologies for aerospace, building, automotive, and maritime sectors, operating through Building Technology and Industrial Technology segments. They focus on energy-efficient hydronic flow control systems and advanced mechatronics, serving OEMs in sustainable transportation and various industrial niches, with a presence across multiple regions across the world.

List of Key Companies in Netherlands Industrial MRO Market

- Aalberts N.V.

- ABB

- Air Liquide

- Dexis Ibérica

- ERIKS Group

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- IP IndustriePartner

- IT’s Me

- KLINGER

- MTU Maintenance Lease Services B.V.

- RS Integrated Supply

- RUBIX

- Schneider Electric

- SKF

- Wurth Nederland N.V.

Netherlands Industrial MRO Industry Developments

April 2024, Honeywell and ITP Aero partnered to establish a new MRO service center in Madrid for F124-GA-200 engines, enhancing repair efficiency, local capabilities for European operators, and supporting sustainable aviation operations.

April 2024, Honeywell introduced Performance+ for Aerospace, a cloud-based platform using AI and machine learning via Forge technology to help MROs and manufacturers modernize production, enhance efficiency, and reduce operational costs through automation advancements.

Netherlands Industrial MRO Market Segmentation

By Product & Services Outlook

- Products

- Mechanical Equipment

- TMS

- Electrical

- Others

- Services

- Maintenance Services

- Repair Services

- Operational Services

By End Use Outlook

- Food, Beverages, and Tobacco Industry

- Chemical & Pharmaceutical Industry

- Base Metals & Metal Products Industry

- Electric & Electronics Industry

- Plastics & Building Material Industry

- Transport Equipment Industry

- Wood, Paper, and Graphics Industry

- Rubber, Plastic, and Non-Metallic

- Petroleum Industry

- Textile, Clothing, and Leather Industry

- Others

Netherlands Industrial MRO Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 7,835.09 million |

|

Market Size Value in 2024 |

USD 8,045.36 million |

|

Revenue Forecast by 2032 |

USD 9,974.50 million |

|

CAGR |

2.7% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Netherlands industrial MRO market size was valued at USD 7,835.09 million in 2023 and is projected to grow to USD 9,974.50 million by 2032.

The market is projected to register a CAGR of 2.7% during the forecast period.

ERIKS Group;, Aalberts N.V.;, Honeywell International Inc.;, Wurth Nederland N.V.;, Henkel AG & Co. KGaA;, Air Liquide;, ABB;, SKF;, Schneider Electric;, RUBIX;, RS Integrated Supply;, IT’s Me;, KLINGER;, Dexis Ibérica;, and IP IndustriePartner.are a few key market players.

The product segment dominated the market in 2023.

The chemical & pharmaceutical industry segment held the largest share of the market in 2023.