Neobanking Market Share, Size, Trends, Industry Analysis Report, By Account Type (Business Account, Savings Account, Others); By Service Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 114

- Format: pdf

- Report ID: PM4485

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

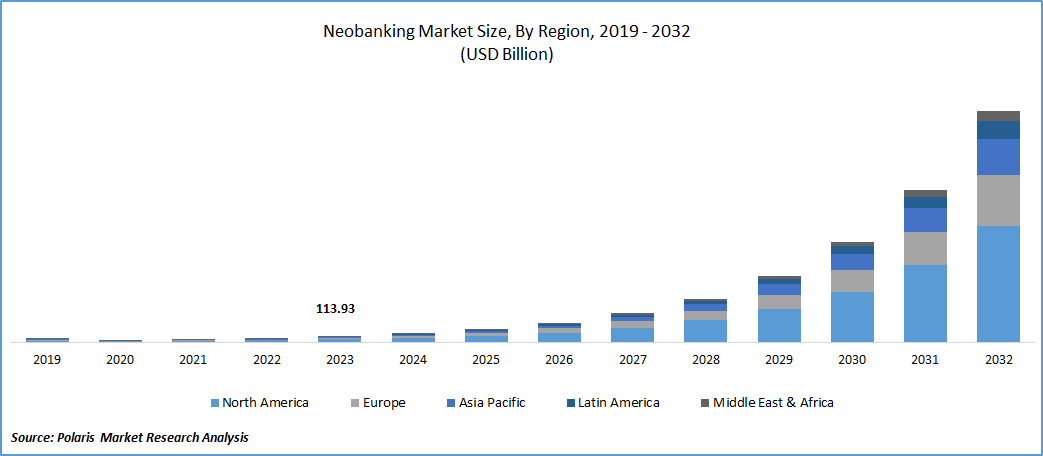

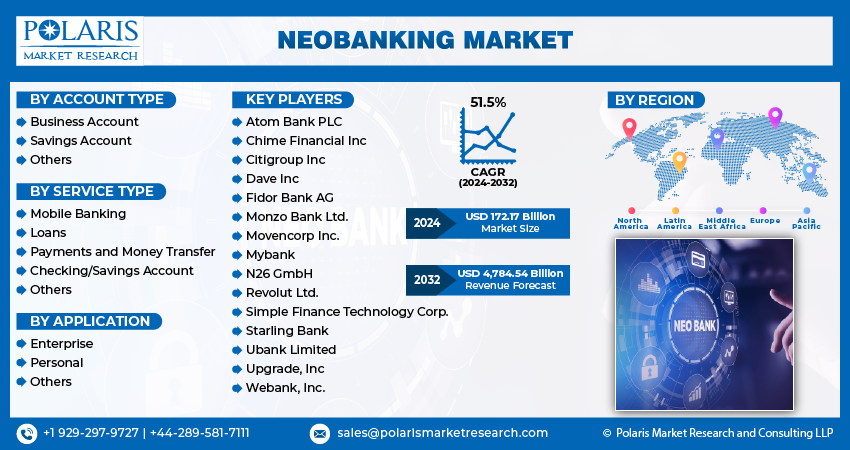

The global neobanking market was valued at USD 113.93 billion in 2023 and is expected to grow at a CAGR of 51.5% during the forecast period.

A neobank is a financial technology that offers banking services through a mobile application or website. These services include electronic money transfers, bill payments, and direct deposits or mobile check deposits. Neobanks generally offer better rates and lower fees compared to traditional banks.

The rising demand for convenience among banking customers is anticipated to fuel market expansion. Neobanks provide banking solutions devoid of the necessity for traditional physical branches or offices. These financial institutions enable users to authenticate their service offerings instantly through online channels and mobile platforms. Furthermore, the widespread adoption of smartphones and the Internet for online banking on a global scale is projected to intensify the demand for neobank platforms.

For instance, In April 2021, Google Pay co-creators have partnered with Federal Bank to launch Fi, a neobank that offers instant savings accounts with debit cards for salaried millennials.

The number of partnerships between banks and organizations to launch neobank platforms is increasing, which is accelerating the growth of the market. The aim of these partnerships is to provide customers with a better experience, and enhance safety and stability. A significant increase in internet penetration worldwide and technological advancements, financial service providers can offer novel digital services to customers. Additionally, the growth in digital wallets has been driving the demand for online banking platforms.

To Understand More About this Research:Request a Free Sample Report

The COVID-19 pandemic had a significant impact on the new banking market. Neobanks, which rely on digital channels and do not have physical branches, initially faced challenges due to economic uncertainties. However, the pandemic has also accelerated the shift towards digital banking as people seek contactless and convenient solutions. Neobanks, equipped with user-friendly mobile apps and streamlined processes, have seen a surge in adoption as more individuals embrace remote and online banking options. The crisis highlighted the importance of digital resilience, leading traditional banks to reassess their strategies. Additionally, neobanks, being agile and tech-driven, were able to adapt swiftly to changing circumstances, giving them a competitive edge. The pandemic acted as a catalyst for neo banks to showcase their flexibility, responsiveness, and commitment to meet evolving customer needs, positioning them as fierce players in the future of banking.

The widespread use of smartphones and affordable internet services, especially in developing countries, has led to an increase in the adoption of neo-banking services. Neobanks have become popular among young adults who are opening their first bank accounts. With the rapid advancement of financial technologies, the adoption of new banking services is anticipated to grow in the future. The growing demand for simplified banking services globally is a significant factor driving the growth of the neobanking market.

Industry Dynamics

Growth Drivers

Increasing demand for digital banking solutions will facilitate the market growth

The market growth of neobanking during the forecast period is primarily driven by the increasing demand for digital banking solutions. With the increasing adoption of digital technologies, consumers are demanding efficient and convenient banking services. Neobanking service providers offer solutions that enable banks and financial institutions to provide digital banking services such as online banking, mobile banking, and digital payments, driving growth in this market. Additionally, banks and other financial institutions are prioritizing the improvement of their customer experience to stay competitive. Neobanking solutions provide customers with personalized, seamless experiences that drive demand for these solutions.

Furthermore, various banks and financial institutions are adopting Business Process Outsourcing (BPOs) to manage their operations better while improving collaboration, simplifying compliance, increasing productivity, and managing risk. BPOs are increasingly being adopted as they offer effective planning and streamlining of data under one platform, which helps regulate operational costs, enhance decision-making, and increase sales. The banking industry is anticipated to continue its adoption of digital technologies, focusing on improving operational and business process efficiency, which is expected to fuel the growth of the neo banking market in the forecast period.

Report Segmentation

The market is primarily segmented based on account type, service type, application, and region.

|

By Account Type |

By Service Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Account Type Analysis

The Business Account Segment Accounted for the Largest Revenue Share in 2023

In 2022, the business account segment held for the largest revenue share. Neobanking has become a popular method for businesses worldwide to make large-scale payouts. The streamlined processes and user-friendly features of neobank platforms not only improve the efficiency of disbursals to vendors and other stakeholders but also contribute to growth by reducing the need for manual intervention.

Neobanks use a user-friendly interface that is designed to protect against cyber threats and improve the online savings account environment. They are also equipped to quickly detect and respond to cyber-attacks within the banking network. Furthermore, customers can securely make international transactions with enhanced safety measures.

By Application Analysis

- The Enterprise Segment Accounted for the Highest Market Share During the Forecast Period

The enterprise segment accounted for the highest market share during the forecast period. These platforms offer services customized for enterprises, such as credit management, transaction management, and asset management. Neobank service providers, which cater to small and medium-sized enterprises (SMEs), are actively expanding their product offerings by acquiring businesses with the aim of enhancing the overall customer experience.

On the other hand, personal segment is anticipated to experience significant growth throughout the forecast period. The popularity of smartphones has enabled consumers to easily adopt neobanking services, which are known for their user-friendly interfaces and convenience. Through mobile apps, these services offer a hassle-free experience for money transfers and payments. The simplified account opening and management process is expected to drive the adoption of neobanking in this sector in the forecast period.

Regional Insights

Europe Accounted for the Largest Market Share in 2023

In 2022, Europe accounted for the largest market contributor in the neobanking market. The growth of the regional market can be attributed to the emergence of innovative technologies and the early adoption of these technologies. Furthermore, companies are focused on launching new product platforms and forming partnerships to strengthen their position in the market. In addition, various neobanks in the region have established brick-and-mortar distribution channels, creating opportunities for growth in the market through an online-to-offline distribution model.

Asia Pacific region is accounted for the fastest growth in the forecast period. The growing adoption of Internet services, coupled with the increased use of smartphones, is expected to accelerate the market growth. In addition, factors such as easy and convenient banking services and the rise in digital-only banks across countries, including Japan, India, and China, are expected to contribute further to regional market growth. Additionally, the young demographics of the region are anticipated to be an additional benefit for the adoption of neobanks.

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Atom Bank PLC

- Chime Financial Inc

- Citigroup Inc

- Dave Inc

- Fidor Bank AG

- Monzo Bank Ltd.

- Movencorp Inc.

- Mybank

- N26 GmbH

- Revolut Ltd.

- Simple Finance Technology Corp.

- Starling Bank

- Ubank Limited

- Upgrade, Inc

- Webank, Inc.

Recent Developments

- In December 2021, Open, a neobank based in India that integrates banking, payments, accounting, expense management, and tax services into a unified platform, has successfully acquired Finin for a sum of $10 million. This strategic acquisition enhances Open's cloud-native Banking Stack financial operating system, providing banks and other financial entities with a robust solution to initiate and broaden their digital banking services for both individuals and enterprises.

- In March 2021, DigiBankASIA, a financial services company headquartered in Singapore, has collaborated with Xebia to introduce UnoBank, a digital bank for the Asian market. By integrating premier banking products, Xebia will serve as UnoBank's technology partner, contributing to the development of Cognito – Uno's advanced digital platform ensuring a distinctive and cutting-edge digital banking experience.

Neobanking Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 172.17 billion |

|

Revenue forecast in 2032 |

USD 4,784.54 billion |

|

CAGR |

51.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Account Type, By Service Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

FAQ's

Neobanking Market report covering key segments are account type, service type, application and region.

Neobanking Market Size Worth $ 4784.54 Billion By 2032

The global neobanking market is expected to grow at a CAGR of 51.5% during the forecast period.

Europe is leading the global market.

The key driving factors in Neobanking Market are Increasing demand for digital banking solutions will facilitate the market growth