Needle Holder Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Cardiovascular, Dental, Gynecology, and Others), Material, Usage Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2025–2034)

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5149

- Base Year: 2024

- Historical Data: 2020-2023

Needle Holder Market Overview

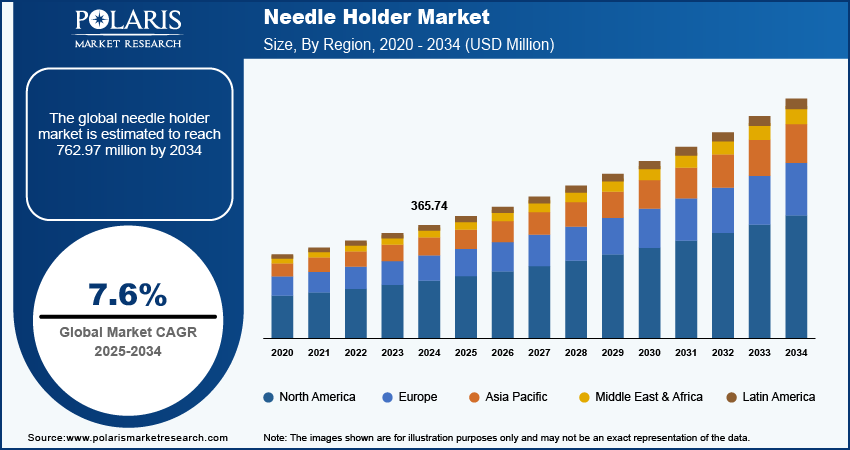

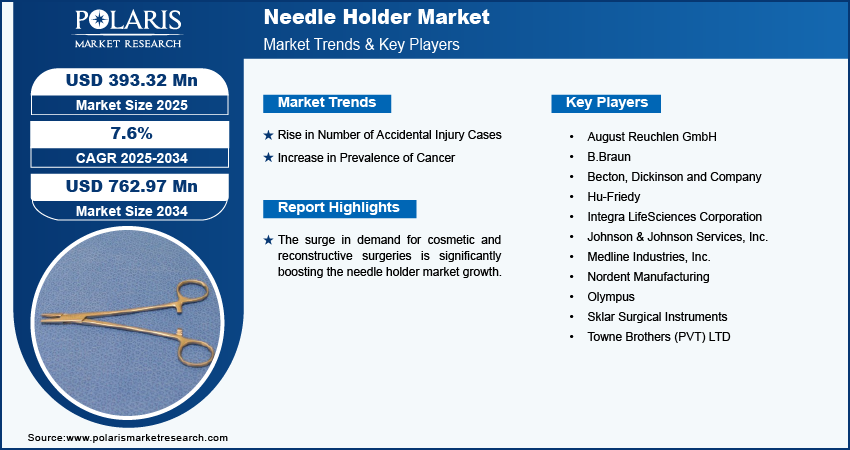

The global needle holder market size was valued at USD 365.74 million in 2024. The market is projected to grow from USD 393.32 million in 2025 to USD 762.97 million by 2034, exhibiting a CAGR of 7.6% during 2025–2034.

A needle holder, also known as a needle driver, is a surgical instrument used by doctors and surgeons to hold a suturing needle during surgical procedures. The rise in healthcare infrastructure investments, particularly in developing regions, is generating greater demand for surgical instruments, specifically needle holders. Furthermore, the rising number of dental surgeries is significantly contributing to the growth of the needle holder market. Needle holders are essential in dental implants and prosthetics for ensuring accurate suturing, reducing post-operative complications, and enhancing recovery. Thus, the growing need for dental surgical interventions, combined with advancements in dental care, is driving the demand for specialized needle holders.

To Understand More About this Research: Request a Free Sample Report

The surge in cosmetic and reconstructive surgeries is significantly boosting the needle holder market. Rising demand for procedures such as facelifts, breast implants, and corrective surgeries increases the need for precise instruments for suturing and wound closure, which is further fueling the needle holder market growth. Furthermore, advancements in surgical techniques and a growing focus on achieving optimal outcomes drive the demand for specialized needle holders.

Needle Holder Market Trends

Rise in Number of Accidental Injury Cases

Increasing incidents of accidents, including trauma from falls, vehicle collisions, and industrial mishaps, often necessitate surgical interventions. According to the Insurance Institute for Highway Safety, in 2022, the US reported 42,514 fatalities from motor vehicle crashes, resulting in a rate of 12.8 deaths per 100,000 individuals and 1.33 deaths per 100 million miles traveled. The rising frequency of accident injury cases is compelling healthcare facilities to enhance their surgical capabilities. The growing surgical interventions require effective suturing and wound closure, where needle holders are critical. Therefore, the rise in accidental injury cases is expected to drive the growth of the needle holder market during the forecast period.

Increase in Prevalence of Cancer

Cancer cases continue to increase globally, leading to a higher number of surgical interventions for diagnosis, treatment, and management of various cancers. Surgical procedures, including biopsies, tumor removals, and reconstructive surgeries, often necessitate the use of precise suturing techniques, where needle holders play a vital role. According to the World Health Organization (WHO), there were approximately 20 million reported cancer cases in 2022. As per the WHO Report, the number of new cancer cases is expected to exceed 35 million by 2050 due to different lifestyles and behavioral environments. Thus, the growing number of cancer patients would boost the demand for high-quality, specialized needle holders for oncological procedures, which, in turn, contributes to the needle holder market growth.

Needle Holder Market Segment Insights

Needle Holder Market Breakdown, by Application Insights

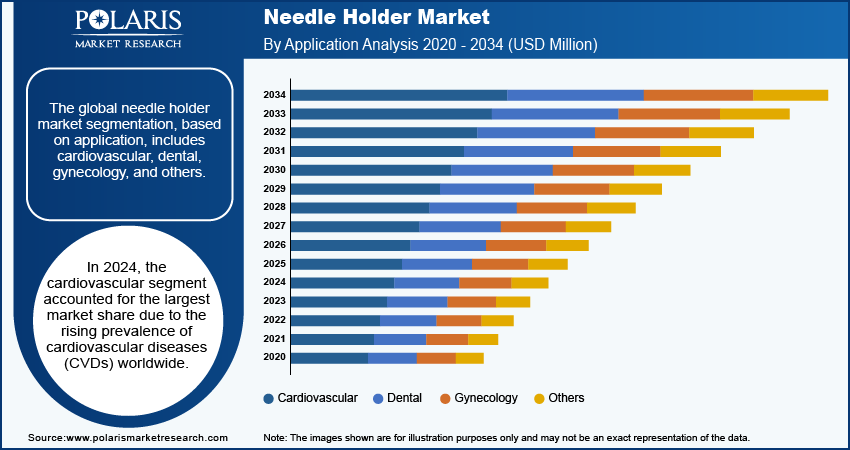

The global needle holder market segmentation, based on application, includes cardiovascular, dental, gynecology, and others. In 2024, the cardiovascular segment accounted for the largest market share due to the rising prevalence of cardiovascular diseases (CVDs) worldwide. For instance, according to the American Heart Association, the age-adjusted death rate from cardiovascular disease reached 233.3 per 100,000 in January 2024, an increase of 4.0% from the rate of 224.4 per 100,000 in 2023. Heart diseases remain a leading cause of death, increasing the demand for cardiovascular surgeries, including procedures such as coronary artery bypass grafting (CABG), valve repair, and aneurysm repairs. These surgeries require precise suturing techniques to ensure the proper placement and healing of tissues, where needle holders are essential instruments.

Needle Holder Market Breakdown, by End Use Insights

The global needle holder market segmentation, based on end use, includes hospitals, ambulatory surgical centers, and others. The hospital segment is expected to register the highest CAGR during the forecast period due to the increasing volume of surgeries being performed in hospital settings. Hospitals are equipped with advanced surgical facilities and specialized medical teams, making them the primary locations for complex procedures such as cardiovascular, orthopedic, and oncological surgeries. The rise in chronic disease prevalence, aging populations, and trauma cases further amplifies the demand for surgeries, leading to increased utilization of surgical instruments, including needle holders. Additionally, hospitals are investing in advanced technologies and high-quality medical equipment to improve patient outcomes, driving the demand for precision instruments. Further, the expanding healthcare infrastructure in emerging regions is expected to fuel the rapid growth of the needle holder market for the hospital segment.

Regional Insights

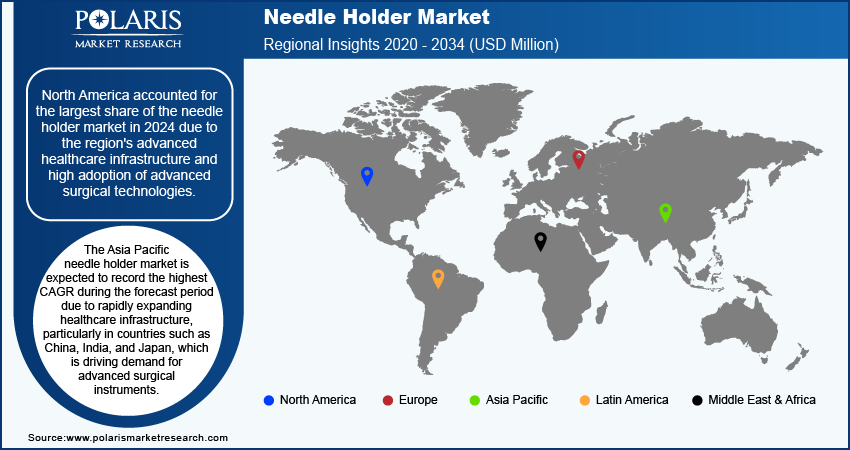

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the needle holder market in 2024 due to the region's advanced healthcare infrastructure and high adoption of advanced surgical technologies propelling the demand for specialized surgical instruments, including needle holders. North America's aging population, which is highly prone to requiring surgeries, further contributes to market growth. According to the Population Reference Bureau, the population of Americans aged 65 and above is expected to rise from 58 million in 2022 to 82 million by 2050, representing a 47% increase.

The US held the largest share of the needle holder market in North America in 2024 due to the presence of leading medical device manufacturers and increasing healthcare expenditure in the country. Moreover, ongoing advancements in the field of medical devices by the major companies have supported the dominant position of the US needle holder market.

The Asia Pacific needle holder market is expected to register the highest CAGR during the forecast period due to rapidly expanding healthcare infrastructure, particularly in countries such as China, India, and Japan, which is driving demand for advanced surgical instruments. The increasing prevalence of chronic diseases, rising medical tourism, and a growing number of surgical procedures across the region are contributing to the market growth in the region. According to the World Cancer Research Fund, in 2022, Australia had the highest cancer rate in men and women combined, at 462.5 people per 100,000. Additionally, an expanding aging population, which is more susceptible to requiring surgical interventions, is fueling demand for precision instruments such as needle holders across Asia Pacific.

The China needle holder market is expected to record a significant CAGR during the forecast period due to the growing aging population that is prone to requiring surgical interventions.

Needle Holder Market – Key Players and Competitive Insights

The competitive landscape of the needle holder market features several global and regional players offering a diverse range of surgical instruments. Key participants such as B. Braun Melsungen AG; Medline Industries, Inc.; Integra LifeSciences Corporation; and Sklar Surgical Instruments dominate through broad product portfolios, extensive distribution networks, and a focus on innovation. Major companies invest in product development to introduce advanced needle holders that enhance precision, ergonomics, and safety in surgical procedures. There are significant investments in research and development to improve materials such as titanium and stainless steel for increased durability and reduced complications.

Smaller and regional players are contributing to the market competitiveness by offering cost-effective solutions and targeting emerging markets, particularly in Asia Pacific and Latin America. Collaborations, partnerships with healthcare institutions, and acquisitions are common strategies used to strengthen market positions. The market is witnessing increased competition due to the rising presence of local manufacturers, particularly in developing regions, producing affordable yet reliable surgical instruments. This competitive dynamic foster innovation and price competition, offering healthcare facilities a wide range of needle holder options tailored to surgical needs. A few major players are August Reuchlen GmbH; B.Braun; Becton, Dickinson and Company; Hu-Friedy; Integra LifeSciences Corporation; J&J Instruments; Medline Industries, Inc.; Nordent Manufacturing; Olympus; Sklar Surgical Instruments; Towne Brothers (PVT) LTD.

B. Braun SE is a medical technology company that produces a wide range of medical devices and pharmaceutical products. Medical devices include surgical instruments, infusion pumps and systems, suture materials, dialysis equipment and accessories, and others. The company operates through Hospital Care, Avitum, and Aesculap. The Hospital Care division specializes in providing nutrition, infusion, and pain therapy products. Its system solutions include single-use products, drugs, and smart medical device systems for infusion therapy. The division also offers parenteral and enteral nutrition products and drink solutions for nutritional therapy. In March 2024, B. Braun Medical Inc. and Orlando Health collaborated to develop innovative solutions for improved patient and clinician access to care.

Johnson & Johnson Services, Inc. is a multinational corporation based in New Brunswick, New Jersey, USA. The company operates through pharmaceuticals, medical devices, and consumer health products operations. Its subsidiary, Janssen Pharmaceuticals, Inc., develops and markets drugs in various therapeutic areas, including neuroscience, oncology, infectious diseases, and immunology. Janssen Pharmaceuticals, Inc. manufactures various drugs, such as Risperdal (risperidone), Remicade (infliximab), and Zytiga (abiraterone). The company also has a medical devices division, which develops and markets a wide range of products, including surgical instruments, orthopedic implants, and diabetes care products. It also has a consumer health division, which develops and markets over-the-counter products such as Band-Aids, Tylenol, and Listerine.

Key Companies in Needle Holder Market

- August Reuchlen GmbH

- B.Braun

- Becton, Dickinson and Company

- Hu-Friedy

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Medline Industries, Inc.

- Nordent Manufacturing

- Olympus

- Sklar Surgical Instruments

- Towne Brothers (PVT) LTD

Needle Holder Industry Developments

In October 2023, Arrotek and NeedleTech consolidated under the Arrotek brand name. The rebranding includes expanded operations in Europe and the US, providing an extended range of services encompassing the design, development, and production of minimally invasive medical devices.

Needle Holder Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Olsen-Hegar Needle Holder

- Mayo-Hegar Needle Holder

- Derf Needle Holder

- Halsey Needle Holder

- Mathieu Needle Holder

- Crilewood Needle Holder

- Webster Needle Holder

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Cardiovascular

- Dental

- Gynecology

- Others

By Material Outlook (Revenue – USD Million, 2020–2034)

- Tungsten Carbide Needle Holder

- Stainless Steel Needle Holder

- Other Materials

By Usage Type Outlook (Revenue – USD Million, 2020–2034)

- Single Use Needle Holders

- Reusable Needle Holders

By End-Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Needle Holder Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 365.74 million |

|

Market Size Value in 2025 |

USD 393.32 million |

|

Revenue Forecast by 2034 |

USD 762.97 million |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global needle holder market size was valued at USD 365.74 million in 2024 and is projected to grow to USD 762.97 million by 2034.

The global market is projected to record a CAGR of 7.6% during the forecast period.

North America accounted for the largest share of the global market in 2024 due to the region's advanced healthcare infrastructure and high adoption of advanced surgical technologies.

A few key players in the market are August Reuchlen GmbH; B.Braun; Becton, Dickinson and Company; Hu-Friedy; Integra LifeSciences Corporation; J&J Instruments; Medline Industries, Inc.; Nordent Manufacturing; Olympus; Sklar Surgical Instruments; Towne Brothers (PVT) LTD.

The cardiovascular segment dominated the market in 2024 due to the rising prevalence of cardiovascular diseases (CVDs) worldwide.

The hospital segment is expected to register the highest CAGR during the forecast period due to the increasing volume of surgeries being performed in hospital settings.