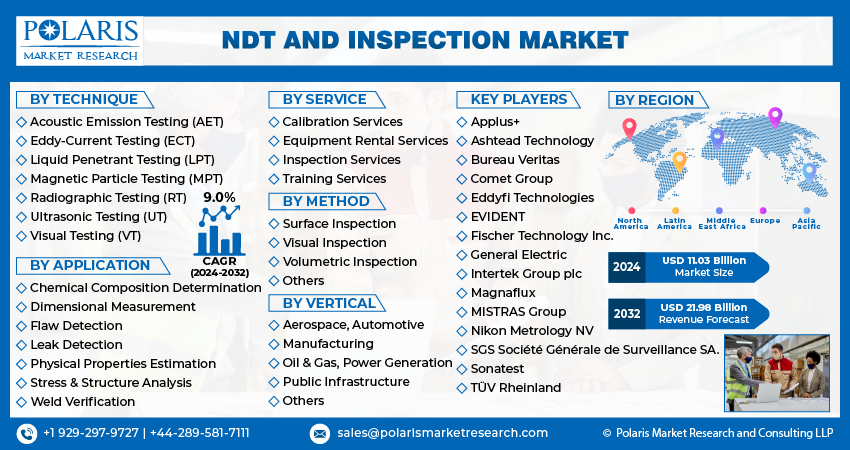

NDT and Inspection Market Share, Size, Trends, Industry Analysis Report, By Technique; By Service; By Method (Surface Inspection, Visual Inspection, Volumetric Inspection, Others); By Vertical; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4642

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

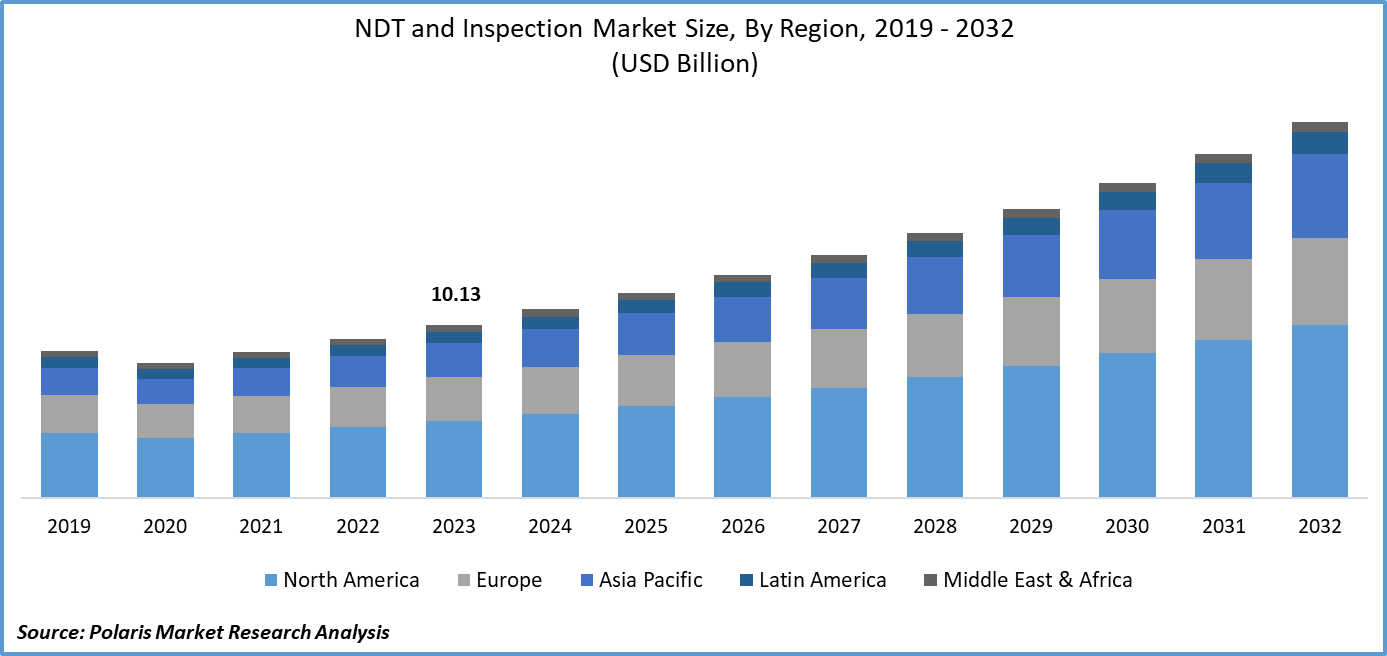

Global NDT and inspection market size was valued at USD 10.13 billion in 2023. The market is anticipated to grow from USD 11.03 billion in 2024 to USD 21.98 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period

Industry Trends

Nondestructive testing (NDT) refers to the examination of materials, components, or systems without causing damage or alteration to their structure or function. It involves various techniques that allow inspectors to evaluate the quality, safety, and reliability of a material or component without compromising its integrity. Inspection, on the other hand, typically involves visually examining a material or component for defects or irregularities. Both NDT and inspection are crucial in ensuring the quality and safety of structures, machines, and products.

The global NDT and inspection market trends is a rapidly growing industry, driven by increasing demand for quality control and safety measures across various industries such as manufacturing, oil & gas, aerospace, automotive, and infrastructure. The key factor for the growth of the market is the increasing awareness of safety and quality standards across industries. As products become more complex and critical, the need for reliable and accurate inspection methods has grown significantly.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2023, Creaform, which is a business unit of AMETEK, Inc., launched VXintegrity. This advanced NDT software platform brings together all analytical functions and tools into a user-friendly interface. This new software is targeted towards inspection teams and service companies.

This has led to higher adoption of NDT techniques to ensure product reliability and durability. Another factor contributing to the growth of the NDT and inspection market is the advancement of technology. New methods such as ultrasonic testing, radiography, and eddy current testing have been developed, offering improved accuracy and efficiency. These advanced methods have made it possible to detect defects and flaws that were previously undetectable, further increasing the demand for NDT services.

Despite this, the market is hindered by the high initial investment cost for NDT equipment and training personnel. This is a significant barrier to the adoption of these techniques. In addition, some NDT techniques are time-consuming, leading to delays in production schedules and increased downtime. This creates a problem for companies that rely on quick turnaround times to meet customer demands. Overall, the market outlook for the NDT and inspection market remains positive as technology continues to advance and awareness of safety and quality standards increases exponentially.

Key Takeaways

- North America dominated the market and contributed over 33% of global NDT and inspection market share in 2023

- By technique category, the ultrasonic testing (UT) segment dominated the global NDT and inspection market size

- By vertical category, the manufacturing segment is expected to grow with a significant CAGR over the NDT and inspection market forecast period

- By method category, the volumetric inspection segment accounts for the largest NDT and inspection market share.

What are the Market Drivers Driving the Demand for the Ndt and Inspection Market?

The Increasing Need for the Monitoring of Infrastructure’s Structural Health and Maintenance Requirements Drives the Ndt and Inspection Market Growth

The aging of infrastructures, combined with the increasing demand for maintenance, has created a need for NDT and inspection equipment and services. Rather than demolishing existing infrastructures and constructing new ones, periodic health monitoring inspections of the aging assets are preferred. This helps extend their operational life and prevent damage by providing precise data during inspections, thereby mitigating the risk of premature and unexpected failures.

NDT and inspection techniques are crucial in this process as they gather information on structural performance parameters, including strains, displacements, and stresses. This data is then analyzed using advanced post-processing tools to infer the structures' current operational state and remaining life. Techniques such as Ultrasonics (UT), Acoustic Emission (AE), Infrared Thermography (IRT), and Digital Image Correlation (DIC)are integral to this process. Diverse sectors, including oil and gas plants and the infrastructure components of bridges, buildings, and power plant structures, require aging asset inspections. Ongoing inspection and health monitoring of concrete and steel structures contribute to the global growth of the NDT and inspection market.

Which Factor is Restraining the Demand for Ndt and Inspection?

Substantial Investments are Required for the Adoption of the Ndt and Inspection

The high cost of investment is a significant restraining factor in the NDT and inspection market, hindering its widespread adoption. The implementation of NDT and inspection technologies requires substantial financial resources, including the purchase of specialized equipment, training of personnel, and maintenance costs. Many organizations, particularly small and medium-sized enterprises (SMEs), don't have the necessary budget to invest in these technologies, limiting their ability to adopt them. Also, the cost of inspector certification and the expense of hiring trained professionals to operate and maintain the equipment can be expensive for some companies. These factors demotivate potential customers from investing in NDT and inspection services, thereby restricting the growth of the market.

Report Segmentation

The market is primarily segmented based on technique, service, method, vertical, application, and region.

|

By Technique |

By Service |

By Method |

By Vertical |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Technique Insights

Based on technique analysis, the market has been segmented on the basis of acoustic emission testing (AET), eddy-current testing (ECT), liquid penetrant testing (LPT), magnetic particle testing (MPT), radiographic testing (RT), ultrasonic testing (UT), visual testing (VT). The ultrasonic testing (UT) segment is expected to dominate the NDT and inspection market in 2023 due to its versatility, accuracy, and cost-effectiveness. UT uses high-frequency sound waves to detect flaws or defects in materials, making it an effective method for inspecting a wide range of products, including metals, composites, and ceramics. Its ability to detect subsurface defects that are not visible to the naked eye makes it particularly useful in critical industries such as aerospace, automotive, and energy.

Also, ultrasonic testing can be used for both destructive and non-destructive testing, allowing for real-time evaluation of materials without the need for sample preparation or damage. This has led to increased adoption of various manufacturing processes, contributing to the largest NDT and inspection market share of the ultrasonic testing segment.

By Vertical Insights

Based on vertical category analysis, the market has been segmented on the basis of aerospace, automotive, manufacturing, oil & gas, power generation, public infrastructure, and others. The manufacturing segment is anticipated to grow significantly during the forecast period since manufacturers are increasingly adopting NDT techniques as part of their quality control processes to ensure that their products meet strict safety and quality standards. In parallel, advancements in NDT technologies have made them more efficient and cost-effective, making it easier for manufacturers to integrate them into their production processes. Also, many countries have implemented stringent regulations requiring manufacturers to use NDT methods to ensure the safety and reliability of their products. As a result, the demand for NDT and inspection services is likely to increase significantly, driving the growth of the manufacturing segment in the NDT and inspection market.

Regional Insights

North America

The North American region, which includes the United States and Canada, emerged as the dominant region in the global Non-Destructive Testing (NDT) and inspection market in 2023. This dominance can be attributed to several factors, such as the presence of well-established industries such as aerospace, automotive, and energy, which require regular NDT and inspection services to ensure the safety and quality of their products. Also, increasing investments in infrastructure development projects, such as bridges, roads, and pipelines, have fueled the demand for NDT and inspection services in the region. The growing industry trends toward outsourcing NDT and inspection services to third-party providers have further contributed to the growth of the market in North America.

Asia Pacific

The Asia Pacific region is experiencing significant growth in the market due to the increasing demand for safety and quality assurance in various industries such as manufacturing, construction, oil and gas, aerospace, and automotive. Many countries in the region, including China, India, Japan, and Indonesia, have strict regulations and standards that require regular inspections and maintenance of equipment and infrastructure, which further drives the demand for NDT services. Along with this, advancements in technologies such as robotics, artificial intelligence, and IoT are enabling the development of new NDT methods and tools that offer improved accuracy, speed, and cost-effectiveness, making them more attractive to companies in the region.

Competitive Landscape

The global market is highly competitive, with numerous players competing for NDT and inspection market share. The market is fragmented, with many small and medium-sized companies offering specialized services and products. Some of the major players in the market include General Electric, Olympus Corporation, Ashtead Technology, and MISTRAS Group. These companies offer a wide range of NDT and inspection solutions, including ultrasonic testing, radiography, eddy current testing, and visual inspection. In addition, there are also several startups and emerging companies that are developing innovative technologies and solutions.

Some of the major players operating in the global market include:

- Applus+

- Ashtead Technology

- Bureau Veritas

- Comet Group

- Eddyfi Technologies

- EVIDENT

- Fischer Technology Inc.

- General Electric

- Intertek Group plc

- Magnaflux

- MISTRAS Group

- Nikon Metrology NV

- SGS Société Générale de Surveillance SA.

- Sonatest

- TÜV Rheinland

Recent Developments

- In August 2023, Waygate Technologies, a Baker Hughes company, introduced the Krautkrämer RotoArray comPAct - a manual phased array (PA) ultrasonic inspection tool designed for large-scale composite materials.

- In October 2022, ICR Integrity (ICR), a provider of Non-Destructive Testing (NDT) solutions, introduced a revolutionary NDT technique called INSONO. This technique is specifically designed for the inspection of composite repairs applied to metallic components.

- In October 2020, Novosound, a company specializing in ultrasonic sensing technology, introduced a new range of products aimed at revolutionizing the non-destructive testing (NDT) market. The product series consists of Kelpie, Belenus, and Nebula, each equipped with advanced features to enhance the accuracy and efficiency of NDT processes.

Report Coverage

The NDT and Inspection market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, technique, service, method, vertical, application, and futuristic growth opportunities.

NDT and Inspection Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.03 billion |

|

Revenue Forecast in 2032 |

USD 21.98 billion |

|

CAGR |

9.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Technique, By Service, By Method, By Vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of NDT and Inspection Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

key companies in NDT and Inspection Market are Applus+, Ashtead Technology, Bureau Veritas, Comet Group, Eddyfi Technologies, EVIDENT, Fischer Technology Inc

NDT and Inspection Market exhibiting a CAGR of 9.0% during the forecast period

The NDT and Inspection Market report covering key segments are technique, service, method, vertical, application, and region.

key driving factors in NDT and Inspection Market are the increasing need for the monitoring of infrastructure's structural health and maintenance requirements

The global NDT and inspection market size is expected to reach USD 21.98 Billion by 2032