Natural Food Color Market Share, Size, Trends, Industry Analysis Report, By Application (Pet Food, Bakery & Confectionery, Fruits & Vegetables, Meat Alternatives/ Plant-based Meat, Oils & Fats, Dairy & Frozen Products, Beverages, Meat Products); By Ingredients; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM1657

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

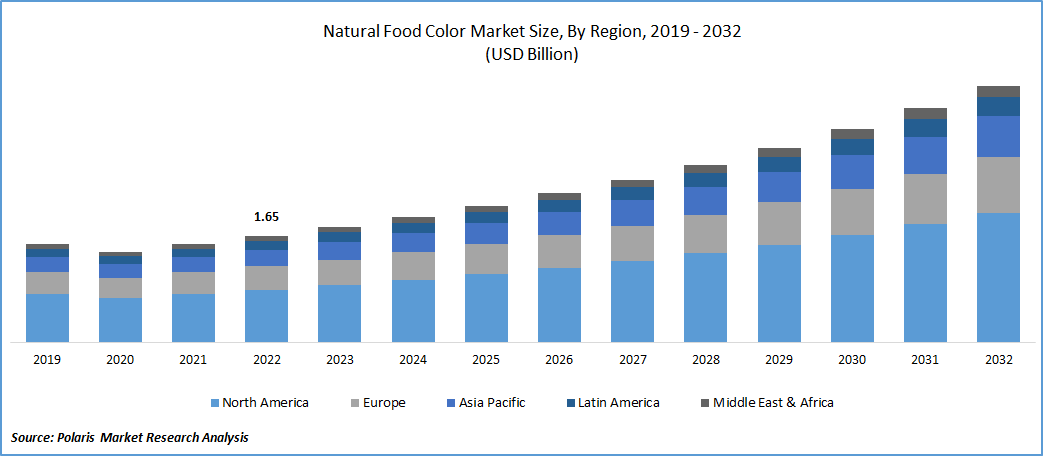

The global Natural Food Color market was valued at USD 1.79 billion in 2023 and is expected to grow at a CAGR of 9.3% during the forecast period.

The increasing demand for natural food colors is primarily fueled by factors that elevate the overall attractiveness and consumption of these products. A key catalyst is the rising emphasis on visual appeal in the food industry, where natural food colors play a crucial role in enhancing the visual allure of food and beverages. Given that consumers often rely on their eyes to assess food quality, products with vibrant and visually captivating colors are perceived as more valuable and are consequently more likely to be selected for purchase.

The increasing awareness and desire for clean-label products continue to drive the expansion of the natural food colors market. Modern consumers are increasingly mindful of the ingredients in their food and beverages, showing a preference for natural alternatives over artificial additives. As a result, there is a notable increase in the demand for natural food colors sourced from fruits, vegetables, and other botanicals. Manufacturers are actively responding to this trend by providing a diverse array of natural food color options, significantly contributing to the growth of the market for these products.

To Understand More About this Research: Request a Free Sample Report

Moreover, the growth of the global food and beverage industry, especially in developing nations, has contributed to the rising demand for natural food colors. With expanding economies and increasing disposable incomes, consumers in these regions are seeking a wider range of food options. This has prompted food manufacturers to adopt natural food colors to meet the evolving preferences and requirements of these emerging Natural Food Color markets.

The pervasive influence of social media and food photography has made a significant impact on the natural food colors market. Platforms such as Instagram and Facebook have cultivated a culture of showcasing food experiences, placing heightened importance on the visual appeal of food, including its colors. Consequently, food manufacturers and chefs are turning to natural food colors sourced from fruits, vegetables, and other botanicals to craft visually striking and Instagram-worthy dishes.

Industry Dynamics

Growth Drivers

Increasing Consumer Awareness About Distinguishing Products

Consumers, particularly in industrialized nations, have enhanced their ability to discern the manufacturing process and the quality of ingredients used in a product. As they gain knowledge about their food and the processing substances, customers develop preferences for products they want to see on the shelves. This heightened consumer demand for goods crafted with solely natural materials and additives creates ample opportunities for the natural food coloring market in the food processing sector. Moreover, the projected period is expected to witness a rise in demand for natural food colorants and coloring, driven by the increasing consumer inclination to restrict the excessive use of artificial colorants in food products.

Report Segmentation

The market is primarily segmented based on ingredients, application, and region.

|

By Ingredients |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Ingredients Analysis

The Beta-Carotene Segment Held the Largest Revenue Share in 2023

The surge in beta-carotene's popularity can be attributed to its natural origin, positioning it as a safer option compared to synthetic alternatives. As a natural pigment and antioxidant present in various vegetables, algae, fruits, and yeast, beta-carotene, belonging to the carotenoid family, alongside pigments like lycopene and lutein, has gained prominence in the food industry.

Recognized for its dual role as a natural food colorant and nutritional supplement, beta-carotene occurs organically in fruits and vegetables such as cantaloupe, sweet potatoes, carrots, and apricots, imparting their distinctive yellow or orange tint. Its appealing color properties make beta-carotene well-suited for incorporation into dairy products, margarine, cheese, soft drinks,salad dressings, and energy drinks.

Moreover, heightened consumer awareness of the potential health impacts of artificial colorants has led to a growing demand for additive-free foods and beverages. In response, many market players are investing in extraction and stabilization technologies to provide naturally sourced food colors, aligning with the increasing consumer preference for more natural options in their food selections.

The blue spirulina segment is poised to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. Extracted from the blue-green algae Arthrospira platensis, blue spirulina is a vivid blue pigment that has gained substantial popularity in the food and beverage industry as a secure and natural substitute for synthetic food dyes. The market for blue spirulina is being propelled by a favorable regulatory landscape and an increasing demand for plant-based diets.

For instance, In November 2022, GNT, a leading color supplier, received official approval from the U.S. Food and Drug Administration (FDA) to employ spirulina extract as a natural food colorant in beverages. This regulatory endorsement presents promising opportunities for manufacturers, enabling them to infuse vibrant blue hues into their products while upholding their clean-label status.

This approval opens avenues for the utilization of spirulina extract in diverse beverage applications, encompassing sports drinks, juice beverages, and alcoholic drinks. GNT has also pioneered an innovative and patented formulation technology ensuring the stability of the extract, further augmenting its appeal among food and beverage manufacturers.

By Application Analysis

The Beverages Segment Accounted for the Highest Market Share During the Forecast Period

The escalating consumer inclination toward healthier and natural choices is propelling the adoption of natural food colors in the beverage sector. With heightened awareness of potential health risks linked to artificial food colors, including allergies and hyperactivity in children, consumers are increasingly seeking beverages that incorporate natural and safe food colors.

In response to this demand, key players in the natural food colors market are proactively launching new products and implementing diverse strategies. For instance, in September 2022, Sun Chemical introduced SUNFOODS Natural Colorants, a collection of natural colorants for food and beverages, showcased at the Supply Side West event in Las Vegas. These colorants, sourced from vegetables, algae, and fruits, are suitable for a range of applications such as bakery, dairy, pet food, and confectionery. This initiative underscores the industry's commitment to delivering natural and clean-label products in alignment with evolving consumer preferences.

The meat alternative/plant-based meat sector demonstrated a CAGR throughout the forecast period. In response to consumer preferences for healthier and sustainable food options, plant-based meats have emerged as a compelling alternative to conventional meat products. Natural food colors, sourced from plants like fruits, vegetables, and algae, play a crucial role in replicating the appearance of real meat, enhancing the visual appeal and appeal of plant-based meats.

For instance, In May 2023, GNT introduced Exberry Compound Red, a novel plant-based natural food concentrate designed to impart a brownish hue to red meat alternatives when grilled or fried. Crafted from carrots and vegetable oil, this ingredient is recognized for its clean-label attributes. The Exberry Compound Red series features two distinct shades, Autumn Red and Fall Forest Red, providing versatility in creating various browned meat colors. Notably, this compound is user-friendly and brings about a color transformation in meat analogs when subjected to heat.

Regional Insights

Europe Dominated the Largest Market in 2023

The surge in European consumers' inclination towards natural, straightforward, and recognizable ingredients stands as a key catalyst propelling the expansion of the natural food colors industry in the region. With an increasing awareness of dietary choices, consumers actively seek healthier snack alternatives featuring all-natural components, particularly within the snack industry. The demand for products bearing labels such as "no additives or preservatives," "GMO-free," "whole grain," or "all-natural" is witnessing a notable rise, reflecting consumers' desire for assurance regarding the quality and healthiness of their food selections. Responding to this shift, food manufacturers are incorporating natural food colors sourced from fruits, vegetables, and plant extracts to align with consumer preferences, leading to substantial market growth.

The Asia Pacific natural food colors market is anticipated to experience the fastest CAGR. Within the Asia Pacific region, the food and beverage industry is actively engaging in innovation as companies strive to distinguish themselves in a competitive market. Natural food colors have emerged as a valuable tool for manufacturers in their pursuit of differentiation and have established a solid presence in the food and beverage sector.

Additionally, regulations like the T/CNFIA 101-2017 on Coloring Foods, issued by the China National Food Industry Association, have exerted a significant impact on the natural food colors market in the country. The stringent criteria set forth in the standard mandate that colorants used in food products must be sourced exclusively from natural and edible raw materials, such as plants, fruits, vegetables, and algae. Moreover, the use of organic solvent extraction for pigment extraction is prohibited, with colorants required to be obtained solely through physical processes.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ADM

- Allied Biotech Corporation

- AROMATAGROUP SRL

- Australian Food Ingredient Suppliers

- BASF SE

- Döhler GmbH

- Givaudan

- IFC Solutions

- INCOLTEC

- Ingredion

- Kalsec Inc.

- NATUREX

- ROHA Group

- Roquette Frères

- San-Ei Gen F.F.I., Inc.

- Sensient Technologies Corporation

- Spring TopCo DK ApS (Oterra)

- Vivify

Recent Developments

- In July 2022, Symrise AG, has introduced an emollient endowed with antimicrobial properties, providing skin protection from head to toe. In addition to various functions, this ingredient plays a role in supporting concepts for dandruff control. It is also effective in skincare products designed for individuals with acne-prone and oily skin.

- In June 2022, Symrise AG, has established a facility in Grasse to strengthen its presence in natural raw materials, particularly for Maison Lautier 1795. This facility will complement the company's existing factories in Holzminden, Germany, and Madagascar.

Natural Food Color Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.95 billion |

|

Revenue forecast in 2032 |

USD 3.99 billion |

|

CAGR |

9.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Ingredients, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Natural Food Colors Market report covering key segments are ingredients, application, and region

Natural Food Color Market Size Worth $ 3.99 Billion By 2032.

The global Natural Food Color market is expected to grow at a CAGR of 9.3% during the forecast period.

Europe is leading the global market.

The key driving factors in Natural Food Colors Market are Increasing consumer awareness about distinguishing products