Natural Beta Carotene Market Share, Size, Trends, Industry Analysis Report: By Source (Algae, Fruit & Vegetable, Fungi, and Palm Oil), Form, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 115

- Format: PDF

- Report ID: PM5268

- Base Year: 2024

- Historical Data: 2020-2023

Natural Beta Carotene Market Overview

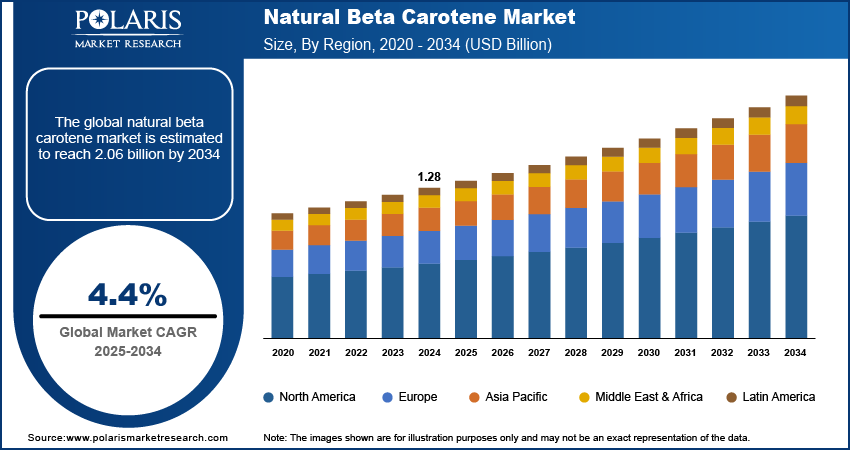

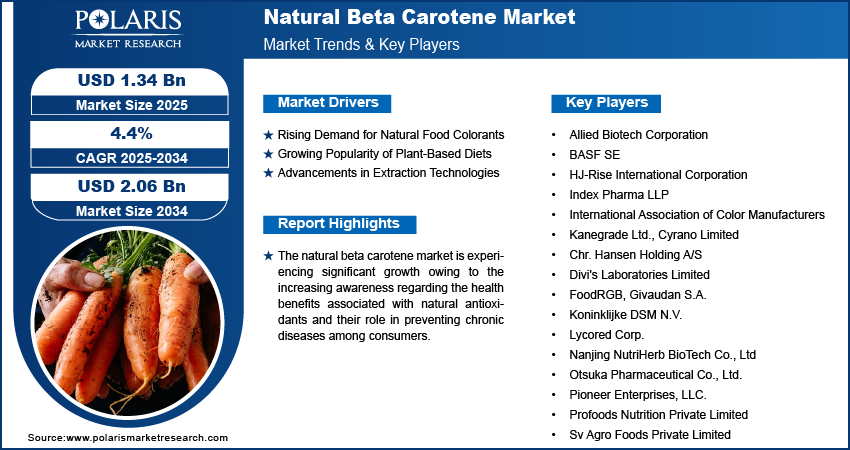

The natural beta carotene market size was valued at USD 1.28 billion in 2024. The market is projected to grow from USD 1.34 billion in 2025 to USD 2.06 billion by 2034, exhibiting a CAGR of 4.4% during 2025–2034.

Natural beta carotene is a naturally occurring pigment and precursor to vitamin A found in various plants, fruits, and algae. It belongs to the carotenoid family of compounds, which are responsible for the red, orange, and yellow hues in many fruits and vegetables.

The natural beta carotene market is experiencing significant growth owing to the increasing awareness regarding the health benefits associated with natural antioxidants and their role in preventing chronic diseases among consumers. The rising demand for natural food colorants, particularly in the food & beverage industry, is also propelling natural beta carotene market expansion.

The surging shift toward plant-based diets and the growing preference for clean-label products are among the future trends that are estimated to contribute to the market dynamics in the coming years. Additionally, advancements in extraction technologies and the rising use of natural beta carotene in cosmetics and dietary supplements are expected to sustain the market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Natural Beta Carotene Market Driver Analysis

Rising Demand for Natural Food Colorants

As consumers become more health-conscious, there is a growing preference for natural ingredients over synthetic alternatives. Natural beta carotene, a popular ingredient in the food & beverage industry, is widely used to enhance the color of products such as juices, dairy, and confectioneries. The shift toward clean-label products, which prioritize transparency and natural ingredients, has further amplified the demand for natural beta carotene and propelled the natural beta carotene market.

Growing Popularity of Plant-Based Diets

The surge in preference for plant-based diets has had a profound impact on the natural beta carotene market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-derived nutrients, including beta-carotene, has risen. This trend is particularly strong in regions such as North America and Europe, where the plant-based movement is gaining significant traction. Natural beta carotene, primarily sourced from fruits and vegetables, aligns perfectly with the preferences of health-conscious consumers seeking natural, plant-based nutritional supplements. Therefore, the rising popularity of plant-based diets will contribute to the natural beta carotene market growth in the coming years.

Advancements in Extraction Technologies

Advancements in extraction technologies are playing a crucial role in the development of the natural beta carotene market. New and improved methods for extracting beta-carotene from natural sources, such as algae and carrots, have enhanced the efficiency and purity of the final product. These technological innovations are making natural beta carotene more accessible and cost-effective, encouraging its use across various industries such as food, cosmetics, and pharmaceuticals. As companies continue to invest in research and development, these advancements are expected to drive the growth of the natural beta carotene market in the future.

Natural Beta Carotene Market Segment Analysis

Natural Beta Carotene Market Assessment by Source Insights

The natural beta carotene market, based on source, is segmented into algae, fruit & vegetable, fungi, and palm oil. The algae segment dominated the market share in 2024 due to its high carotenoid content and sustainable cultivation methods. The increasing demand for clean-label and plant-based ingredients in food, beverages, and dietary supplements significantly bolstered the growth of this segment. Algae cultivation requires minimal land and water resources, making it an eco-friendly option amid rising environmental concerns. Additionally, advancements in algae farming technologies, including closed-system photobioreactors, have enhanced production efficiency and quality, further strengthening its market position.

The fruit and vegetable segment is projected to dominate the market in the coming years. This growth is attributed to the widespread consumer preference for familiar and recognizable sources of nutrients. Fruits such as carrots and sweet potatoes, along with leafy greens, are rich in beta carotene and appeal to consumers prioritizing holistic nutrition. The increasing trend toward functional foods and beverages that incorporate natural colorants and antioxidants is driving demand in this segment. Furthermore, the rise of organic farming and the growing availability of non-GMO options align with consumer expectations, ensuring robust expansion in the future.

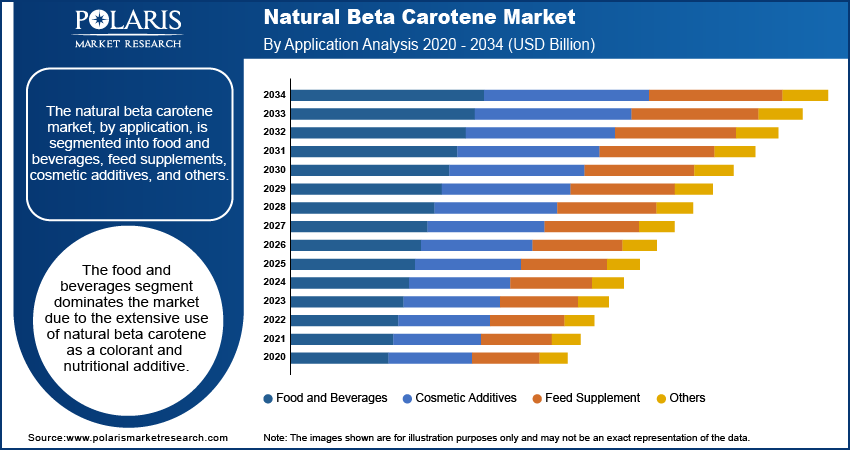

Natural Beta Carotene Market Evaluation by Application Insights

The natural beta carotene market, by application, is segmented into food and beverages, feed supplements, cosmetic additives, and others. The food and beverages segment dominates the market due to the extensive use of natural beta carotene as a colorant and nutritional additive. Its popularity stems from the increasing consumer demand for natural ingredients in food products, where beta-carotene enhances visual appeal and adds nutritional value. The emphasis on clean-label products in the food & beverage industry has solidified the dominance of this segment as manufacturers seek to replace synthetic additives with natural alternatives.

The cosmetic additives segment is witnessing the highest growth in the market. As the beauty & personal care industry increasingly leans toward natural and organic formulations, the demand for natural beta carotene as an ingredient in skincare and cosmetic products is rising rapidly. This growth is driven by the antioxidant properties of beta-carotene, which are highly valued in antiaging and skin protection products. The rising consumer preference for cosmetic products that are free from synthetic chemicals and rich in natural ingredients is propelling this segment’s growth.

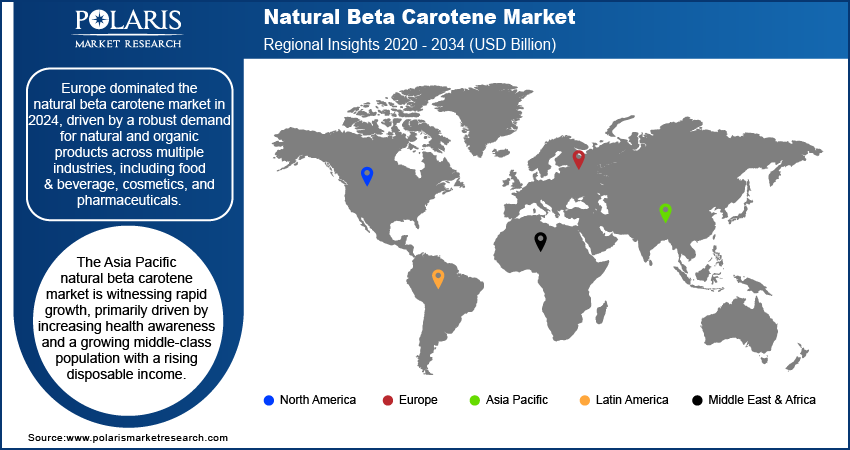

Natural Beta Carotene Market Share by Region

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the natural beta carotene market in 2024, driven by a robust demand for natural and organic products across multiple industries, including food & beverage, cosmetics, and pharmaceuticals. The region's stringent regulations on synthetic additives have accelerated the shift towards natural alternatives, with natural beta carotene being a preferred choice due to its clean-label appeal. Additionally, the strong emphasis on health and wellness among European consumers has boosted the market, as natural beta carotene is widely recognized for its antioxidant properties and nutritional benefits. Countries such as Germany, France, and the UK are key contributors to the regional market growth, supported by a well-established food processing and cosmetics industry.

The Asia Pacific natural beta carotene market is witnessing rapid growth, primarily driven by increasing health awareness and a growing middle-class population with a rising disposable income. The food & beverage industry in countries such as China, India, and Japan is expanding rapidly, creating a substantial demand for natural colorants and nutritional supplements. Moreover, the region's booming cosmetic industry, coupled with a growing preference for natural ingredients in skincare and beauty products, is propelling the natural beta carotene market growth in the region. The expanding agricultural sector in Asia Pacific also supports the production and availability of natural sources of beta carotene, contributing to the region's market growth.

Natural Beta Carotene Market – Key Players and Competitive Analysis Report

The natural beta carotene market is highly competitive, with several key players actively contributing to its growth and development. Notable companies in this market are Allied Biotech Corporation, BASF SE, HJ-Rise International Corporation, Index Pharma LLP, International Association of Color Manufacturers, Kanegrade Ltd., Chr. Hansen Holding A/S, colorMaker, Inc., Cyrano Limited, Divi's Laboratories Limited, FoodRGB, Givaudan S.A., Koninklijke DSM N.V., Lycored Corp., Nanjing NutriHerb BioTech Co., Ltd, Otsuka Pharmaceutical Co., Ltd., Pioneer Enterprises, LLC., Profoods Nutrition Private Limited, Sv Agro Foods Private Limited. These companies are engaged in various strategies such as mergers and acquisitions, product innovations, and expansions to strengthen their market position and meet the growing demand for natural beta carotene across different industries.

In terms of competitive analysis, BASF SE is among the major players, benefiting from its extensive product portfolios and strong global distribution networks. The company holds a significant market share due to its ability to consistently innovate and meet stringent regulatory standards in regions such as Europe and North America. Lycored Ltd. and Chr. Hansen Holding A/S also holds a considerable share, focusing on high-quality natural beta carotene derived from sources such as tomatoes and algae. Their commitment to sustainability and natural ingredient sourcing has resonated well with consumers and businesses alike, particularly in regions with a strong demand for clean-label products.

Key Companies in the Natural Beta Carotene Market

- Allied Biotech Corporation

- BASF SE

- HJ-Rise International Corporation

- Index Pharma LLP

- International Association of Color Manufacturers

- Kanegrade Ltd.

- Chr. Hansen Holding A/S

- Cyrano Limited

- Divi's Laboratories Limited

- FoodRGB, Givaudan S.A.

- Koninklijke DSM N.V.

- Lycored Corp.

- Nanjing NutriHerb BioTech Co., Ltd

- Otsuka Pharmaceutical Co., Ltd.

- Pioneer Enterprises, LLC.

- Profoods Nutrition Private Limited

- Sv Agro Foods Private Limited

Natural Beta Carotene Market Developments

- In June 2024, BASF SE announced the expansion of its production facilities to increase the output of natural beta carotene, highlighting its commitment to meeting the rising consumer demand for natural and sustainable products.

- In April 2024, DSM announced a strategic partnership to enhance its sustainability efforts in the natural ingredients sector, further solidifying its leadership in the market.

Natural Beta Carotene Market Segmentation

By Source Outlook (Revenue – USD Billion, 2020–2034)

- Algae

- Fruit & vegetable

- Fungi

- Palm Oil

By Form Outlook (Revenue – USD Billion, 2020–2034)

- Oil

- Powder

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Food and Beverages

- Feed Supplement

- Cosmetic Additives

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Natural Beta Carotene Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.28 billion |

|

Market Size Value in 2025 |

USD 1.34 billion |

|

Revenue Forecast in 2034 |

USD 2.06 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global natural beta carotene market size was valued at USD 1.28 billion in 2024 and is projected to grow to USD 2.06 billion by 2034.

The global market is projected to register a CAGR of 4.4% during 2025–2034.

Europe accounted for the largest share of the global market.

Notable companies in this market include Allied Biotech Corporation, BASF SE, HJ-Rise International Corporation, Index Pharma LLP, International Association of Color Manufacturers, Kanegrade Ltd., Chr. Hansen Holding A/S, colorMaker, Inc., Cyrano Limited, Divi's Laboratories Limited, FoodRGB, Givaudan S.A., Koninklijke DSM N.V., Lycored Corp., Nanjing NutriHerb BioTech Co., Ltd, Otsuka Pharmaceutical Co., Ltd., Pioneer Enterprises, LLC., Profoods Nutrition Private Limited, Sv Agro Foods Private Limited.

The food and beverages segment accounted for the largest market share.