Nanomedicine Market Size, Share, & Industry Analysis Report

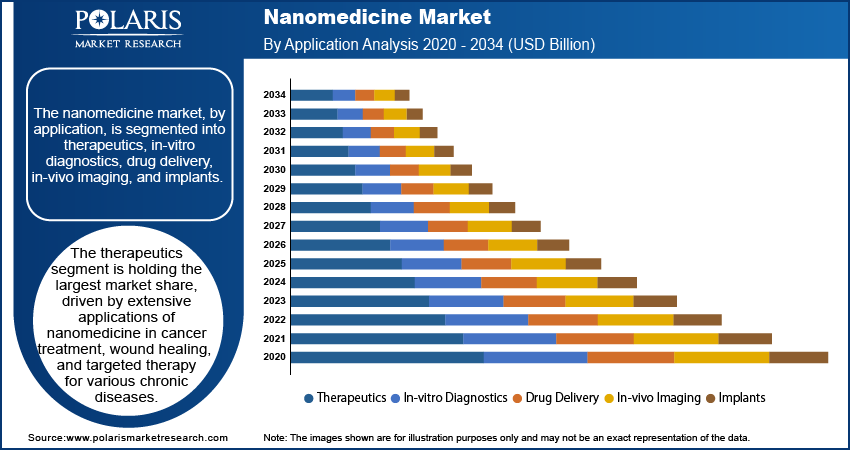

: By Application (Therapeutics, In-Vitro Diagnostics, Drug Delivery, In-Vivo Imaging, and Implants), Indication, Molecule Type, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 114

- Format: PDF

- Report ID: PM3637

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

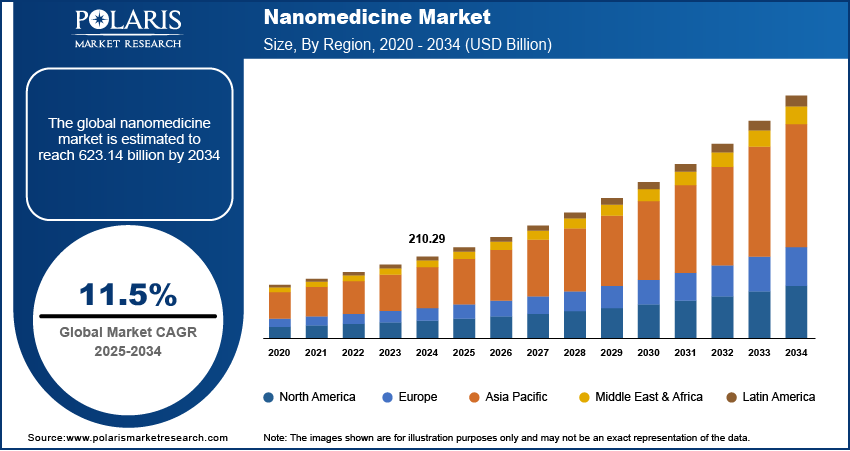

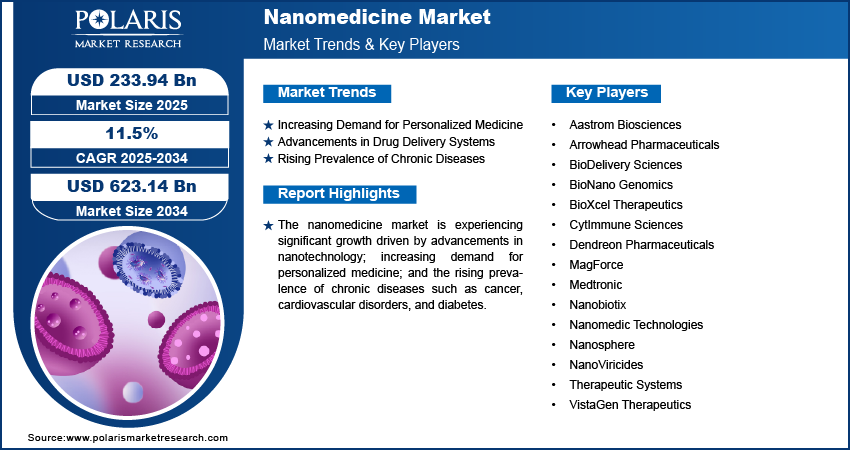

The nanomedicine market size was valued at USD 210.29 billion in 2024. The market is projected to grow from USD 233.94 billion in 2025 to USD 623.14 billion by 2034, exhibiting a CAGR of 11.5% during 2025–2034. The nanomedicine market is expanding due to rising chronic diseases, advanced drug delivery systems, increasing R&D investments, growing aging populations, and technological innovations in nanotechnology for diagnostics, therapeutics, and regenerative medicine.

Key Insights

- The therapeutics segment leads the market, driven by its broad application in treating cancer, chronic illnesses, and wound healing, alongside increasing demand for precision therapies that enhance efficacy while minimizing side effects.

- Clinical oncology holds the largest market share during the forecast period, fueled by the global rise in cancer cases and the growing need for targeted, minimally invasive treatments that improve patient outcomes and reduce systemic toxicity.

- North America dominates global nanomedicine revenue, supported by robust R\&D funding, a strong presence of top pharmaceutical and biotech firms, and advanced healthcare infrastructure that accelerates innovation and early adoption of nanomedical technologies.

- Europe remains a key region in the market, backed by substantial research funding, collaborative academic-industry efforts, and a mature healthcare system that fosters clinical translation and regulatory support for emerging nano therapies.

- Asia Pacific is witnessing rapid growth in the nanomedicine sector, propelled by expanding healthcare needs, increasing investment in biotech research, and growing government focus on modernizing healthcare through advanced medical technologies and infrastructure development.

Industry Dynamics

- Rising demand for advanced, targeted therapies is driving nanomedicine adoption, as patients and healthcare providers seek more effective treatments with fewer side effects for chronic diseases and complex medical conditions.

- Expanding use of nanomedicine in oncology and personalized treatment is creating new growth opportunities, offering precision drug delivery systems that improve therapeutic outcomes and reduce toxicity in cancer care.

- Regulatory challenges, high development costs, and limited clinical data on long-term safety and efficacy hinder broader nanomedicine adoption, particularly in markets with strict medical standards and approval processes.

- Technological advancements in nanocarriers and drug delivery systems are promoting innovation, enabling more efficient, site-specific therapies that align with the healthcare industry's shift toward precision medicine and improved patient outcomes.

Market Statistics

- 2024 Market Size: USD 210.29 billion

- 2034 Projected Market Size: USD 623.14 billion

- CAGR (2025-2034): 11.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The nanomedicine market refers to the use of nanotechnology in medical applications, including the development of drugs, diagnostic tools, and therapeutic devices at the nanoscale. This market is driven by the increasing demand for personalized medicine, advancements in drug delivery systems, and the rising prevalence of chronic diseases. Nanomedicine allows for more precise targeting of treatments, minimizing side effects and improving efficacy. Key nanomedicine market trends include the growing focus on nanomaterial-based drug delivery, cancer therapy, and diagnostic imaging. Additionally, ongoing research and development and increasing regulatory approvals are expected to drive market growth in the coming years.

Market Dynamics

Increasing Demand for Personalized Medicine

Personalized medicine involves tailoring medical treatments to individual patients based on genetic, environmental, and lifestyle factors. Nanomedicine offers advanced solutions, such as targeted drug delivery and molecular imaging, which are key to personalizing treatment regimens. The ability to target specific cells or tissues reduces side effects and improves the effectiveness of treatments, especially in oncology and rare diseases. A study published in Nature Nanotechnology named “Smart cancer nanomedicine” highlighted that nanomedicine has the potential to revolutionize personalized cancer treatment by enabling more precise and less invasive approaches. Therefore, the growing demand for personalized medicine drives the market development.

Advancements in Drug Delivery Systems

Traditional drug delivery methods face various challenges such as low bioavailability, toxicity, and difficulty in reaching target sites. Nanomedicine addresses these challenges by using nanoparticles to carry and release drugs at targeted sites, improving therapeutic outcomes. For example, liposomes, dendrimers, and polymeric nanoparticles can enhance drug solubility, stability, and targeting. As per the research article published in the Pubmed titled “Nano based drug delivery systems: recent developments and future prospects,” nanoparticle-based delivery systems significantly improve the bioavailability of poorly soluble drugs, thus expanding treatment options. Therefore, the rising advancements in drug delivery systems fuel the market demand.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as cancer, cardiovascular disorders, and diabetes, has driven the demand for more effective and innovative treatment options. Nanomedicine enables early diagnosis, efficient drug delivery, and more effective treatment modalities for such conditions. For example, nanoparticles are being used in early cancer detection through advanced imaging techniques and as carriers for chemotherapy drugs that target tumors more precisely. According to the World Health Organization, cancer is expected to be the leading cause of death globally by 2030, further highlighting the need for novel therapeutic solutions such as nanomedicine. Hence, the rising prevalence of chronic diseases is expected to boost the market growth during the forecast period.

Segment Insights

By Application-Based Insights

The nanomedicine market, by application, is segmented into therapeutics, in-vitro diagnostics, drug delivery, in-vivo imaging, and implants. The therapeutics segment holds the largest market share, driven by its extensive applications in cancer treatment, wound healing, and targeted therapy for various chronic diseases. Nanomedicine enables the development of treatments with high precision, minimizing side effects and improving therapeutic outcomes. Among these, cancer therapeutics using nanotechnology is one of the most promising areas, with nanoparticles delivering chemotherapy drugs directly to cancer cells, thus enhancing the drug’s efficacy. Furthermore, drug delivery remains a rapidly expanding segment, registering the highest growth due to increasing research on nanoparticles for targeted delivery and improved bioavailability of drugs, particularly in treating diseases that require localized treatment, such as cancer and neurological disorders.

The in-vitro diagnostics and in-vivo imaging segments are witnessing steady growth, with nanotechnology improving the sensitivity and accuracy of diagnostic tools and imaging techniques. The ability of nanoparticles to interact with biological markers at the molecular level has revolutionized diagnostic procedures, allowing for early-stage disease detection and better monitoring of therapeutic responses. Additionally, implants using nanotechnology are gaining attention due to their enhanced biocompatibility and durability, improving patient outcomes in surgeries and orthopedic treatments. While drug delivery and therapeutics dominate the market share, the in-vitro diagnostics and implants segments are also expected to experience notable growth as technological advancements continue to develop during the forecast period.

By Indication-Based Insights

The nanomedicine market, by indication, is segmented into clinical oncology, infectious diseases, clinical cardiology, orthopedics, and others. The clinical oncology segment holds the largest nanomedicine market share, driven by the growing prevalence of cancer worldwide and the increasing need for advanced treatment options. Nanomedicine provides targeted therapies that enhance the efficacy of chemotherapy and radiation treatment while minimizing side effects. Nanoparticles can deliver drugs directly to cancer cells, improving the precision of treatment, which has become a crucial factor in the management of various cancer types. This segment is expected to continue dominating the market, with ongoing research and clinical trials focusing on novel nanoparticle-based therapies for hard-to-treat cancers such as pancreatic and lung cancer.

The infectious diseases segment is registering the highest growth, driven by the rising global burden of infections, including bacterial, viral, and fungal diseases. Nanomedicine offers innovative solutions for the development of antimicrobial agents, vaccines, and diagnostic tools that can address antibiotic resistance and enhance treatment effectiveness. Additionally, the clinical cardiology segment is gaining attention with the use of nanomedicine in cardiovascular disease management, particularly in drug delivery systems for targeted treatment of heart diseases and in improving diagnostic imaging techniques. The orthopedics segment is also witnessing growth due to the use of nanomaterials in implants and bone regeneration, providing enhanced biocompatibility and faster healing. The others segment includes indications such as neurological disorders and diabetes and is expected to witness growth during the forecast period.

Regional Analysis

By region, the study provides nanomedicine market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global nanomedicine market revenue, primarily due to the high investments in research and development, presence of leading pharmaceutical and biotechnology companies, and a well-established healthcare infrastructure. The region’s advanced healthcare system, strong regulatory frameworks, and increasing adoption of innovative medical technologies drive the regional market growth. The US, in particular, is a key player, with significant government funding for nanotechnology research, coupled with a growing demand for personalized medicine and advanced therapeutic solutions. Additionally, North America’s strong focus on clinical trials, early-stage adoption of new medical treatments, and high healthcare expenditure make it the dominant region in the global nanomedicine market. Other regions, including Europe and Asia Pacific, also show considerable growth potential, but North America remains the leader due to its established market dynamics and innovation-driven approach.

Europe is a significant region in the global nanomedicine market, driven by strong research initiatives and an advanced healthcare system. The region is home to several prominent research institutions and universities focusing on nanotechnology and medical applications, which has fueled innovation in the field. Countries such as Germany, France, and the UK lead in terms of technological advancements and clinical trials. The European Union has also supported the adoption of nanomedicine through funding and regulatory frameworks aimed at ensuring safety and efficacy. The market in Europe is witnessing steady growth, particularly in clinical oncology, drug delivery, and diagnostic applications. The rising prevalence of chronic diseases, especially cancer, and increasing demand for personalized treatments are expected to fuel the Europe nanomedicine market expansion in the coming years.

The Asia Pacific nanomedicine market is experiencing rapid growth, driven by rising healthcare demands, increasing investments in research and development, and a growing focus on advanced medical technologies. Countries such as China, India, Japan, and South Korea are at the forefront of this growth, with significant governmental support and private sector investments in nanotechnology research. China, in particular, is making substantial progress in nanomedicine, focusing on drug delivery systems and cancer treatments. The region's large population and rising healthcare needs contribute to the growing demand for more effective medical treatments, further boosting the Asia Pacific nanomedicine market growth. Additionally, improvements in healthcare infrastructure and the adoption of advanced technologies are expected to fuel the regional market expansion during the forecast period.

Key Players and Competitive Insights

Key players in the market include companies such as Dendreon Pharmaceuticals, which specializes in immunotherapies for cancer, and Nanosphere, a molecular diagnostics company. Another important player is CytImmune Sciences, which focuses on nanomedicine for cancer treatment, particularly their nano-based drug delivery systems. Medtronic, known for its medical device innovations, has also been involved in nanotechnology for medical devices such as implantable devices. Aastrom Biosciences develops nanomedicine treatments, particularly for regenerative medicine and cell therapies. Also, Nanobiotix focuses on the use of nanoparticles to enhance radiation therapy, and MagForce focuses on nanotechnology-based cancer treatments. Other players include BioNano Genomics, specializing in nanotechnology for genome analysis, and BioDelivery Sciences, which utilizes nanotechnology to deliver therapeutics. NanoViricides focuses on the development of antiviral therapies, while VistaGen Therapeutics is exploring the use of nanotechnology in drug development for neurological diseases. Other active players include Arrowhead Pharmaceuticals, Therapeutic Systems, and Nanomedic Technologies.

The competitive landscape of the market is characterized by a mix of large pharmaceutical companies and specialized startups, all of which are investing heavily in research and development to expand their nanomedicine portfolios. Companies such as Medtronic and BioDelivery Sciences focus on leveraging existing healthcare infrastructure to integrate nanotechnology into their products, while smaller companies such as NanoViricides and MagForce are concentrating on niche therapeutic applications, such as antiviral drugs and cancer treatments. The market’s innovation is mainly driven by the need for more effective, targeted treatments, which have prompted these players to advance in areas such as drug delivery, diagnostics, and cancer therapy.

In terms of market positioning, players such as Medtronic and BioDelivery Sciences benefit from their established presence in the healthcare market, which allows them to integrate nanomedicine advancements more rapidly into their existing product lines. Meanwhile, specialized companies such as CytImmune Sciences and Nanobiotix are making strides in novel, innovative nanomedicine applications, contributing to market diversity. The competitive environment is expected to continue evolving as both established companies and new entrants push the boundaries of what nanomedicine can offer in terms of treatment precision, patient outcomes, and personalized medicine solutions.

Medtronic is a prominent player in the nanomedicine market, primarily known for its medical devices and solutions. The company has been involved in incorporating nanotechnology into its product range, particularly for implantable devices and drug delivery systems. Medtronic’s focus is on improving patient outcomes through technological advancements, and its efforts in nanomedicine are aimed at enhancing the precision and effectiveness of its medical treatments.

Nanobiotix is focused on using nanotechnology to improve cancer treatment. The company is developing therapies that use nanoparticles to enhance the effectiveness of radiation therapy and improve tumor targeting. Nanobiotix’s research is aimed at providing better outcomes for patients of various types of cancer by making treatments more targeted and less invasive.

List of Key Companies

- Aastrom Biosciences

- Arrowhead Pharmaceuticals

- BioDelivery Sciences

- BioNano Genomics

- BioXcel Therapeutics

- CytImmune Sciences

- Dendreon Pharmaceuticals

- MagForce

- Medtronic

- Nanobiotix

- Nanomedic Technologies

- Nanosphere

- NanoViricides

- Therapeutic Systems

- VistaGen Therapeutics

Industry Developments

- In November 2024, Medtronic received FDA approval for a new implantable device that integrates nanotechnology to improve the treatment of chronic pain, marking a significant step in the use of nanomedicine in pain management.

- In October 2024, Nanobiotix announced that it had completed a clinical trial for its lead product, NBTXR3, in combination with radiation therapy for soft tissue sarcoma, with promising results indicating a potential breakthrough in cancer treatment.

Market Segmentation

By Application Outlook

- Therapeutics

- In-Vitro Diagnostics

- Drug Delivery

- In-Vivo Imaging

- Implants

By Indication Outlook

- Clinical Oncology

- Infectious Diseases

- Clinical Cardiology

- Orthopedics

- Others

By Molecule Type Outlook

- Nanoparticles

- Metal & Metal Oxide Nanoparticles

- Liposomes

- Polymers & Polymer Drug Conjugates

- Hydrogel Nanoparticles

- Dendrimers

- Inorganic Nanoparticles

- Nanoshells

- Nanotubes

- Nanodevices

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 210.29 billion |

|

Market Size Value in 2025 |

USD 233.94 billion |

|

Revenue Forecast by 2034 |

USD 623.14 billion |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The nanomedicine market has been segmented into detailed segments of application, indication, and molecule type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The nanomedicine market growth and marketing strategy primarily focuses on increasing research and development efforts to create more effective and targeted treatments. Companies are expanding their product portfolios through strategic collaborations, partnerships, and acquisitions to enhance their technological capabilities. Additionally, there is an emphasis on clinical trials and regulatory approvals to ensure the safety and efficacy of nanomedicine products. Market players are also investing in geographic expansion, targeting emerging markets with high demand for advanced healthcare solutions. To increase market visibility, firms are using digital marketing channels and attending industry events to showcase innovations.

FAQ's

The nanomedicine market size was valued at USD 210.29 billion in 2024 and is projected to grow to USD 623.14 billion by 2034.

The market is projected to register a CAGR of 11.5% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include Aastrom Biosciences, Arrowhead Pharmaceuticals, BioDelivery Sciences, BioNano Genomics, BioXcel Therapeutics, CytImmune Sciences, Dendreon Pharmaceuticals, MagForce, Medtronic, and Nanobiotix, among others

The therapeutics segment accounted for the largest share of the market in 2024.

The clinical oncology segment accounted for the largest share of the market in 2024.

Nanomedicine refers to the use of nanotechnology in medical applications, including the development of drugs, diagnostic tools, and therapeutic devices at the nanoscale (typically between 1 and 100 nanometers). This field aims to improve the diagnosis, treatment, and prevention of diseases by leveraging the unique properties of nanoparticles, such as their ability to target specific cells, deliver drugs more precisely, and enhance the effectiveness of therapies while minimizing side effects. Nanomedicine encompasses various areas, including drug delivery systems, cancer treatments, in-vitro diagnostics, and imaging technologies. It is considered a promising approach to personalized and precision medicine.

A few key trends in the market are described below: Targeted Drug Delivery Systems: Increased focus on developing nanoparticles that can deliver drugs directly to specific cells or tissues, improving treatment efficacy and reducing side effects. Use of Nanomaterials in Cancer Treatment: Advancements in using nanomaterials for targeted cancer therapies, enabling better tumor detection, drug delivery, and combination treatments. Demand for Personalized Medicine: Growing demand for nanomedicine in personalized treatments tailored to individual genetic profiles, enhancing the effectiveness of therapies. Regenerative Medicine: Use of nanotechnology in tissue regeneration and healing, particularly in areas such as orthopedics and wound care.

A new company entering the nanomedicine market must focus on developing targeted drug delivery systems, particularly for cancer and chronic diseases, as precision medicine continues to gain traction. Exploring novel applications in regenerative medicine and tissue repair could also offer a competitive advantage, especially in areas such as orthopedics and wound healing. Additionally, investing in early-stage diagnostics using nanotechnology to detect diseases at a molecular level can differentiate the company. Collaborations with academic institutions and other biotech firms for research and development could help accelerate product innovation. Emphasizing regulatory compliance and safety in product development will be critical to building trust and gaining market approval.

Companies manufacturing, distributing, or purchasing nanomedicine and related products, and other consulting firms must buy the report.