Nanofiltration Membrane Market Share, Size, Trends, Industry Analysis Report, By Type (Polymeric, Ceramic, Hybrid, Others); By Module; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4606

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

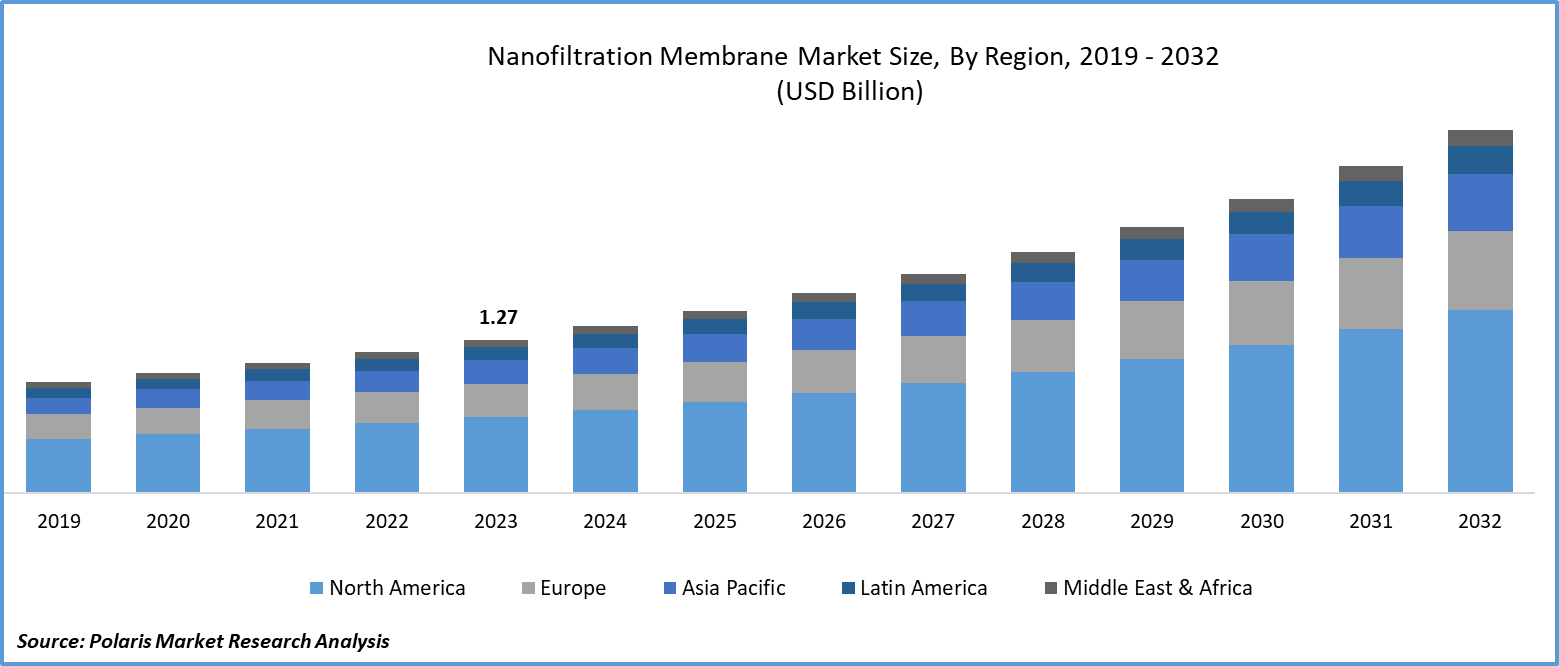

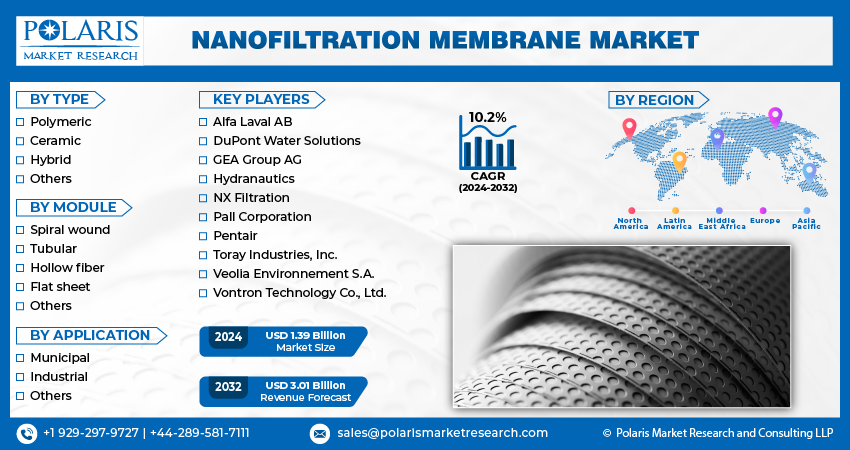

Nanofiltration Membrane Market size was valued at USD 1.27 billion in 2023. The market is anticipated to grow from USD 1.39 billion in 2024 to USD 3.01 billion by 2032, exhibiting the CAGR of 10.2% during the forecast period.

Market Overview

Nanofiltration membranes are highly utilized in the pharmaceutical industry, water treatment, biotechnology, and other verticals attributable to their superior filtration capacity and the potential to hinder contaminants and other particles from flowing through flexible permeable membranes. The rising demand for automobiles, primarily e-vehicles, in the marketplace is positively influencing market growth owing to their use in the automotive and semiconductor manufacturing processes for fabrication procedures.

- For instance, in July 2023, DuPont introduced a new nanofiltration membrane, DuPont FilmTec LiNE-XD, for lithium brine purification. This initiative supports the ongoing demand for direct lithium extraction.

To Understand More About this Research: Request a Free Sample Report

Moreover, nanofiltration is gaining importance in the food and beverage industry, driven by their prevalent use of filtration in the processing of juices, dairy products, wine, and beer. This is anticipated to boost the demand for nanofiltration membranes in the coming years. The rising researchers’ efforts to separate chemicals from water are significantly gaining the use of nanofiltration. For instance, a 2023 study published in Desalination Journal developed the positively charged nanofiltration membrane to separate magnesium from the seawater.

Growth Drivers

The rising extraction process of oil and gas

The rising oil and gas extraction process in the world market is significantly benefiting the growth of the nanofiltration membrane market as it can be utilized in the separation of resources from impurities, facilitating the higher quality of oil and gas for end users. In addition, it is widely incorporated in brine solution processing as it involves the separation of water generated from salts and impurities derived in the extraction activity.

Furthermore, growing companies' initiatives exploring the application of nanofiltration in the food industry is expected to fuel the nanofiltration membrane market growth during the forecast period. For instance, in February 2024, DuPont introduced nanofiltration elements product line, FilmTec Hypershell NF245XD for dairy operations.

The increasing number of research studies focusing on nanofiltration

The global dye industry is looking for nanofiltration membranes due to the presence of stringent regulations on the textile emissions, primarily among the nations like India, China, and Bangladesh. Additionally, the higher use of water in manufacturing and dye coloring, are playing a significant role in driving the demand for nanofiltration membranes in the world.

The growing studies unraveling the effectiveness of nanofiltration membranes is anticipated to boost market growth. For instance, a 2023 study focused on reviewing the recent developments in nanofiltration membranes, specifically those that are used to extract heavy metals from wastewater. The polyvinyl amine and glutaraldehyde membranes showed 99.90% treatment efficiency in extracting Cr3+ from wastewater.

Restraining Factors

Higher initial costs will impede market growth

The higher deployment and maintenance costs of the nanofiltration membrane and limited awareness about them among the end-users are likely to hinder the expansion of the global market in the long run.

Report Segmentation

The market is primarily segmented based on type, module, application, and region.

|

By Type |

By Module |

By Application |

By Region |

|

|

|

|

By Type Analysis

Polymeric segment is likely to register the highest growth during the forecast period

The polymeric segment will grow with substantial pace, due to its ease of production and filtration of wastewater. Polymeric nanofiltration membranes are widely employed in separation processes, from water filtration to industrial manufacturing purification, due to their effectiveness and adaptability

For instance, in 2023, a study published in PubMed Central focused on reviewing the biomedical applications of polymeric nanofiltration membranes. It shows development of artificial organs, like the liver, lungs, and pancreas, thereby inducing the adoption of the polymeric membranes.

The ceramic segment led with a substantial revenue share in 2023, largely attributable to its ability to offer higher hydrophilicity and thermal & chemical resistance. This is driving its use in dairy production, oil and water separation, filtering wastewater, and dye filtration. A 2022 study explored the utilization of periodic electrolysis to limit fouling and promote the filtration efficiency of ceramic membranes.

By Module Analysis

Hollow fiber segment accounted for the largest market share in 2023

The hollow segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. It plays a significant role in removing large particles based on their size in the liquid with the selective filters. The higher rate of scalability of hollow fiber is anticipated to witness significant growth potential in the coming years.

Research studies are revealing potential opportunities for hollow fiber. For instance, a 2023 study focused on reviewing the production process of hollow fiber nanofiltration in labs for long-term applications. The increased geometral and chemical stability of hollow fiber with the polyelectrolyte multilayer production process is gaining adoption in multiple applications, making it a sustainable alternative to spiral fiber nanofiltration.

The spiral wound segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in demand for whey protein and lactose concentration. The availability of several configurations of spiral wound nanofiltration with multiple membrane lengths and types is stimulating its use in the global space. The lower chance of membrane breakability compared to the hollow, ease of cleaning process, and strong design are likely to create new growth potential during the study period.

By Application Analysis

Industrial segment held a prominent share in terms of revenue in 2023

The industrial filtration segment held an iconic growth share in revenue in 2023, which is highly accelerated due to the continuous rise in its adoption in brine recovery. The enormous strength of avoiding larger quantities of sulfate and permitting sodium chloride ions through the nanofiltration membrane makes it a suitable solution for brine recovery in the industrial process.

The growing progress in nanofiltration membrane application in water treatment, pharmaceuticals, and chemical and petrochemical processing are the crucial factors leading to higher revenue in the marketplace. However, according to the nanofiltration membrane market analysis, rising municipal water treatment activities in the world are projected to showcase new demand for nanofiltration membranes in the coming years.

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region dominated the global market. This is due to rising sustainable practices in water recovery and reutilization in municipal and industrial applications. The progress in investment activities in water treatment plants is positively influencing the demand for nanofiltration membranes. For instance, in October 2023, the US Agriculture Department unveiled an allotment of USD 800 million for rural infrastructure projects.

- For instance, Stanly County, a county in North Carolina announced that it has USD 32 million to promote wastewater treatment in West Stanly, which is expected to start construction in January 2025.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing need for water and the rising population growth in the region. Climate change is causing water scarcity in the world, driving the need for wastewater treatment by countries. The presence of industrial and manufacturing hubs in the region, such as India and China, is contributing to the higher demand for nanofiltration membranes in the coming years due to their effective filtration potential.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The nanofiltration membrane market is moderately fragmented and consolidated, driven by the presence of several players with ongoing expansion activities, specifically partnerships and acquisitions. Key players are focusing on research and development activities focusing on high-productive & bio-separation solutions in the bio-pharmaceutical space. For instance, in November 2023, Nijhuis Saur Industries and NX Filtration entered into a collaboration agreement to develop MONF, an advanced mobile, hollow fiber nanofiltration unit.

Some of the major players operating in the global market include:

- Alfa Laval AB (Sweden)

- DuPont Water Solutions (US)

- GEA Group AG (Germany)

- Hydranautics (US)

- NX Filtration (Netherlands)

- Pall Corporation (US)

- Pentair (US)

- Toray Industries, Inc. (Japan)

- Veolia Environnement S.A. (France)

- Vontron Technology Co., Ltd. (China)

Recent Developments in the Industry

- In March 2024, a study published in Desalination Journal focused on development of composite nanofiltration membrane with the integration of electrostatic air spray disposition and found the improved separation capability, hydrophilicity, and longer stability.

- In November 2022, NX Filtration and Transcend entered a partnership with the aim of showcasing the advantages of direct nanofiltration membranes through generative design software.

Report Coverage

The nanofiltration membrane market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, module, application, and their futuristic growth opportunities.

Nanofiltration Membrane Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.39 billion |

|

Revenue forecast in 2032 |

USD 3.01 billion |

|

CAGR |

10.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Nanofiltration Membrane Market report covering key segments are type, module, application and region

The global nanofiltration membrane market size is expected to reach USD 3.01 billion by 2032

Nanofiltration Membrane Market exhibiting the CAGR of 10.2% during the forecast period.

North America is leading the global market

key driving factors in Nanofiltration Membrane Market are rising extraction process of oil and gas