Nanocellulose Market Size, Share, Trends, Industry Analysis Report: By Type, Application, Distribution Channel, Raw Material (Wood and Non-Wood), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM3226

- Base Year: 2024

- Historical Data: 2020-2023

Nanocellulose Market Overview

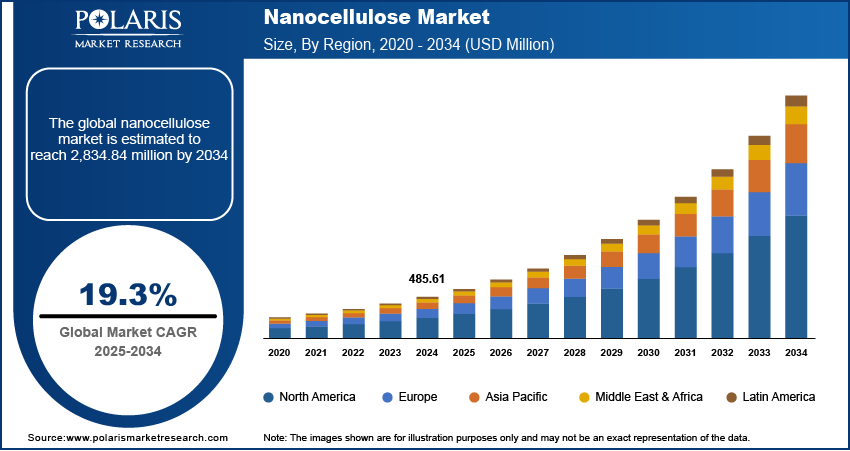

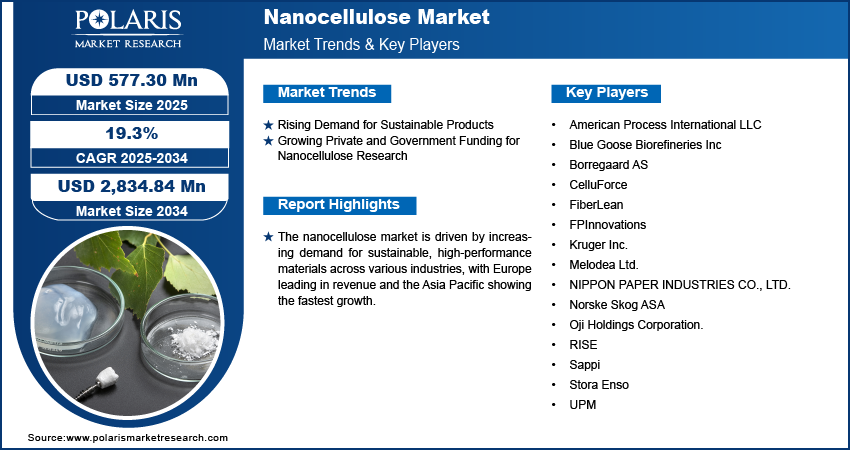

The global nanocellulose market size was valued at USD 485.61 million in 2024. The market is expected to grow from USD 577.30 million in 2025 to USD 2,834.84 million by 2034, at a CAGR of 19.3% from 2025 to 2034.

Nanocellulose is a sustainable, high-performance nanomaterial derived from cellulose and alpha cellulose. The nanomaterial is known for its exceptional mechanical strength, lightweight properties, and biodegradability.

The nanocellulose market growth is driven by its expanding applications in the electronics and semiconductor industry. Nanocellulose is emerging as a critical component in printed electronics, flexible displays, and radar sensors with the increasing demand for lightweight, flexible, and high-strength materials. Its superior mechanical and thermal properties, coupled with its compatibility with nanocomposites, make it an attractive alternative to traditional synthetic materials in the development of next-generation electronic devices. For instance, in April 2022, researchers from Osaka University, in collaboration with The University of Tokyo, Kyushu University, and Okayama University, developed a nanocellulose paper semiconductor. This new material allows for the design of 3D structures at nano, micro, and macro scales while also offering a wide range of tunable electrical properties. Furthermore, its potential to enhance conductivity and improve the durability of electronic components is fostering its adoption in the semiconductor sector.

To Understand More About this Research: Request a Free Sample Report

The increasing utilization of nanocellulose in advanced medical and healthcare products is another major factor boosting the nanocellulose market expansion. The biocompatibility, non-toxicity, and moisture-retaining capabilities of nanocellulose make it an ideal material for applications such as wound dressings, drug delivery systems, and tissue engineering. Its exceptional barrier properties and high surface area contribute to improved absorption and controlled release mechanisms, enhancing the efficacy of medical formulations. For instance, in October 2024, UPM Biomedicals launched FibGel, a natural injectable hydrogel made from birch wood cellulose and water. It offers a safe and sustainable solution for soft tissue repair and regenerative medicine designed for permanent medical devices. Additionally, ongoing research and advancements in bio-based materials are accelerating the adoption of nanocellulose in the healthcare industry, where sustainable and high-performance biomaterials are in growing demand. This rising integration into medical applications is expected to reinforce its position as a key material in the global healthcare sector.

Nanocellulose Market Driver Dynamics

Rising Demand for Sustainable Products

Nanocellulose is gaining traction due to its biodegradable nature, high mechanical strength, and lightweight properties as industries shift towards eco-friendly alternatives. Innovations in material science have further enhanced its functional attributes, enabling its use in sectors such as packaging, automotive, and construction. The development of nanocellulose-based composites and coatings with superior durability and performance characteristics is reinforcing its role as a viable replacement for synthetic materials in various applications. For instance, in July 2024, the European Investment Bank (EIB) provided a loan of USD 456.75 million to Stora Enso, a forestry company, to help them develop more environmentally friendly packaging for food and personal care items. The funding will support the upgrade of their manufacturing facility in Oulu, Finland, where Stora Enso has already invested USD 1.0428 billion to produce recyclable fiber-based packaging. This alignment of sustainability goals with technological advancements is driving the nanocellulose market development.

Growing Private and Government Funding for Nanocellulose Research

Governments and private institutions are investing in R&D initiatives to optimize production processes and explore new applications for nanocellulose, recognizing its potential across various high-value industries. For instance, in November 2021, AVAPCO, in partnership with Birla Carbon, received USD 500,000 from P3Nano and an additional USD 230,000 from the USDA Forest Service to commercialize the nanocellulose dispersion composite for the tire and rubber markets. These funding programs support pilot-scale production and commercialization efforts, as well as foster cross-industry collaborations that are critical for the widespread adoption of nanocellulose. Moreover, the focus on sustainable material innovation aligns with regulatory frameworks and policy incentives that encourage the use of bio-based alternatives like nanocellulose. Thus, the sustained financial backing from both public and private entities is playing a key role in advancing nanocellulose technologies, boosting the nanocellulose market demand across industries.

Nanocellulose Market Segment Insights

Nanocellulose Market Assessment by Application Outlook

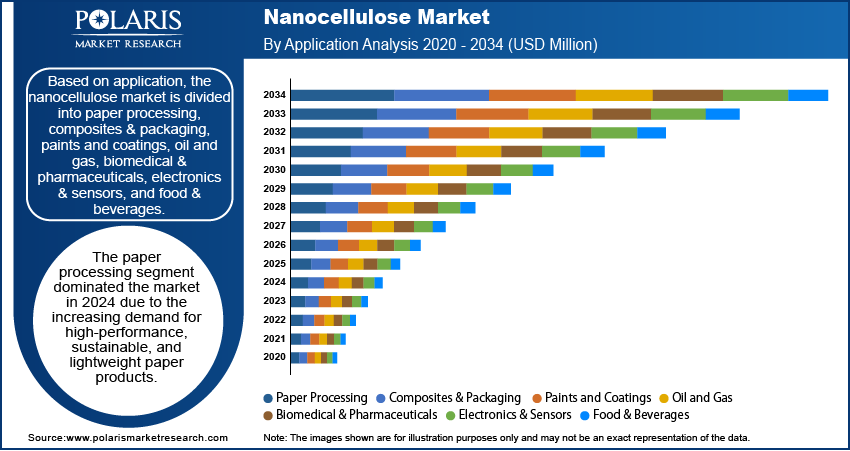

The global nanocellulose market assessment, based on application, includes paper processing, composites & packaging, paints and coatings, oil and gas, biomedical & pharmaceuticals, electronics & sensors, and food & beverages. The paper processing segment dominated the market in 2024 due to the increasing demand for high-performance, sustainable, and lightweight paper products. Nanocellulose enhances the mechanical strength, barrier properties, and durability of paper, making it a preferred additive in specialty and commercial-grade paper manufacturing. Its ability to improve printability, reduce raw material consumption, and enhance recyclability aligns with the paper industry's shift toward eco-friendly solutions. Additionally, the growing adoption of nanocellulose in advanced packaging applications, such as biodegradable and food-safe packaging, has contributed to the segment's market leadership. The push for sustainable alternatives to conventional paper additives continues to drive nanocellulose market expansion in this sector.

Nanocellulose Market Evaluation by Type Outlook

The global nanocellulose market evaluation, based on type, includes cellulose nanofibrillated (micro fibrillated cellulose), bacterial cellulose, cellulose nanocrystal (nanocrystalline cellulose), and others. The cellulose nano fibrillated segment is expected to witness the fastest nanocellulose market growth from 2025 to 2034 due to its superior mechanical properties, high aspect ratio, and extensive application potential. Cellulose nano fibrillated (CNF) offers excellent reinforcement capabilities, making it ideal for producing lightweight composites, high-strength coatings, and functional additives in multiple industries. Its compatibility with bio-based materials, along with advancements in production scalability, has positioned CNF as a key material in packaging, automotive, and biomedical applications. Moreover, ongoing research in CNF-based nanocomposites and their use in functional materials, such as aerogels and membranes, are accelerating its demand, supporting nanocellulose market growth trajectory.

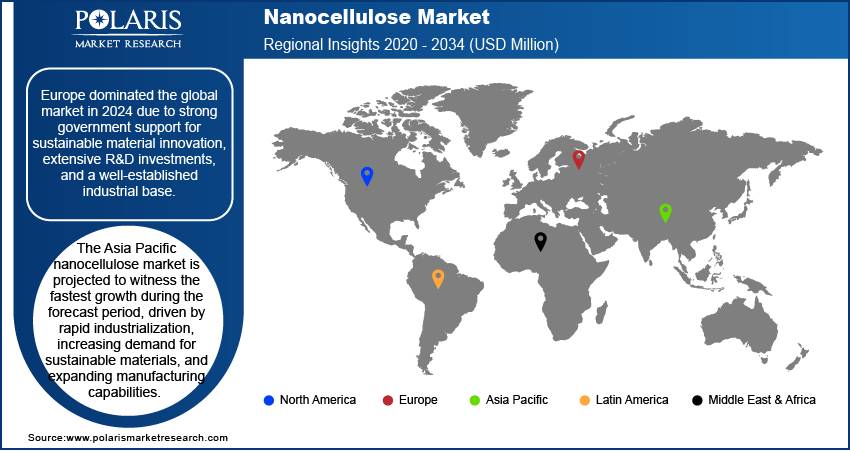

Nanocellulose Market Regional Analysis

By region, the report provides the nanocellulose market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the global market in 2024 due to strong government support for sustainable material innovation, extensive R&D investments, and a well-established industrial base. The region has been at the forefront of bio-based material adoption, driven by stringent environmental regulations promoting biodegradable and renewable alternatives. Leading research institutions and industry players in Europe have been actively advancing nanocellulose production technologies, enhancing commercialization and large-scale application. For instance, in October 2024, Stora Enso launched Europe's largest dry-forming production facility in Skene, Sweden, using PulPac's innovative technology. The unit produces sustainable fiber-based packaging alternatives to plastic, using a water and energy-efficient process. This breakthrough demonstrates Stora Enso's commitment to advancing sustainable packaging solutions with minimal environmental impact. Additionally, the presence of key end-use industries, including packaging, automotive, and healthcare, has contributed to sustained demand for nanocellulose-based products. These factors collectively position Europe as the dominant revenue contributor in the global nanocellulose market.

The Asia Pacific nanocellulose market is projected to witness the fastest growth during the forecast period, driven by rapid industrialization, increasing demand for sustainable materials, and expanding manufacturing capabilities. The region’s strong emphasis on eco-friendly packaging, high-performance composites, and advanced healthcare solutions has fueled nanocellulose adoption across various applications. Additionally, growing investments in research and commercialization efforts, particularly in countries such as Japan, China, and South Korea, are fostering technological advancements in nanocellulose production. For instance, in September 2024, Oji Holdings Corporation and Toyota Motor East Japan, Inc. installed a highly transparent and rigid canopy made from cellulose nanofibers (CNF) in an autonomous robot. The CNF composite material simplifies assembly, reduces weight, and supports sustainable practices in automotive design. The rising demand for bio-based alternatives in consumer goods, along with supportive government initiatives promoting green materials, is further accelerating nanocellulose market expansion in the region.

List of Key Companies in Nanocellulose Market

- American Process International LLC

- Blue Goose Biorefineries Inc

- Borregaard AS

- CelluForce

- FiberLean

- FPInnovations

- Kruger Inc.

- Melodea Ltd.

- NIPPON PAPER INDUSTRIES CO., LTD.

- Norske Skog ASA

- Oji Holdings Corporation.

- RISE

- Sappi

- Stora Enso

- UPM

Nanocellulose Market – Key Players and Competitive Insights

The competitive landscape combines global leaders and regional players competing to capture nanocellulose market share through innovation, strategic alliances, and regional expansion. Global players such as Stora Enso, UPM-Kymmene Corporation, and others leverage robust R&D capabilities and extensive distribution networks to deliver advanced nanocellulose products, including cellulose nanofibrils (CNF), cellulose nanocrystals (CNC), and bacterial nanocellulose (BNC). Nanocellulose market trends indicate rising demand for sustainable solutions in packaging, composites, and biomedical applications, reflecting advancements in production technologies and material science. According to nanocellulose market statistics, the market is projected to grow significantly, driven by increasing applications in the automotive, electronics, personal care, and pharmaceutical industries.

Competitive strategies include mergers and acquisitions, partnerships with research institutions, and the introduction of innovative nanocellulose-based products to address the growing demand for eco-friendly and high-performance materials. These developments underline the role of technological innovation, market adaptability, and regional investments in driving market expansion. A few key major players are American Process International LLC; Blue Goose Biorefineries Inc; Borregaard AS; CelluForce; FiberLean; FPInnovations; Kruger Inc.; Melodea Ltd.; NIPPON PAPER INDUSTRIES CO., LTD.; Norske Skog ASA; Oji Holdings Corporation; RISE; Sappi; Stora Enso; and UPM.

Nippon Paper Industries Co., Ltd. is a Japanese company established in 1949, primarily engaged in the manufacture and sale of a diverse range of paper products, such as paperboard, thermal paper, and household paper products. The company operates through four main segments: paper and paperboard, lifestyle related, energy, and lumber, construction materials and civil engineering. In recent years, Nippon Paper has focused on innovation in sustainable materials, particularly nanocellulose, which is derived from plant fibers. This material is recognized for its unique properties, such as high strength and lightweight characteristics, making it suitable for various applications in industries such as packaging, electronics, and biomedical fields. The company's commitment to research and development in nanocellulose positions it as a leader in advancing eco-friendly solutions within the paper manufacturing sector.

Oji Holdings Corporation, established in 1873 and headquartered in Tokyo, specializes in the global pulp and paper industry. The company operates across multiple segments, including industrial materials, household products, functional materials, and printing media. Oji Holdings is recognized for its diverse product offerings with approximately 156 subsidiaries worldwide and operations across various countries, offering products like containerboard, packaging materials, and specialty papers. In recent years, Oji Holdings has focused on developing nanocellulose, a sustainable material derived from plant fibers that offers exceptional strength and lightweight properties. This innovative material has applications in various fields, such as packaging, electronics, and medical devices. Oji aims to enhance the functionality of nanocellulose while promoting environmental sustainability by leveraging its expertise in forestry and paper manufacturing. The company's commitment to innovation positions it as a leader in the transition towards eco-friendly materials in the industry.

Nanocellulose Industry Developments

November 2024: Biesterfeld partnered with Anomera Inc., a Canadian manufacturer of sustainable cellulose materials, to expand its CASE product portfolio with the addition of nanocellulose products DextraCel HS and DextraCel HP.

July 2022: Anomera, Inc. started production at its carboxylated CNC facility in Canada, with a capacity of 170 tons per year.

Nanocellulose Market Segmentation

By Type Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Cellulose Nanofibrillated (Micro fibrillated Cellulose)

- Bacterial Cellulose

- Cellulose Nanocrystal (Nanocrystalline Cellulose)

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Paper Processing

- Composites & Packaging

- Paints and Coatings

- Oil and Gas

- Biomedical & Pharmaceuticals

- Electronics & Sensors

- Food & Beverages

By Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Online

- Offline

By Raw Material Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Wood

- Non-Wood

By Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nanocellulose Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 485.61 million |

|

Market Size Value in 2025 |

USD 577.30 million |

|

Revenue Forecast by 2034 |

USD 2,834.84 million |

|

CAGR |

19.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in kilotons; Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global nanocellulose market size was valued at USD 485.61 million in 2024 and is projected to grow to USD 2,834.84 million by 2034.

The global market is projected to register a CAGR of 19.3% during the forecast period.

Europe dominated the global market in 2024.

Some of the key players in the market are American Process International LLC; Blue Goose Biorefineries Inc; Borregaard AS; CelluForce; FiberLean; FPInnovations; Kruger Inc.; Melodea Ltd.; NIPPON PAPER INDUSTRIES CO., LTD.; Norske Skog ASA; Oji Holdings Corporation; RISE; Sappi; Stora Enso; and UPM.

The paper processing segment dominated the market in 2024.