n-Butanol Market Share, Size, Trends, Industry Analysis Report, By End-Use (Chemical, Agriculture, Paints & Coatings, Pharmaceutical, Construction, Personal Care); By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 114

- Format: PDF

- Report ID: PM2086

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

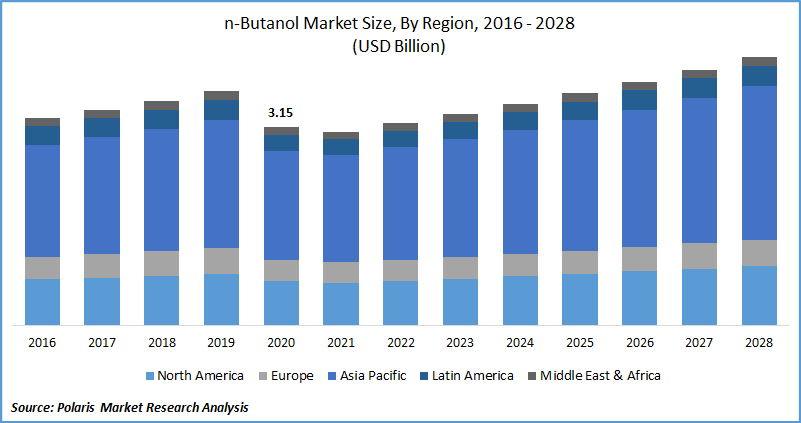

The global n-Butanol market size was valued at USD 3.15 billion in 2020 and is expected to grow at a CAGR of 4.8% during the forecast period. n-Butanol is alcohol, which is obtained through petrochemical processes. It offers high energy content and low vapor pressure. Although n-butanol has limited miscibility in water, it is soluble in most organic solvents such as glycols, ethers, and hydrocarbons.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

n-butanol is increasingly used as a solvent for manufacturing consumer products and as a chemical intermediate for developing other chemicals. n-butanol is used as a solvent for dyes, paints, varnishes, resins, and vegetable oils. Some other applications of n-butanol include perfumes, photographic films, manufacturing of pharmaceuticals, and production of textiles & artificial leather.

The COVID-19 outbreak has negatively impacted the market for n-butanol owing to operational challenges, transportation delays, and travel restrictions. The automotive and construction industries have been severely affected by the pandemic and have experienced disruption of the supply chain and workforce impairment. Manufacturing activities have also been halted due to various government regulations across the globe. Restrictions on imports of goods to curb the spread of the virus have further contributed to limiting the market growth for n-Butanol.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing population coupled with the rise in industrialization, especially in emerging economies, has increased the demand for n-butanol from the construction and textile industries. n-butanol is increasingly being used in a wide range of applications such as chemical, pharmaceutical, and agriculture. The increasing disposable income and growing urbanization have increased the demand for hygiene products, shaving products, and other cosmetics, supporting the adoption of n-butanol in the personal care segment. The use of n-butanol as a solvent owing to its high compatibility and solubility has also accelerated its sale across various industries. The rising environmental concerns and growing demand for sustainable fuel options have increased the application of n-butanol as a biofuel.

The growth in the building and construction industry is expected to fuel the growth of this market. n-butanol is used in a variety of products used for construction such as coatings, paints, adhesives, and varnishes among others. Growth in disposable income coupled with increasing middle-class aspirational spending has increased the construction of residential buildings, especially in emerging economies. There has been increasing infrastructure development along with growing awareness associated with green and sustainable buildings, accelerating the adoption of n-butanol in the construction sector. Growing market demand from emerging economies and technological advancements are expected to offer growth opportunities during the forecast period.

Report Segmentation

The market is primarily segmented on the basis of application, end-use, and region.

|

By Application |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insights by Application

On the basis of application, the market is segmented into butyl carboxylates (butyl acrylate, butyl acetate, glycol ethers), specialty chemicals, lubricants, plasticizers, and others. The butyl carboxylates segment dominated the global market in 2020 owing to its increasing utilization in adhesives, coatings, and engineering plastics. Other applications of butyl carboxylates include chemicals, plastics, and textiles. Increasing application in the building and construction sector, rising development of public infrastructure, and growing use in the automotive industry further boost the growth of this segment.

Insights by End-Use

The end-use industry segment has been divided into chemical, agriculture, paints and coatings, pharmaceutical, construction, personal care, and others. The product is used in the construction sector due to extensive coatings, paints, adhesives, and varnishes. Growth in the construction sector, especially from emerging economies, and the development of public infrastructure supports the growth of this segment. This segment is also influenced by the rising population, growing industrialization, and increasing consumer spending.

Geographic Overview

Asia-Pacific dominated the global n-Butanol market in 2020. Increasing urbanization, growing population, expansion of international players in this region, and technological advancements are some factors attributed to the market growth of this region.

The increasing disposable incomes and industrial growth in countries such as China, India, Japan result in greater market demand. Rising applications in the automotive and construction sectors, increasing utilization of the product in personal care products and strengthening the pharmaceutical sector in China, India, and Japan boost the market growth.

Competitive Landscape

The leading players in the n-Butanol market include The Dow Chemical Company, Sasol Limited, Arkema S.A., Mitsubishi Chemical Corporation, Eastman Chemical Company, Sinopec, Cobalt Technologies, BASF SE, Jiangsu Huachang Chemical Industry Company Limited, Andhra Petrochemicals Ltd., OQ Chemicals, Green Biologics Inc., PetroChina Company Limited, KH Neochem, and Ineos Group Ltd.

To expand their customer base and strengthen their market presence, these companies are expanding their presence across various geographies and entering new markets in developing regions. To meet rising consumer market demands, companies are also introducing new innovative products to the market.

n-Butanol Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.15 billion |

|

Revenue forecast in 2028 |

USD 4.27 billion |

|

CAGR |

4.8% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Application, By End-Use, and By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

The Dow Chemical Company, Sasol Limited, Arkema S.A., Mitsubishi Chemical Corporation, Eastman Chemical Company, Sinopec, Cobalt Technologies, BASF SE, Jiangsu Huachang Chemical Industry Company Limited, Andhra Petrochemicals Ltd., OQ Chemicals, Green Biologics Inc., PetroChina Company Limited, KH Neochem, and Ineos Group Ltd. |