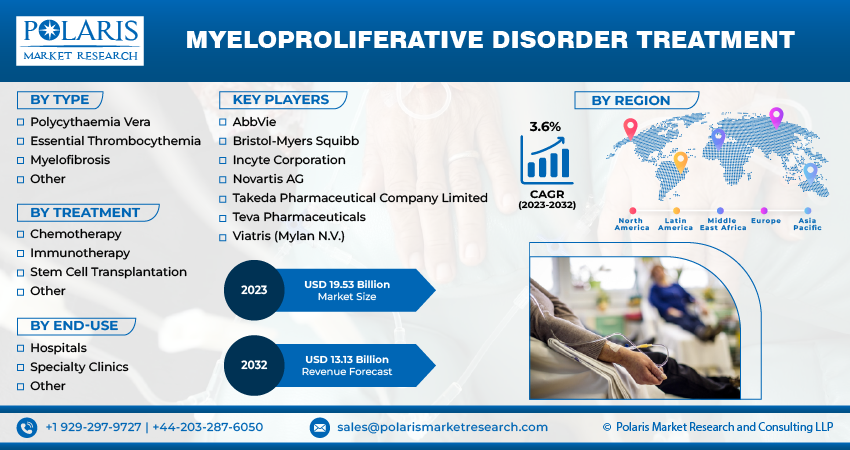

Myeloproliferative Disorder Treatment Market Share, Size, Trends, Industry Analysis Report, By Type (Polycythaemia Vera, Essential Thrombocythemia, Myelofibrosis, Other), By Treatment, By End-Use, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3936

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

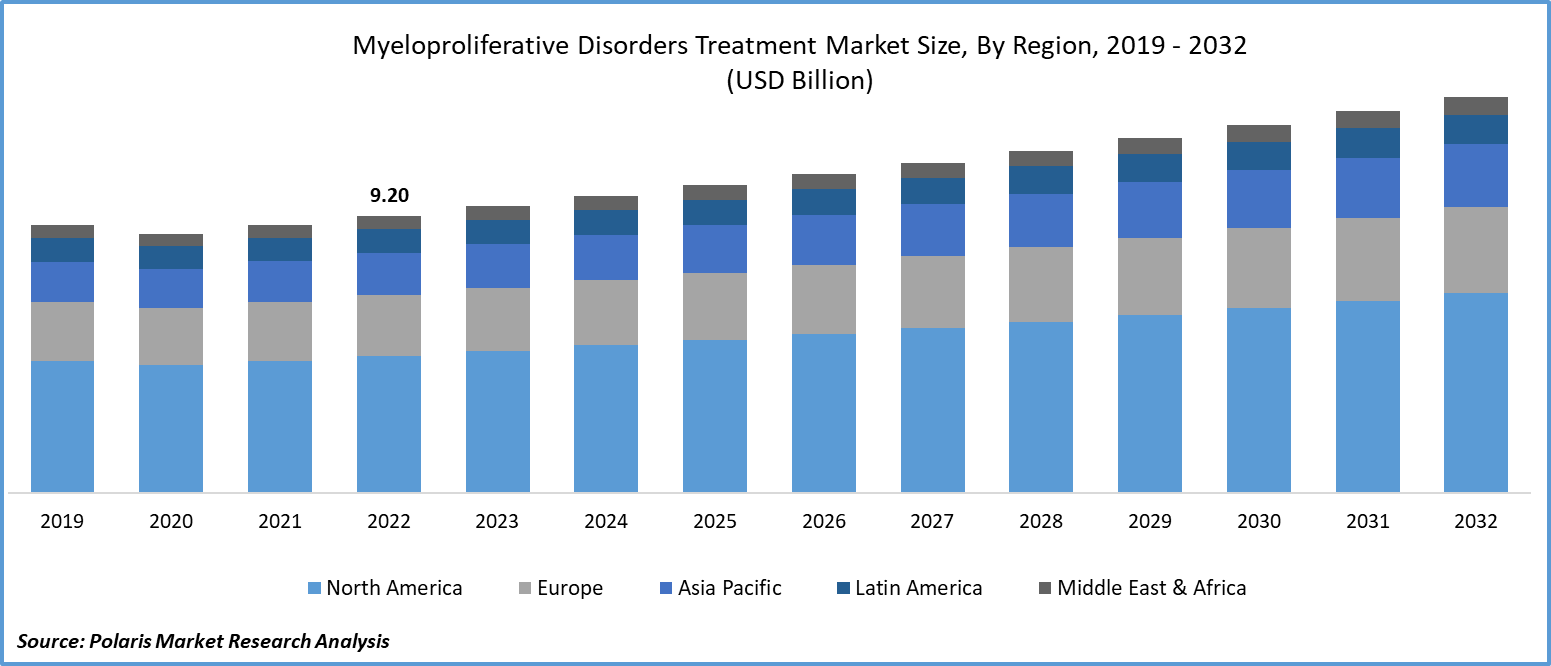

The global myeloproliferative disorder treatment market was valued at USD 9.20 billion in 2022 and is expected to grow at a CAGR of 3.6% during the forecast period.

The market is experiencing growth due to several key trends. One of these trends is the availability of novel drugs and a robust pipeline of pharmaceutical products. This indicates that there are continuous advancements and innovations in the field of medicine for myeloproliferative disorders, which is driving market expansion. Additionally, the increasing incidence of myeloproliferative disorders is contributing to market growth. According to a Myeloproliferative Neoplasms, published in May 2022, revealed that myeloproliferative neoplasms are more common among males than females. The incidence rate of new cases per 100,000 individuals was approximately 2.4 in males, while it was 1.4 in females.

To Understand More About this Research: Request a Free Sample Report

This rise in cases can be attributed to factors such as the aging population, changing lifestyles, and increased public awareness about these disorders. As people live longer and the awareness of such conditions grows, more individuals are being diagnosed and treated for myeloproliferative disorders, which in turn fuels the demand for related pharmaceuticals and treatments, thus driving the myeloproliferative disorder treatment market forward.

Chronic myeloproliferative disorders are rare but serious blood-related malignancies characterized by the abnormal accumulation of mature myeloid cells and their precursors in the blood and bone marrow. The currently available drugs for these disorders have limitations, as they have not demonstrated disease-modifying effects and are insufficient in addressing critical patient needs. These unmet needs encompass several crucial aspects of managing myeloproliferative disorders, including preventing the progression of hematological complications, extending the lifespan of affected individuals, reducing the risk of cardiovascular complications often associated with these disorders, and enhancing the overall quality of life for patients.

These significant unmet needs in the treatment of chronic myeloproliferative disorders create a notable opportunity for the development of innovative and groundbreaking therapies. First-in-class treatments that can effectively address these unmet needs have the potential to revolutionize the management and outcomes of these disorders, providing substantial benefits to patients who are currently underserved by existing pharmaceutical options. This represents a promising area for research and development in the field of hematological oncology.

For Specific Research Requirements: Request for Customized Report

The COVID-19 pandemic had a favorable effect on the market by leading to an increase in cases of chronic myeloproliferative neoplasm (MPN) and related disorders. For instance, as per an article from the American Society of Hematology published in September 2021, individuals with intermediate-2 or high-risk myelofibrosis were anticipated to face a higher risk of adverse outcomes if they contracted COVID-19. It was also noted that thromboembolic (TE) complications were on the rise in COVID-19 patients, particularly in the advanced stages of the disease. The heightened risk of thromboembolic (TE) complications associated with COVID-19 became a significant concern for individuals with myeloproliferative neoplasms due to their pre-existing susceptibility to thrombotic and hemorrhagic complications.

Industry Dynamics

Growth Drivers

- Growing demand for effective treatments.

The growing demand for effective treatments in the field of Myeloproliferative Disorders (MPD) is driven by several factors. Firstly, MPDs are a group of rare hematological conditions characterized by the overproduction of blood cells, which can lead to severe health complications, including clotting disorders and an increased risk of leukemia. As such, there is a critical need for therapies that can effectively manage and treat these disorders to improve the quality of life and survival rates for affected individuals.

Secondly, advances in medical research and our deeper understanding of the molecular mechanisms underlying MPDs have created opportunities for targeted therapies. This has kindled hope for more precise, well-tolerated treatments with fewer side effects. Patients and healthcare providers are increasingly seeking these innovative therapeutic options, which can offer better outcomes and enhanced patient experiences.

Additionally, the prevalence of MPDs is not negligible, and it appears to be rising due to improved diagnostic capabilities. With an aging population, the demand for treatments is expected to increase as well. This demographic shift underscores the necessity for effective therapies that can address the unique challenges posed by MPDs.

The growing demand for effective MPD treatments is a response to the pressing medical needs of patients, advances in scientific understanding, and the expanding patient population. The development of more targeted and efficient therapies is a promising prospect that could significantly improve the management of these disorders and enhance the overall healthcare landscape for affected individuals.

Report Segmentation

The market is primarily segmented based on type, treatment, end-use, and region.

|

By Type |

By Treatment |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The myelofibrosis segment accounted for the largest market share in 2022

The myelofibrosis segment held the largest revenue share in 2022. The growth of this segment can be attributed to the expanding research efforts and the increasing occurrence of myelofibrosis. For instance, a study titled "Real-world survival of US patients with intermediate- to high-risk myelofibrosis: impact of ruxolitinib approval," which was published in October 2021, revealed that population-based studies estimate the incidence of primary myelofibrosis in the United States to be around 0.3 per 100,000 person-years.

According to an article by the Leukaemia Foundation, in June 2020, primary myelofibrosis is categorized as a rare chronic condition, with approximately 1 out of every 100,000 individuals being diagnosed with it. While it can manifest at any age, it tends to be identified later in life, typically between the ages of 60 and 70 years. Interestingly, the article also noted that about 20.0% of individuals diagnosed with primary myelofibrosis initially exhibit no symptoms of the condition.

Additionally, the continuous introduction of new drugs for addressing myelofibrosis is expected to drive growth in this segment. For instance, in May 2022, Active Biotech disclosed that the United States Food and Drug Administration (FDA) had granted Orphan Drug Designation to tasquinimod for the treatment of myelofibrosis.

Regional Insights

- North America region dominated the global market in 2022

North America emerged as the largest region in 2022. This growth can be attributed to several factors, including the increasing prevalence of myeloproliferative disorders, higher investments in research and development, and ongoing research efforts aimed at developing innovative treatments for these disorders within the region.

For instance, in September 2020, Bristol Myers received approval from Health Canada for INREBIC (neratinib), a new once-daily oral medication designed to treat adults with an enlarged spleen and associated symptoms resulting from intermediate-2 or high-risk primary myelofibrosis, post-polycythemia vera myelofibrosis, or post-essential thrombocythemia myelofibrosis. Instances like this are expected to drive growth in the region.

Increasing research and development investments by major players in the United States, along with a growing body of research, are key factors propelling the growth of the market in the country. For example, a study titled "Next Generation Therapeutics for the Treatment of Myelofibrosis," published in April 2021, highlights the exploration of non-VAK inhibitor-based therapies in pre-clinical and clinical settings. While JAK inhibitors have received approval for myelofibrosis treatment, they have a limited impact on disease progression. Moreover, patient’s refractory to JAK inhibition face poor survival rates. To address these challenges, ongoing research efforts aim to develop more effective treatments for the disorder.

Key Market Players & Competitive Insights

The market exhibits a concentrated structure characterized by the presence of a limited number of prominent companies operating both globally and within specific regions. These companies are strategically focusing on collaborations for research and development, diversifying their product portfolios, and expanding into emerging markets as key initiatives to enhance their market presence. It is anticipated that low-cost generic Gleevec will gain swift adoption and emerge as the preferred first-line treatment for CML.

Some of the major players operating in the global market include:

- AbbVie

- Bristol-Myers Squibb

- Incyte Corporation

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceuticals

- Viatris (Mylan N.V.)

Recent Developments

- In February 2022, the FDA in the United States approved pacritinib (marketed as Vonjo), an oral kinase inhibitor that targets JAK2, IRAK1, and CSF1R. This approval allows pacritinib to be used in the treatment of intermediate or high-risk primary or secondary myelofibrosis, making it the first medication specifically designed for patients with significantly low platelet counts, known as thrombocytopenia.

- In December 2021, the United States Food and Drug Administration (FDA) approved peginterferon α-2b, marketed as Besremi, for the treatment of polycythemia vera.

Myeloproliferative Disorder Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 9.53 billion |

|

Revenue Forecast in 2032 |

USD 13.13 billion |

|

CAGR |

3.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Treatment, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |