Global Myasthenia Gravis Disease Market Size, Share, Trends, Industry Analysis Report: By Treatment Type (Thymectomy, Cholinesterase Inhibitors, and Rapid Immunotherapies), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1546

- Base Year: 2024

- Historical Data: 2020-2023

Myasthenia Gravis Disease Market Overview

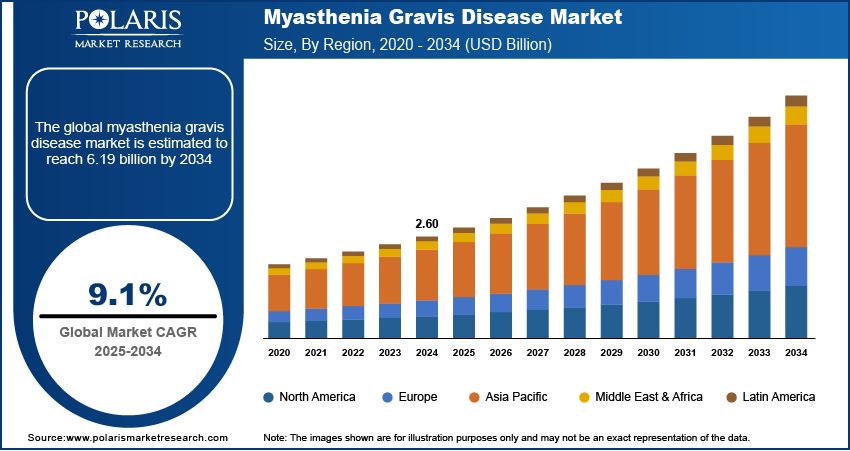

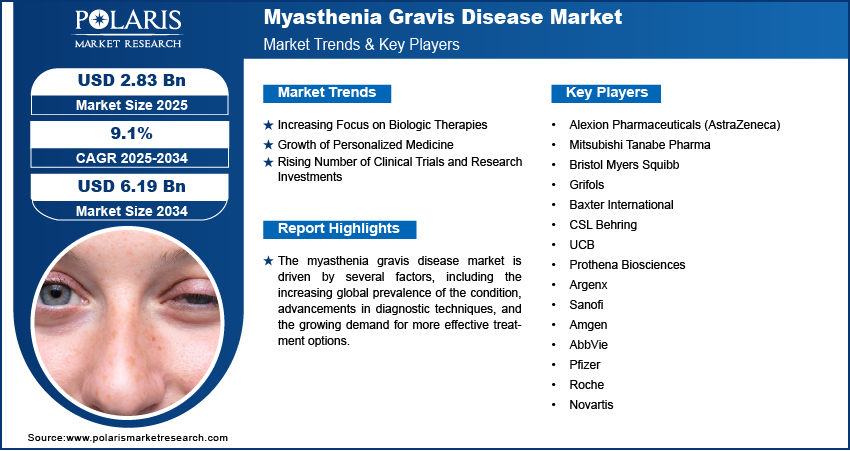

The myasthenia gravis disease market size was valued at USD 2.60 billion in 2024. The market is projected to grow from USD 2.83 billion in 2025 to USD 6.19 billion by 2034, exhibiting a CAGR of 9.1% during the forecast period.

Myasthenia Gravis (MG) is a rare, chronic autoimmune disorder that causes weakness in the skeletal muscles, affecting voluntary movements. The myasthenia gravis disease market encompasses treatments and therapies aimed at managing the symptoms and progression of the disease. The market is primarily driven by the increasing global prevalence of MG, advancements in diagnostic techniques, and the development of innovative therapies, including biologics and immunosuppressive treatments. Growing awareness and the expansion of clinical trials for MG are also contributing to market growth. Additionally, the rising demand for personalized medicine and improved healthcare infrastructure in emerging markets are notable trends influencing the market. These factors, along with continued research and development, are expected to drive growth in the MG disease treatment market.

To Understand More About this Research: Request a Free Sample Report

Myasthenia Gravis Disease Market Dynamics

Increasing Focus on Biologic Therapies

One of the major myasthenia gravis (MG) disease market driver is the growing focus on biologic therapies, particularly monoclonal antibodies. The increasing recognition of the autoimmune nature of MG has led to the development of targeted treatments that modify the immune response. The approval of drugs such as eculizumab (Soliris) and ravulizumab (Ultomiris) has significantly advanced the treatment options available for patients, offering better disease control and fewer side effects compared to traditional therapies. Biologic therapies are proving to be highly effective for patients with severe or treatment-resistant MG, driving their demand. A report by the National Institute of Neurological Disorders and Stroke (NINDS) indicates that around 10 to 15% of MG patients are refractory to traditional treatments, making biologics a critical option for this group.

Growth of Personalized Medicine

The trend toward personalized medicine in the MG market is becoming more prominent as advancements in genetic research and molecular profiling allow for more tailored treatments. Personalized therapies aim to optimize the therapeutic outcomes based on the individual’s specific disease characteristics, genetic makeup, and response to previous treatments. This trend is driven by the growing understanding of the molecular mechanisms underlying MG, enabling clinicians to provide more effective and targeted interventions. The increasing use of genetic testing and biomarkers is expected to enhance the precision of treatments. The shift toward personalized medicine in MG is evidenced by the expanding clinical trials, such as those involving Zilucoplan, a complement inhibitor being evaluated for its targeted effects on MG symptoms.

Rising Number of Clinical Trials and Research Investments

The number of clinical trials targeting myasthenia gravis has been steadily increasing as pharmaceutical companies and research institutions intensify efforts to find new and more effective treatments. This surge in clinical trials is driven by the unmet need for therapies that can provide long-term disease control with fewer side effects. The US National Institutes of Health (NIH) reports that in 2023, more than 50 active clinical trials were in process of new drug candidates for MG. This growing research investment reflects the industry's recognition of MG as a significant therapeutic challenge, especially for patients with severe forms of the disease. Additionally, these trials are exploring new treatment avenues, such as gene therapy and cell-based therapies, promising further innovation in the myasthenia gravis disease market.

Myasthenia Gravis Disease Market Segment Insights

Myasthenia Gravis Disease Market Assessment by Treatment Type

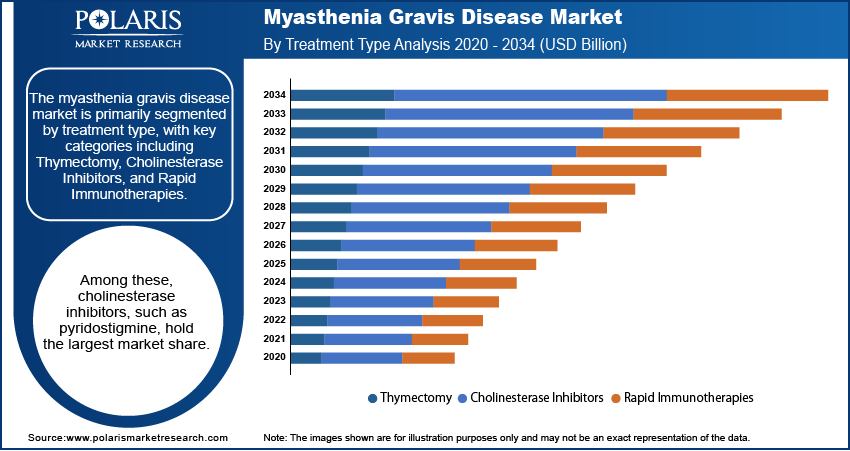

The myasthenia gravis disease market segmentation, based on treatment type, includes thymectomy, cholinesterase inhibitors, and rapid immunotherapies. Among these, cholinesterase inhibitors, such as pyridostigmine, hold the largest myasthenia gravis disease market share. These drugs are considered first-line treatments for the majority of MG patients, as they help improve neuromuscular transmission by inhibiting the breakdown of acetylcholine. Cholinesterase inhibitors have been widely used for years, contributing to their dominant position in the market. Their ability to alleviate symptoms, especially in mild to moderate cases, makes them a staple in the management of MG, resulting in steady demand across global markets.

Rapid immunotherapies, including intravenous immunoglobulin (IVIG) and plasmapheresis, are gaining significant traction due to their effectiveness in managing acute exacerbations and severe MG symptoms. This segment is also experiencing the fastest growth, as these therapies provide rapid symptom relief for patients with refractory MG who do not respond well to other treatments. The growing number of clinical studies and the approval of newer immunosuppressive agents are driving the expansion of this segment. Thymectomy, a surgical procedure often recommended for patients with thymoma or those with generalized MG, continues to hold a crucial position but remains less widespread compared to pharmacological treatments. However, its role in long-term disease management and certain subsets of MG patients ensure its steady contribution to the market.

Myasthenia Gravis Disease Market Evaluation by End Use

The myasthenia gravis disease market, segmented by end-use, includes hospitals and clinics, with hospitals holding the largest market share. Hospitals serve as the primary setting for the treatment of severe or complex cases of Myasthenia Gravis, where patients often require intensive care, diagnostic tests, and a multidisciplinary approach to disease management. The advanced infrastructure and availability of specialized medical professionals in hospitals make them the preferred choice for both acute exacerbations and long-term treatment management. Hospitals also provide access to cutting-edge therapies such as intravenous immunoglobulin (IVIG), plasmapheresis, and surgical interventions like thymectomy, further reinforcing their dominant position in the market.

The clinics segment, while smaller, is experiencing the highest growth rate. The shift toward outpatient care and the increasing number of specialized MG clinics offering tailored treatments have contributed to this growth. Clinics provide more focused care for stable or less severe cases of MG, allowing for routine follow-ups and management with medications like cholinesterase inhibitors. The growing demand for cost-effective and accessible care is driving more patients toward clinics, particularly in regions with expanding healthcare infrastructure. With the increasing prevalence of MG and the rising adoption of outpatient care models, the clinics segment is expected to continue registering robust growth.

Myasthenia Gravis Disease Market Regional Insights

By region, the study provides myasthenia gravis disease market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by advanced healthcare infrastructure, high awareness levels, and significant research and development investments. The US, in particular, leads in the adoption of new treatments such as biologics and immunotherapies, supported by a robust healthcare system and favorable reimbursement policies. Additionally, the region benefits from a large patient population and high demand for specialized care, including hospital-based treatments and clinical trials. The growing focus on personalized medicine and the presence of major pharmaceutical companies further contribute to North America's dominance. Other regions, such as Europe and Asia Pacific, are also expanding their market presence, but North America remains the leading contributor to market growth due to its well-established healthcare network and innovative treatment options.

The myasthenia gravis disease market in Europe is experiencing steady growth, supported by a well-established healthcare system and increased patient awareness. Countries such as Germany, the UK, and France are key contributors, driven by their advanced medical infrastructure and strong emphasis on research and development in rare diseases. The adoption of biologic therapies and rapid immunotherapies is rising, particularly in countries with high healthcare expenditures. Additionally, the availability of specialized centers for rare disease management and the growing number of clinical trials are expanding treatment options for MG patients. However, varying reimbursement policies across different European countries can create disparities in access to advanced treatments.

Asia Pacific is witnessing the fastest growth rate in the myasthenia gravis market. This growth is primarily attributed to the expanding healthcare infrastructure, increasing healthcare awareness, and a rising patient population in countries such as China, India, and Japan. The demand for treatment options, particularly biologics and immunotherapies, is increasing as healthcare systems in these countries are improving and expanding access to specialized care. Japan, with its advanced medical technologies, plays a significant role in the region’s market, while India and China are emerging markets where better access to healthcare services and growing awareness are expected to drive myasthenia gravis disease market expansion. Moreover, the rising trend of medical tourism and clinical trials in these countries’ further boosts market growth.

Myasthenia Gravis Disease Market – Key Market Players and Competitive Insights

Key players in the myasthenia gravis disease market include pharmaceutical companies and biotechnology firms that focus on developing treatments for rare autoimmune disorders. Notable companies in the market include Alexion Pharmaceuticals (a part of AstraZeneca), which manufactures eculizumab (Soliris) and ravulizumab (Ultomiris), both of which are used in treating MG. Other companies such as Mitsubishi Tanabe Pharma, known for mecasermin (a treatment for MG), and Bristol Myers Squibb, with its Rituximab therapy, also contribute to the therapeutic landscape. Additionally, Grifols manufactures IVIG therapies, while Baxter International and CSL Behring are involved in the production of immunoglobulin therapies. UCB focuses on Keppra, a medication used off-label for MG management. Other companies, such as Prothena Biosciences and Argenx, are developing innovative therapies targeting the immune system, including caplacizumab and c5 complement inhibitors.

The competitive landscape of the myasthenia gravis industry is characterized by a shift toward biologic therapies and advanced immunotherapies, which are providing more effective treatment options for patients with severe or refractory MG. Companies are increasingly focusing on biologics such as monoclonal antibodies, which specifically target immune components to improve patient outcomes. There is also a growing interest in personalized medicine, as some companies, such as Sanofi and Amgen, are exploring treatments tailored to genetic and molecular profiles, which could enhance the efficacy of MG management. Furthermore, clinical trials for new therapies, including gene therapies, are underway, making innovation a central focus of the competition in this market.

Despite the advancements in treatment options, competition remains centered on overcoming challenges related to treatment affordability, accessibility, and long-term patient management. Larger companies such as AstraZeneca and Roche benefit from robust distribution networks and established market presence, but smaller biotech firms are also making significant strides by introducing novel therapies and targeting underserved patient groups. Regulatory approval processes and reimbursement policies will continue to shape the competitive dynamics, with companies focusing on enhancing the safety and efficacy profiles of their treatments to maintain market share. As clinical research evolves, companies that invest in rare disease treatments, such as AbbVie and Pfizer, are likely to play an increasingly important role in addressing the diverse needs of myasthenia gravis patients.

One major player in the myasthenia gravis market is Alexion Pharmaceuticals, now part of AstraZeneca. Alexion’s primary contribution to the market is through its treatments, such as eculizumab (Soliris) and ravulizumab (Ultomiris), which are used to manage severe forms of myasthenia gravis. These treatments work by targeting the immune system to help control the symptoms of the disease.

Another key player is Grifols, which manufactures intravenous immunoglobulin (IVIG) therapies for myasthenia gravis (MG). These therapies are widely used to provide short-term relief to MG patients by improving neuromuscular function.

Key Companies in Myasthenia Gravis Disease Market

- Alexion Pharmaceuticals (AstraZeneca)

- Mitsubishi Tanabe Pharma

- Bristol Myers Squibb

- Grifols

- Baxter International

- CSL Behring

- UCB

- Prothena Biosciences

- Argenx

- Sanofi

- Amgen

- AbbVie

- Pfizer

- Roche

- Novartis

Myasthenia Gravis Disease Market Developments

- September 2023: AstraZeneca announced that it was expanding access to these medications through updated insurance plans and patient support programs, aiming to improve accessibility for patients in need of advanced treatment options.

- August 2023: Grifols announced an investment in expanding its production capacity to meet the growing demand for immunoglobulin products. This reflects the increased focus on rare disease treatments, including myasthenia gravis.

Myasthenia Gravis Disease Market Segmentation

By Treatment Type Outlook

- Thymectomy

- Cholinesterase Inhibitors

- Rapid Immunotherapies

By End Use Outlook

- Hospitals

- Clinics

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Myasthenia Gravis Disease Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.60 billion |

|

Market Size Value in 2025 |

USD 2.83 billion |

|

Revenue Forecast in 2034 |

USD 6.19 billion |

|

CAGR |

9.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

? The myasthenia gravis disease market size was valued at USD 2.60 billion in 2024 and is projected to grow to USD 6.19 billion by 2034.

? The market is projected to register a CAGR of 9.1% during the forecast period, 2025-2034.

? North America had the largest share of the market.

? Notable companies in the market include Alexion Pharmaceuticals (a part of AstraZeneca), which manufactures eculizumab (Soliris) and ravulizumab (Ultomiris), both of which are used in treating MG. Other companies like Mitsubishi Tanabe Pharma, known for mecasermin (a treatment for MG), and Bristol Myers Squibb, with its Rituximab therapy, also contribute to the therapeutic landscape.

? The cholinesterase inhibitors segment accounted for the largest market share.

? The hospitals segment accounted for the largest share of the market.

? Myasthenia Gravis (MG) is a chronic autoimmune disorder that causes weakness in the skeletal muscles, particularly those responsible for controlling voluntary movements like eye muscles, facial muscles, and limbs. The condition occurs when the body’s immune system produces antibodies that interfere with the communication between nerve cells and muscle cells, preventing the normal transmission of signals. This leads to muscle weakness that worsens with activity and improves with rest. The severity of the disease varies among individuals, with symptoms ranging from mild to life-threatening. Common symptoms include drooping eyelids, double vision, difficulty swallowing, and overall muscle weakness. MG is typically managed with treatments that include medications, immunotherapies, and sometimes surgical options like thymectomy.

? A few key myasthenia gravis disease market trends are described below: Increased focus on biologic therapies: Growing adoption of monoclonal antibodies and other biologics, such as eculizumab and ravulizumab, for more effective treatment of severe MG. Shift toward personalized medicine: Advances in genetic research and molecular profiling, allowing for tailored therapies based on individual patient characteristics. Rising number of clinical trials: Increasing investment in research and development, with many new therapies undergoing clinical trials for better management of MG. Expansion of immunotherapies: The growing use of intravenous immunoglobulin (IVIG) and plasmapheresis for managing acute symptoms and exacerbations in MG patients.

? A new company entering the Myasthenia Gravis market could focus on developing innovative therapies that target underserved patient populations, such as those with refractory or severe forms of the disease. Investing in biologics and personalized medicine, including monoclonal antibodies and gene therapies, would differentiate the company by addressing unmet needs in treatment efficacy. Additionally, focusing on improving patient access to medications through cost-effective solutions, along with partnerships for expanding clinical trials and research, could position the company as a leader in advancing MG care. Strengthening global distribution networks, especially in emerging markets, would also offer a competitive edge.

? Companies manufacturing, distributing, or purchasing Myasthenia Gravis Disease and related products, and other consulting firms must buy the report.