Mutual Fund Assets Market Share, Size, Trends, Industry Analysis Report, By Investment Strategy, By Type, By Distribution Channel, By Investment Style, By Investor Type, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3858

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

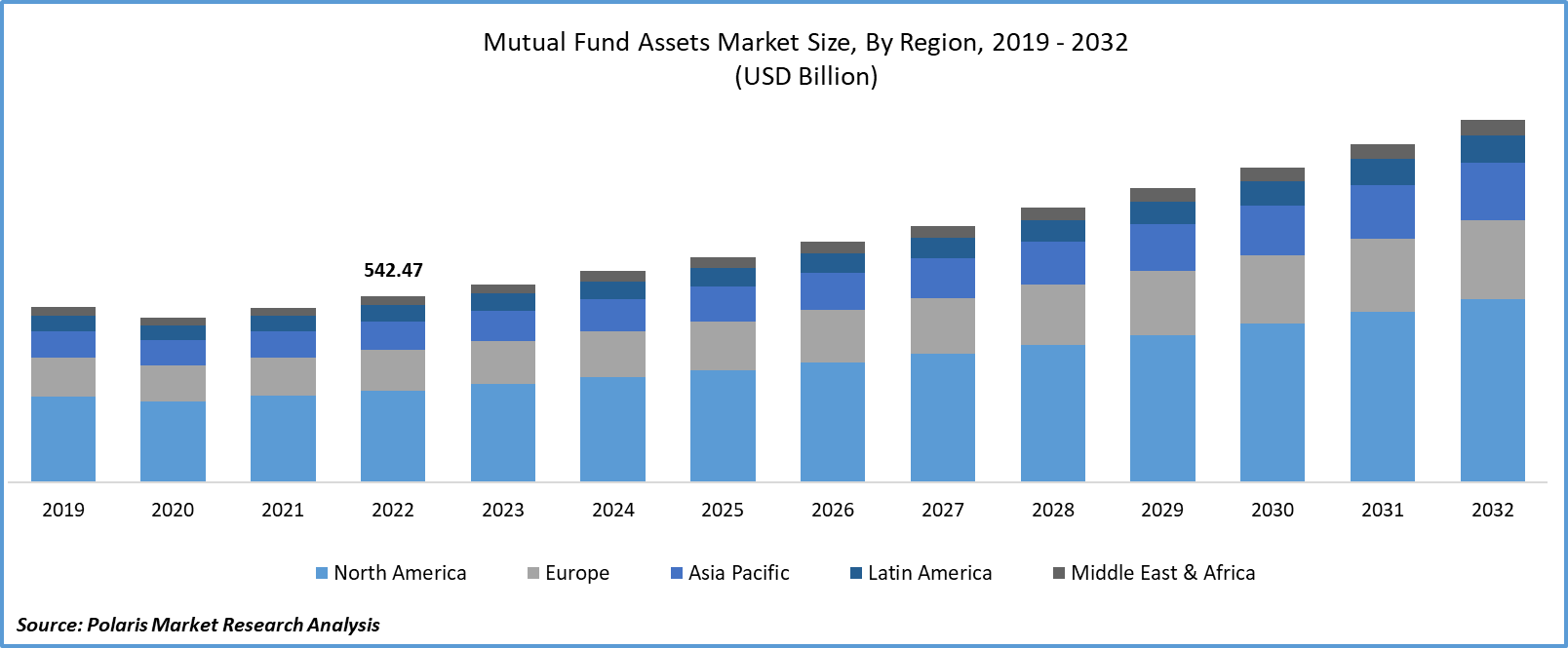

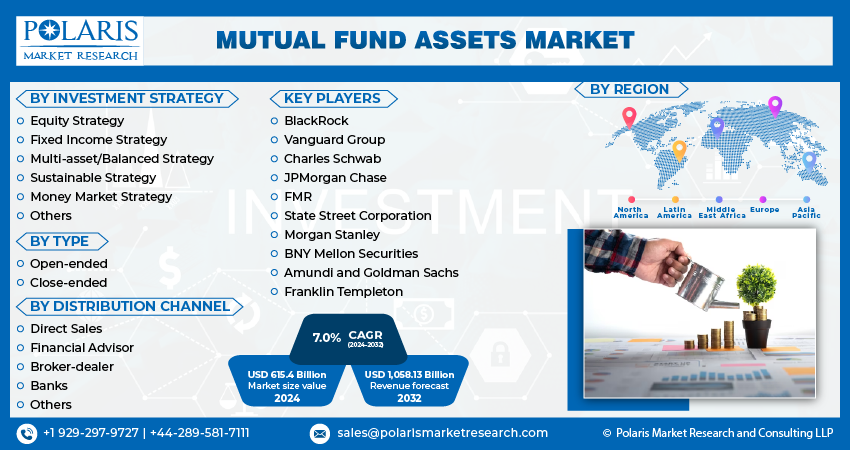

The global mutual fund assets market size and share was valued at USD 577.51 billion in 2023 and is expected to grow at a CAGR of 7.0% during the forecast period.

The availability of liquidity empowers investors to align their investment choices with their financial goals and respond effectively to changing market dynamics, cultivating a positive investment environment. The straightforwardness and ease linked to mutual fund investments play pivotal roles in propelling market expansion. Mutual funds provide a user-centric investment avenue that accommodates a wide spectrum of investors, including those with limited investment knowledge. Investors can participate in the market with modest capital and obtain entry to expertly managed, diversified portfolios, eliminating the necessity for in-depth market scrutiny or individual stock picking

A mutual fund is a type of investment where a number of people's contributions are combined to purchase a range of bonds, stocks, and other securities. A qualified money manager oversees this combination of investments, giving investors a portfolio that is designed to align with the investment goals specified in the fund's prospectus. Also, compared to buying a single stock or bond, investing in a mutual fund gives people access to a wide variety of assets, which can help reduce risk. The performance of the fund, less any fees or charges, determines the returns that investors receive. Small and individual investors can gain access to professionally managed portfolios of stocks, bonds, and other asset classes through mutual funds, which is boosting the mutual fund assets market growth.

Additionally, due to their accessible liquidity, low initial commitment requirements, transparency in operations, and compounding potential, mutual funds are becoming increasingly popular investments globally. This is because they allow investors to create wealth. Furthermore, people's preference for these funds has increased due to asset diversification and lower risk. As a result, the mutual fund assets market share has experienced remarkable growth.

To Understand More About this Research: Request a Free Sample Report

The accessibility and user-friendly nature of mutual funds significantly contribute to their broad popularity, driving the expansion of the market. Nonetheless, this growth is tempered by the inherent potential for market volatility and investment risk. Mutual funds are susceptible to market fluctuations, which can lead to the erosion of investors' initial investments. Furthermore, types of mutual funds, such as those concentrated on specific sectors or emerging markets, might entail heightened risk levels. To address this limitation, investors can embrace a diversified investment strategy by distributing their funds across various asset classes and fund types.

The mutual fund assets market growth report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The mutual fund assets market has witnessed heightened investor curiosity and engagement due to the impact of the COVID-19 pandemic. As conventional investment channels like real estate and fixed deposits encountered unpredictabilities in the pandemic's wake, investors pursued alternate avenues, with mutual funds emerging as a favored choice. This heightened demand has resulted in the expansion of mutual fund assets as an increasing number of investors direct their capital toward these investment instruments. Additionally, the pandemic expedited the uptake of digital platforms and online investment practices. In the face of lockdowns and social distancing protocols, investors shifted towards online platforms to conveniently access and oversee their investments.

Industry Dynamics

Growth Drivers

Rising customer preference for safe investments

Investors can utilize mutual funds to achieve diversification across a wide array of assets, including stocks, bonds, and commodities. This diversification is a strategic approach that aids in minimizing risk by distributing investments across different sectors and types of assets. As a result, the potential for more stable and consistent returns is enhanced. Additionally, mutual funds offer the advantage of professional management, which contributes to the continued expansion of the mutual fund assets market.

Investors who are constrained by time, knowledge, or resources to oversee their investment portfolios directly can capitalize on the expertise of professional fund managers. These managers engage in comprehensive research, analysis, and decision-making on behalf of investors, with the goal of realizing the fund's defined investment objectives. The presence of seasoned fund managers fosters investor confidence and draws them toward participating in mutual funds.

A notable growth catalyst is the increased liquidity that mutual funds offer. In contrast to certain alternative investment avenues, mutual funds provide investors with seamless accessibility to their invested capital. The adaptability inherent to mutual funds permits investors to engage in transactions involving fund shares at the current Net Asset Value (NAV) on any business day.

Report Segmentation

The market is primarily segmented based on investment strategy, type, distribution channel, and region.

|

By Investment Strategy |

By Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Investment Strategy Analysis

Equity strategy segment accounted for the largest share in 2022

The equity strategy segment held the largest share. Opting for investments in equity mutual funds presents the benefit of attaining exposure to a varied collection of companies, thus mitigating the perils linked to individual stock holdings. This strategy of diversification empowers investors to tap into different markets and styles, facilitating the creation of all-encompassing portfolios that align with their distinct financial aims. Through the dispersion of investments across numerous companies, equity mutual funds offer a comprehensive methodology for reaching investment objectives, all the while lessening the susceptibility inherent in relying solely on a solitary stock.

The sustainable strategy segment will grow at a rapid pace. It will be driven by investors' heightened focus on tackling worldwide issues like climate change, income disparities, and corporate governance. A variety of options that support sustainability are at investors' disposal, including ESG Integration Funds, Negative Screening Funds, & Impact Funds. These funds not only aid investors in reducing exposure to risk but also enable them to harmonize their investments with their principles, thereby propelling the advancement of this sector.

By Type Analysis

Open-ended segment accounted for the largest share in 2022

The open-ended segment held the largest share. This dominance is rooted in the adaptability and liquidity attributes it offers. Open-ended mutual funds lack a fixed count of shares and possess the ability to issue new shares or redeem existing ones based on the demands of investors. This affords investors the freedom to purchase or sell shares at their discretion, ensuring convenient access to their invested capital. Furthermore, the open-ended structure empowers fund managers to dynamically oversee the portfolio by adjusting holdings in response to market conditions and investment goals.

The close-ended segment will grow at a rapid pace. These funds frequently direct their investments toward specialized or niche sectors that hold the promise of enhanced growth and profitability. This allure draws in investors who are in search of potentially amplified returns on their investments. Moreover, the constrained quantity of shares available in close-ended funds fosters an aura of exclusivity, which in turn can stimulate demand and elevate prices.

By Distribution Channel Analysis

Direct sales segment accounted for the largest share in 2022

The direct sales segment held the largest share. Direct sales afford investors the ease and adaptability to acquire mutual fund units directly, bypassing intermediaries like brokers or financial advisors. This empowers investors with heightened authority over their investment choices and has the potential to reduce expenses associated with distribution fees or commissions. Furthermore, direct sales establish transparency and direct interaction between the fund company & the investor.

The financial advisor segment will grow at a rapid pace. Numerous investors actively pursue professional counsel and direction while making investment choices, especially those confronted with intricate financial scenarios or enduring aspirations. Financial advisors possess the requisite expertise and know-how to guide investors through the intricacies of mutual fund investments, crafting bespoke investment strategies in the process. Furthermore, financial advisors extend individualized investment suggestions rooted in their client's risk appetite, financial aims, and investment duration. This personalized methodology resonates with investors who place importance on a tailored investment encounter.

By Regional Analysis

North America dominated the global market in 2022

North America dominated the global market. The comprehensive and diverse nature of the region’s financial sector attracts a substantial array of investors, both institutional & retail. These investors place their trust and reliance on mutual funds as a favored investment avenue. Furthermore, it embodies a culture of investment and boasts a high level of financial literacy among its populace. Investors in the region are notably well-informed and proactively seek out investment prospects to enhance their wealth, with mutual funds standing out as a popular and preferred choice.

APAC will grow at a substantial pace. The region's notable economic expansion and the escalating middle-class populations resulted in amplified disposable incomes and an augmented appetite for investment prospects. As individuals and households amass wealth, their focus is progressively shifting toward mutual funds as a means of investment, thereby facilitating portfolio diversification and the pursuit of potential returns. Furthermore, the maturation of financial markets and the relaxation of investment regulations in numerous Asia-Pacific nations have created avenues for both domestic and international fund managers to extend a broad spectrum of mutual fund offerings.

Competitive Insight

The Mutual Fund Assets Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- BlackRock

- Vanguard Group

- Charles Schwab

- JPMorgan Chase

- FMR

- State Street Corporation

- Morgan Stanley

- BNY Mellon Securities

- Amundi and Goldman Sachs

- Franklin Templeton

Recent Developments

- In July 2023, Franklin Templeton introduced the Franklin Sealand China A-shares fund, designed to offer retail investors in Singapore the chance to engage with the China A-shares market. This fund's central emphasis lies in directing investments toward China A-shares and equity securities issued by Chinese companies listed on the domestic stock exchange. The fund's overarching aim is to realize enduring capital growth over the long term.

Mutual Fund Assets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 615.4 billion |

|

Revenue Forecast in 2030 |

USD 1,058.13 billion |

|

CAGR |

7.0% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

Investment strategy, type, distribution channel, investment style, investor type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of the mutual fund assets market landscape with the latest statistical insights for 2024, meticulously crafted by Polaris Market Research Industry Reports. Uncover the market's share, size, and revenue growth rate, supplemented by a forward-looking market forecast until 2032 and a retrospective glance at its history. Elevate your understanding of this dynamic industry by securing a complimentary PDF download of the sample report and stay ahead in the ever-evolving realm of the mutual fund assets market.

FAQ's

The global mutual fund assets market size is expected to reach USD 1,058.13 billion by 2032.

Key players in the market are BlackRock, Vanguard Group, Charles Schwab, JPMorgan Chase.

North America contribute notably towards the global mutual fund assets market.

The global mutual fund assets market is expected to grow at a CAGR of 7.0% during the forecast period.

The mutual fund assets market report covering key segments are investment strategy, type, distribution channel, and region.