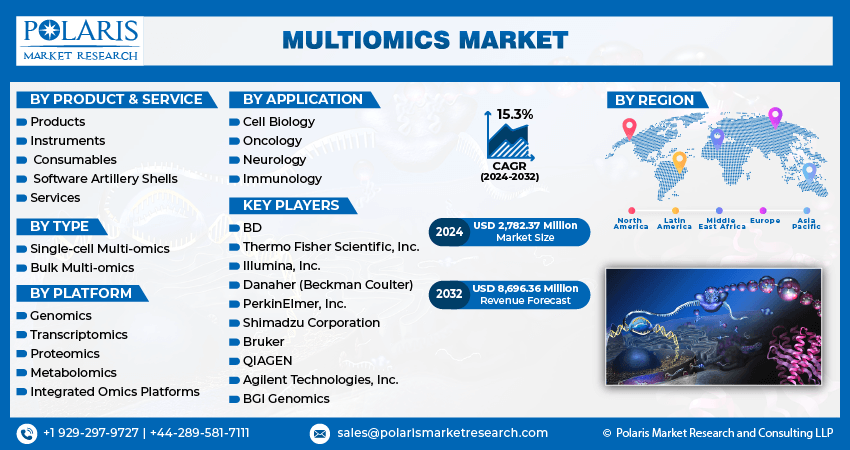

Multiomics Market Size, Share, Trends, Industry Analysis Report, By Product & Services (Products, and Services); By Type (Single-cell Multi-omics and Bulk Multi-omics); By Platform; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 117

- Format: PDF

- Report ID: PM5002

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

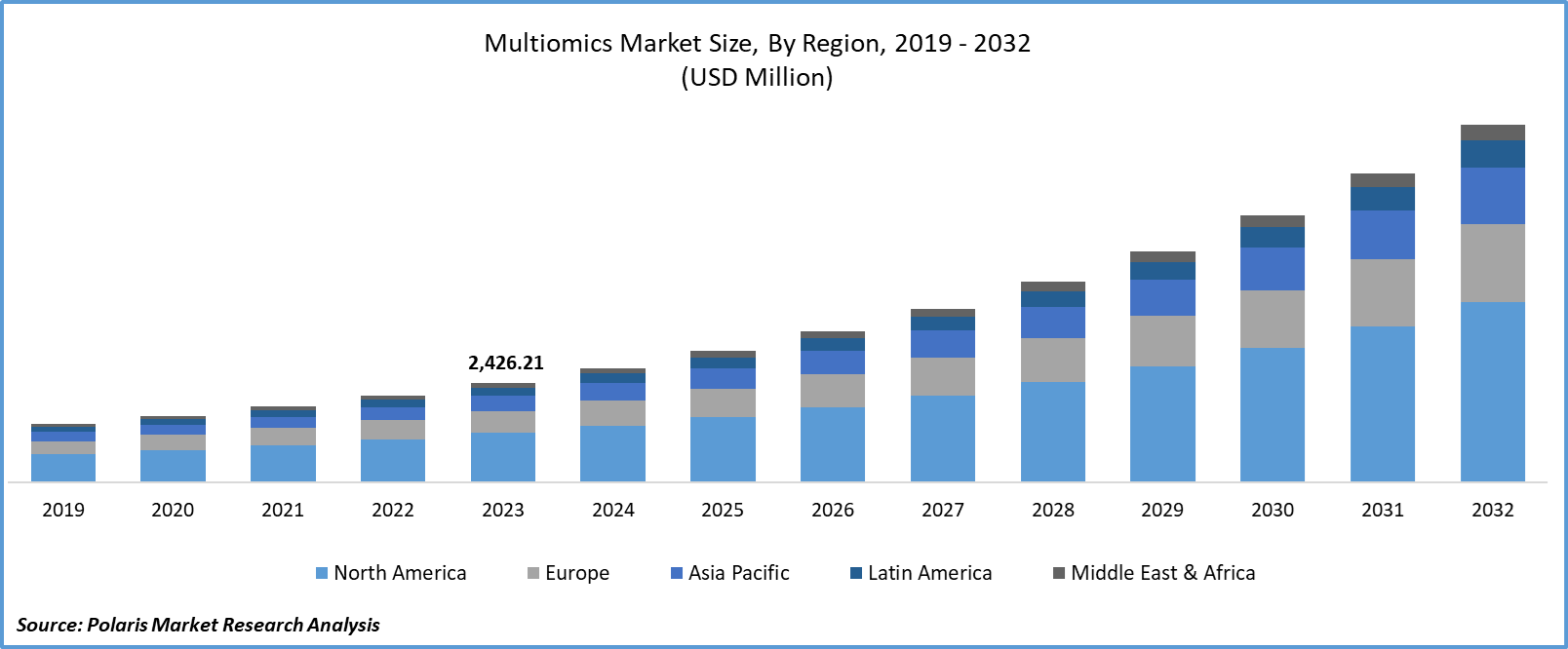

Multiomics Market size was valued at USD 2,426.21 million in 2023. The multi-omics industry is anticipated to grow from USD 2,782.37 million in 2024 to USD 8,696.36 million by 2032, exhibiting a CAGR of 15.3% during the forecast period.

Market Overview

The multi-omics encompasses the integration of multiple omics disciplines (genomics, proteomics, metabolomics, and others) to analyze biological systems comprehensively. It enables holistic insights into complex biological phenomena, driving advancements in personalized medicine and precision agriculture. The multiomics market growth is driven by advancements in technology such as cloud-based and single-cell technology, increased investment in R&D, and rising demand for better diagnostic tests. For instance, in June 2021, SCIEX launched the OneOmics suite software and the Molecule Profiler app. OneOmics is a cloud-based platform that is used to analyze large-scale data sets of lipids, proteins, and metabolites. Also, it facilitates easy processing of research and analysis of large-scale data of multi-omics studies.

Furthermore, the rising chronic diseases such as diabetes, cancer, heart disease, and others facilitate the need for multi-omics software or solutions to understand complex molecular data. This increasing prevalence of chronic diseases drives the multiomics market during the forecast period. In January 2024, according to the Global Heart & Circulatory Diseases Factsheet Report, in 2021, approximately 200 million cases were registered for coronary heart disease (CHD), with 110 million men and 80 million women globally.

To Understand More About this Research: Request a Free Sample Report

Moreover, increasing collaboration and partnership among key players such as Thermo Fisher Scientific, Lunaphore, & Bruker facilitates multiomics market growth. For instance, in April 2023, Bio-Techne & Lunaphore partnered to develop an automated same-slide spatial multi-omics solution. This collaboration aims to create advanced technology that enables the detection of protein and RNA biomarkers on the same slide and the understanding of disease mechanisms for improved therapeutics and diagnostics.

Growth Drivers

Technological Advancements in Single-Cell Multi-Omics

Technological advancements play an important role in driving the growth of the multiomics market. Single-cell multi-omics integrated with advanced technology such as AI and data analytics enable in-depth analysis of individual cells and provide insights into proteomics, metabolomics, genomics, & transcriptomics. These advances among players have formed strategic partnerships and collaborations to cater to the demand for single-cell multi-omics-based software. For instance, in July 2022, Sirona Dx Partnered with Scailyte for AI-driven software for single-cell analysis. This partnership aims to focus on applications within oncology and immunology.

Increased Funding for Research and Development

Increased funding for research and development plays a significant role in driving the multiomics market. Various government agencies and market players invested to increase advancement in human health and disease. Industry academia collaboration focuses on the new technology development for multi-omics applications, paves the importance for personalized medicine in early disease diagnosis. For instance, in September 2023, the National Institutes of Health (NIH) funded USD 50.3 million for research on multi-omics research on human health and disease for five years.

Restraining Factors

High Investment in Advanced Technology

The higher investment in advanced technology, such as data analytics, artificial intelligence, machine learning, and others, due to the complexity of data integration, hinders the market's growth. High expenses may restrict innovation and impede the pace of technological advancement in the multi-omics industry, potentially hindering market demand in the coming years.

Report Segmentation

The multiomics market segmentation is primarily based on product & service, type, platform, application, and region.

|

By Product & Service |

By Type |

By Platform |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product & Service Analysis

The Product Segment Accounted for the Largest Market Share in 2023

The product segment held the largest revenue share in the multiomics market due to the rising prevalence of chronic diseases globally. Moreover, the growing adoption of single-cell multi-omics with the integration of advanced technology further boosts the segment’s growth in the multiomics market. For instance, in January 2024, BD and Hamilton collaborated to standardize single-cell multi-omics applications using robotics. This collaboration aims to enable greater standardization and reduce human error while conducting large-scale single-cell multi-omics experiments.

By Type Analysis

Single-Cell Multi-Omics Segment Accounted for the Largest Market Share in 2023

The single-cell multi-omics segment held the largest market share for the multiomics market in 2023 because of its use in various applications such as developmental biology, cancer biology, gene therapy, stem cell biology, and functional screening. Also, market players are introducing products integrated with AI, leading to a growing demand for single-cell multi-omics products. For example, in May 2023, Deepcell launched the AI-powered single-cell analysis REM-I platform.

Single-cell multi-omics technologies enable the simultaneous profiling of multiple molecular layers, such as the genome, epigenome, transcriptome, and proteome, within individual cells. This provides unprecedented opportunities to explore cellular diversity and heterogeneity by revealing regulatory connections between different omics layers.

The bulk multi-omics segment is projected to grow at a significant CAGR in the multiomics market during the projected period. This growth is primarily due to advantages such as the simplicity of the process, the ability to dissect large-scale samples, and cost-effectiveness. Moreover, expanding applications in personalized medicine and drug discovery also drive the segment’s growth in the multiomics market.

By Platform Analysis

The Metabolomics Segment is Expected to Witness the Highest Growth

The metabolomics segment is projected to grow at the highest CAGR during the projected period, mainly driven by technological advancement in metabolomics platforms and expanding applications in personalized medicine and drug discovery. For instance, in November 2023, Panome Bio added unbiased proteomics to its proprietary metabolomics platform to deliver innovative multi-omics services.

The Genomics segment garnered the largest revenue share for the multiomics market in 2023. The advancements in genomic data analysis tools and decreasing costs of sequencing technologies drive the segment growth. Market players like Biomodal are introducing new products and solutions for new epigenetic and pedigree analysis. For instance, in April 2024, Biomodal (Cambridge Epigenetix) launched a multi-omics solution, which shows the combined power of genetic and epigenetic information from a single low-volume sample.

Global Multiomics Market, Segmental Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Regional Insights

The North American Region Registered the Largest Share of the Global Market in 2023

The North America multiomics market held the dominant share in 2023 owing to the presence of key players, collaborations among the industry & research community, and investments in the multi-omics applications. Further, the rising chronic diseases in the region also boost the multiomics market growth. For instance, as per the statistics published by the Canadian Cancer Society (CCS), in 2023, around 239,100 people were diagnosed with cancer in Canada, with a mortality of 20%. Also, the expansion of laboratories by leading players to cater to the demand for multi-omics drives the market in the region. For instance, in February 2024, Singleton, a single-cell multi-omics solutions provider, expanded its presence in Michigan, the US, with a new office and laboratories.

The Europe multiomics market will grow rapidly during the forecast period, owing to the growing government initiatives towards research projects on large-scale analysis, such as cancer and cardiovascular diseases, and promoting the overall healthcare system. For instance, France's government launched the France Genomic Medicine Plan 2025. The objective of this plan is to leverage the French healthcare system with closer integration of research, training, and innovation to enhance healthcare services and improve quality of life.

Global Multiomics Market, Regional Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The growing investments in R&D for drug discovery and new technology are positively impacting the global multiomics market. The ongoing expansion initiatives, including partnerships, acquisitions, and collaborations, are fueling competition in the marketplace. For instance, in January 2023, CosmosID launched metabolomics services aiming to expand its multi-omics capabilities.

Some of the major players operating in the global multiomics market include

- BD

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher (Beckman Coulter)

- PerkinElmer, Inc.

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI Genomics

Recent Developments in the Industry

- In January 2024, Akoya Biosciences and Thermo Fisher Scientific announced a license & distribution agreement to deliver spatial multi-omics solutions.

- In April 2023, NIOA, Fulgent Genetics introduced the Mission Bio platform for single-cell multi-omics for clinical research. It aims to offer Pharma drug developers single-cell multi-omics for biomarker discovery, & single-cell minimal residual disease (MRD) development at a certain scale.

Report Coverage

The Multiomics Market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product & services, type, platform, application, end-user, and their futuristic growth opportunities.

Multiomics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,782.37 million |

|

Revenue Forecast in 2032 |

USD 8,696.36 million |

|

CAGR |

15.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Multiomics Market size was valued at USD 2,426.21 million in 2023 and is projected to grow to USD 8,696.36 million by 2032.

The global market is projected to grow at a CAGR of 15.3% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are BD (U.S), Thermo Fisher Scientific, Inc. (U.S.), Illumina, Inc. (U.S.), Danaher (Beckman Coulter) (U.S.), PerkinElmer, Inc. (U.S.), Shimadzu Corporation (Japan), Bruker (U.S.), QIAGEN (Germany), Agilent Technologies, Inc. (U.S.), and BGI Genomics (China).

The Single-cell multi-omics segment category held the highest share of the market in 2023.

The metabolomics segment is expected to witness the highest growth during the forecast period