mRNA Vaccines and Therapeutics Market Size, Share, Trends, Industry Analysis Report: By Type (Self-Amplifying mRNA-Based Vaccines and Conventional Non-Amplifying mRNA-Based Vaccines), Application, Treatment Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 129

- Format: PDF

- Report ID: PM5328

- Base Year: 2024

- Historical Data: 2020-2023

mRNA Vaccines and Therapeutics Market Overview

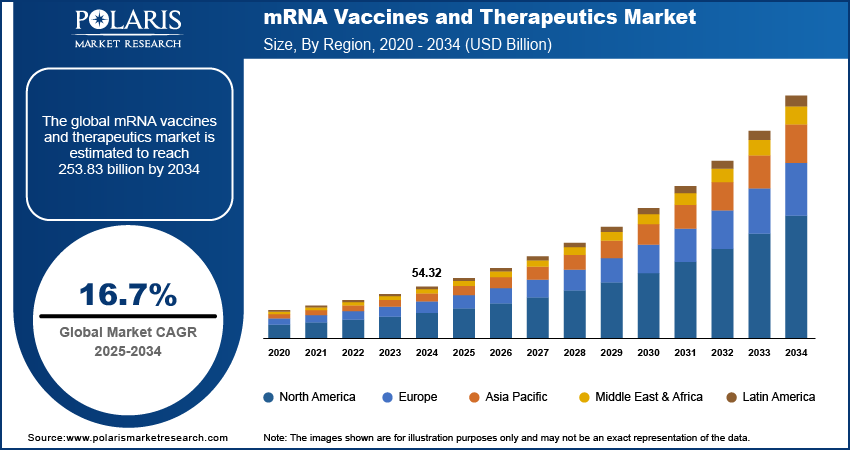

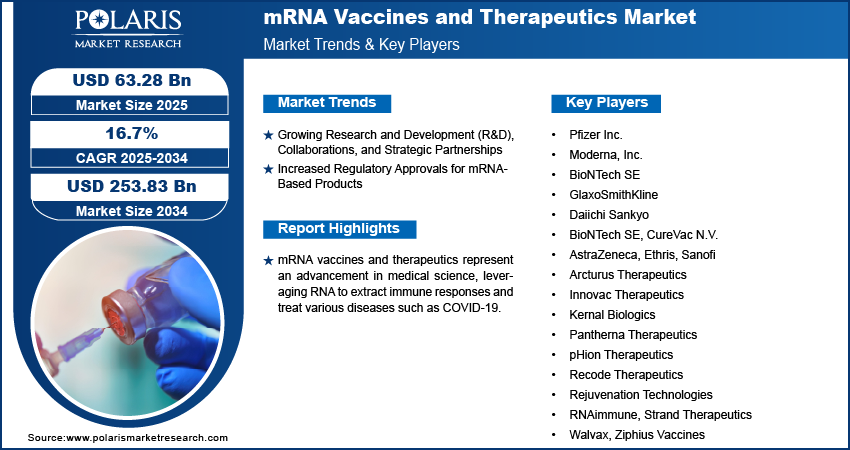

The mRNA vaccines and therapeutics market size was valued at USD 54.32 billion in 2024. The market is projected to grow from USD 63.28 billion in 2025 to USD 253.83 billion by 2034, exhibiting a CAGR of 16.7% 2025–2034.

mRNA vaccines and therapeutics represent an advancement in medical science, leveraging RNA to extract immune responses and treat various diseases such as COVID-19. mRNA vaccines and therapeutics are further being explored for therapeutic purposes, including protein replacement therapy and gene editing.

The increasing prevalence of chronic diseases worldwide is propelling the global mRNA vaccines and therapeutics market development. According to data published by the National Institute of Health (NIH), one in three adults globally has more than one chronic condition or multiple chronic conditions (MCC). Chronic conditions such as cancer, cardiovascular diseases, and autoimmune disorders require targeted therapies that conventional treatment methods don’t provide. mRNA technology, with its ability to instruct cells to produce specific proteins, offers an approach to address these diseases. It enables rapid development of personalized medicines tailored to individual patient needs, enhancing treatment outcomes. Moreover, mRNA-based solutions are versatile and adaptable, making them suitable for addressing the complex and evolving nature of chronic illnesses. This potential for precision medicine, coupled with the increasing prevalence of chronic diseases globally, drives demand for mRNA vaccines and therapeutics as they revolutionize disease management and improve patient quality of life.

To Understand More About this Research: Request a Free Sample Report

The mRNA vaccines and therapeutics market demand is driven by the growing incidence of infectious diseases such as COVID-19. Healthcare and medical companies such as Pfizer and Moderna utilized mRNA technology to develop vaccines and treatments against COVID-19 due to its high efficacy, scalability, and ability to adapt to various virus variants such as Alpha, Beta, Delta, and Omicron. This increases the demand for mRNA vaccines and therapeutics around the globe.

mRNA Vaccines and Therapeutics Market Dynamics

Growing Research and Development (R&D), Collaborations, and Strategic Partnerships

Research and development (R&D), collaborations, and strategic partnerships among research institutes and key companies are accelerating innovation and development of new mRNA vaccines by pooling resources, expertise, and technologies to overcome scientific and manufacturing challenges. For instance, in January 2021, Ribometrix, Inc., a biotechnology company that develops small molecule therapeutics to treat human diseases, announced a strategic collaboration with Genentech, a member of the Roche Group, to discover and develop novel RNA-targeted small molecule therapeutics against several targets conditions such as cancer, neurodegenerative diseases, and infectious diseases. Similarly, in August 2024, Eli Lilly, a pharmaceutical company, opened a 346,000-square-foot facility to advance RNA-based therapeutics. Therefore, the growing strategic activities such as research and development (R&D), collaborations, and strategic partnerships among research institutes and key companies propel the global mRNA vaccines and therapeutics market revenue.

Increased Regulatory Approvals for mRNA-Based Products

The increased regulatory approvals for mRNA-based products are driving the global mRNA vaccines and therapeutics market expansion. In August 2024, the US Food and Drug Administration (FDA) approved and authorized updated mRNA COVID-19 vaccines to better protect against circulating variants. Regulatory approvals build public confidence, encouraging broader adoption of mRNA technologies in healthcare. These approvals pave the way for mRNA expanded use in various applications, including infectious diseases, cancer, and rare genetic disorders. Additionally, they promote further investments in mRNA vaccines and therapeutics research, development, and manufacturing infrastructure, enabling the production of innovative products at scale.

mRNA Vaccines and Therapeutics Market Segment Analysis

mRNA Vaccines and Therapeutics Market Assessment by Type

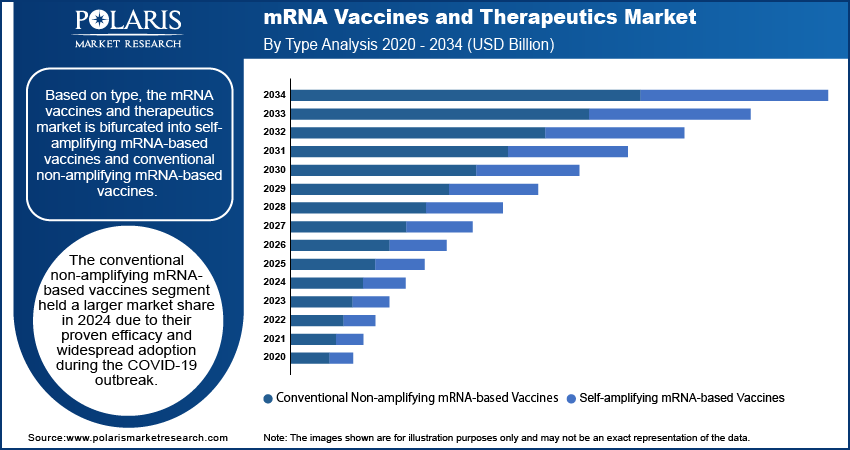

Based on type, the mRNA vaccines and therapeutics market is bifurcated into self-amplifying mRNA-based vaccines and conventional non-amplifying mRNA-based vaccines. The conventional non-amplifying mRNA-based vaccines segment held a larger market share in 2024 due to their proven efficacy and widespread adoption during the COVID-19 pandemic. These vaccines, including those developed by leading pharmaceutical companies such as Pfizer-BioNTech and Moderna, demonstrated robust immune responses and adaptability to COVID-19 viral variants. The scalability of production and established regulatory pathways further contributed to the segment dominance. Governments and healthcare organizations globally prioritized these vaccines due to their rapid development timelines and ability to mitigate severe outcomes of infectious diseases.

mRNA Vaccines and Therapeutics Market Evaluation by Application

In terms of application, the mRNA vaccines and therapeutics market is divided into cancer, infectious diseases, autoimmune diseases, and others. The infectious diseases segment accounted for a major market share in 2024 due to the effective results of mRNA-based COVID-19 vaccines. mRNA vaccines demonstrated high efficacy, rapid development timelines, and adaptability to viral mutations, establishing them as the foundation of global vaccination campaigns. Governments and healthcare organizations prioritized mRNA vaccines to combat the outbreak, which led to significant investments in mRNA technology and manufacturing infrastructure. Additionally, researchers expanded the application of mRNA vaccines and therapeutics to other infectious diseases, including influenza, Zika virus, and cytomegalovirus, which support the dominance of the segment.

The cancer segment is expected to grow at a rapid pace during the forecast period owing to the ability of mRNA technology to revolutionize cancer treatment by enabling the development of personalized cancer vaccines and cancer immunotherapies. These therapies utilize mRNA to encode tumor-specific antigens, stimulating the immune system to target and destroy cancer cells. The growing prevalence of cancer, coupled with the increasing clinical successes of mRNA vaccines in early cancer treatment trials, has attracted significant investments from pharmaceutical companies and research institutes, making the segment the fastest-growing during the assessment period.

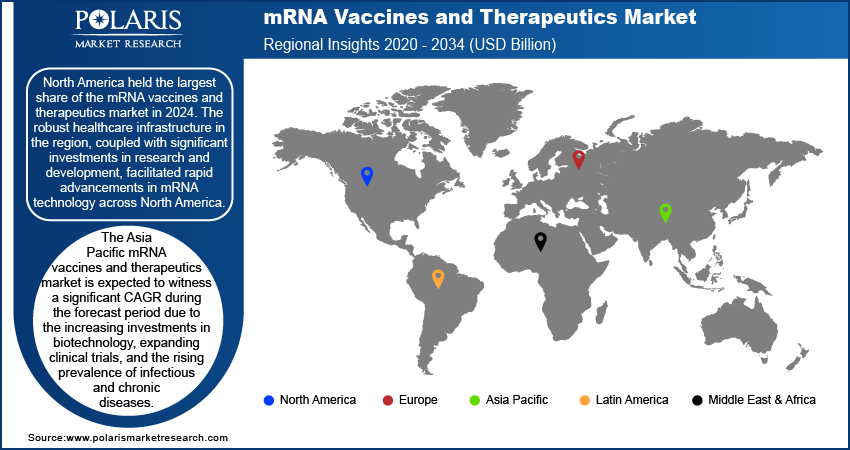

mRNA Vaccines and Therapeutics Market Regional Analysis

By region, the study provides the mRNA vaccines and therapeutics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024. The robust healthcare infrastructure in the region, coupled with significant investments in research and development, facilitated rapid advancements in mRNA technology. The US dominated the North American market, owing to the success of key players such as Moderna and Pfizer-BioNTech in developing and deploying COVID-19 vaccines based on mRNA technology. Strategic government initiatives such as Operation Warp Speed provided funding and logistical support that accelerated vaccine development and delivery. High awareness of medical technologies and the region's strong regulatory framework further contributed to the mRNA vaccines and therapeutics market expansion in North America.

The Asia Pacific mRNA vaccines and therapeutics market is expected to register a significant CAGR during the forecast period due to the increasing investments in biotechnology, expanding clinical trials, and the rising prevalence of infectious and chronic diseases. Countries such as China, India, and Japan are at the forefront of this growth, with China leading the region due to its extensive biopharmaceutical manufacturing capabilities and government support for mRNA research. Collaborative efforts between local and global companies have also accelerated innovation and production in the region. Additionally, Asia Pacific's large and diverse population creates substantial demand for mRNA vaccines and therapeutics, particularly in response to emerging infectious diseases such as COVID-19 and evolving healthcare needs.

mRNA Vaccines and Therapeutics Market – Key Players and Competitive Analysis

Major market players are investing heavily in research and development to expand their offerings, which will drive the mRNA vaccines and therapeutics market growth during the forecast period. Market participants are also adopting various strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The mRNA vaccines and therapeutics market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are Pfizer Inc.; Moderna, Inc.; BioNTech SE; GlaxoSmithKline; Daiichi Sankyo; BioNTech SE; CureVac N.V.; AstraZeneca; Ethris; Sanofi; Arcturus Therapeutics; Innovac Therapeutics; Kernal Biologics; Pantherna Therapeutics; pHion Therapeutics; Recode Therapeutics; Rejuvenation Technologies; RNAimmune; Strand Therapeutics; Walvax; and Ziphius Vaccines.

Pfizer Inc., a global player in the biopharmaceutical industry, has a rich history spanning over 170 years, characterized by its commitment to discovering, developing, manufacturing, and commercializing innovative healthcare products. The company's diverse portfolio encompasses a wide range of therapeutic areas, including oncology, inflammation, cardiovascular health, metabolic diseases, and rare disorders. Pfizer's extensive product lineup includes both prescription medications and vaccines, alongside consumer healthcare products that are well-known globally. Pfizer developed the COVID-19 Comirnaty vaccine in collaboration with BioNTech. The vaccine demonstrated remarkable efficacy and showcased the potential of mRNA technology to revolutionize vaccine development.

AstraZeneca is a multinational pharmaceutical and biotechnology company headquartered in Cambridge, UK. Formed in 1999 through the merger of the Swedish company Astra AB and the British Zeneca Group, AstraZeneca has established itself as one of the world's largest pharmaceutical firms, with a diverse portfolio that spans various therapeutic areas, including oncology, cardiovascular health, gastrointestinal disorders, respiratory diseases, neuroscience, and inflammation. In response to the COVID-19 outbreak, the company developed the Vaxzevria vaccine in collaboration with the University of Oxford. This mRNA vaccine has played a critical role in global vaccination efforts, demonstrating efficacy and safety.

List of Key Companies in mRNA Vaccines and Therapeutics Market

- Pfizer Inc.

- Moderna, Inc.

- BioNTech SE

- GlaxoSmithKline

- Daiichi Sankyo

- BioNTech SE

- CureVac N.V.

- AstraZeneca

- Ethris

- Sanofi

- Arcturus Therapeutics

- Innovac Therapeutics

- Kernal Biologics

- Pantherna Therapeutics

- pHion Therapeutics

- Recode Therapeutics

- Rejuvenation Technologies

- RNAimmune

- Strand Therapeutics

- Walvax

- Ziphius Vaccines

mRNA Vaccines and Therapeutics Market Developments

September 2023: Moderna, a biotechnology company, expanded its mRNA medicine with positive clinical results across cancer, rare diseases, and infectious diseases.

January 2023: BioNTech SE, a global next-generation immunotherapy company, signed a Memorandum of Understanding (MoU) with the Government of the United Kingdom (UK) to benefit patients by accelerating clinical trials for personalized mRNA immunotherapies with the aim to provide personalized cancer therapies for up to 10,000 patients by the end of 2030.

December 2022: Moderna, Inc., a biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines, announced it had received emergency use authorization (EUA) from the US FDA for its BA.4/BA.5 Omicron-targeting bivalent COVID-19 booster vaccine, mRNA-1273.222, in children 6 months through 5 years of age.

mRNA Vaccines and Therapeutics Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Self-Amplifying mRNA-based Vaccines

- Conventional Non-Amplifying mRNA-Based Vaccines

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cancer

- Infectious Diseases

- Autoimmune Diseases

- Others

By Treatment Type Outlook (Revenue, USD Billion, 2020–2034)

- Monoclonal Antibody

- Gene Therapy

- Cell Therapy

- Other

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Research Laboratories and Organizations

- Hospitals

- Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

mRNA Vaccines and Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 54.32 billion |

|

Market Size Value in 2025 |

USD 63.28 billion |

|

Revenue Forecast by 2034 |

USD 253.83 billion |

|

CAGR |

16.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global mRNA vaccines and therapeutics market size was valued at USD 54.32 billion in 2024 and is projected to grow to USD 253.83 billion by 2034.

The global market is projected to register a CAGR of 16.7% during the forecast period.

North America accounted for the largest share of the global market in 2024.

A few of the key players in the market are Pfizer Inc.; Moderna, Inc.; BioNTech SE; GlaxoSmithKline; Daiichi Sankyo; BioNTech SE; CureVac N.V.; AstraZeneca; Ethris; Sanofi; Arcturus Therapeutics; Innovac Therapeutics; Kernal Biologics; Pantherna Therapeutics; pHion Therapeutics; Recode Therapeutics; Rejuvenation Technologies; RNAimmune; Strand Therapeutics; Walvax; and Ziphius Vaccines.

The cancer segment is projected for significant growth in the global market during the forecast period.

The conventional non-amplifying mRNA-based vaccines segment dominated the market in 2024.