Motor Grader Market Share, Size, Trends, Industry Analysis Report, By Vehicle Weight (< 10, 11 to 45, 46 >), By Engine Capacity, By Drive Type (Electric, ICE), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3576

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

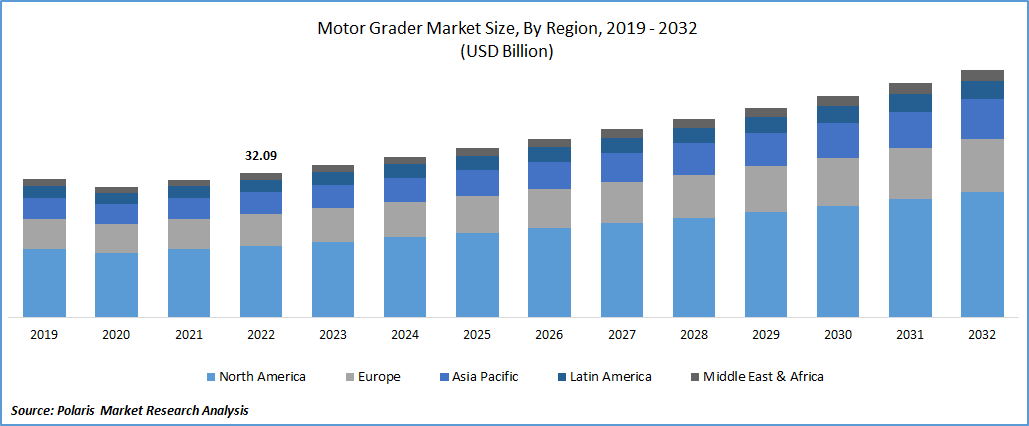

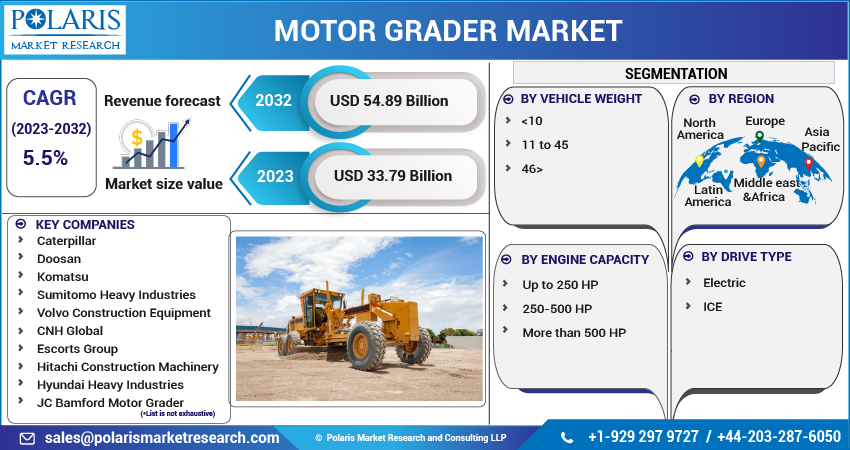

The global motor grader market was valued at USD 32.09 billion in 2022 and is expected to grow at a CAGR of 5.5% during the forecast period. Increased construction projects, mining activities, and infrastructure development worldwide drive the growing demand for motor graders. Government investments in renovating existing public infrastructure and authorizing the construction of new infrastructure, such as airports and roads, are expected to fuel the expansion of the motor grader industry in the foreseeable future. Key players in the industry are actively investing in developing technologically advanced motor graders. Therefore, there has been an increase in operational time and improved efficiency, thanks to the integration of automation to streamline various functions and tasks. Additionally, manufacturers prioritize the design of operator cabs with modifications that enhance operational efficiency and comfort. These technological advancements contribute to the growing demand for motor graders among construction contractors, thereby bolstering the overall growth of the motor grader industry.

To Understand More About this Research: Request a Free Sample Report

The outbreak of the COVID-19 pandemic resulted in the implementation of stringent lockdown measures across countries to contain the spread of the virus. These measures, including manufacturing and construction operations restrictions, created significant challenges for motor grader manufacturers, like the automotive, tourism, and hospitality industries. As a result, original equipment manufacturers (OEMs) in the motor grader industry experienced a decline in revenue and a reduction in the production of units. The pandemic had a detrimental impact on motor grader manufacturers' financial performance and operational capabilities.

During the pandemic, countries like China, the USA, and India witnessed a significant decline in construction activities and spending. However, as the pandemic improved, the construction market in developed and developing economies began to recover from the downturn. The resumption of construction activities and the announcement of new infrastructure and mining projects stimulated the demand for motor graders and supported the growth of the motor grader industry. Furthermore, in the post-COVID-19 period, market leaders in the industry introduced enhanced versions of their flagship series, incorporating design improvements and automation features. These advancements further propelled the growth of the motor grader industry as contractors and companies sought technologically advanced machines to improve efficiency and productivity in their operations.

Shortage of skilled workers for operating off-road and construction equipment poses a significant challenge to the growth of the motor grader market. Motor graders are complex machines that require skilled and qualified operators. Professional operators not only help prevent accidents but also play a crucial role in enhancing the overall performance and productivity of the machinery. The lack of skilled and qualified operators could impede the market's growth in specific regions. Moreover, the high maintenance and repair costs associated with motor graders can put additional pressure on construction budgets. This can further hinder the growth of the motor grader industry, as businesses may be hesitant to invest in expensive equipment with significant ongoing maintenance expenses.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The motor grader market has achieved significant growth and success by prioritizing innovation, international competitiveness, and integrating new technologies. To create advanced, energy-efficient, and economically viable motor graders, companies are investing more in research and development (R&D). Despite challenges such as the COVID-19 pandemic, labor shortages, supply chain disruptions, and semiconductor shortages, original equipment manufacturers (OEMs) in the industry are utilizing various organic and inorganic strategies to stay ahead of the competition.

Motor graders now come with advanced features such as auto-gain and mastless grade control. Auto-gain allows operators to adjust the cross-slope gain setting based on the operating conditions, ensuring precise blade movement and enhancing operational efficiency. Caterpillar's motor grader has integrated mast-less grade control, which improves the productivity, accuracy, and efficiency of automated grading systems. Unlike GPS masts, the motor grader is not limited, providing more flexibility in operation. The integrated mast-less grading system can be added to older machines on-site or included in new machines from the manufacturer.

Report Segmentation

The market is primarily segmented based on by vehicle weight, engine capacity, drive type, and region.

|

By Vehicle Weight |

By Engine Capacity |

By Drive Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

11 to 45 segment accounted for the largest market share in 2022

11 to 45 segments accounted for the largest market share in 2022. These are well-suited for small to medium-grading tasks. They offer efficiency and power for medium to large-scale commercial construction projects. These motor graders are particularly useful for leveling grounds, establishing smooth foundations, and working on large construction sites, highways, and roads. They are also suitable for grading in confined spaces.

Companies like Caterpillar are focusing on developing cost-effective motor graders to cater to specific needs such as road maintenance, government projects, and ground finishing. Caterpillar equips its medium-duty motor graders with engines that deliver improved torque and offer all-wheel options. The demand for versatile medium motor graders and the emergence of refurbishment or new projects in the agriculture, mining, and road construction sectors are expected to drive the segment’s demand.

Up to 250 HP segment garnered largest share in 2022

The segment with motor graders up to 250 HP had the highest revenue share and is expected to grow significantly during the forecast period. This growth is largely driven by residential and commercial construction projects that require the use of motor graders. These motor graders are commonly used in large-scale port construction, highway construction, and mining operations, and their automation helps to reduce labor costs while also allowing for remote operation monitoring. Additionally, the growth of this segment is being fueled by various product advancements, such as the use of electric motors powered by fuel cells. By incorporating fuel cells, the motor graders can have smaller and more efficient engines, which in turn allows for larger operator cabins and overall improved machine performance.

APAC region dominated the global market in 2022

APAC region dominated the global market with a considerable market share. Improvements in the economy and infrastructure development in emerging countries like India, South Korea, and China have been instrumental in supporting the construction industry. Large manufacturers in these countries have established a strong presence and continue to invest in new manufacturing facilities, further bolstering the construction sector. The demand for enhanced infrastructure, including residential buildings, educational institutions, healthcare facilities, sports stadiums, office complexes, and airports, is rising in Asian nations such as China, India, and other emerging economies. This increasing need for infrastructure development drives the demand for motor graders in the region.

Competitive Insight

Some of the major players operating in the global market include Caterpillar, Doosan, Komatsu, Sumitomo Heavy Industries, Volvo Construction Equipment, CNH Global, Escorts Group, Hitachi Construction Machinery, Hyundai Heavy Industries, JC Bamford Motor Grader, John Deere, Kobelco, Liebherr-International, Mitsubishi, and Sany Heavy Industries.

Recent Development

- In December 2021, Caterpillar Inc. introduced the 120 GC motor grader. Caterpillar has incorporated its advanced Cat Connect Technology into the design of these motor graders, resulting in improved operational costs, productivity, fuel economy, and reduced fuel consumption.

Motor Grader Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 33.79 billion |

|

Revenue forecast in 2032 |

USD 54.89 billion |

|

CAGR |

5.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Vehicle Weight, By Engine Capacity, By Drive Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Caterpillar, Doosan, Komatsu, Sumitomo Heavy Industries, Volvo Construction Equipment, CNH Global, Escorts Group, Hitachi Construction Machinery, Hyundai Heavy Industries, JC Bamford Motor Grader, John Deere, Kobelco, Liebherr-International, Mitsubishi, and Sany Heavy Industries. |

FAQ's

The global motor grader market size is expected to reach USD 54.89 billion by 2032.

Key players in the motor grader market are Caterpillar, Doosan, Komatsu, Sumitomo Heavy Industries, Volvo Construction Equipment, CNH Global, Escorts Group.

Asia Pacific contribute notably towards the global motor grader market.

The global motor grader market is expected to grow at a CAGR of 5.5% during the forecast period.

The motor grader market report covering key segments are vehicle weight, engine capacity, drive type, and region.