Morocco Bus Market Size, Share, Trends, Industry Analysis Report: By Type (Single Deck and Double Deck), Application, Fuel Type, and Capacity – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 114

- Format: PDF

- Report ID: PM5094

- Base Year: 2023

- Historical Data: 2019-2022

Morocco Bus Market Overview

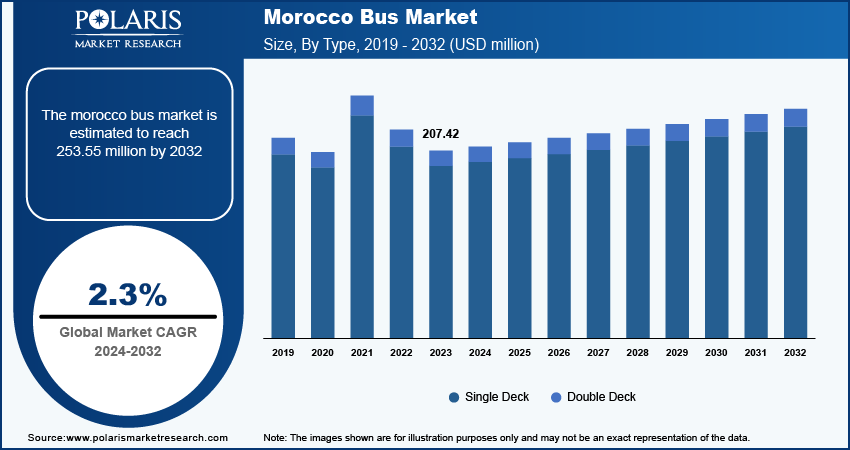

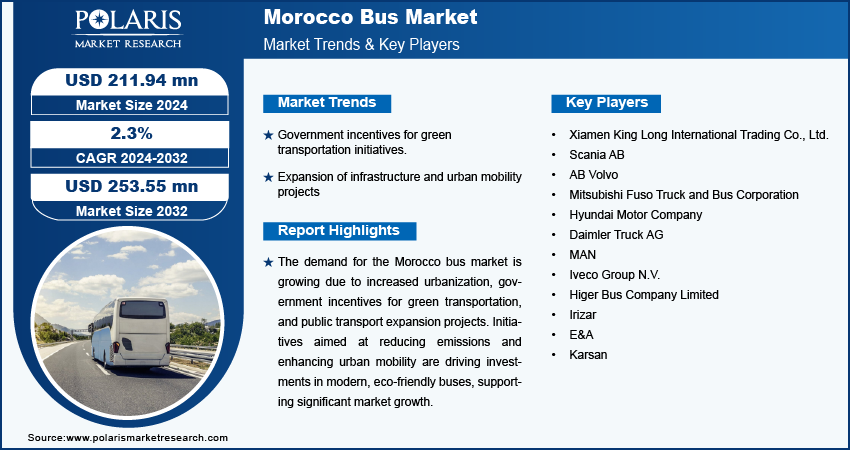

The Morocco bus market size was valued at USD 207.42 million in 2023. The market is projected to grow from USD 211.94 million in 2024 to USD 253.55 million by 2032, exhibiting a CAGR of 2.3% during 2024–2032.

The demand for Morocco’s bus market is experiencing significant growth due to various initiatives aimed at improving urban mobility and public transport infrastructure. Morocco's government has taken a proactive approach to improve transportation, especially through the $1.1 billion investment aimed at upgrading the public transport system. This ambitious project, led by the Ministry of Interior, will introduce 3,500 new buses in 32 cities by 2029, emphasizing both infrastructure improvement and modernizing urban management systems. Such large-scale projects are aimed at improving urban mobility, easing traffic congestion, and providing accessible transportation options for millions of residents and tourists.

To Understand More About this Research: Request a Free Sample Report

The Moroccan government is driving sustainable urban development by upgrading infrastructure and urban management systems. These efforts, led by the Ministry of Interior, focus on modernizing public transit, including the acquisition of new buses and expanding efficient networks. For instance, in Casablanca, two new Bus Rapid Transit (BRT) lines, Bw1 and Bw2, were launched by RATP Dev as part of the CasaBusway network. These modern BRT lines complement the city's existing tramway system, offering quicker and more accessible transportation for its growing population.

Companies are also addressing Morocco's growing urban mobility demands by introducing advanced bus models. For instance, in 2020, Daimler Buses secured a major order from ALSA for 500 city buses, including 420 solo and 80 articulated Mercedes-Benz Conecto buses, all meeting Euro VI emission standards. These buses contribute to Casablanca’s public transport modernization, aligning with the government's strategic goals. This collaboration between corporate and government initiatives fosters Morocco's bus market growth while enhancing urban mobility nationwide.

Morocco Bus Market Drivers and Trends

Government Incentives for Green Transportation Initiatives

Government incentives in Morocco are driving the demand for electric buses and promoting green transportation. For instance, the recent partnership with South Korea to introduce 20 electric buses and an Intelligent Transport System in Marrakech, backed by a $12.6 million investment. This initiative aligns with Morocco's 2050 Low-Carbon Strategy, reflecting the government's dedication to sustainable mobility and carbon emission reduction. Morocco's proactive stance, including VAT rate variations and electric vehicle exemptions, has already spurred the adoption of electric buses, with 12 on the road and plans for 60 more.

Companies, including E&A and Irizar, are central to this growth, reflecting both local and international investments in the electric bus sector. The government's financial incentives and policy support encourage continued investment in electric vehicle technology and infrastructure. These initiatives are vital to the expansion of Morocco's electric vehicle infrastructure and fleet, positioning the country as a regional leader in sustainable urban mobility and contributing to the overall Morocco bus market growth.

Expansion of Infrastructure and Urban Mobility Projects

Morocco's investment in modernizing its transport infrastructure, including new road networks, highways, and urban transit systems, is driving the demand for buses. The country enhances connectivity between urban and rural areas, and there is a growing need for a reliable bus fleet to handle increasing passenger volumes. This infrastructure development supports Morocco’s goal of creating a more integrated transportation system. In cities such as Casablanca, Marrakech, and Rabat, where rapid expansion is leading to traffic congestion, buses play a crucial role in offering flexible, cost-effective, and large-capacity public transportation solutions.

The government's focus on green transportation initiatives, such as promoting electric and hybrid buses, aligns with the broader aim of improving urban mobility. These initiatives reduce environmental impact while catering to the rising demand for efficient public transit in urban centers. As a result, the synergy between infrastructure growth and the need for modern, eco-friendly bus fleets is fostering Morocco's bus market growth.

Morocco Bus Market – Segment Insights

Morocco Bus Market: Type-Based Insights

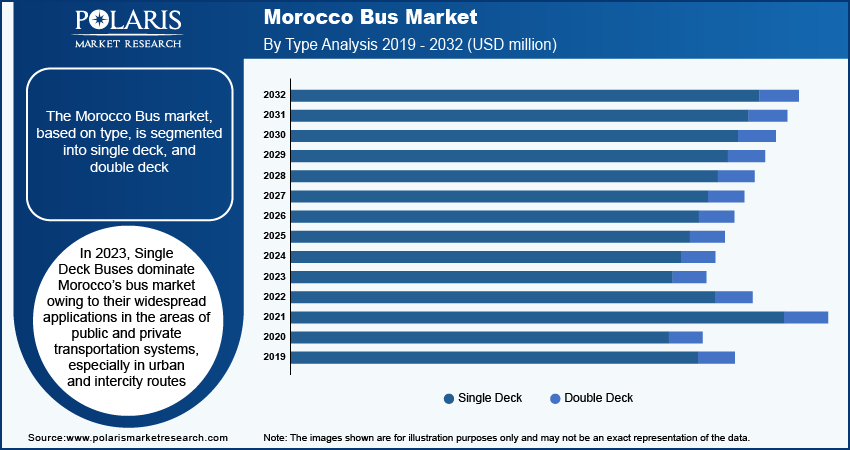

The Morocco bus market, based on type, is segmented into single deck and double deck. In 2023, the single deck segment dominated the market, accounting for around 92% of market revenue (190.6 million). Single deck buses dominate Morocco’s bus market due to their versatility, cost-efficiency, and suitability for both urban and intercity routes. These buses, with varying seat capacities, are widely used by public transport companies in cities such as Casablanca, Marrakesh, and Rabat. Their ability to navigate narrow city streets and rural roads makes them essential for Morocco's growing public transit systems.

The government in Morocco is promoting the use of single deck buses to enhance public transport infrastructure. For instance, the Rabat-Salé Tramway project and other initiatives aim to expand urban mobility, with single deck buses serving as key connectors. Moreover, initiatives such as public-private partnerships, those among companies such as Alsa Maroc (operating in Marrakesh), are fuelling the demand for single deck buses. Their lower maintenance costs and ease of operation make single deck buses a practical choice, further contributing to the growth of the Morocco bus market.

Morocco Bus Market: Fuel Type-Based Insights

The Morocco bus market, based on fuel type, is segmented into diesel and electric/hybrid. The electric/hybrid segment is expected to grow at 4.8% CAGR over the forecast period. Electric and hybrid buses are gaining momentum in Morocco, driven by government efforts to reduce carbon emissions. Cities such as Casablanca and Rabat are adopting these buses to modernize public transport and cut pollution. For instance, Spain's Irizar has introduced electric bus models, while BYD collaborates with Moroccan authorities to expand electric fleets.

Although adoption is in its early stages, Casablanca is committed to expanding electric bus usage as charging infrastructure improves. The decreasing battery costs and government subsidies are suspended to drive high upfront expenses, giving a significant boost to the Morocco bus market.

Morocco Bus Market: Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Morocco bus market grow. Market participants are also undertaking a variety of strategic activities to expand their footprint across the region, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations. To expand and survive in a more competitive and rising market climate, the Morocco bus industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Morocco bus market to benefit clients and boost business growth. In recent years, the market has offered some technological advancements. Major players in the Morocco bus market are Xiamen King Long International Trading Co., Ltd.; Scania AB; AB Volvo; Mitsubishi Fuso Truck and Bus Corporation; Hyundai Motor Company; Daimler Truck AG; MAN; Iveco Group N.V.; Higer Bus Company Limited; Irizar; E&A; and Karsan

Scania AB, a subsidiary of Volkswagen Truck & Bus, manufactures trucks, buses, and engines, offering diverse services and operating in over 100 countries with significant R&D and production facilities. In October 2023, Scania introduced a new battery-electric bus platform at Busworld, featuring 520 kWh batteries for heavy vehicles, achieving over 500 km range and advancing its commitment to electrification and CO2 reduction.

AB Volvo is a multinational corporation specializing in trucks, buses, construction equipment, and engines, offering a wide range of services globally through an extensive network of dealerships and workshops. In March 2024, Volvo Buses expanded its global electromobility range to encompass operations beyond urban areas and between cities with the introduction of the new Volvo BZT Electric. This platform is designed for city, intercity, and commuter operations and is available in various configurations to optimize efficiency, sustainability, and profitability for operators worldwide.

List of Key Companies in Morocco Bus Market

- Xiamen King Long International Trading Co., Ltd.

- Scania AB

- AB Volvo

- Mitsubishi Fuso Truck and Bus Corporation

- Hyundai Motor Company

- Daimler Truck AG

- MAN

- Iveco Group N.V.

- Higer Bus Company Limited

- Irizar

- E&A

- Karsan

Morocco Bus Industry Developments

March 2024, Volvo Buses has introduced the new Volvo 8900 Electric, a low-entry electric bus designed for city, intercity, and commuter use.

October 2023, Hyundai Motor Co., South Korea's leading automaker, and Iveco Group N.V. have solidified their collaboration by introducing the hydrogen fuel-cell electric vehicle (FCEV) E-WAY H2. This partnership has resulted in the unveiling of a hydrogen-powered city bus jointly developed by the two companies.

June 2022, MAN Truck & Bus plans introduced its global electric bus chassis, building on the success of the Lion's City E, with prototype deliveries in 2023 and series production beginning in 2024, initially focusing on two-axle intercity buses.

Morocco Bus Market Segmentation

By Type Outlook

- Single Deck

- Double Deck

By Application Outlook

- Transit Bus

- Intercity/Motorcoaches

- School Bus

- Tourist Bus

- Staff Pickup/Hotel Shuttle

- Others

By Fuel Type Outlook

- Diesel

- Electric/Hybrid

By Capacity Outlook

- 15-30 Seats

- 31-50 Seats

- Over 50 Seats

Morocco Bus Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 207.42 million |

|

Market Size Value in 2024 |

USD 211.94 million |

|

Revenue Forecast in 2032 |

USD 253.55 million |

|

CAGR |

2.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Morocco bus market size was valued at USD 207.42 million in 2023.

The market is projected to register a CAGR of 2.3% during the forecast period.

Xiamen King Long International Trading Co., Ltd.; Scania AB; AB Volvo; Mitsubishi Fuso Truck and Bus Corporation; Hyundai Motor Company; Daimler Truck AG; MAN; Iveco Group N.V.; Higer Bus Company Limited; Irizar; E&A; and Karsan are a few key market players.

The single deck segment dominated the market in 2023.

The diesel segment held the largest share in the Morocco market in 2023.