Molecular Infectious Disease Testing Market Size, Share, Trends, Industry Analysis Report: By Product & Service, Type (Multiplex Testing and Singleplex Testing), Test Type, Disease, Technology, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5437

- Base Year: 2022

- Historical Data: 2020-2023

Molecular Infectious Disease Testing Market Overview

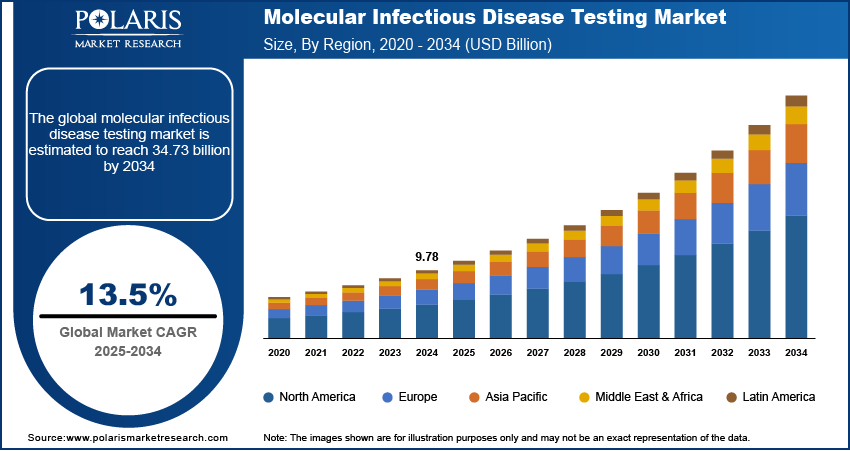

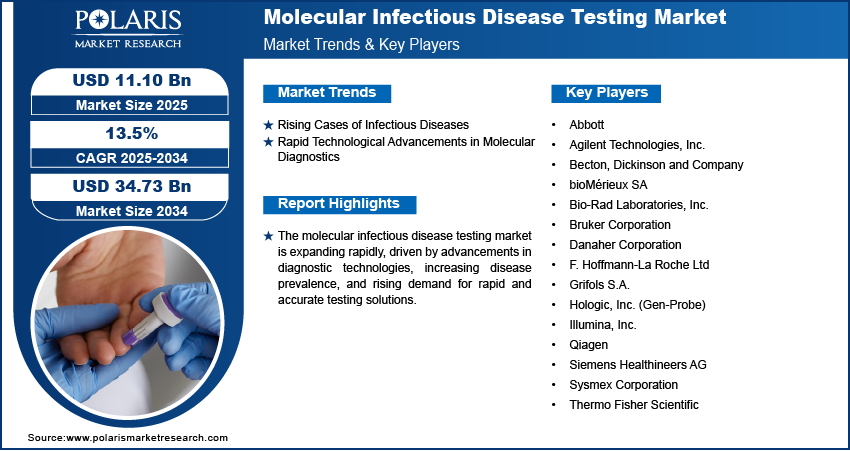

The global molecular infectious disease testing market size was valued at USD 9.78 billion in 2024. It is expected to grow from USD 11.10 billion in 2025 to USD 34.73 billion by 2034, at a CAGR of 13.5% during 2025–2034.

Molecular infectious disease testing refers to advanced diagnostic techniques that detect and identify pathogens (viruses) at the molecular level using nucleic acid-based methods such as PCR and next-generation sequencing. The market for molecular infectious disease testing is experiencing growth, driven by the increasing demand for point-of-care (POC) testing. The need for rapid, accurate, and decentralized diagnostic solutions has surged, particularly where timely detection is essential for effective patient management. POC molecular testing allows healthcare providers to make immediate clinical decisions, improving treatment outcomes and reducing the burden on centralized laboratories. In November 2024, Cepheid’s Xpert Mpox POC test was listed under WHO’s Emergency Use Listing (EUL) for rapid mpox detection. Approved by the FDA in February 2023, it provides results in under 40 minutes via PCR, allowing decentralized, near-patient testing for mpox clades I and II. The growing adoption of these rapid molecular diagnostic solutions across hospitals, clinics, and home care settings is shaping molecular infectious disease testing market expansion.

To Understand More About this Research: Request a Free Sample Report

Another driver fueling molecular infectious disease testing market growth is the increasing funding for molecular testing from government bodies, healthcare organizations, and private investors. For instance, in September 2022, the CDC released USD 90 million in funding for five years to establish the Pathogen Genomics Centers of Excellence (PGCoE) network. The aim was to improve pathogen genomics, molecular epidemiology, and bioinformatics to improve microbial threat prevention, control, and response. Substantial investments in research and development have led to technological advancements, improving the efficiency and accessibility of molecular diagnostics. Funding initiatives are also supporting the expansion of diagnostic infrastructure and the development of innovative testing platforms. Therefore, as governments and healthcare agencies prioritize early disease detection and pandemic preparedness, financial support continues to strengthen the adoption of molecular infectious disease testing worldwide.

Molecular Infectious Disease Testing Market Dynamics

Rising Cases of Infectious Diseases

The increasing prevalence of diseases such as respiratory infections, sexually transmitted infections, and emerging pathogens has boosted the need for accurate and rapid detection methods. According to a 2021 analysis by our world in data, there were approximately 560,843 infectious disease-related deaths in the US in 2021. Molecular diagnostics offer superior sensitivity and specificity compared to conventional techniques, allowing early diagnosis and targeted treatment, as the growing burden of bacterial, viral, and fungal infections necessitates advanced diagnostic solutions. The demand for efficient diagnostic tools is further amplified by the global emphasis on disease surveillance, infection control, and public health preparedness, driving the adoption of molecular testing across healthcare settings.

Rapid Technological Advancements in Molecular Diagnostics

Innovations such as real-time PCR, digital PCR, and next-generation sequencing have remarkably improved the ability to detect pathogens with higher precision and reduced turnaround times. In June 2024, QIAGEN launched 35 new digital PCR Microbial DNA Detection Assays for its QIAcuity platform, targeting pathogens causing tropical diseases, STIs, and UTIs. These assays improve infectious disease research and surveillance, offering precise, sensitive pathogen detection for public health efforts. Automation and miniaturization of molecular diagnostic platforms have facilitated decentralized testing, making it feasible for point-of-care and resource-limited settings by improving the accuracy, speed, and accessibility of infectious disease testing. Additionally, advancements in multiplex testing allow simultaneous detection of multiple pathogens, improving diagnostic efficiency. These technological improvements are driving the adoption of molecular infectious disease testing, strengthening its role in modern healthcare diagnostics.

Molecular Infectious Disease Testing Market Segment Assessment

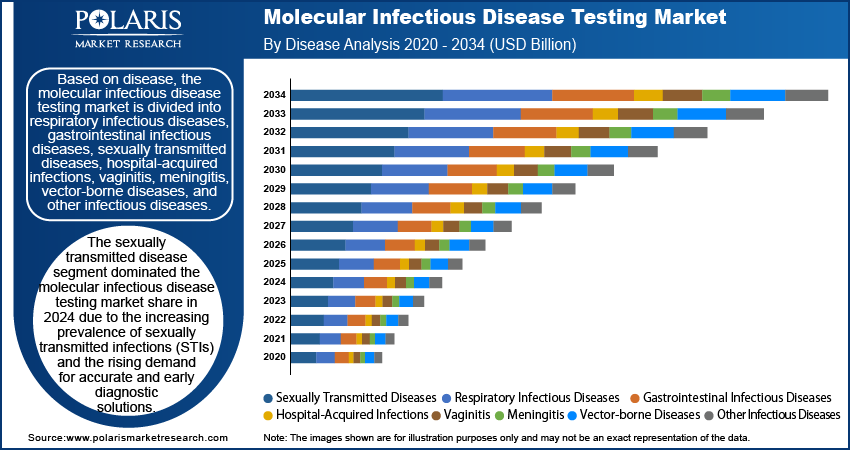

Molecular Infectious Disease Testing Market Assessment by Disease Outlook

The global molecular infectious disease testing market segmentation, based on disease, includes respiratory infectious diseases, gastrointestinal infectious diseases, sexually transmitted diseases, hospital-acquired infections, vaginitis, meningitis, vector-borne diseases, and other infectious diseases. The sexually transmitted disease segment dominated the market share in 2024 due to the increasing prevalence of sexually transmitted infections (STIs) and the rising demand for accurate and early diagnostic solutions. The growing awareness of STI-related complications and the implementation of routine screening programs have driven the adoption of molecular diagnostic tests, which offer high sensitivity and specificity. Additionally, the integration of point-of-care molecular testing for STIs has improved accessibility and timely detection, facilitating immediate clinical interventions. The focus on early disease management, associated with advancements in multiplex testing for multiple STI pathogens, has further contributed to the molecular infectious disease testing market demand.

Molecular Infectious Disease Testing Market Evaluation by Product & Service Outlook

The global molecular infectious disease testing market segmentation, based on product & service, includes reagents & kits, instruments, and services & software. The reagents & kits segment is expected to witness the fastest market growth during the forecast period, driven by the increasing adoption of molecular diagnostic tests across healthcare settings. The rising demand for consumables such as nucleic acid extraction kits, PCR reagents, and pathogen-specific assay kits is attributed to the high testing volume and the need for repeat purchases. Technological advancements in assay design, such as multiplex and real-time PCR kits, have improved test efficiency and specificity, supporting molecular infectious disease testing market development. Additionally, the widespread use of reagents & kits in both centralized laboratories and point-of-care testing accelerates segment growth, making it the most rapidly expanding category in the market.

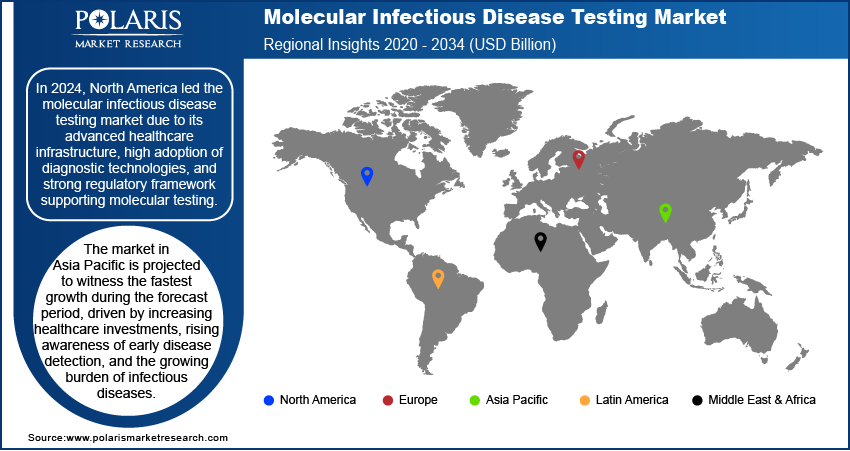

Molecular Infectious Disease Testing Market Outlook by Region

By region, the report provides the molecular infectious disease testing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the molecular infectious disease testing market share in 2024, primarily due to its well-established healthcare infrastructure, high adoption rate of advanced diagnostic technologies, and strong regulatory framework supporting molecular testing. The presence of major market players, associated with substantial investments in research and development, has fueled innovation in molecular diagnostic solutions. Additionally, the region has a high burden of infectious diseases, such as respiratory and sexually transmitted infections. For instance, in 2023, CDC reported over 2.4 million cases of syphilis, gonorrhea, and chlamydia were reported, including 209,000 syphilis, 600,000 gonorrhea, and 1.6 million chlamydia cases. Notably, 3,882 congenital syphilis cases were reported, with 279 resulting in stillbirths or neonatal/infant deaths, driving the demand for accurate and rapid diagnostic tools. The growing implementation of government initiatives for disease surveillance and early detection, along with the increasing preference for molecular testing in clinical practice, has further strengthened North America's leadership in the market.

The Asia Pacific molecular infectious disease testing market is projected to witness the fastest growth during the forecast period, driven by increasing healthcare investments, rising awareness of early disease detection, and the growing burden of infectious diseases. Expanding access to molecular diagnostic technologies, particularly in emerging economies, is facilitating molecular infectious disease testing market penetration and adoption. In September 2022, Sansure Biotech collaborated with QuantuMDx to launch the Q-POC platform, aiming to develop and produce rapid, portable molecular diagnostic tests. The partnership focuses on expanding test menus, reducing costs, and improving precision medicine solutions for infectious diseases and other applications. The region is also experiencing a rise in demand for point-of-care testing solutions, supported by government initiatives to improve diagnostic capabilities in rural and urban healthcare settings. Additionally, the presence of a large patient population and ongoing advancements in healthcare infrastructure are creating a favorable environment for molecular infectious disease testing market opportunity, positioning Asia Pacific as the fastest growing region in the market.

Molecular Infectious Disease Testing Market – Key Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for molecular infectious disease testing market share through innovation, strategic alliances, and geographic expansion. Global players such as Roche Diagnostics, Thermo Fisher Scientific, Abbott Laboratories, and BioMérieux leverage robust R&D capabilities and extensive distribution networks to deliver advanced molecular diagnostic tools, including PCR, next-generation sequencing (NGS), and multiplex testing platforms. Molecular infectious disease testing market trends indicate rising demand for rapid, accurate, and decentralized testing solutions, such as point-of-care (POC) molecular diagnostics, driven by the need for timely disease detection and management. According to molecular infectious disease testing market statistics, the market is projected to grow, fueled by the increasing prevalence of infectious diseases, advancements in genomic technologies, and the growing adoption of personalized medicine. Regional companies focus on cost-effective and localized solutions, particularly in emerging markets. Molecular infectious disease testing market competitive strategies include mergers and acquisitions, partnerships with research institutions, and the development of innovative diagnostic products to address evolving healthcare needs. These trends highlight the importance of technological innovation, market adaptability, and strategic investments in driving the expansion of the molecular infectious disease testing industry. A few key major players are Abbott; Danaher Corporation; bioMérieux SA; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Becton, Dickinson and Company; Hologic, Inc. (Gen-Probe); Illumina, Inc., Grifols S.A.; Qiagen; Siemens Healthineers AG; Sysmex Corporation; Bruker Corporation; and Thermo Fisher Scientific.

QIAGEN is a global provider of molecular diagnostic solutions, particularly in the field of infectious disease testing. The company's QIAstat-Dx system is a major platform for molecular infectious disease diagnostics, utilizing multiplex PCR technology to rapidly identify a wide range of pathogens in a single sample. This syndromic testing approach allows for the simultaneous detection of multiple viral, bacterial, and fungal pathogens, significantly improving the speed and accuracy of diagnosis compared to traditional microbiological methods. QIAstat-Dx offers several panels that have been cleared by regulatory bodies such as the US FDA and have received CE-marking in the EU. These panels include tests for respiratory, gastrointestinal, and central nervous system infections, providing critical diagnostic insights in under an hour. The system's efficiency and rapid turnaround time allow healthcare providers to make timely treatment decisions, improving patient outcomes, and reducing healthcare burdens. QIAGEN's commitment to molecular diagnostics extends beyond infectious diseases, with ongoing expansions into areas such as neurodegenerative and metabolic diseases through strategic partnerships. The company's broad range of CE-IVD-marked sample and assay technologies supports standardized and integrated molecular diagnostics workflows, ensuring high-quality results and streamlined laboratory operations. QIAGEN continues to play a major role in advancing molecular infectious disease testing globally by leveraging advanced technologies, such as digital PCR and syndromic testing.

F. Hoffmann-La Roche Ltd, commonly known as Roche, is a Swiss multinational healthcare company renowned for its contributions to pharmaceuticals and diagnostics. Founded in 1896 by Fritz Hoffmann-La Roche, the company has evolved in developing innovative therapeutic and diagnostic products. Roche operates under two main divisions: Pharmaceuticals and Diagnostics, with a strong focus on oncology, immunology, ophthalmology, infectious diseases, and neuroscience. The company specializes in molecular infectious disease testing. It offers a range of in vitro diagnostics, which are crucial for detecting and managing infectious diseases. These diagnostics help healthcare professionals to identify pathogens and monitor disease progression effectively. Roche's molecular testing solutions are designed to provide accurate and rapid results, facilitating timely treatment decisions. This aligns with Roche's broader strategy of personalized healthcare, where diagnostics play a major role in tailoring treatments to individual patient needs. Roche continues to innovate and expand its offerings in molecular infectious disease testing, contributing significantly to global healthcare advancements.

List of Key Companies in Molecular Infectious Disease Testing Market

- Abbott

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Grifols S.A.

- Hologic, Inc. (Gen-Probe)

- Illumina, Inc.

- Qiagen

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific

Molecular Infectious Disease Testing Industry Developments

May 2022: BD launched the FDA-cleared BD COR MX/PX System, a fully automated, high-throughput molecular diagnostics platform. It integrates sample processing and testing, delivering up to 1,000 results in 24 hours, starting with the BD CTGCTV2 assay for detecting chlamydia, gonorrhea and trichomoniasis.

September 2024: Roche launched the cobas Respiratory flex test, using its TAGS technology for multiplex PCR testing. It detects up to 12 respiratory viruses simultaneously, a substantial improvement over standard PCR tests, allowing efficient syndromic testing on high-throughput analyzers.

Molecular Infectious Disease Testing Market Segmentation

By Product & Service Outlook (Revenue, USD Billion, 2020–2034)

- Reagents & Kits

- Instruments

- Services & Software

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Multiplex Testing

- Singleplex Testing

By Test Type Outlook (Revenue, USD Billion, 2020–2034)

- Laboratory Tests

- Point-of-Care Tests

By Disease Outlook (Revenue, USD Billion, 2020–2034)

- Respiratory Infectious Diseases

- Gastrointestinal Infectious Diseases

- Sexually Transmitted Diseases

- Hospital-Acquired Infections

- Vaginitis

- Meningitis

- Vector-Borne Diseases

- Other Infectious Diseases

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Polymerase Chain Reaction

- Isothermal Nucleic Acid Amplification Technology

- DNA-Sequencing & Next-Generation Sequencing

- In-Situ Hybridization

- DNA Microarrays

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Molecular Infectious Disease Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.78 billion |

|

Market Size Value in 2025 |

USD 11.10 billion |

|

Revenue Forecast by 2034 |

USD 34.73 billion |

|

CAGR |

13.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.78 billion in 2024 and is projected to grow to USD 34.73 billion by 2034.

The global market is projected to register a CAGR of 13.5% during the forecast period.

North America dominated the global market in 2024.

A few of the key players in the market are Abbott; Danaher Corporation; bioMérieux SA; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Becton, Dickinson and Company; Hologic, Inc. (Gen-Probe); Illumina, Inc., Grifols S.A.; Qiagen; Siemens Healthineers AG; Sysmex Corporation; Bruker Corporation; and Thermo Fisher Scientific.

The sexually transmitted disease segment dominated the market share in 2024.