Modular Instruments Market Size, Share, Trends, Industry Analysis Report: By Platform, Distribution Channel (Direct Distribution, Indirect Distribution, and Others), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5522

- Base Year: 2024

- Historical Data: 2020-2023

Modular Instruments Market Overview

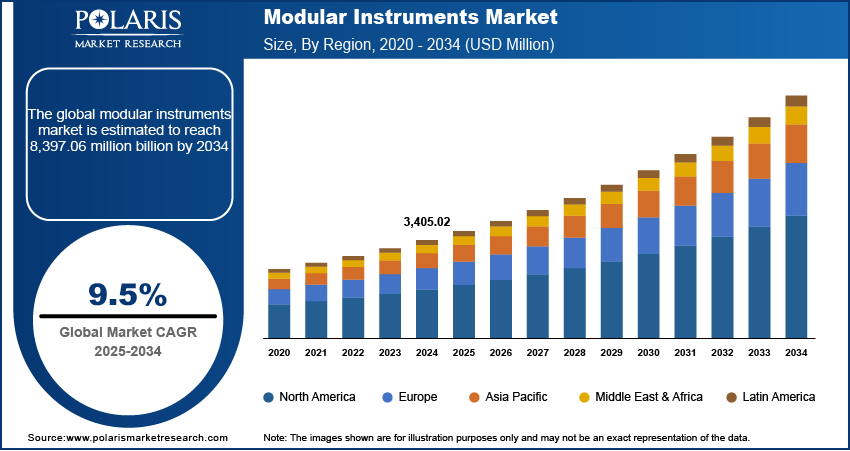

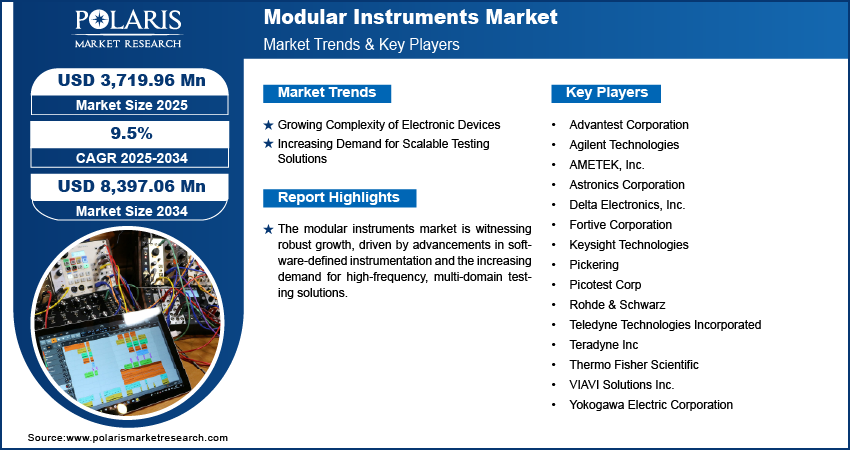

The global modular instruments market was valued at USD 3,405.02 million in 2024. The market is expected to grow from USD 3,719.96 million in 2025 to USD 8,397.06 million by 2034, at a CAGR of 9.5% from 2025 to 2034.

Modular instruments are flexible, configurable test and measurement solutions that consist of interchangeable modules integrated into a common platform. The market for modular instruments is experiencing substantial growth, driven by rapid technological advancements that improve precision, scalability, and automation in testing environments. For instance, in November 2022, Teledyne LeCroy launched SimPASS USB, a simulation protocol analyzer for USB4 80Gbps, allowing pre-silicon design verification. It allows users to analyze RTL simulation vectors, identify design flaws early, and reduce costly redesigns, improving USB4 development efficiency. Continuous innovations in hardware and software, such as high-speed data acquisition and AI-driven analytics, are improving measurement accuracy and efficiency. These advancements facilitate modular instruments to serve the evolving demands of industries such as telecommunications, aerospace, automotive, and healthcare, reinforcing their role as essential tools in modern testing and development.

To Understand More About this Research: Request a Free Sample Report

Another key driver boosting the modular instruments market development is the growing adoption of Industry 4.0 and IoT integration across industrial sectors. The increasing implementation of smart manufacturing and connected systems necessitates advanced testing solutions capable of handling complex, high-speed data processing. This is apparent in the development of cutting-edge tools designed to meet these evolving demands. For instance, in October 2023, Rohde & Schwarz launched the R&S MXO 5, its first eight-channel oscilloscope, building on the success of the R&S MXO 4. The advanced tool enhances testing capabilities, enabling engineers to address complex design challenges with greater precision and efficiency. Modular instruments, with their reconfigurable architecture, seamlessly integrate into automated workflows, allowing real-time monitoring and predictive maintenance. This trend aligns with the shift toward digital transformation, where industries are leveraging IoT-driven data insights to improve productivity, optimize operational efficiency, and assure compliance with strict quality standards.

Modular Instruments Market Dynamics

Growing Complexity of Electronic Devices

Traditional test equipment often falls short in meeting evolving testing demands with the advancement of semiconductor technology, miniaturization, and the integration of multifunctional components. Modern electronics require highly precise and adaptable testing solutions, and modular instruments offer the flexibility to configure and upgrade testing setups according to specific requirements, providing compatibility with next-generation electronic designs. For instance, in November 2024, Pickering Interfaces launched PXIe embedded controller (model 43-920-002), the most compact and powerful 3U one-slot controller for the PXI Express platform. It improves modular signal switching and simulation solutions for electronic test and verification. The ability of modular instruments to support high-speed data acquisition, real-time analysis, and multi-domain testing makes them essential in industries such as telecommunications, automotive, and consumer electronics, where innovation cycles are becoming increasingly shorter.

Increasing Demand for Scalable Testing Solutions

Conventional test systems often lack the adaptability to accommodate uneven requirements, leading to inefficiencies in resource utilization. Modular instruments address this challenge by allowing seamless expansion and reconfiguration, allowing cost-effective testing strategies that align with product development lifecycles. For instance, in November 2024, CloudBees Launchable, an AI-powered testing platform, became available on AWS Marketplace. It uses AWS infrastructure to improve testing efficiency with predictive test selection and AI-driven analysis, helping developers optimize workflows and accelerate software delivery cycles. The ability of modular instruments to integrate with automated and remote testing frameworks further improves productivity, making them an ideal choice for industries prioritizing flexibility, efficiency, and long-term investment optimization in testing infrastructure. As industries seek efficient ways to manage diverse and evolving testing needs, the modular instruments market demand continues to rise.

Modular Instruments Market Segment Insights

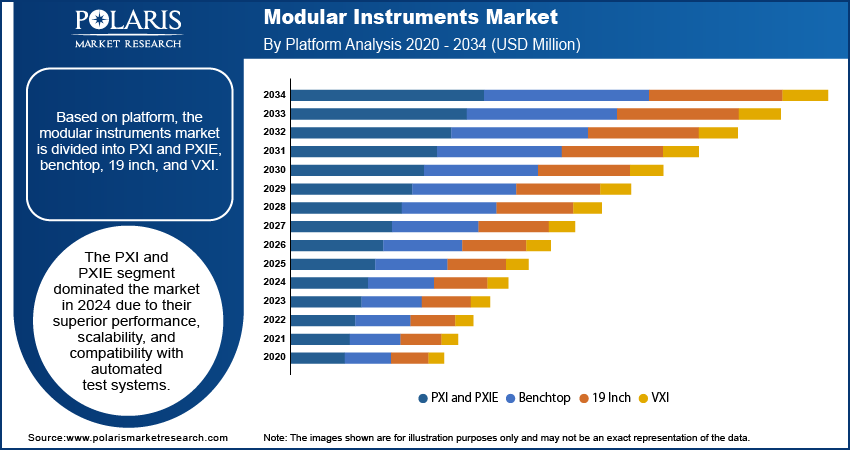

Modular Instruments Market Assessment by Platform Outlook

The global modular instruments market assessment, based on platform, includes PXI and PXIE, benchtop, 19 inch, and VXI. The PXI and PXIE segment dominated the modular instruments market in 2024 due to their superior performance, scalability, and compatibility with automated test systems. PCI eXtensions for Instrumentation (PXI) and PXI Express (PXIe) platforms offer high-speed data transfer, synchronized measurements, and seamless integration with software-defined instrumentation, making them the preferred choice for industries such as aerospace, automotive, and telecommunications. Their modular architecture allows flexible system configurations, allowing users to tailor testing setups to specific application requirements. Additionally, advancements in RF and mixed-signal testing have solidified PXI and PXIe as the leading platforms, addressing the increasing demand for high-performance test solutions.

Modular Instruments Market Evaluation by Distribution Channel Outlook

The global modular instruments market evaluation, based on distribution channel, includes direct distribution, indirect distribution, and others. The direct distribution segment dominated the modular instruments market in 2024, driven by the increasing demand for customized solutions and technical support. Direct distribution channels allow manufacturers to establish stronger customer relationships, assuring tailored solutions that meet industry specific testing requirements. This model provides businesses with direct access to advanced modular instruments, allowing seamless integration and efficient deployment. Additionally, the direct distribution approach improves after-sales support, training, and technical assistance, which are critical for industries relying on precision testing solutions. The shift towards digital transformation and automation further supports the need for direct engagement between manufacturers and end users, contributing to the segment’s leading market position.

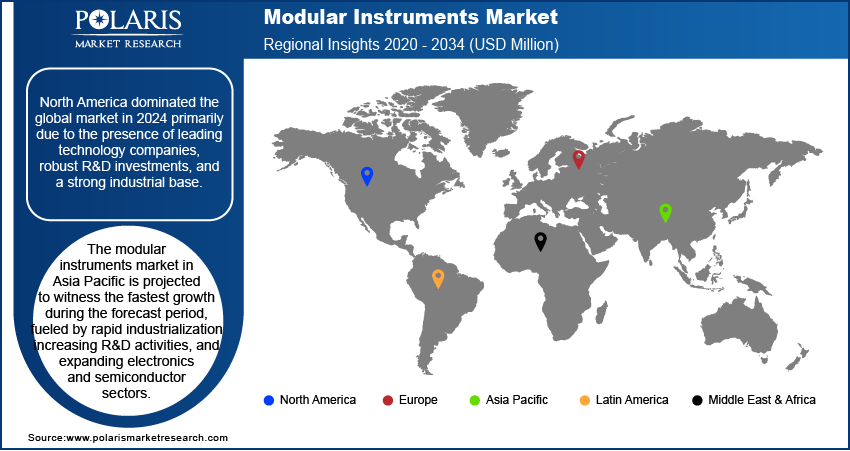

Modular Instruments Market Regional Analysis

By region, the report provides the modular instruments market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the modular instruments market revenue in 2024 primarily due to the presence of leading technology companies, robust R&D investments, and a strong industrial base. For instance, in January 2025, FormFactor and Advantest expanded their partnership to advance semiconductor testing. Combining FormFactor’s wafer probe solutions with Advantest’s automated test equipment, the collaboration aims to improve testing for advanced nodes, 3D ICs, and high-bandwidth memory, addressing next-generation device challenges. The high adoption of advanced testing solutions across industries such as aerospace, defense, telecommunications, and automotive drives the region's dominance. The demand for high-performance modular instruments has surged with continuous advancements in 5G, IoT, and semiconductor technologies. Strict regulatory requirements and the need for precision testing in mission-critical applications have further fueled market expansion. The presence of major market players and innovation-driven industries positions North America as the leading region in modular instrumentation.

The Asia Pacific modular instruments market is projected to witness the fastest growth during the forecast period, fueled by rapid industrialization, increasing R&D activities, and expanding electronics and semiconductor sectors. For instance, in September 2024, Delta and Universal Instruments launched next-gen solutions at SEMICON Taiwan, including AI-driven digital twin platforms and advanced semiconductor equipment. These innovations improve front-end and back-end processing, enhance cybersecurity, and accelerate product development, addressing challenges in semiconductor manufacturing. Countries such as China, Japan, South Korea, and India are investing heavily in advanced manufacturing and automation, driving the demand for scalable and cost-effective testing solutions. The growing adoption of Industry 4.0, IoT, and wireless communication technologies further accelerates the need for high-performance modular instruments. Additionally, government initiatives promoting technological advancements and smart manufacturing are fostering modular instruments market expansion, positioning Asia Pacific as a major growth region for modular instrumentation.

Modular Instruments Market – Key Players and Competitive Insights

The competitive landscape combines global leaders and regional players competing to capture modular instruments market share through innovation, strategic alliances, and regional expansion. Global players such as Delta Electronics, Inc., Agilent Technologies, and others leverage robust R&D capabilities and extensive distribution networks to deliver advanced modular instrument and customizable tool systems. Modular instruments market trends indicate rising demand for solutions such as interchangeable components and multi-functional platforms. According to modular instruments market analysis, the market is projected to grow, driven by increasing adoption in telecommunications testing, semiconductor manufacturing, aerospace & defense industries, and automated production environments.

Regional companies capitalize on localized needs by offering cost-effective and tailored products, especially in emerging markets. Modular instruments market competitive strategy includes mergers and acquisitions, partnerships, and the introduction of innovative modular designs. These developments underline the role of technological innovation, market adaptability, and regional investments in driving the modular instruments industry expansion. A few key major players are Advantest Corporation; Agilent Technologies; AMETEK, Inc.; Astronics Corporation; Delta Electronics, Inc.; Fortive Corporation; Keysight Technologies; Pickering; Picotest Corp; Rohde & Schwarz; Teledyne Technologies Incorporated; Teradyne Inc; Thermo Fisher Scientific; VIAVI Solutions Inc.; and Yokogawa Electric Corporation.

AMETEK, Inc. is an American multinational company founded in 1930, headquartered in Berwyn, Pennsylvania. The company specializes in the design and manufacturing of electronic instruments and electromechanical devices. It operates through two main segments: the Electronic Instruments Group (EIG) and the Electromechanical Group (EMG). EIG produces advanced instruments for industrial, process, and power markets, while EMG specializes in automation systems, temperature control systems, and specialty metals. AMETEK has a strong presence worldwide with over 220 manufacturing sites and serves diverse industries such as aerospace, power, medical, and industrial markets. In terms of modular instruments, AMETEK's acquisition of VTI Instruments in 2014 expanded its capabilities in precision modular instrumentation and solutions for electronic signal acquisition, distribution, monitoring, and analysis. This strategic move aligns with AMETEK's growth model, which emphasizes operational excellence, new product development, global expansion, and strategic acquisitions. The company's focus on modular instruments supports its mission to provide differentiated technology solutions that improve productivity and sustainability across various sectors. AMETEK continues to outperform market benchmarks with a diverse workforce and a commitment to innovation, delivering substantial growth over the past few decades.

Teradyne Inc. is an American company specializing in the design, development, manufacture, and sale of advanced test and automation solutions. Headquartered in North Reading, Massachusetts, Teradyne plays a critical role in providing the reliability and performance of a wide range of electronic products, such as semiconductors, wireless devices, and complex electronics systems. The company's solutions span the entire development process, from concept to shipping, helping manufacturers bring high-quality innovations such as smart devices, life-saving medical equipment, and data storage systems to market more quickly. Teradyne's product portfolio includes modular instruments, which are part of its comprehensive test solutions. These modular systems are designed to be flexible and adaptable, allowing them to be easily integrated into various test environments. Teradyne's modular approach supports the testing of complex electronic systems, providing that products meet their design specifications and perform reliably. In addition to its test solutions, Teradyne has expanded its offerings through strategic acquisitions, notably in the field of robotics. The company acquired Universal Robots and Mobile Industrial Robots (MiR), improving its capabilities in industrial automation and robotics. This expansion has allowed Teradyne to provide comprehensive automation solutions that improve electronic testing, and it also improves manufacturing efficiency and productivity across various industries. Teradyne continues to innovate and support its diverse customer base worldwide with a global presence.

List of Key Companies in Modular Instruments Market

- Advantest Corporation

- Agilent Technologies

- AMETEK, Inc.

- Astronics Corporation

- Delta Electronics, Inc.

- Fortive Corporation

- Keysight Technologies

- Pickering

- Picotest Corp

- Rohde & Schwarz

- Teledyne Technologies Incorporated

- Teradyne Inc

- Thermo Fisher Scientific

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

Modular Instruments Industry Developments

January 2025: Teradyne and Infineon collaborated to advance power semiconductor testing. Teradyne acquired part of Infineon’s automated test equipment, which aims to enhance innovation and address testing challenges for emerging technologies such as silicon carbide and gallium nitride.

April 2023: Kinectrics and X-Energy collaborated to design, construct, and operate one of North America’s first commercial-scale Helium Test Facilities. The HTF tested critical components of X-energy’s Xe-100 modular reactor under high-temperature, high-pressure helium conditions.

Modular Instruments Market Segmentation

By Platform Outlook (Revenue, USD Million, 2020–2034)

- PXI and PXIE

- Benchtop

- 19 Inch

- VXI

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Direct Distribution

- Indirect Distribution

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Telecommunications

- Aerospace & Defence

- Automotive

- Transportation

- Electronics

- Semiconductor

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Modular Instruments Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,405.02 million |

|

Market Size Value in 2025 |

USD 3,719.96 million |

|

Revenue Forecast by 2034 |

USD 8,397.06 million |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global modular instruments market size was valued at USD 3,405.02 million in 2024 and is projected to grow to USD 8,397.06 million by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

North America dominated the modular instruments market in 2024.

Some of the key players in the market are Advantest Corporation; Agilent Technologies; AMETEK, Inc.; Astronics Corporation; Delta Electronics, Inc.; Fortive Corporation; Keysight Technologies; Pickering; Picotest Corp; Rohde & Schwarz; Teledyne Technologies Incorporated; Teradyne Inc; Thermo Fisher Scientific; VIAVI Solutions Inc.; and Yokogawa Electric Corporation.

The PXI and PXIE segment dominated the market in 2024.